WSP1! trade ideas

ES Weekly Outlook & Game Plan 20/07/2025ES Weekly Outlook & Game Plan

🧠 Fundamentals & Sentiment

Market Context:

ES continues its bullish momentum, driven by institutional demand and a supportive U.S. policy environment.

📊 Technical Analysis:

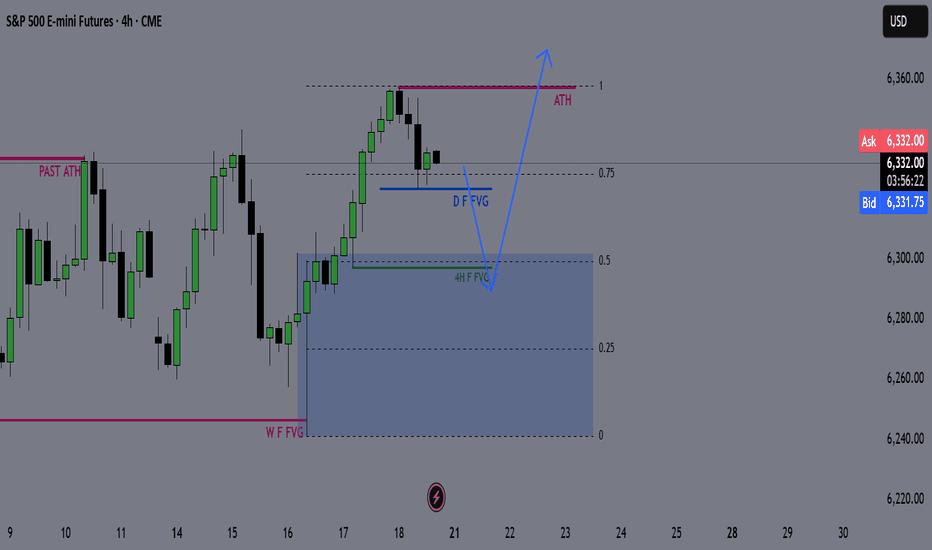

Price is currently in price discovery, and the weekly structure remains strongly bullish — so I prefer to follow the strength.

We might see a minor retracement before pushing further above the all-time high (ATH).

🎯 Game Plan:

I'm expecting a potential retracement to the 0.5 Fibonacci level, which is the discount zone in a bullish environment.

Interestingly, the 4H liquidity zone aligns perfectly with the 0.5 Fib level — this confluence suggests price may gather enough energy from there to make new highs.

✅ Follow for weekly recaps & actionable game plans.

NASDAQ: Still Bullish! Look For Valid Buys!Welcome back to the Weekly Forex Forecast for the week of July 21-25th.

In this video, we will analyze the following FX market:

NASDAQ (NQ1!) NAS100

The Stock Indices are strong, and showing no signs of selling off. Buy it until there is a bearish BOS.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

S&P 500: Buyers Are Still In Control! Continue To Look For LongsWelcome back to the Weekly Forex Forecast for the week of July 21-25th.

In this video, we will analyze the following FX market:

S&P 500 (ES1!)

The Stock Indices are strong, and showing no signs of selling off. Buy it until there is a bearish BOS.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

Still Bullish BiasOn the 4HR , there is already 2 legs down to start the month, similar to what happened in May. Markets typically has had 2 legs down before moving higher. Its August and its gonna be choppy.

We may test the tip of last years candle before we move even higher, which is another probably 80-100 points. However the hourly seems to reject this idea based on a 9 TD Sequential Count as the first alert failed and Bear continues pushing the price down. When in doubt always look at a higher timeframe. Just my thought of the probable outcome. Trade safe.

Friday's support clearly shown This is why I use the Accurate Swing Trading System (Ceyhun). Look at it in default configuration on this daily MES1! chart. I drew the red horizontal lines where the indicator line is "flat". That is what I am trying to show you. An "Emergent Quality" of the indicator. I note the line at 6,241 and the LOD at 6239.50. ( line at 6318 failed to support the price) My experience with it says it's better than Fibonacci, Camarilla etc. Where do we go from here?.....The market will show us....Let the Ceyhun show you support and resistance on shorter term charts....You will be glad you did. Happy Trades. DAP

08/1/25 Trade Journal, and ES_F Stock Market analysis EOD accountability report: +440

Sleep: 6 hours

Overall health: Good

VX Algo System Signals from (9:30am to 2pm)

— 9:30 AM Market Structure flipped bearish on VX Algo X3!

