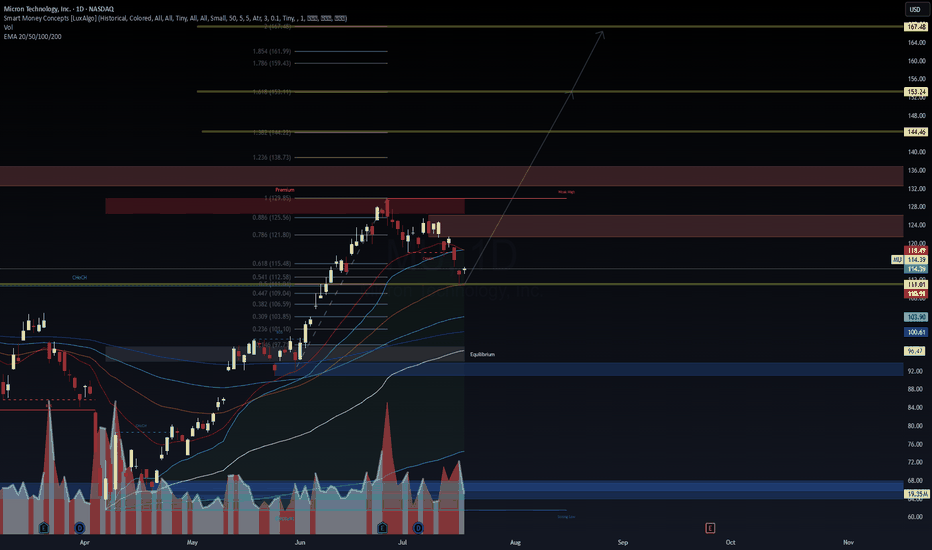

$MU – Preparing for Institutional Flow Reversal?📈 NASDAQ:MU – Preparing for Institutional Flow Reversal?

Micron ( NASDAQ:MU ) is at a crucial confluence zone, holding just above the 0.618 retracement ($115.48) after a CHoCH breakdown. With EMAs (20/50/100/200) aligning under price, the technical setup hints at an early-stage liquidity grab bef

5.34 BRL

3.98 B BRL

128.60 B BRL

About Micron Technology

Sector

Industry

CEO

Sanjay Mehrotra

Website

Headquarters

Boise

Founded

1978

ISIN

BRMUTCBDR008

FIGI

BBG00P14K500

Micron Technology, Inc. engages in the provision of innovative memory and storage solutions. It operates through the following segments: Compute and Networking Business Unit (CNBU), Mobile Business Unit (MBU), Embedded Business Unit (EBU), and Storage Business Unit (SBU). The CNBU segment includes memory products and solutions sold into client, cloud server, enterprise, graphics, and networking markets. The MBU segment is involved in memory and storage products sold into smartphone and other mobile-device markets. The EBU segment focuses on memory and storage products sold into automotive, industrial, and consumer Markets. The SBU segment consists of SSDs and component-level solutions sold into enterprise and cloud, client, and consumer storage markets. The company was founded by Ward D. Parkinson, Joseph Leon Parkinson, Dennis Wilson, and Doug Pitman on October 5, 1978 and is headquartered in Boise, ID.

Related stocks

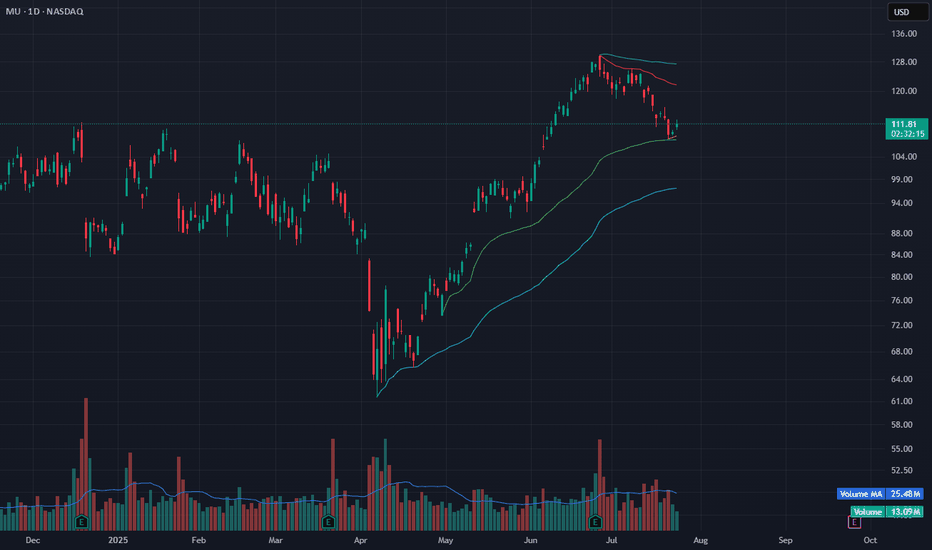

MU Bounce at VWAP Support – Eyeing Relief Toward $118MU is showing signs of a potential reversal after a multi-week pullback. Price held the anchored VWAP zone (green line) near $109 and bounced today with a +1.83% move on 13M volume.

