How to navigate the Amazonian Squeeze. AMZNHello I am the Cafe Trader.

This week has been a deep dive on the MAG 7 and today AMZN is up next.

We are going to look at long term and short term opportunities.

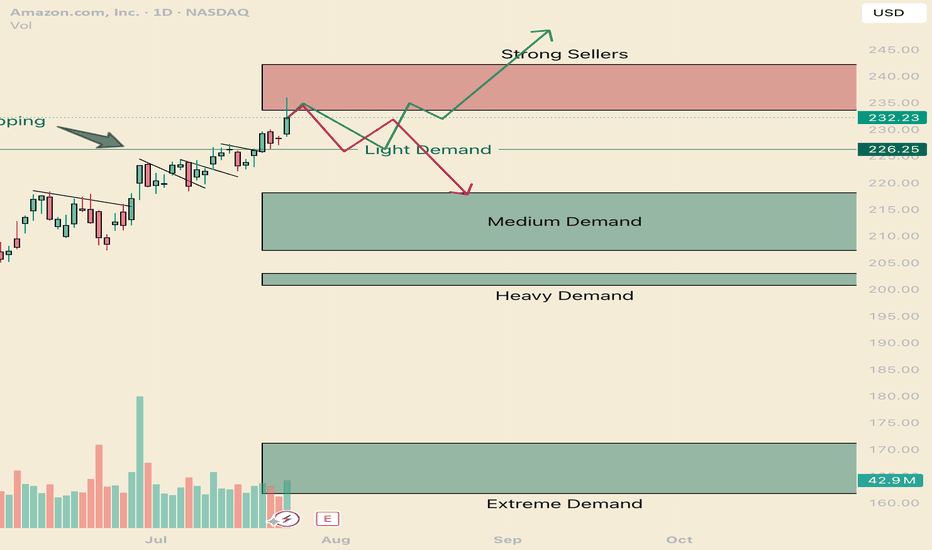

We are near the All Time Highs, with one final Seller to get through before making the break.

Today we tested to see if those sellers

Key facts today

Amazon has scrapped plans for a 300 million euro facility in Dublin due to power supply issues. The project aimed to support AI data centers and create 500 jobs.

Amazon showcased its AI innovations at the World Artificial Intelligence Conference in Shanghai, joining over 800 companies to highlight AI devices and large language models.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

128.28 MXN

1.24 T MXN

13.30 T MXN

9.60 B

About Amazon.com

Sector

Industry

CEO

Andrew R. Jassy

Website

Headquarters

Seattle

Founded

1994

FIGI

BBG000D5YZ71

Amazon.com, Inc. engages in the provision of online retail shopping services. It operates through the following business segments: North America, International, and Amazon Web Services (AWS). The North America segment includes retail sales of consumer products and subscriptions through North America-focused websites such as amazon.com and amazon.ca. The International segment offers retail sales of consumer products and subscriptions through internationally-focused websites. The Amazon Web Services segment involves in the global sales of compute, storage, database, and AWS service offerings for start-ups, enterprises, government agencies, and academic institutions. The company was founded by Jeffrey P. Bezos in July 1994 and is headquartered in Seattle, WA.

Related stocks

Amazon Has a Mixed Technical Picture Heading Into EarningsNext week will see four of the "Magnificent Seven" stocks report quarterly earnings -- Apple NASDAQ:AAPL , Amazon NASDAQ:AMZN , Microsoft NASDAQ:MSFT and Meta Platforms NASDAQ:META . Let's check out AMZN ahead of its results.