— 10:12 AM VXAlgo ES X1 Buy signal

— 10:20 AM VXAlgo NQ X1 Buy Signal

—12:30 PM Market Structure flipped bullish on VX Algo X3!

— 1:00 PM Market Structure flipped bearish on VX Algo X3!

— 1:50 PM VXAlgo ES X1 Buy signal,

— 3:00 PM Market Structure flipped bullish on VX Algo X3!**

What’s are some news or takeaway from today? and What major news or event impacted the market today?

Market range expanded a lot today, we dropped over 100 points today and sometimes i forget to adjust my bracket orders to go for 10 -15 points take profits when the volatility is so high. But overall, it was a good day, I knew to be patient as market was wild and sometimes you want to just snipe a few trades and call it a day before you get caught on the wrong side.

The great thing about big moves is that it will eventually hit a major level and it will react really well, you just have to wait for it.

a great question is will the market recover? Or is going back down to April prices?

News

*STOCKS TUMBLE TO END THE WEEK, VIX SPIKES AS SOFT JOBS DATA STOKE ECONOMIC JITTERS

What are the critical support levels to watch?

--> Above 6330= Bullish, Under 6310= Bearish

ID: 2025 - 0158.1.2025

Trade #15 of 2025 executed.

Trade entry at 140 DTE (days to expiration).

Excellent fills this morning, well under mid. Created a GTC working order two days ago and let price come to me. No chasing. There are TONS of external liquidity voids resting below.

Target profit is 5% ROI

Happy Trading!

-kevin

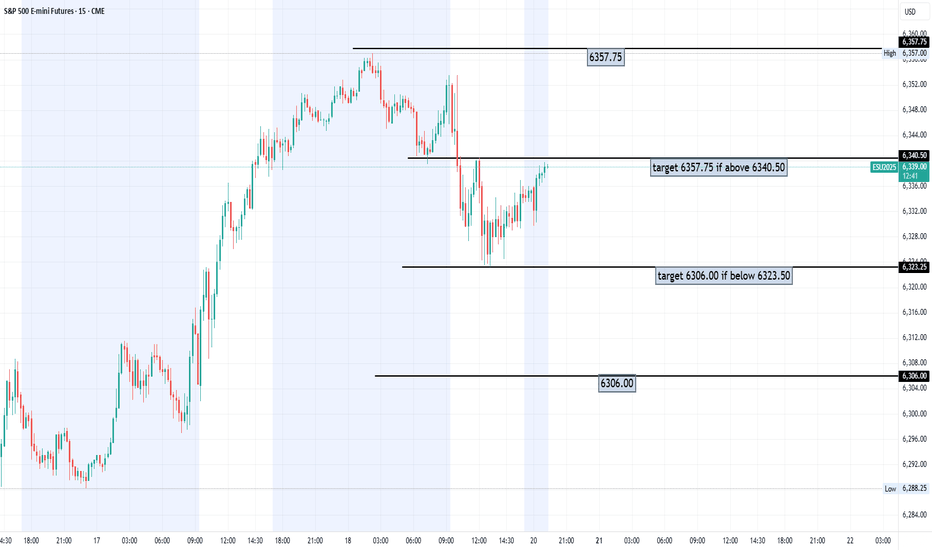

ES - August 1st Daily Plan Update - 7:35amAugust 1st, 2025 - 7:35am Update:

Price couldn't clear 6370 overnight and tested 6350 2x and then back tested around 3am and then sold off, which is what I was looking to happen as posted last night. Overnight price has dropped to 6296 and is currently at 6310. The reclaim of 6321 area should give us a back test of the 6350 resistances ahead. IF, price can clear 6321, first target 1 -6335, target 2 - 6350, then 6370 then 6403 are next up.

IF, we lose 6296, we would want to see a reclaim of it to enter a trade. IF, ES sells off today, better to get out the way and wait for price to reclaim 6296.

