ID: 2025 - 0042.3.2025

4rd trade of 2025 executed.

Trade entry at 165 DTE (days to expiration).

Trade construct is a PDS (put debit spread) at Delta 15 combined with a PCS (put credit spread) at Delta 15. Overlapping short strikes give it the "unbalanced" butterfly nomenclature.

Sizing and strike selection is designed to keep the risk/reward "AT EXPIRATION" to a 1:1 risk profile. This lets charm work it's magic (second order greek), while exploiting the fact that this is a non-directional bias. The process is a disciplined and systematic approach letting time decay evaporate the extrinsic time value from the short options until target profit is achieved.

IF target profit is not captured after 60 DIT (days in trade), then target is reduced by 50% for the next 30 days.

Happy Trading!

-kevin

WSP1! trade ideas

ID: 2025 - 0031.27.2025

3rd trade of 2025 executed.

Trade entry at 144 DTE (days to expiration).

Trade construct is a PDS (put debit spread) at Delta 15 combined with a PCS (put credit spread) at Delta 15. Overlapping short strikes give it the "unbalanced" butterfly nomenclature.

Sizing and strike selection is designed to keep the risk/reward "AT EXPIRATION" to a 1:1 risk profile. This lets charm work it's magic (second order greek), while exploiting the fact that this is a non-directional bias. The process is a disciplined and systematic approach letting time decay evaporate the extrinsic time value from the short options until target profit is achieved.

IF target profit is not captured after 60 DIT (days in trade), then target is reduced by 50% for the next 30 days.

Happy Trading!

-kevin

ID: 2025 - 0052.18.2025

Trade #5 of 2025 executed. So simple, yet far from easy...

Trade entry at 178 DTE (days to expiration).

Trade construct is a PDS (put debit spread) at Delta 15 combined with a PCS (put credit spread) at Delta 15. Overlapping short strikes give it the "unbalanced" butterfly nomenclature.

Sizing and strike selection is designed to keep the risk/reward "AT EXPIRATION" to a 1:1 risk profile. This lets charm work it's magic (second order greek), while exploiting the fact that this is a non-directional bias. The process is a disciplined and systematic approach letting time decay evaporate the extrinsic time value from the short options until target profit is achieved.

IF target profit is not captured after 60 DIT (days in trade), then target is reduced by 50% for the next 30 days.

Happy Trading!

-kevin

Putting the current pullback from ATHs into context ES FuturesCME_MINI:ES1!

Big Picture:

ATH on December 6th, 2024: 6,184.50

There has been no significant correction or pullback since the ATH.

Currently, the market has pulled back ~8.20% from the ATH.

The previous correction (over a 10% pullback, but less than a 20% downturn) occurred after ES futures hit an all-time high of 5,856 on July 15th, 2024. The market bottomed out on August 5th, 2024.

Currently, ES futures are trading below the 50% retracement level from the ATH on December 6th, 2024, and the swing low on August 5th, 2024, at 5,719.25.

Given the current "risk-off" sentiment, let's review the updated price map for ES Futures.

Key Levels:

Important level to reclaim if no correction: 5,795.25 - 5,800

Key LVN (Low Volume Node): 5,738 - 5,696

Mid 2024 range: 5,574.50

Key Support: 5,567.25 - 5,528.75

2024 YTD mCVAL (Market Composite Value Area Low): 5,449.25

2022 CVAH (Composite Value Area High): 5,280

Key Support: 5,567.25 - 5,528.75

This zone is important in the event of a 10% pullback, which could lead to a bounce thereafter.

On our regular 4-hour time frame, which we use for weekly analysis and preparation, higher lows have been breached, and ES futures are now trading below the lows from November 4th, 2024, January 13th, 2025, and February 28th, 2025.

The probable next downside target is the 50% retracement of the 2024 range, which stands at 5,574.50.

Unless we see a sustained bounce that reclaims the 5,795.25 - 5,800 zone, the key support level at 5,567.25 - 5,528.75 is likely to be tested, aligning with our expected 10% pullback.

Note that a bear market (i.e., a pullback greater than 20%) wouldn't begin until prices drop to around 4,900, which is still about 750 points away from the current price level of 5,650.

Considering all the above, what can we expect this week?

CPI and PPI data are due this week, and the market is currently in "risk-off" mode. This sentiment is exacerbated by Federal Reserve Chairman Powell's comments on needing more data before altering rate path, combined with tariffs complicating the US economy.

What price level might prompt policymakers to adjust their stance?

The Fed’s dual mandate considers both 2% inflation and low unemployment. With the unemployment rate edging above 4% and inflation remaining high, this upcoming inflation reading is critical. We believe this report may trigger volatility not seen in recent months with CPI releases. We have the SEP and FOMC rate decision coming up on March 19th, 2024.

Scenario 1: Soft CPI than expectations

Expecting volatile price action, however, a V-shaped recovery given softer CPI reading. Markets go in wait and see

Scenario 2: Range bound week

In this scenario, we expect a range bound week, with inflation print in line and markets in wait and see mode for FED FOMC announcement.