Amazon's Fundamental Analysis

FactSet recently reported analys

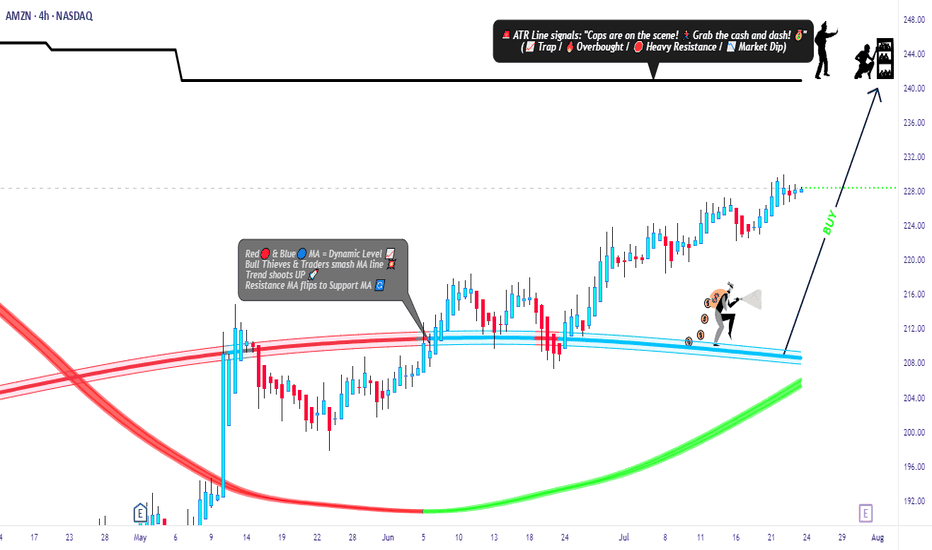

Amazon Market Robbery Blueprint – Swing/Scalp Long Setup🟨💣 “AMZN Market Heist Blueprint – Bullish Robbery in Progress 🚨💼💸” 💣🟨

By Thief Trader – Rob the Market with Precision

🌍 Hello World! Hi, Hola, Ola, Bonjour, Hallo, Marhaba!

🤑💰 Calling all Money Makers & Market Robbers – get ready to execute the next bullish heist on AMAZON.COM, INC (NASDAQ: AMZN),

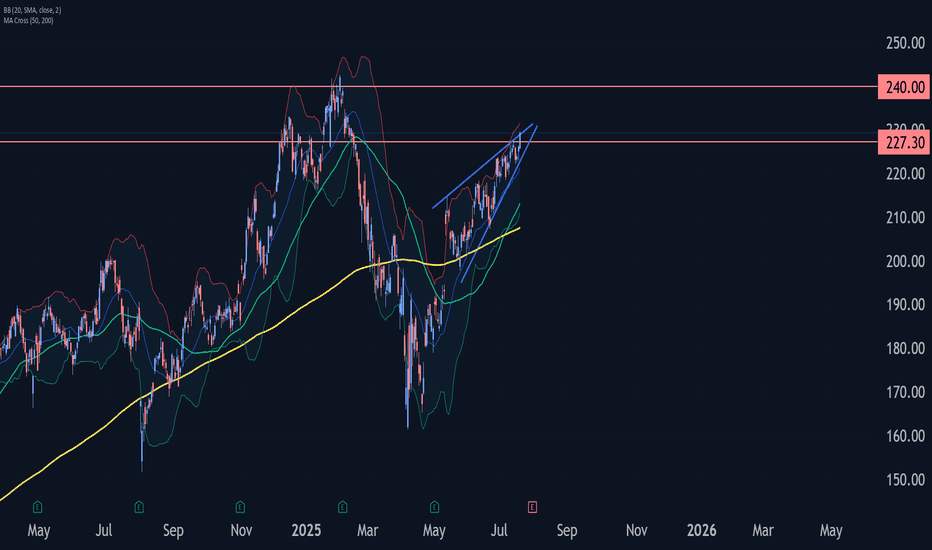

Amazon Wave Analysis – 21 July 2025

- Amazon broke resistance zone

- Likely to rise to resistance 240.00

Amazon recently broke the resistance zone between the resistance level 227.30 (top of the previous impulse wave i) and the resistance trendline of the daily Rising Wedge from May.

The breakout of this resistance zone accelerated

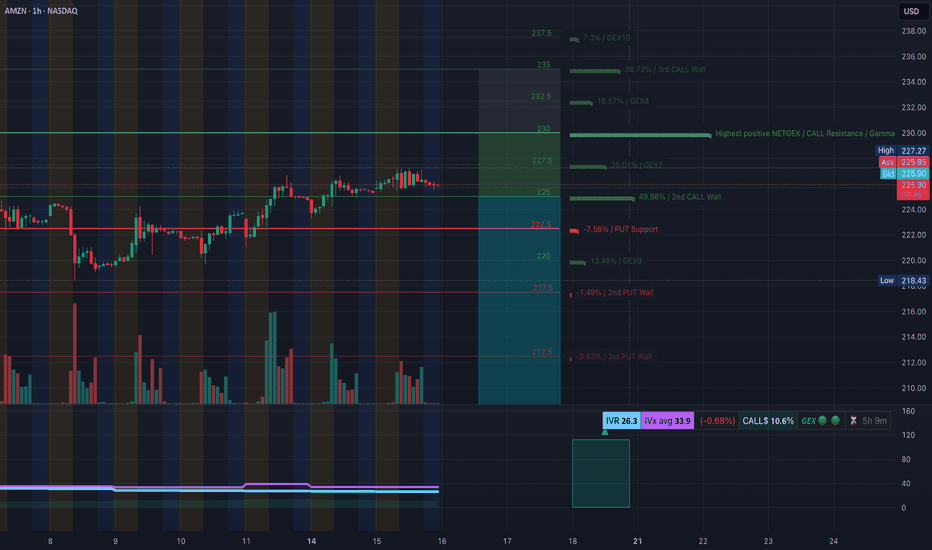

AMZN at a Crossroad! TA for July 16Options & Intraday Trading Setups to Watch This Week 🔍

