740,000.000

0.000 BRL

2.49 B BRL

15.45 B BRL

About Palantir Technologies Inc.

Sector

Industry

CEO

Alexander Caedmon Karp

Website

Headquarters

Denver

Founded

2003

ISIN

BRP2LTBDR001

FIGI

BBG0123NSC58

Palantir Technologies, Inc. engages in the business of building and deploying software platforms that serve as the central operating systems for its customers. It operates through the Commercial and Government segments. The Commercial segment focuses on customers working in non-government industries. The Government segment is involved in providing services to customers that are the United States government and non-United States government agencies. Its platforms are widely used in areas such as defense, intelligence, healthcare, energy, and financial services, supporting data integration, large-scale analytics, and operational decision-making. The company was founded by Alexander Ceadmon Karp, Peter Andreas Thiel, Stephen Cohen, Joseph Lonsdale, and Nathan Dale Gettings in 2003 and is headquartered in Denver, CO.

Related stocks

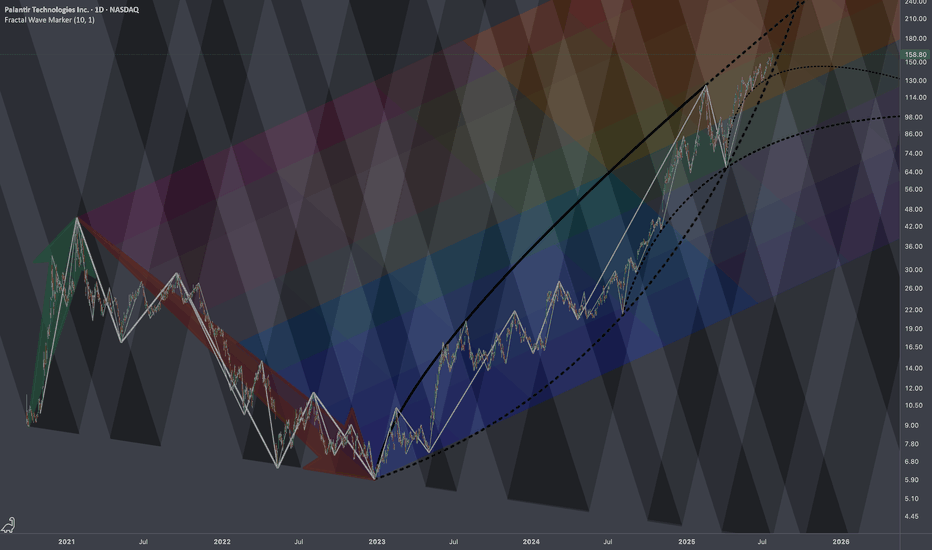

$PLTR: Regressive Heatmap🏛️ Research Notes

Technically this looks overbought, but fundamentally we know that under current administration this company is clear beneficiary (new contracts). Seems to explain why chart's dips were bought off extending bullish phases of cycle. However, there is still always a limit (as price