August 1st, 2025 - 6:53pm Session Opening Hour- Daily Plan

Thursday's high was 6468 and low was 6358. We have been in this range for the past week.

6366-74 was the area that we broke out into this range and have tested this zone the past 2 days.

In order for us to move higher, we need to break above 6366-70 which then can target 6403, 6417, 6433.

If we break below 6350 the next target areas for a reaction is 6336, 6317, 6272

Ideally, we can build structure here at 6350 and clear 6366-70 or look for price to touch the zones in blue below and then flush and recover 6350 zone for a nice move to the 6366-70 first target.

Structure Says Short… But Will News Flip the Script?Price continues to unwind following Thursday’s distribution, where we saw clear seller control above the 6420–6430 zone. Heikin Ashi candles show strong trend conviction with no upper wicks, and the EMA stack remains fully bearish. We're now pressing into the 0% Fibonacci extension at 6294, with the next low sitting around 6260 a clean vacuum zone that could fill quickly if the trend accelerates.

The volume profile from the breakdown range highlights 6429.25 as the point of control, acting as our primary rejection zone. Any pop into the 6383–6420 area will likely meet resistance. That’s our “dead cat bounce then fade” zone a textbook retracement rejection setup. Unless we reclaim 6435+ with conviction, the short bias remains intact.

We’re already short from 6306, targeting 6260. Stops are invalidated on a strong reclaim above the 6435 level.

However, today brings serious macro risk:

Trump has announced sweeping new tariffs on 92 countries, including 35% on Canada and 39% on Switzerland, triggering equity market anxiety. These surprise trade actions could cause intraday spikes or violent reversals, especially if retaliatory news drops intraday.

Amazon’s Q2 earnings missed cloud revenue expectations, putting pressure on tech futures.

U.S. Non farm Payrolls (NFP) are due at 8:30 AM ET, with expectations at +110K and unemployment ticking up to 4.2%. A strong jobs print could derail September rate cut hopes and add fuel to downside continuation or completely reverse sentiment.

We’re aware of this news risk and will adjust intraday. No stubborn bias here. But structurally, price is still in a trend, and this setup favours continuation unless macro flips the table.

My Setup Summary:

- Bias: Bearish (Trend Continuation)

- Entry: 6306 (Short)

- Target: 6260

- Invalidation: 6435 reclaim

- Confluence: POC rejection, Fib retrace, bearish EMAs, weak retrace structure

- News Risk: Tariffs, Amazon earnings miss, NFP at 8:30 AM ET

Good luck today and hope that we end the week profitable.

ES : Key levels⚠️ VOLATILITY WARNING ⚠️

Trading around major news can be extremely unpredictable. Trade responsibly!

Here are the key levels that the market will be interested in. So far, the green level of ~6.263 is likely to bounce, but it is old. I'd wait for something fresher.

From the minor timerframe, we can soon go long from ~6.352. If I'm at my computer and everything works out at this level as it should, I'll let you know.

The market is concernedThe structure of the S&P 500 daily chart implies a market that is concerned. Although many of the fundamentals released on Thursday were basically meeting market expectations, there is concern about the impact of the tariffs there is concern about geopolitical factors and there is concern about how the market will absorb Friday's economic numbers. Sellers are here but will they have a reason to follow through to the downside as we go into the weekend.

ES - August 1st, 2025 - Session Opening HourAugust 1st, 2025 - 6:53pm Session Opening Hour- Daily Plan

Thursday's high was 6468 and low was 6358. We have been in this range for the past week.

6366-74 was the area that we broke out into this range and have tested this zone the past 2 days.

In order for us to move higher, we need to break above 6366-70 which then can target 6403, 6417, 6433.

If we break below 6350 the next target areas for a reaction is 6336, 6317, 6272

Ideally, we can build structure here at 6350 and clear 6366-70 or look for price to touch the zones in blue below and then flush and recover 6350 zone for a nice move to the 6366-70 first target.