🧠 GEX Analysis & Options Sentiment (Tanuki)

* GEX Sentiment: Mildly Bullish

* CALLs Volume: 10.6% → Neutral-to-Weak Bullish

* IV Rank (IVR): 26.3 → Low implied volatility rank

* IVx Avg: 33.9 → Neutral options environment

Gamma Walls / Levels t

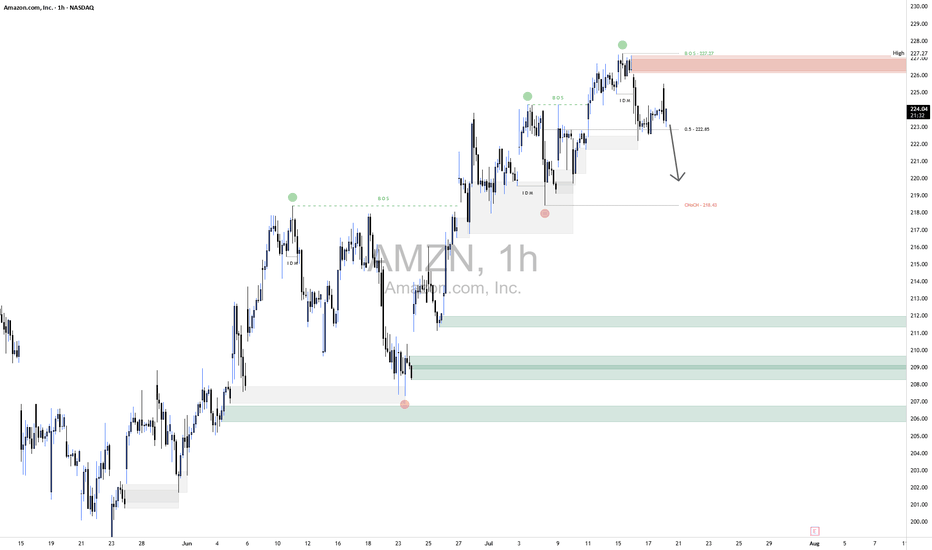

AMZN Short1.Liquidity Landscape

Buy-Side Liquidity Cleared:

Liquidity above the recent swing high was taken — likely triggering breakout traders and stop orders from earlier shorts.

This move appears to be a classic liquidity raid before a reversal.

Sell-Side Liquidity in Focus:

Price is now targeting sel

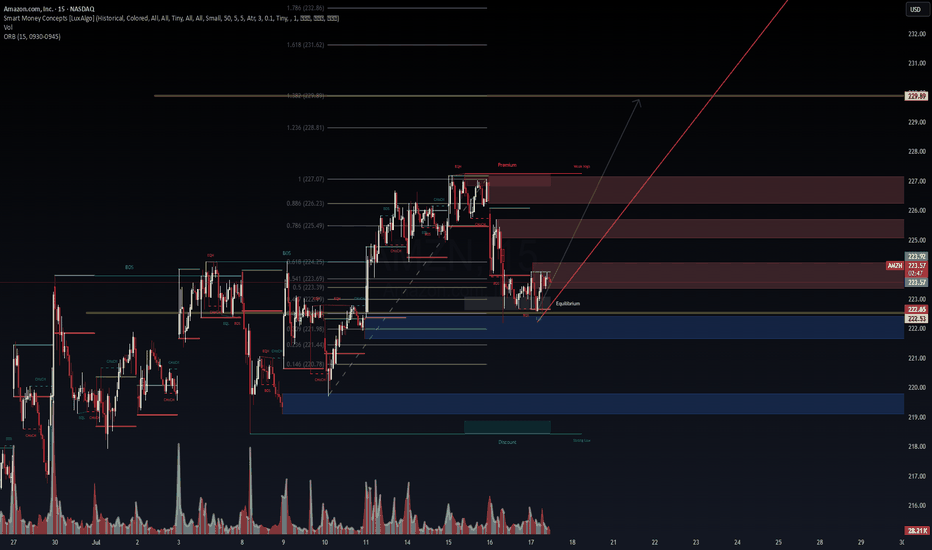

AMZN 15m – Institutional Demand Reclaim in Progress | VolanX Pro📈 AMZN 15m – Institutional Demand Reclaim in Progress | VolanX Protocol Alert

Amazon (AMZN) is staging a potential bullish reversal from a deep discount zone following a strong rejection near the 0.146–0.236 Fibonacci confluence at ~$220.78–221.44. We are now consolidating near the equilibrium zone

