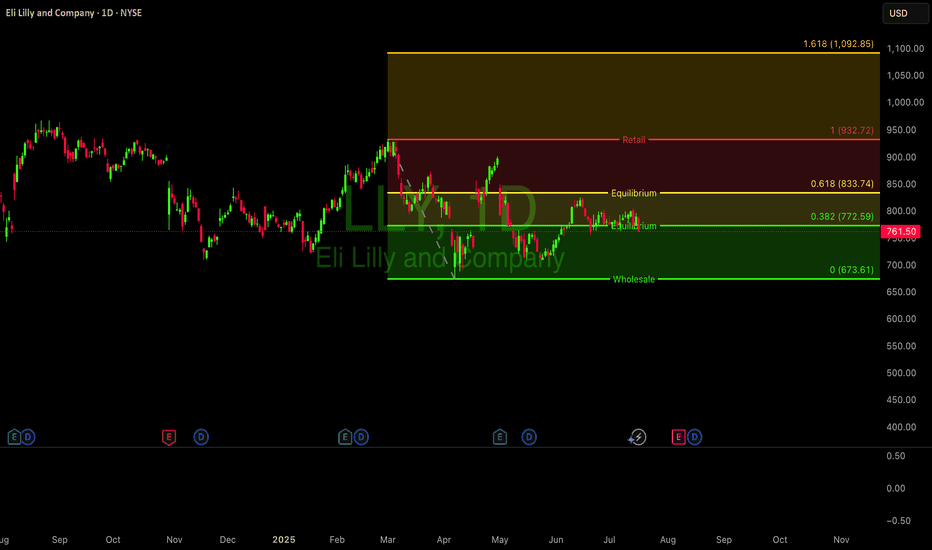

Just want to be there.. $LLYNYSE:LLY is showing classic signs of a Stage 3 top after its massive multi-year run. The trend has stalled, and the stock is now in a volatile sideways range.

Resistance: $975 Critical Support: $690

A weekly close below support would be a major bearish signal, potentially confirming the top and i

Key facts today

Eli Lilly's Jaypirca (Pirtobrutinib) met its main goal in a Phase 3 trial, surpassing Imbruvica in treating chronic lymphocytic leukemia and small lymphocytic lymphoma.

Eli Lilly's shares dropped about 4% to $784 after Novo Nordisk's profit warning. However, Eli Lilly's weight-loss drug Zepbound outpaced Wegovy prescriptions by over 100,000 weekly.

4,427.86

0.03 BRL

57.09 B BRL

242.82 B BRL

About Eli Lilly and Company

Sector

Industry

CEO

David A. Ricks

Website

Headquarters

Indianapolis

Founded

1876

ISIN

BRLILYBDR006

FIGI

BBG002QBHFC7

Eli Lilly & Co. engages in the discovery, development, manufacture, and sale of pharmaceutical products. The firm's products consist of diabetes, oncology, immunology, neuroscience, and other products and therapies. The company was founded by Eli Lilly in May 1876 and is headquartered in Indianapolis, IN.

Related stocks

Eli Lilly (LLY) – Full Technical + Fundamental Analysis (July 20

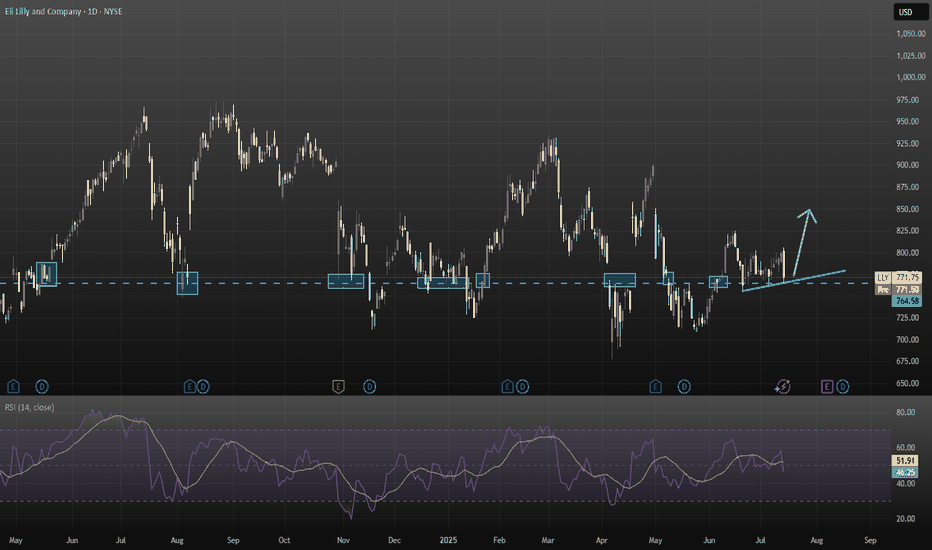

I wanted to take a deeper dive into LLY and analyze more than just trendlines—looking into both the technical structure and the broader fundamentals of the stock.

