Weekly Market Forecast: Stocks Markets Could Push Higher!In this video, we will analyze the S&P 500, NASDAQ, and DOW JONES futures for the week of April 14-18th.

The Stock Market Indices ended a turbulent week on a bullish note, and next week could see some continuation. The markets have peeked above the consolidation, and could be on the way to resume the overall bullish trend.

Wait for confirmations of the trend before jumping in! One bad report of tariffs or geo-political news can turn the markets down at any time.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

WSP1! trade ideas

## ES (S&P 500) Futures Analysis

### **Current Situation**

1. **Price**: The ES futures contract (ESM2025) is currently at 5,391.25, up +89.25 (+1.68%) today.

2. **EMA**:

- EMA 5,749.80 is above the current price, indicating potential resistance.

- EMA 5,639.12 is also above the current price.

3. **RSI**: The Relative Strength Index is at 43.96, suggesting the market is neither overbought nor oversold.

### **Technical Analysis**

#### **Elliott Wave Theory**

- The chart suggests the completion of a 5-wave upward move, labeled (1) through (5).

- Currently, it seems the market might be undergoing a corrective phase.

#### **EMA Analysis**

- **EMA 5,749.80**: This EMA level might act as significant resistance.

- **EMA 5,639.12**: Like the other EMA, it presents resistance.

#### **RSI Divergence**

- The chart marks "Bear" zones. The RSI reading of 43.96 doesn't confirm oversold conditions, but it's approaching that area.

### **Recommendations for Traders**

1. **Short-Term Strategy**:

- Watch for resistance around the 5,640 level (EMA 5,639.12). A failure to break above this level could signal a continuation of the downward correction.

- If the price breaks above 5,640, it could test the higher EMA around 5,750.

2. **Medium-Term Strategy**:

- Be cautious about the potential for a deeper correction following the completion of the 5-wave pattern.

- Key support levels to watch include prior wave 4.

3. **Levels to Watch**:

- Resistance: 5,639.12 and 5,749.80.

- Support: Prior wave 4.

### **Conclusion**

The ES futures appear to be in a corrective phase after completing an upward 5-wave pattern. Traders should watch key resistance levels and be aware of the potential for further downside. A break above the EMAs could signal a continuation of the uptrend.

---

Answer from Perplexity: www.perplexity.ai

Buyers entered the S&P 500 on FridayStructurally in the S&P 500 daily chart it appears that buyers entered the market on Friday but it is in a tenuous situation because all it will take will be a comment, a negotiated deal or some other tariff situation that can create tremendous volatility for this market. If those fundamentals do not occur the expectation would be a firmer S&P 500 starting in the Asia session Sunday night at 5 o'clock Chicago time.

April 11th Trade Journal & Market AnalysisApril 11th Trade Journal & Market Analysis

EOD accountability report: +1566.50

Sleep: 6 hour, Overall health: going thru Flu symptoms

**Daily Trade Recap based on VX Algo System **

12:08 PM Market Structure flipped bullish on VX Algo X3!

1:00 PM VXAlgo ES X1 Sell Signal (2x Signal)

Today was a very choppy for the early part of the day, tested pre market lows and almost broke it because of consumer sentiment.

We eventually bounce and started moving upward toward the 5 min and 10 min resistance , and eventually broke out with the market structure flipping bullish at 12:08, we went back for a 1 min MOB backtest and pushed up further.

Monday plan; look for back to support as noted on the video

BIG BIG weekI think 7 FED speakers,

A lot of tension in the markets, tops mean polarisation, considering reflexivity theory extreme volatility will ensue.

A lot of people might think the -0.786 ATH we got before the holidays is the top. I think they are mistaken as seen in the analysis below.

There is still legroom for higher, this is a big bet on my part.

I have a few contracts on the mag7 (GOOGL, TSLA and META) focusing on GOOGL since they seem to be in the same headwind as S&P