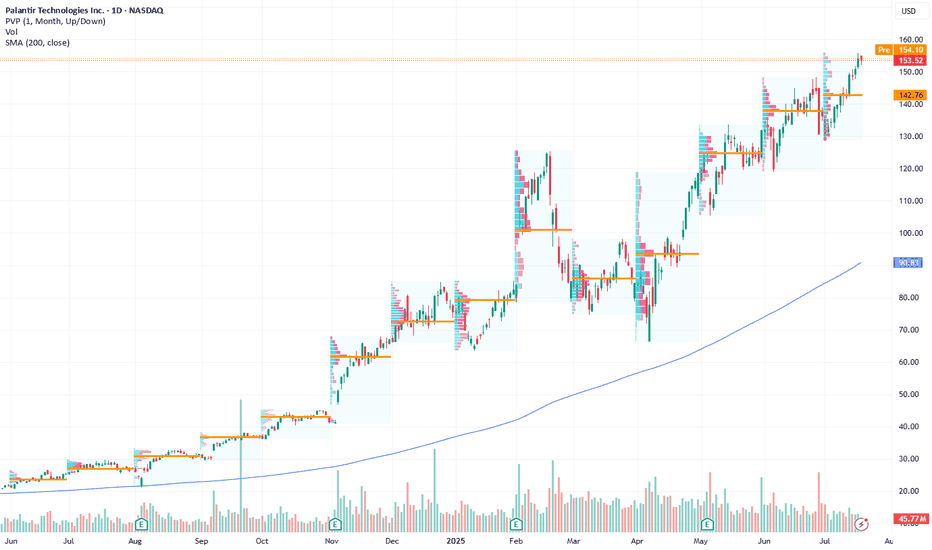

Palantir Technologies (PLTR) Shares Surpass $160Palantir Technologies (PLTR) Shares Surpass $160 for the First Time

Shares of Palantir Technologies (PLTR), a company specialising in big data analytics software, have continued their impressive performance. Following an extraordinary rally of approximately 340% in 2024, the stock remains among th

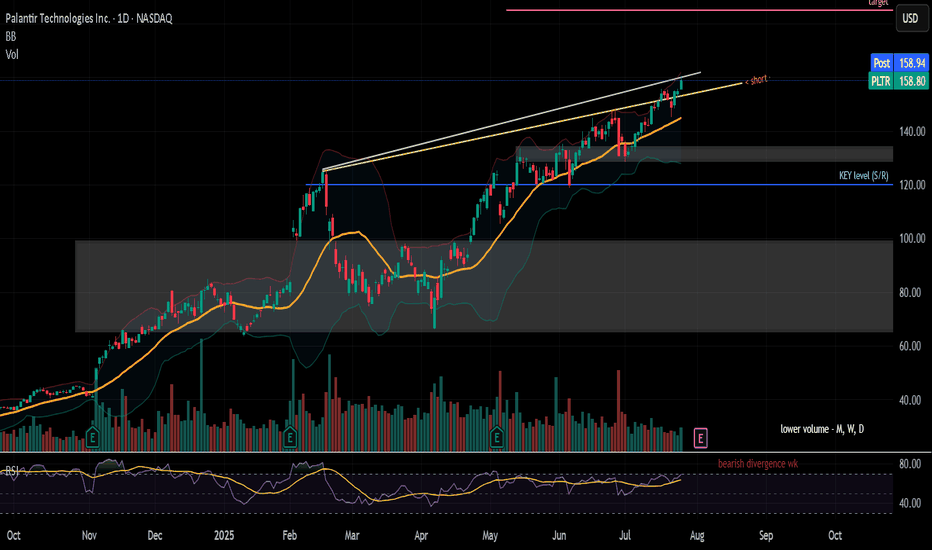

Hot Take, PLTR is a BubbleHello I am the Cafe Trader.

Price Action suggest we haven't had a proper buyer since $90.

Now I know that this can sound a bit off putting (especially if you bought above $90).

Even if this crashed, I am not suggesting you sell your long term position. I would instead look into hedging your posi

Palantir Technologies: Long Opportunity Amid AI MomentumCurrent Price: $153.52

Direction: LONG

Targets:

- T1 = $159.20

- T2 = $165.80

Stop Levels:

- S1 = $150.70

- S2 = $147.30

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to ide

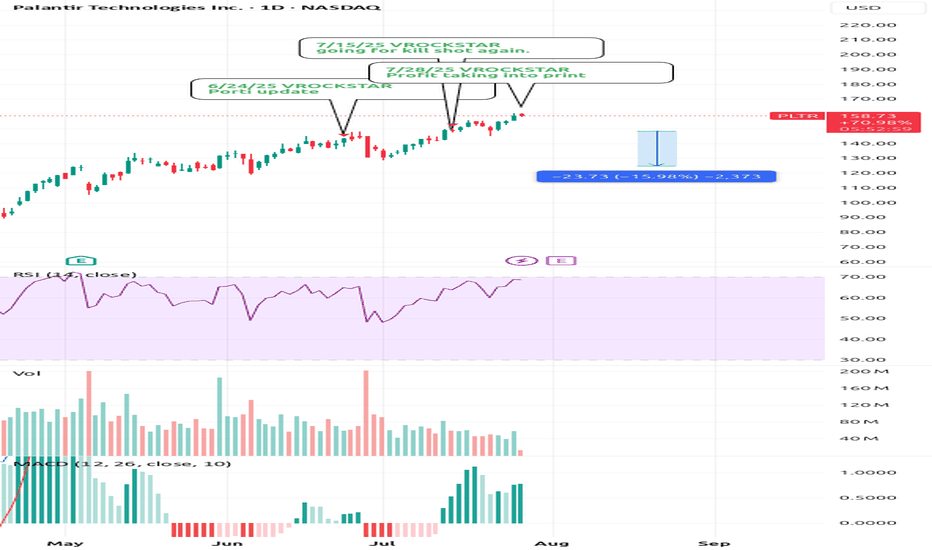

7/28/25 - $pltr - Profit taking into print7/28/25 :: VROCKSTAR :: NASDAQ:PLTR

Profit taking into print

- no idea what print brings

- but mgmt have been sell-only

- valuation is what it is... inexplicable by anyone

- i'd not be surprised to see anything happen on the result

- but into result, big holders (read: not you) are likely going t

PLTR is doing it... pullback honeyThis video has my thoughts about PLTR and a trading view tip... the data window!!! Who knew?

Hope the talk inspires you as you decide on future investments; especially when it's stalling or pulling back.

My short term bias is bearish for a pullback on PLTR. Not sure when it will happen, but <155 i

PLTR - Rising wedge formation leads to potentially larger move🧠 PLTR WEEKLY TECH+FUNDAMENTAL BRIEF

Ticker: NASDAQ:PLTR | Sector: AI / Big Data / Defense Tech

Date: July 27, 2025

🔍 Chart Watch: Rising Wedge Risk

Palantir is trading within a rising wedge formation, a pattern often signaling bearish reversal if upward momentum fades. Recent price action has ti

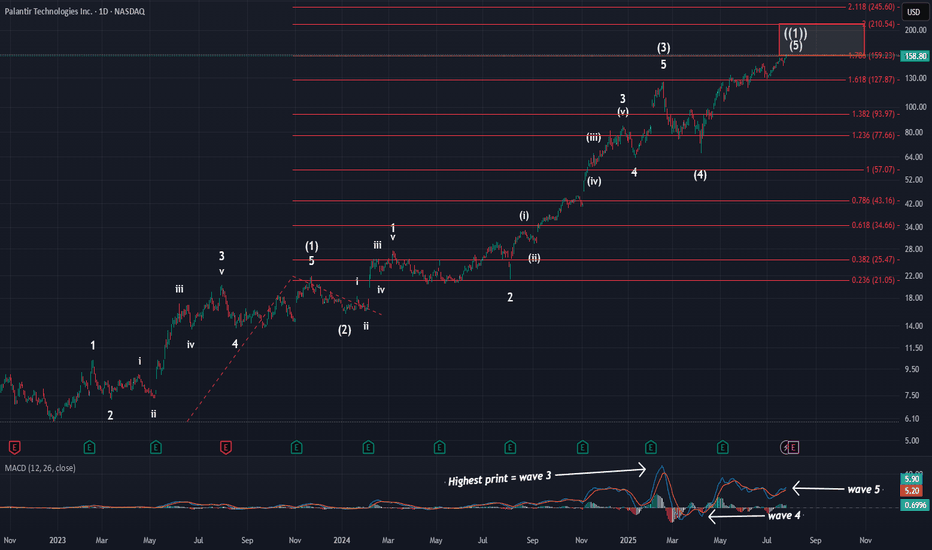

PalantirOn Friday, price hit the 1.236 extension and the larger red 1.786 extension @ $159. Tonight, I wanted to zoom out to show you where price is in the grand scheme of things. As you can see, we have all of the needed waves in place to consider this larger pattern complete. We have finally hit the stand

PLTR Long trade!🟢

You’re expecting price to move upward, and your chart reflects a breakout setup with multiple resistance levels marked.

🔍 Key Technical Elements Noted:

Ascending triangle breakout:

The pink trendlines show an ascending triangle (bullish pattern) that successfully broke out.

Support Zone:

Aroun

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.