14,878.05

0.01 BRL

53.13 B BRL

237.08 B BRL

About Uber Technologies, Inc.

Sector

Industry

CEO

Dara Khosrowshahi

Website

Headquarters

San Francisco

Founded

2009

ISIN

BRU1BEBDR009

FIGI

BBG00R3TCRH2

Uber Technologies, Inc. is a technology platform, which engages in the development and operation of technology applications, networks, and product to power movement from point A to point B. The firm offers ride services and merchants delivery service providers for meal preparation, grocery, and other delivery services. It operates through the following segments: Mobility, Delivery, and Freight. The Mobility segment refers to products that connect consumers with Mobility Drivers who provide rides in a variety of vehicles, such as cars, auto rickshaws, motorbikes, minibuses, or taxis. The Delivery segment offers consumers the chance to search for and discover local restaurants, order a meal, and either pick-up at the restaurant or have the meal delivered. The Freight segment focuses on connecting Carriers with Shippers on its platform, and gives Carriers upfront, transparent pricing, and the ability to book a shipment. The company was founded by Oscar Salazar Gaitan, Travis Kalanick, and Garrett Camp in 2009 and is headquartered in San Francisco, CA.

Related stocks

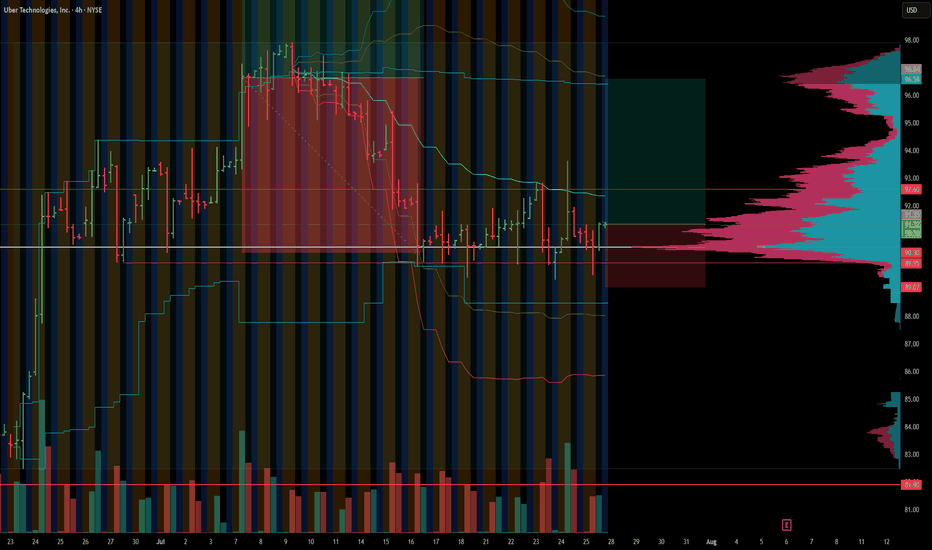

Uber swing playBullish Setup (if you think bounce holds)

• Buy Call Spread:

• Buy $90 Call (Sept expiry)

• Sell $100 Call (same expiry)

• Lower premium, defined risk. Target profit if stock runs to resistance.

• Cash-Secured Put:

• Sell $85 Put (Sept)