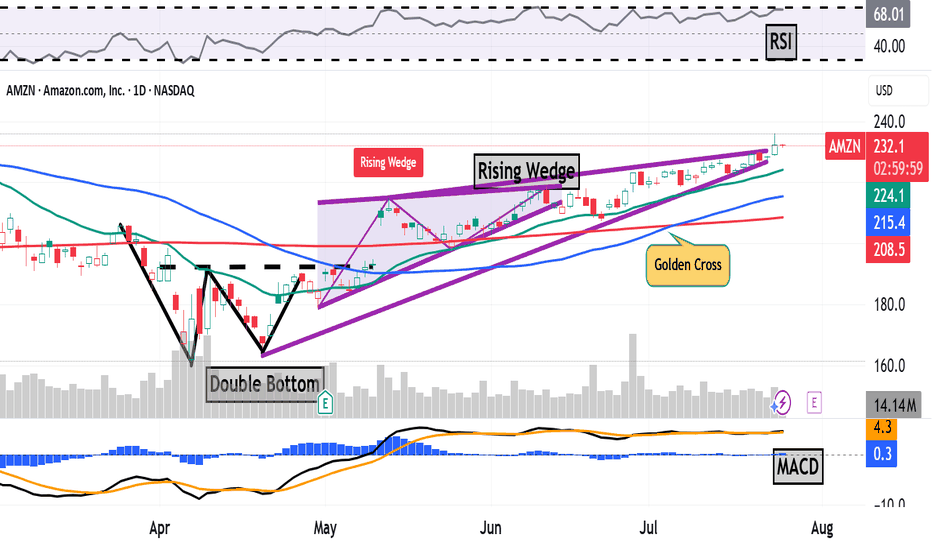

AMZN: Daily Trend Change with Bullish Continuation Setup

🗓 Published: June 26, 2025

📍 Ticker: NASDAQ:AMZN – Amazon.com Inc.

🕒 Timeframes: Daily & 4H

📊 Technical Bias: Bullish

📈 Trend: Higher Highs & Higher Lows

🧠 Analysis Summary

Amazon has successfully reclaimed a bullish market structure on the daily chart by forming higher highs and higher lows sin

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where AMZN is featured.

Frequently Asked Questions

The current price of AMZN is 4,301.54 MXN — it has decreased by −0.20% in the past 24 hours. Watch AMAZON COM INC stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BMV exchange AMAZON COM INC stocks are traded under the ticker AMZN.

AMZN stock has risen by 2.66% compared to the previous week, the month change is a 4.92% rise, over the last year AMAZON COM INC has showed a 29.02% increase.

We've gathered analysts' opinions on AMAZON COM INC future price: according to them, AMZN price has a max estimate of 5,567.10 MXN and a min estimate of 3,618.62 MXN. Watch AMZN chart and read a more detailed AMAZON COM INC stock forecast: see what analysts think of AMAZON COM INC and suggest that you do with its stocks.

AMZN reached its all-time high on Feb 4, 2025 with the price of 4,998.98 MXN, and its all-time low was 10.75 MXN and was reached on Mar 31, 2011. View more price dynamics on AMZN chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

AMZN stock is 0.62% volatile and has beta coefficient of 1.34. Track AMAZON COM INC stock price on the chart and check out the list of the most volatile stocks — is AMAZON COM INC there?

Today AMAZON COM INC has the market capitalization of 45.60 T, it has increased by 0.94% over the last week.

Yes, you can track AMAZON COM INC financials in yearly and quarterly reports right on TradingView.

AMAZON COM INC is going to release the next earnings report on Jul 31, 2025. Keep track of upcoming events with our Earnings Calendar.

AMZN earnings for the last quarter are 32.57 MXN per share, whereas the estimation was 27.99 MXN resulting in a 16.38% surprise. The estimated earnings for the next quarter are 24.85 MXN per share. See more details about AMAZON COM INC earnings.

AMAZON COM INC revenue for the last quarter amounts to 3.19 T MXN, despite the estimated figure of 3.18 T MXN. In the next quarter, revenue is expected to reach 3.04 T MXN.

AMZN net income for the last quarter is 350.88 B MXN, while the quarter before that showed 417.07 B MXN of net income which accounts for −15.87% change. Track more AMAZON COM INC financial stats to get the full picture.

No, AMZN doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jul 26, 2025, the company has 1.56 M employees. See our rating of the largest employees — is AMAZON COM INC on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. AMAZON COM INC EBITDA is 2.62 T MXN, and current EBITDA margin is 19.15%. See more stats in AMAZON COM INC financial statements.

Like other stocks, AMZN shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade AMAZON COM INC stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So AMAZON COM INC technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating AMAZON COM INC stock shows the strong buy signal. See more of AMAZON COM INC technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.