JDCO34 trade ideas

Bullish Gartley Pattern – Trade Setup on JD.comPotential Bullish Gartley pattern has formed with the following structure: XABCD.

initial low X = 23.45 , Price rallies to point A, then forms a corrective structure down to

D = 30.71 trough BCD. CD leg is downward, completing the pattern.

Despite the decline, point D is higher than X, suggesting a bullish setup. The area around D (30.71) is identified as a Potential Reversal Zone (PRZ).

Confluences Supporting a Long Entry

1. Gartley Completion at PRZ

Point D lies near the 78.6% Fibonacci retracement of the XA leg — a typical Gartley completion level.

2. Rising Support Trend Line

D is aligned with a yellow ascending trend line, reinforcing it as a potential bounce area.

3. MACD Bullish Divergence

Price makes a lower low into D, while MACD forms a higher low, signaling bullish momentum divergence.

Trade Plan

* Enter long after confirmation via a strong bullish candle*(e.g., bullish engulfing, hammer)

* Preferably accompanied by above-average volume

Stop Loss:

* Place stop just below point D (30.71)

* Allow a small buffer (e.g., 1–2% below) to account for noise

Targets – Fibonacci Retracement of CD Leg:

1. Target 1 – 38.2%

2. Target 2 – 61.8%

3. Target 3 – 78.6%

4. Target 4 – 100% (full retracement of CD)

Risk Management:

* Use appropriate position sizing (e.g., risk only 1–2% of total capital)

* Consider trailing the stop as targets are hit to lock in profits

$JD | Potential long setupPotential reversal at the .618

If we just K.I.S.S. we might just get lucky.. at least that’s the idea! Right..??

Trade idea:

Potential long scenario playing out that is worth the shot for me, with proper risk management of course. For discussion purposes this is a very small trade in my portfolio, <1/2% of overall portfolio..

Trade:

I have drawn a Fibonacci from the wick low of ~$20.87 to the wick high of ~$46.81 on the monthly candle chart and you can see that the price is currently trading at the .618 fib. I have taken a trade at this level in anticipation of a reversal, which may or may not occur. There are tons of trades out there like the one I have mentioned, you don’t have to be right all of the time or even a majority of the time, you just have to know how to manage risk and take losses/profits at the right time.

Trade parameters:

Buy at the .618 fib or current market price: $31.22

Risk/Reward: 1:7.31🤑

(Risk 14% for potential 108%)

SL @ next fib zone .786: $26.69

For profit zones I have ran a fib from the top @ $108.44 to the bottom at $20.87 and will be using the fib zones as TP zones. The 3 different zones are listed below:

TP1: .236 fib @ ~$41.33 (~32%)

TP2: .382 fib @ ~$54.16 (~73%)

TP3: .50 fib @ ~$64.43 (~106%)

Estimated time frame for all 3 targets to be hit: 1-3 years

It is best to come up with a strategy before hand as to how much you plan to take at each level. For me, I plan on selling 1/4 at the first zone, 1/2 of what’s remaining at the next zone and then the rest at the final zone (may let a share or 2 ride for fun). Whether or not any of these zones are hit is obviously all up to the stock and whether it cooperates with my thesis! I chose to post this trade because I like the risk/reward opportunity here. If anyone has any opinions, would love to hear them!

Thanks and HaPpY tRaDiNg!

NOT FINANCIAL ADVICE!!!

JD.cm | JD | Long at $33.16Like Amazon NASDAQ:AMZN and Alibaba NYSE:BABA , I suspect AI and robotics will enhance JD.com's NASDAQ:JD automation in warehousing, delivery, and retail. There is some risk here, like other Chinese stocks, that they could be delisted from the US market if trade/war tensions rise. But I just don't think that is likely (no matter the threats) due to the importance of worldwide trade and investment. I could be way wrong, though...

NASDAQ:JD has a current P/E of 8.1x and a forward P/E of 1.2x, which indicates strong earnings growth ahead. The company is healthy, with a debt-to-equity of 0.4x, Altmans Z Score of 2.6, and a Quick Ratio of .9 (could be better).

From a technical analysis perspective, the historical simple moving average (SMA) band is still in an overall downtrend but starting to level out (accumulation of share area). It is possible, however, that the price may drop into the $20s to close out the existing price gaps on the daily chart as tariff threats arise. But that area is another personal entry zone if fundamentals hold.

Thus, while it could be a bumpy ride and the risk is there for delisting, NASDAQ:JD is in a personal buy zone at $33.16 (with known risk of drop to the $20s in the near-term).

Targets into 2028:

$44.00 (+32.7%)

$52.00 (+56.8%)