Sources: i have a list of sources at the end of my report

Technical Breakdown:

Current Price: ~$771.75

Resistance Zone: $950–970 p

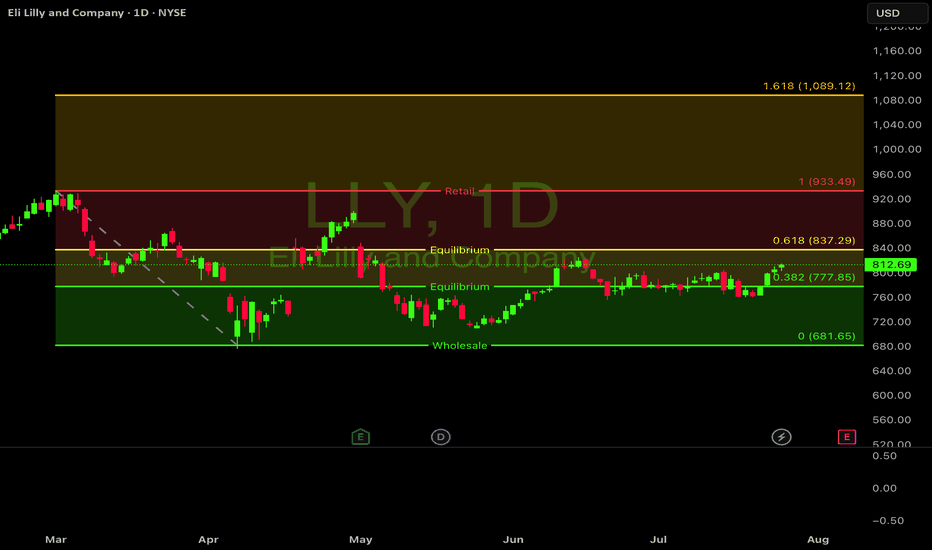

Conservative Bullish Case for Eli Lilly: A Pharmaceutical LeaderEli Lilly (LLY) is currently trading at $812.95, having recently shown strength by climbing from the mid-$700s to over $800 in the past month. The stock has established a key support zone in the $760-780 range while testing resistance around the current price level.

Fundamental Strength

LLY's rece

LLY - Earnings upcoming, recent news makes this appealing📈 LLY — Eli Lilly & Co.

Ticker: LLY | Sector: Biotech / Pharmaceuticals

Date: July 26, 2025

Current Price: ~$813

Resistance Zone: $825

Support Zone: $740–$750

🧪 Recent Drug News

1. EMA Backs Alzheimer’s Drug Donanemab (Kisunla)

The European Medicines Agency’s advisory committee has issued a positiv

$LLY Technical Setup – Breakout ReloadingNYSE:LLY is holding a critical mid-range level, and the chart hints at a potential accumulation before a breakout. Here's the updated view:

🔹 Horizontal Range Still Intact: Price remains trapped between ~$710 support and ~$965 resistance. These levels have acted as major turning points for over a

ELI LILLY Is starting its next big rally.Eli Lilly (LLY) is about to test its 1W MA50 (blue trend-line) following a rebound just below the 1W MA100 (green trend-line). The latter, has been the ultimate market Support since May 2018 (last time it broke below it).

The overall correction since the July 15 2024 High seems like a Bull Flag pat

Eli Lillly $LLYNYSE:LLY – Long Setup Ahead of June FOMC

Eli Lilly remains fundamentally strong, with robust growth in revenue (+45% YoY), driven by weight-loss and diabetes drugs like Mounjaro and Zepbound. Despite this, the stock saw a recent pullback after a lowered FY25 profit outlook.

Technical View:

LLY is

LLY Daily: Navigating Key Levels - Two Strategic OpportunitiesOVERVIEW:

LLY has recently undergone a significant correction from its highs, finding strong demand at a crucial support zone. Price action now presents two distinct, high-probability long entry scenarios based on the stock's interaction with key horizontal levels. My analysis outlines potential ent

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

XS238628644

ELI LILLY 21/43Yield to maturity

7.79%

Maturity date

Sep 14, 2043

US532457BY3

ELI LILLY 20/50Yield to maturity

7.42%

Maturity date

May 15, 2050

US532457BZ0

ELI LILLY 20/60Yield to maturity

7.15%

Maturity date

Sep 15, 2060

US532457BU1

ELI LILLY 19/59Yield to maturity

6.22%

Maturity date

Mar 15, 2059

US532457BT4

ELI LILLY 19/49Yield to maturity

6.12%

Maturity date

Mar 15, 2049

LLY4492882

Eli Lilly and Company 3.95% 15-MAY-2047Yield to maturity

6.07%

Maturity date

May 15, 2047

US532457BS6

ELI LILLY 19/39Yield to maturity

6.03%

Maturity date

Mar 15, 2039

LLY4217068

Eli Lilly and Company 3.7% 01-MAR-2045Yield to maturity

6.02%

Maturity date

Mar 1, 2045

LLY5547405

Eli Lilly and Company 4.95% 27-FEB-2063Yield to maturity

5.87%

Maturity date

Feb 27, 2063

LLY5750032

Eli Lilly and Company 5.1% 09-FEB-2064Yield to maturity

5.83%

Maturity date

Feb 9, 2064

LLY5547404

Eli Lilly and Company 4.875% 27-FEB-2053Yield to maturity

5.82%

Maturity date

Feb 27, 2053

See all LILY34 bonds

Curated watchlists where LILY34 is featured.