• Collect premium. If UBER dips, you get assigned at an

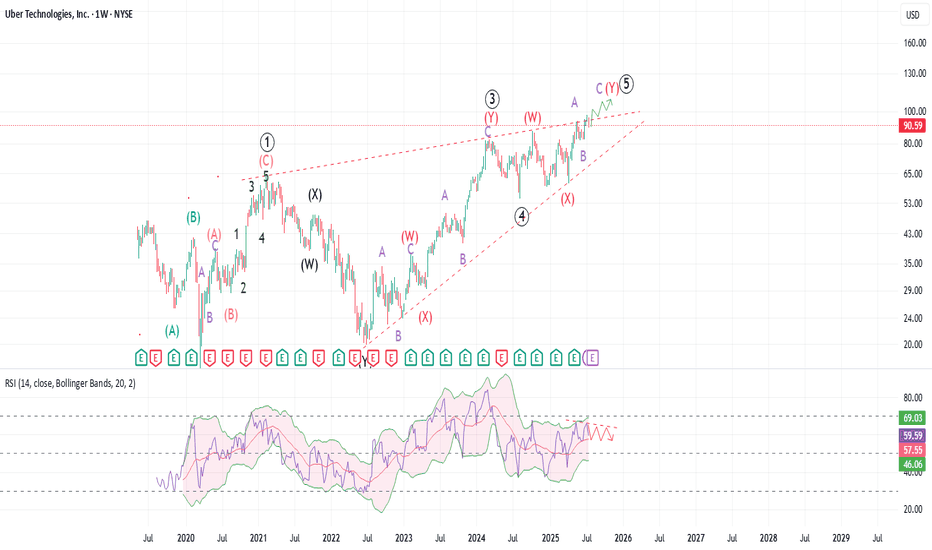

Uber: The end is nigh! Uber is most likely approaching a cycle degree end with a massive leading diagonal structure. The price might get higher than $100 or even close to $150, and it will look like an impulse, but most likely that would a long-term top. Uber is facing maximum pressure from robotaxi competitors and higher

$UBER: Why $UBER Is a Robotaxi WinnerUber is on the verge of a major transformation, with robotaxis set to become a game-changing profit engine.

Technical charts indicate we can enter a long position today with low risk, while aiming for a long term rally resumption from here. Monthly and quarterly timeframe Time@Mode trends are bull

Long Trade Description (UBER | Uber Technologies Inc.)📄

Ticker: NYSE:UBER

Timeframe: 30-Minute Chart

Trade Type: Long – Ascending Triangle Breakout

UBER is forming a strong ascending triangle near resistance, with bullish momentum and clean structure. Entry is taken around $97.48, anticipating a breakout above the horizontal level. Target is set at

UBER · Daily — “Channel-Break” Idea Toward $110 → $125Why I Like the Setup

Secular Up-Channel: Since mid-2023 price has respected a textbook rising channel (~$30 tall).

Fresh Breakout Attempt: UBER is now pressing the upper rail near $100. A daily close above it would signal a new expansion phase.

Measured-Move Math: Projecting the channel’s height f

Uber’s Path to $95+Uber Technologies (UBER) is positioning itself for long-term growth by expanding beyond its core ride-hailing and delivery businesses into advertising, travel, service partnerships, and autonomous vehicle (AV) technology. These strategic moves aim to diversify revenue streams and enhance operational

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

UBRT4884099

Uber Technologies, Inc. 7.5% 15-SEP-2027Yield to maturity

7.15%

Maturity date

Sep 15, 2027

USU9029YAF7

UBER TECHNO. 20/28 REGSYield to maturity

6.12%

Maturity date

Jan 15, 2028

UBRT5886387

Uber Technologies, Inc. 5.35% 15-SEP-2054Yield to maturity

5.88%

Maturity date

Sep 15, 2054

UBRT5886385

Uber Technologies, Inc. 4.8% 15-SEP-2034Yield to maturity

4.95%

Maturity date

Sep 15, 2034

USU9029YAG5

UBER TECHNO. 21/29 REGSYield to maturity

4.85%

Maturity date

Aug 15, 2029

UBRT5886386

Uber Technologies, Inc. 4.3% 15-JAN-2030Yield to maturity

4.29%

Maturity date

Jan 15, 2030

UBRT6077245

Uber Technologies, Inc. 0.0% 15-MAY-2028Yield to maturity

−3.44%

Maturity date

May 15, 2028

UBRT5706997

Uber Technologies, Inc. 0.875% 01-DEC-2028Yield to maturity

−7.29%

Maturity date

Dec 1, 2028

UBRT5323752

Uber Technologies, Inc. 0.0% 15-DEC-2025Yield to maturity

−30.10%

Maturity date

Dec 15, 2025

See all U1BE34 bonds

Curated watchlists where U1BE34 is featured.