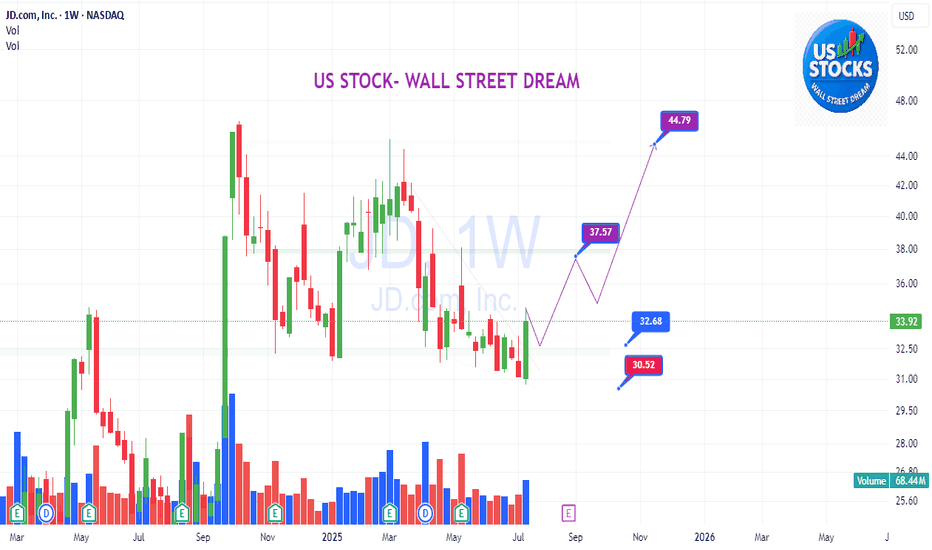

JD last correction is overSince fiscal stimulus announced by China, JD started to print an expanding diagonal which I labeled in black as 1-2-3-4-5. Currently, wave 4 is over (or will be over within a few days) and wave 5, the longest in such a type of diagonal, is set to unfold.

Which supportive evidence I found:

wave 4 is formed as a double three as (w)-(x)-(y) and (y) contains and ending diagonal - see green impulsive wave down. The diagonal's wave 5 reached the lower edge.

wave 4 retraced 61.8% of wave 3

wave can be seen as a bullish flag - it nicely fits into the channel (I showed in green)

both RSI and MACD show bullish divergence with price on daily

I believe JD will revert with strong impulse up in the coming days.

See divergences:

Has JD.com Bottomed?JD.com has languished for a couple of months, but some traders may think the Chinese e-commerce stock has bottomed.

The first pattern on today’s chart is the April low of $31.80. JD closed below the level once in May but quickly rebounded. That could be interpreted as a false breakdown.

Second, MACD made a higher low as prices made a lower low . Such “bullish divergence” can potentially signal reversals.

Third, the stock crossed above the 8- and 21-day exponential moving averages and is pulling both higher. That may suggest its short-term direction is now pointing upward.

Fourth, the rising 200-day simple moving average could reflect the presence of a longer-term uptrend.

Last, consider the February low around $38. JD stalled around the same area in April and May. With the stock more than 10 percent below that old resistance, could chart watchers see further space to the upside?

Check out TradingView's The Leap competition sponsored by TradeStation.

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options and futures. If you're born to trade, we could be for you. See our Overview for more.

Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options or futures); therefore, you should not invest or risk money that you cannot afford to lose. Online trading is not suitable for all investors. View the document titled Characteristics and Risks of Standardized Options at www.TradeStation.com . Before trading any asset class, customers must read the relevant risk disclosure statements on www.TradeStation.com . System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors.

Securities and futures trading is offered to self-directed customers by TradeStation Securities, Inc., a broker-dealer registered with the Securities and Exchange Commission and a futures commission merchant licensed with the Commodity Futures Trading Commission). TradeStation Securities is a member of the Financial Industry Regulatory Authority, the National Futures Association, and a number of exchanges.

TradeStation Securities, Inc. and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., both operating, and providing products and services, under the TradeStation brand and trademark. When applying for, or purchasing, accounts, subscriptions, products and services, it is important that you know which company you will be dealing with. Visit www.TradeStation.com for further important information explaining what this means.

JD.com - To long or not to long ?If you want to gain market share in a newly encroached area that you are entering, sometimes, having hoards of cash in your balance sheet helps. That is the case for JD.com who has recently entered into the food delivery business in China, competing with the likes of market leader, Meituan and Alibaba.

The recent financials has been encouraging though I am concerned what happens when the stimulus package by the government ceases? The additional spending by consumers for electronic appliances which JD.com is famous for, would this come to a dismal ending once the government handouts ceased?

Many analysts predict a profit target of 50 but I am more optimistic as I feel it has much more legs to go up.

As usual, please DYODD

Bullish BO of a descending channel and triangleJD has been pulling back for quite a while, and has just recently broken from the descending channel, after touching a higher TF dynamic support level, reacting from it and today with volume, obviously, every trade has their risks, plus tomorrow is it's earnings release so keeping that in mind... Need to act quickly if investors don't like the results and actually pull the market back down, however, it could go positively and allow us to capitalize on the uptrend as well.

So it is a slight risky trade, however, never invest the whole lot in one go, and accumulate as the price allows you to do it!

Bullish Divergence for 9618 in dailyGiven the spot of bullish divergence in RSI,

and that 1-2-3-4-5 is potentially completed,

I would like to change my prediction from a bearish market to a bullish market.

The retracement to $115 will be completed in future months.

I estimate 9618 will be raising as B in this month

JD.COM - we had amazing earnings, waiting for the yearly report!JD.com is scheduled to release its fourth-quarter and full-year 2024 financial results on March 6, 2025.Analysts are optimistic about the company's performance, with several key indicators pointing toward positive growth:

Earnings Projections:

Earnings Per Share (EPS): The consensus estimate for the upcoming quarter is $0.85, reflecting an increase from last year's $0.73 for the same period.

Revenue Growth: Projections indicate a year-over-year revenue growth of approximately 6.61%, with expected revenues rising from $43.11 billion to $45.96 billion.

Analyst Ratings:

Strong Buy Recommendation: Based on evaluations from nine analysts, JD.com has received a consensus rating of "Strong Buy," underscoring confidence in the company's growth trajectory.

Future Outlook:

Earnings Growth: Forecasts suggest JD.com's earnings will grow by 13% per annum, with an anticipated EPS growth rate of 12.8% annually.

Revenue Projections: The company's revenue is expected to increase by 5.6% per year, indicating sustained business expansion.

These positive indicators reflect JD.com's robust market position and its potential for continued growth in the upcoming earnings release.

Entry: 42.00

Target 70.00