Let's see how this plays out

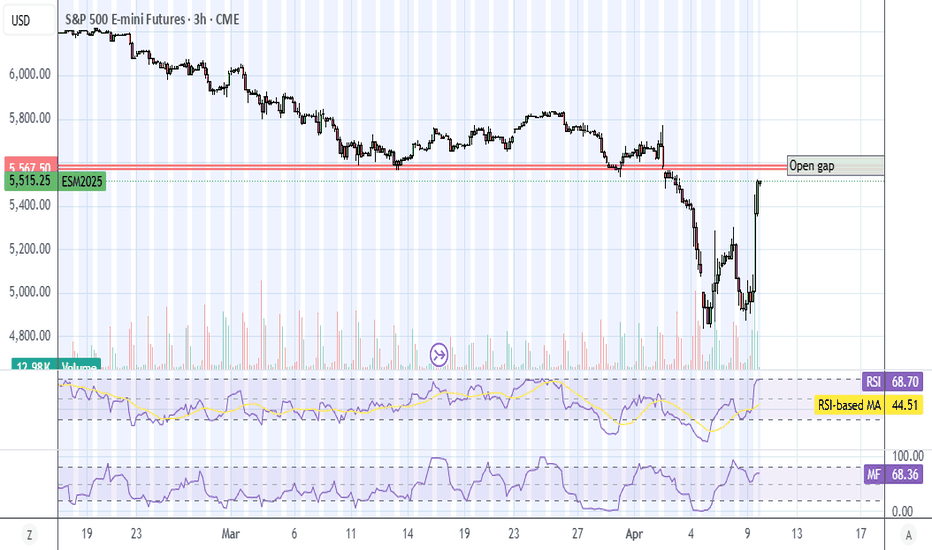

ES Premarket Update3hr MFI is headed quickly to oversold, and the dollar index is bouncing back a little. FUtures are also green.

I expect the market to bounce up when MFI gets oversold, so possibly a gap up which sells off then market goes back up?

Gold trade is on hold until currency direction is determined. The dollar will eventually break though, so holding the small position I bought yesterday morning..... that way I'll watch gold. We'll see where that goes....

US dollar is oversold on 3hr and daily charts, so there's a chance it will bounce back up.... or maybe it just goes into full tank mode and ignores indicators. Hard market to judge.

Inside dayThe expectation for Friday's price behavior in the daily chart on the S&P 500 is for Friday's action to trade within the range of Thursday's high to low price range. It will be interesting to see how the market unfolds going into this weekend after the tremendous volatility we had this week. We need new news to see a dramatic move in this market for Friday.

ES 3hr UpdateRSI hit overbought so we got a dip. We may get another dip when MFI gets overbought today, or just a bigger dip if it hits overbought premarket. Will we get a melt up instead? I dunno.

Keep in mind that China still has tariffs, but also keep in mind he's going to do exemptions. So that rules out shorting AAPL or any sector like auto.

We will get another huge pop when he pauses China tariffs eventually. Also, at this point the futures gap fill is inevitable.

Also, companies like NVDA and TSLA had issues even without the tariffs, so there's that as well. They probably overshot the target because of teh short squeeze.

I've got a PCRA trade that I posted yesterday. Other than that, I think I will just go back to playing the 3hr indicator, and buy when RSI or MFI hit oversold. Not gonna short anything until next week. Looks like GM is gonna lose half the gain from yesterday because they use Chinese parts, but Trump also said he'll do exemptions so not gonna play it. Also, EVERYTHING GOES UP in a major short squeeze, even garbage like FCEL. When he makes a China deal, you'll be hosed if you're short. PDD went up yesterday and premarket even though Trump hit China with 125%.

I can't predict what Trump will do with China, so just pay attention to the news.

ES 3hr UpdateNot sure if I will have time to post an update tomorrow morning, futures are red, RSI looks like it's headed to oversold, foreign investors are ditching US assets, nobody trusts Trump. Index futures, stocks, bonds, and the US dollar all selling off.

With Trump gaming the market, it's easy to get whipsawed into a loss. Get caught holding puts when "news" comes out, and you're toast. I'm expecting "news" because of the bond selloff, Trump is rate sensitive because of his real estate interests.

I plan on buying gold if the US dollar loses support. See my gold posts. It's the only high confidence play I could come up with. If you like to leverage with options, you can do GLD calls, UUP puts, UDN calls, or bet on Euros, Swiss francs, or yen.

April 10th Trade Journal & Market AnalysisEOD accountability report: +$3087.50

Sleep: 6 hour, Overall health: going thru Flu symptoms

**Daily Trade Recap based on VX Algo System **

10:27 AM VXAlgo ES X1 Buy signal (double buy signal)

12:30 PM VXAlgo NQ X1 Buy Signal (triple buy signal)

1:45 PM VXAlgo NQ X3 Buy Signal (triple buy signal) + market structure = A+ set up

Took some time off the last few days from trading futures to

re-organize the options account and long term port, got back into trading futures today.

ES UpdateTrump is obviously gaming the market, so there's really no point in even looking at charts or indicators, lol. It's hard to take him seriously now.

The gap will fill, maybe as soon as tomorrow morning. Then we get another huge pump sometime within the next week when he repeals the China tariffs and sets then to 10% or something.

Just hold your favorite stock and wait it out. I bet he exempts AAPL, auto parts, and whatever else from the China tariffs. GM and even PDD went up today in anticipation.

I had a few GM puts, saw the jump, tried to climb on as fast as possible. I prioritized my retirement account ahead of my options play, but I made a little money, hopefully more the next few days, lol.

Expecting a melt up, then a jump when he caves in to China, no shorting anything for the next week until everything stabilizes. NVDA and TSLA still have other issues aside from tariffs, so those will be targets. Gotta let the short squeeze complete first, I have a 3 day rule. Wait 3 days, lol.