Scenario 3: High CPI print

With a higher CPI print, FED will be in a difficult position to cut rates. Will this bad news be bad for the market or good? Mounting risks point to further downside if we do not get any pivot on macro level to support the economy.

ES Morning Update Mar 10thFor the last three days, 5720 has been the key battleground in ES—testing, bouncing, breaking below, squeezing, and repeating. After another bounce to the 5764+ target on Friday, we’re back under it again.

As of now:

• Same setup: 5720 must reclaim to target 5745, 5763

• If 5700 fails, expect a dip to 5676 first

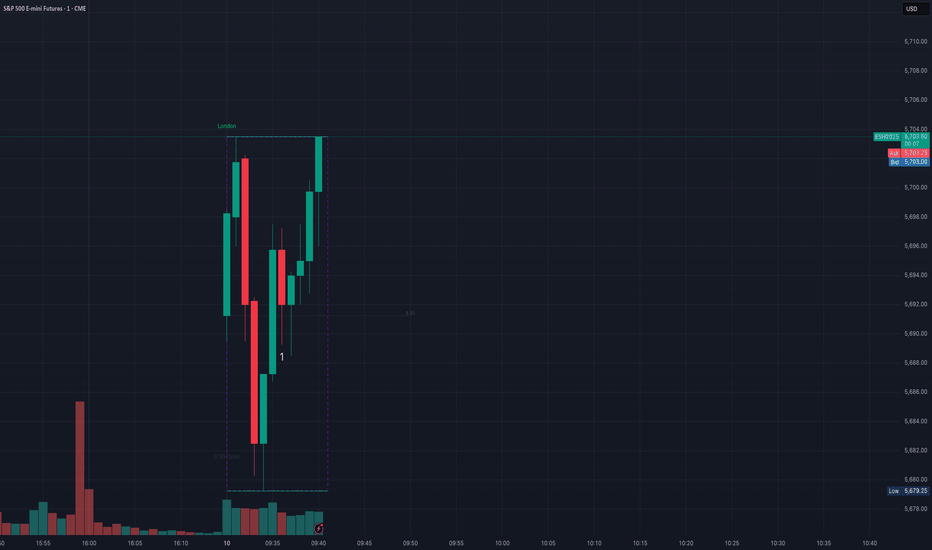

ES - Strong rejection of lower prices On ES , it's nice to see a strong buying reaction at the price of 5697.

There's a significant accumulation of contracts in this area, indicating strong buyer interest. I believe that buyers who entered at this level will defend their long positions. If the price returns to this area, strong buyers will likely push the market up again.

Strong rejection of lower prices and high volume cluster are the main reasons for my decision to go long on this trade.

Happy trading

Dale

S&P e-mini daily chart reviewDaily chart review 3-9-25

I see a bull flag wedge, with nested wedges as well, and a tight bear channel down. This week could see a push up from a double bottom to test prices above.

Friday's reversal bar is the 3rd attempt for bulls to reverse this trend, increasing the likelihood

of a significant pullback from this bearish channel. This week, I expect bullish action before trend resumption downward. The lower probability event would be a large

bearish breakout from here, which could be powerful and lead to 1-2 more legs down.

S&P e-mini Weekly chart reviewWeekly review 3-9-25

2 weeks ago saw a non-overlapping bear bar signaling likely continuation down. We have now

completed a bull flag wedge pattern testing the breakout of the Sept 9th week. Last week's bar was strong, suggesting lower prices, but I expect a pullback first. This is

a tight channel down, and the market is in AIS, and there will be sellers above. That being said, I expect a pullback next week before bears get another leg down. I expect buying early in the week at least. The lower probability event would be another strong bear bar, which would

likely result in 1-2 more legs down before a pullback.

S&P e-mini futures monthly chart review 3-9-253-9-25 Mnthly chart review

Bear breakout, but from a bad buy signal.

Likely 2 legs sideways to down from here. I think this is leg 1

Depending on your count, the trend up lasted 26 or 14 bars. You would expect a correction

of half that many bars at least, meaning either 14 or 7 bars, sideways to down. We've had 4,

meaning at least 3 more bars sideways to down is a safe bet. We will also likely overlap the

lower wick of Feb's bar by some amount soon. This March bar is in it's early formation, which

is less favorable for the bulls. The later part of the month is when you want to see the

breakout. I think it's high probability that we eventually touch the EMA, but that may take 2-3 months.

S&P, NASDAQ, DOW JONES Weekly Market Forecast: Mar 10-14 In this video, we will analyze the S&P 500, NASDAQ, AND DOW JONES Futures. We'll determine the bias for the upcoming week, and look for the best potential setups.

Markets have been bearish due to mixed numbers employment, Fed statements, and uncertainty in US trade policies. Are the markets poised for a bounce back week? Perhaps. Traders will need to exercise patience before jumping in these volatile markets, waiting for the proper confirmations before we determine a bias. Once the markets tip their hand in that way, we can take advantage.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

Can ES Stop The Bleeding?Outlook - Last week every bounce was followed by another sell off making it had for bulls to

gain any momentum. But Fridays session closed with a strong push to the next HVA and prices

refused to break below 5760 the last 4 hours of the session. On open will look for long entries

above 5775.5 which is the previous weeks close. If 5775.5 rejects will look for 2nd retest and reject to enter short. Lots of news this week so sticking to levels will be important.