I will update the plan based on overnight price action by 8am EST, Friday August 1st, 2025

**07/31/25 Trade Journal, and ES_F Stock Market analysis **

EOD accountability report: +

Sleep: 5.5 hours

Overall health: Good

** VX Algo System Signals from (9:30am to 2pm) **

— 9:00 AM Market Structure flipped bullish on VX Algo X3

— 9:30 AM VXAlgo ES X7 Sell signal

— 9:32 AM Bullish market structure got cancelled

— 11:40 AM VXAlgo NQ X1 Buy Signal

— 12:40 PM VXAlgo NQ X1 Sell Signal

— 1:00 PM Market Structure flipped bullish on VX Algo X3!

— 1:22 PM if we lose 6415 and stayy under it . Bullish Market structure is cancelled.

— 1:55 PM VXAlgo NQ X1 Buy Signal

What’s are some news or takeaway from today? and What major news or event impacted the market today?

Today marked the 4th day of the structure signals being iffy as they try to tip the volumes bullish just to cancel it right afterwards.

I was starting to get a bit tilted today as I had a bunch of orders at area that didn't get filled and eventually just gave up trying to have a green day and walked away.

looking at some of the other charts, i also we are getting a doji on the longer time frames and it is starting to look like bear's wet dream.

However, Mag 7 stock earnings were really great, the only downside was rate cut isn't happening.

News

*U.S. STOCKS END LOWER, VIX JUMPS AS S&P 500, NASDAQ RETREAT FROM RECORDS DESPITE MONSTER META AND MICROSOFT EARNINGS

What are the critical support levels to watch?

--> Above 6415= Bullish, Under 6403= Bearish

Retail Used Indicators. You Used Structure. You Got Paid.MES printed a textbook quant setup today, delivering a high-confidence breakdown that played out almost mechanically. Price action first broke down from a well-respected rising trend channel, then pulled back into the 50% Fibonacci retracement zone at 6,426.75, drawn from the recent swing high at 6,457.50 to the low at 6,395.75.

The retracement also aligned with a heavy volume node, which acted as a clear supply zone. What followed was a rounded retest structure that resembled a teacup formation not as a bullish setup, but rather as a liquidity bait, luring in breakout buyers before delivering a clean rejection from the equilibrium zone.

This type of structure a trend line break + fib pullback + rounded retest + expansion move is one of Staakd’s high-probability short patterns, historically completing the measured move back to 0% (6,395.75) over 70% of the time. That target has now been hit, and with price currently consolidating below the broken structure and inside a low-volume area, we could now see a secondary move toward 6,375 if 6,395 fails to hold. If instead we see a relief bounce, the optimal re-entry zone sits between 6,410 and 6,420, just beneath the broken fib and previous channel floor.

This is one of those trades where structure, volume, and historical probability all lined up. The teacup retest served its purpose: trap liquidity, reject from the midpoint, and release pressure into the lower range. Unless MES reclaims 6,430, the bias remains firmly bearish.

These setups tend to show up 9–14 times per year on MES alone, especially during high-volume NY sessions or post-news volatility. What you’re looking for is a strong, clean trending structure that finally breaks then watch for a pullback to the 50–61.8% retracement zone, ideally aligning with a volume node or prior support. Often, this retest forms a rounded “teacup” shape a trap zone that attracts late buyers just before the breakdown. Once that zone rejects with momentum, price tends to expand cleanly toward the 0% fib level, or even extend further.

Track this pattern. Log it. It’s one of the most repeatable, mechanical moves we see in futures and when it shows up, it usually pays.

My recommendation is simple: ditch the clutter. Most retail traders are buried under recycled YouTube strategies, lagging indicators, and overcomplicated systems. The truth? Price structure, volume, and basic fib geometry are more than enough to build consistent trades. Go back to basics. Read the chart, not the noise. You'll be surprised how quickly your trading improves when you stop outsourcing your bias to indicators and start trusting clean, mechanical setups like this.

ES - July 31st Daily PlanJuly 31, 2025 8:55am - Daily Plan

We currently have support at 6448 in yellow. If we can flush 6448 and reclaim around 6452, that would be a good entry for a level-to-level move and target 6460, 6468.

Next level is shown in Green & Red around the 6430-6434 zone, and this is the high of yesterday and the overnight session low. There is an open gap that could be filled at 6426 and then the reclaim of 6432 would be a nice entry to test the 6448 resistance, could then continue to move higher to 6460, 6468+.