S&P - What will happen next for the S&P?The S&P 500 has been dropping quickly after Trump's tariff policies were announced. It fell from 5750 to 4900, and is now at 5053, all in just a few days. This is a sharp decline, and sellers are clearly in control right now.

However, after such a big drop, it's common to see a short-term bounce before the market continues to fall. There is strong resistance between 5400 and 5500, which lines up with the golden pocket (a key level in technical analysis). This could make it harder for the S&P to rise past these levels.

Looking further down, there is another strong support area between 4500 and 4600. This level also matches the golden pocket on the daily chart, making it an important point for potential support. If the market keeps falling, we could see this area tested before any significant recovery.

Right now, it seems likely that the market will keep going lower. My main expectation is that we’ll get a small rally first, which could trick some traders into thinking the market is recovering, before continuing down. However, with all the uncertainty around the news and policies right now, it's also possible the market could keep dropping sharply without much of a rally.

Keep a close eye on the markets and stick to good risk management practices. If you don’t, it could really hurt your portfolio. Stay alert and adjust your strategy as things change.

Thanks for your support.

- Make sure to follow me so you don't miss out on the next analysis!

- Drop a like and leave a comment!

MES1! - Micro E - Mini S&P 500 Futures (Liquidity Grab Zone)Here I have the S&P Micro Futures showing consolidation in a tight range with about a 200 point spread to trade in. I have created this box to warn traders especially novice traders that this is a dangerous trade zone meant to grab liquidity (take your money). I would highly suggest to sit on your hands and wait for the price action to move out of the Liquidity Grab Box with a confirmed candle body close above or below the zone, at least 30 - 60 mins and with volume before taking a trade.

It seems that this consolidation is setting up for the next drop lower or higher depending on the tariff/trade war data we receive. Good Luck to all, preserve your capital and let the setups come to you, don't chase the price action, it will lead you into a trap.

S&P 500 Testing Key SupportThis analysis aims to provide you with a clear understanding of the market’s direction and potential inflection points on the Weekly timeframe.

Bearish/Bullish Trend Analysis

Trend Condition:

Bullish Trends: 3

Bearish Trends: 11

Overview: The market shows a predominant bearish outlook with 11 trend lines indicating a downward movement. However, there are 3 bullish trends emerging, suggesting some areas of resistance or potential reversal points.

Price Action and Momentum Zones

Current Price and Change:

Currently, the S&P 500 Futures are at 4,979.75, down 117.00 points or approximately -2.30%.

Market Behavior: This week’s sharp decline is consistent with the dominant bearish trend but the presence of a few bullish lines hints at possible undercurrents of recovery or resistance.

Momentum Zones:

The index has recently entered a lower price band, testing significant support levels that could dictate the next movements within this bearish trend.

Fibonacci Retracement Levels

Current Position Relative to Levels:

The futures are hovering around the 50.0% Fibonacci retracement level.

Key Fibonacci Levels:

23.6% → 5,537.68

38.2% → 5,148.66

50.0% → 4,834.25

61.8% → 4,519.84

Analysis: The proximity to the 50.0% level at 4,834.25 is noteworthy, as this level often acts as a moderate support in downtrends. Remaining around this level could suggest a stabilization or minor corrective rally if buying interest increases.

Overall Market Interpretation

Despite the downturn this week, the S&P 500 Futures showing some bullish signals could indicate a complex market environment where traders are assessing whether the current levels present buying opportunities or if the bearish trend will persist.

Summary

The S&P 500 Futures have faced a significant decline early in the trading week. With the market currently testing the 50.0% Fibonacci level, this could be a crucial juncture. The market's next steps will depend heavily on whether it can sustain above this level, potentially leading to a stabilization or a continued descent. Monitoring these Fibonacci levels will be key in predicting the short-term future of the market.

Futures electronic hoursFutures electronic hours

💡 This idea focuses on trading futures during the electronic trading hours — the periods outside the regular cash session, where unique price behavior often occurs due to lower liquidity and algorithmic dominance.

📊 Core Strategy:

During electronic hours (typically post-market/pre-market), futures like ES, NQ, or CL often show sharp moves driven by global macro news, low-volume liquidity zones, or overnight positioning. These moves can offer high-probability setups when combined with key levels from the regular session.

🧠 How to use it:

1. Mark key support/resistance levels from the previous regular session.

2. During electronic hours (e.g., 6 PM – 9 AM ET), monitor price interaction with these levels.

3. Look for rejection, breakout, or fakeout signals, ideally with volume spikes.

4. Use tight risk management due to increased volatility and spreads.

⏱️ Electronic hours are often overlooked but can offer clean technical setups for experienced traders, especially in quiet news environments or after major macro releases.

📌 Works well with futures contracts like ES, NQ, CL, and GC. Can also be adapted for FX and crypto markets which trade 24/7.