Pivot - 5775.5

Upside Targets:

* 5790.5--58119.75--5848.5--5882

Downside Targets:

* 5771.75--5710--5763

= Bullish momentum

Es strong bullish set up?Es is bouncing off a major TL and just completed a market maker sell model after 3 consecutive consolidation stages. its now bouncing off the 50% of the origin of the move and could be taking out all of the trend line liquidity upwards. Lots of equal highs to be taken out on the way up. We got major red folder news this week. Im looking for possible strong distribution on Wednesday and Thursday with the CPI and PPI drop.

ES1!: Intraday levels March 9/10Here are the levels for ES1! for you fellow day traders.

Probability rests with a retracement down to 5,725, with approximately a 79% probability.

The raw probability scores are listed on each level.

My bias is consolidation/both directions. I suspect we at min the first low and high target throughout the Asia, Europe and NYSE trading sessions.

As always, not advice!

Safe trades!

QUICK LOOK AT A FEW INDICATORS AND INTEREST IN A SERIES?Quick overview testing out the upload from a browser on a ethernet connection computer vs wifi with the desktop downloaded app. Do you find value in this and want to make a regular series? Contact me if so and follow. Esp if your a developer and want to add some videos to your products, free, locked or paid. Im game. Platforms, customization and breaking down analytics is the life. Its what i enjoy and maybe you will too!

Thank you All,

DrawDownKing CME_MINI:ES1!

World Recession 2025 Has Begun: Comparing last 25 YearsHistory Lessons

The global recession of 2025 has started, and it's time to evaluate how previous global crises, initiated primarily by the U.S. economy, have impacted the world's leading economies over the past 25 years. Historical data reveals the most resilient and vulnerable economies during periods of global instability.

📌 Most Resilient Economy (by crisis resilience):

Russia is identified as the most resilient economy, uniquely demonstrating significant growth (+187%) during the global crisis of 2001. Russia's average result across the three crises is +26%, making it the only country in the list with a positive average during crisis periods.

This remarkable growth in Russia in 2001 resulted from a rapid recovery following the 1998 crisis, significant increases in oil prices, and an influx of foreign investments following the ruble's devaluation. These factors enabled the Russian market not only to withstand but also significantly grow, distinguishing it from other global markets.

📌 The Weakest Economies (by crisis resilience):

Germany and France were the weakest, each experiencing an average drawdown of 55%. Germany notably suffered a substantial drop of 72% in 2001, underscoring its vulnerability to global economic shocks.

This vulnerability arises because German and French economies heavily depend on exports and international trade, making them particularly sensitive to declines in global demand and economic instability.

📌 Overall Resilience Ranking (from strongest to weakest):

🇷🇺 Russia (+26%) ✅ (only country with positive average due to recovery in 2001)

🇨🇳 China (-43%) (least vulnerable among other countries)

🇬🇧 UK (-45%)

🇺🇸 USA (-48%)

🇮🇳 India (-50%)

🇯🇵 Japan (-52%)

🇫🇷 France (-55%) ❌

🇩🇪 Germany (-55%) ❌

📌 Assessment of Other Assets:

Oil exhibited deep drawdowns across all crises (average -69%), confirming its high sensitivity to global economic instability and demand shocks.

Bitcoin experienced a moderate decline (-53%) during the 2020 crisis, comparable to equity markets of developed countries.

📌 Additional Observations:

Russia, despite showing positive performance, remains heavily reliant on commodity markets (primarily oil and gas). Its exceptional performance in 2001 resulted from unique recovery circumstances following the severe internal crisis of 1998.

Over the long term, the U.S. economy remains the most diversified, stable, and resilient due to its market size, robust financial infrastructure, and high degree of diversification.

In conclusion, based on crisis drawdown data, Russia appears as the strongest economy, while Germany and France were the weakest. Among alternative assets, oil proved to be the most volatile.

ES/SPY George W Bush PatternA thousand scenarios could unfold with price action. But if were to guess (which is exactly what I am doing (from experience), ES/SPY will take the longest and most torturous and yet most powerful route to form a bottom and pave the way for the big yearly move up...forming a W pattern. (no good old genius George has nothing to do with it). None the less the W will take the longest and be the most powerful proving a long and well crafted W pattern. The other alternatives are a multi day or multi week more shallow bottom essentially forming a series of smaller W's or my guess (as mentioned) which is a large W with higher top to bottom (middle of the W) movements, or of course we could just get a V bottom which means the only ones who really succeed most are the one who just buy and hold.

Market Forecast UPDATES! Monday, Mar 3rdIn this video, we will update the forecasts posted last March 2nd for the following markets:

ES \ S&P 500

NQ | NASDAQ 100

YM | Dow Jones 30

GC |Gold

SiI | Silver

PL | Platinum

HG | Copper

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.