This level also aligns with the lower Bollinger Band — a common mean-reversion setup after extended downside. A short

MU eyes on $95/97: Double Golden fib zone Ultra-High GravityMU looking to exit a Double Golden zone $95.33-97.23

Break could pop to next resistance zone $109.41-111.38

Expecting some orbits around this ultra high gravity zone.

.

Previous Plot that caught the bottom EXACTLY:

==================================================

.

Micron Technology - Another +50% rally will follow!Micron Technology - NASDAQ:MU - will rally another +50%:

(click chart above to see the in depth analysis👆🏻)

About two months ago Micron Technology perfectly retested a confluence of support. This retest was followed by bullish confirmation, nicely indicating a reversal. So far we saw a rally o

Bullish flag Pattern on MUIt appears there is a Bull flag occurring in MU. Weve seen an 82% rise since the lows caused by the market drop in April and our now seeing a slight retraction back into the 21 EMA. Price is currently at 118.6 with some support at the 114 level. Using a Stop Loss just below this support level should

MU - SMC Premium Zone Rejection | Targeting Equilibrium Before E📉 MU - SMC Premium Zone Rejection | Targeting Equilibrium Before Expansion

🔍 WaverVanir DSS Framework | SMC x Fibonacci x Liquidity

We just observed rejection from the Premium zone and 0.886 Fibonacci retracement near $129.85, aligning with prior weak high liquidity. Price has shown signs of distri

Micron Technology Inc.: Optimistic Long-Term Outlook Driven by ACurrent Price: $124.53

Direction: LONG

Targets:

- T1 = $128.50

- T2 = $130.00

Stop Levels:

- S1 = $123.00

- S2 = $120.00

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging the collective intelligence

MU bulls are out for blood!boost and follow for more ❤️🔥 MU had a very bullish break of trend resistance/ALL simple move average resistance that were previously holding it back. Now bulls took back control and are out for blood.. on the big dip earlier this year you can see resistance from 2022 acted as its new bottom/suppor

Micron Technology - Starting the next +80% move!Micron Technology - NASDAQ:MU - perfectly respects structure:

(click chart above to see the in depth analysis👆🏻)

Starting back in mid 2024, Micron Technology created the expected long term top formation. We witnessed a correction of about -60%, which ultimately resulted in a retest of a conflu

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

MU5283110

Micron Technology, Inc. 3.477% 01-NOV-2051Yield to maturity

6.95%

Maturity date

Nov 1, 2051

MU5283109

Micron Technology, Inc. 3.366% 01-NOV-2041Yield to maturity

6.77%

Maturity date

Nov 1, 2041

MU6062157

Micron Technology, Inc. 6.05% 01-NOV-2035Yield to maturity

5.45%

Maturity date

Nov 1, 2035

MU5980483

Micron Technology, Inc. 5.8% 15-JAN-2035Yield to maturity

5.41%

Maturity date

Jan 15, 2035

MU5283108

Micron Technology, Inc. 2.703% 15-APR-2032Yield to maturity

5.39%

Maturity date

Apr 15, 2032

MU5537465

Micron Technology, Inc. 5.875% 09-FEB-2033Yield to maturity

5.18%

Maturity date

Feb 9, 2033

MU5568332

Micron Technology, Inc. 5.875% 15-SEP-2033Yield to maturity

5.14%

Maturity date

Sep 15, 2033

MU6062156

Micron Technology, Inc. 5.65% 01-NOV-2032Yield to maturity

5.02%

Maturity date

Nov 1, 2032

MU5732741

Micron Technology, Inc. 5.3% 15-JAN-2031Yield to maturity

4.78%

Maturity date

Jan 15, 2031

MU4858016

Micron Technology, Inc. 4.663% 15-FEB-2030Yield to maturity

4.78%

Maturity date

Feb 15, 2030

US595112BV4

MICRON TECHN 22/29Yield to maturity

4.68%

Maturity date

Nov 1, 2029

See all MUTC34 bonds

Curated watchlists where MUTC34 is featured.