Those are the areas I will be looking to grab some points today!

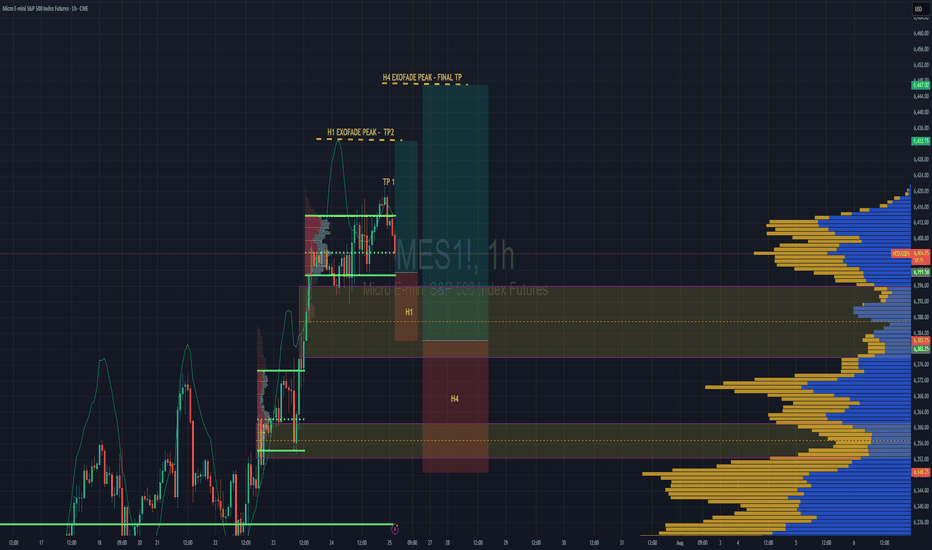

S&P 500 Intraday & Swing Entries H1 entry is close to getting activated for intraday.

If you want a swing trade then wait for H4 entry (you might be waiting a while obviously)

Reason for entries - We have broken out of Balance since July 25th and currently in a trend phase until we establish a new value area, or return to the one we broke out from.

So since Trend and Momentum is UP, then we should find Low Volume Areas to enter in the direction of the trend for a classic pullback entry trade.

07/30/25 Trade Journal, and ES_F Stock Market analysis EOD accountability report: +960

Sleep: 5 hours

Overall health: still struggling with sleep due to heat waves

VX Algo System Signals from (9:30am to 2pm)

— 8:30 AM Market Structure flipped bearish on VX Algo X3!✅

— 9:45 AM Market Structure flipped bullish on VX Algo X3! ✅

— 10:30 AM Market Structure flipped bullish on VX Algo X3!❌

— 11:30 AM Market Structure flipped bearish on VX Algo X3!❌

— 12:00 PM VXAlgo NQ X1DD Buy Signal, ✅

— 12:30 PM Market Structure flipped bullish on VX Algo X3!✅

What’s are some news or takeaway from today? and What major news or event impacted the market today?

I have started to noticed that the last 3 days, we have been getting false triggers on market structure signals and it almost feels MM are trying to do it to break people's algo that trade on that.

This is a good reminder that no matter how successful the signal has been for the last 30 days, you still need to have risk management. additionally, it's also a good way to test people's faith and trick new traders in going back to doing random things because it makes them think market can behave randomly and nothing works.

this is why i always tell people to religiously test out a system for 30 days before giving up.

News

*FEDERAL RESERVE SKIPS RATE CUT, KEEPS FED FUNDS RATE AT 4.50%

What are the critical support levels to watch?

--> Above 6410= Bullish, Under 6400= Bearish

Tech Earnings & Fed Meeting - July 30th - ES 100pt drop?I trade ES Futures and have identified an important support shelf that if broken could accelerate lower.

There is lower monthly volume below 6400 area. The monthly Point of Control is currently at 6300. The monthly 61.8% retracement is 6316. We have a fed meeting today and while trapping can happen, my lean is that we lose the 6400 level this week and could reach the 6316 target very quickly. Each level drawn are the more significant levels as to where institutional buyers may step in.