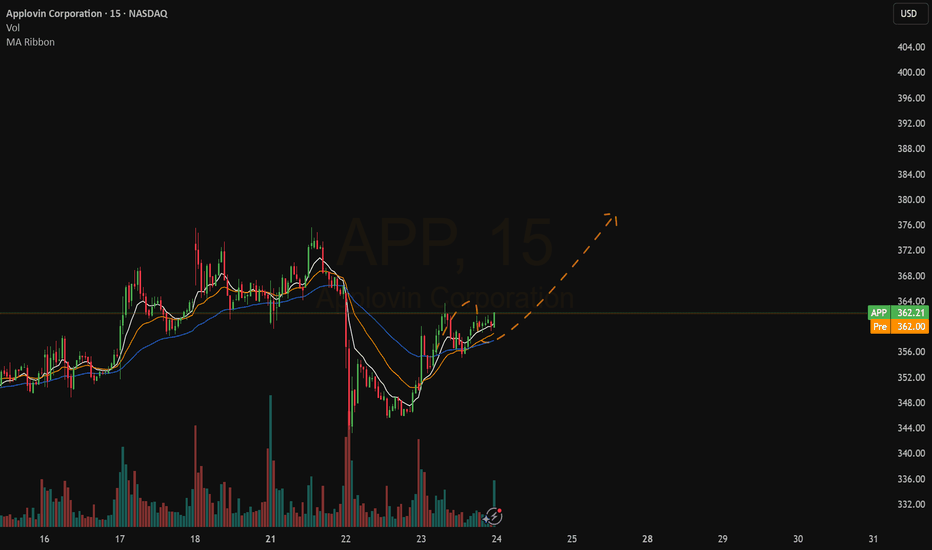

Buy Idea APP (Applovin Corp)Entry: $371 - 372

Stop: $342.50

Risk per share: $28.80

Earnings Catalyst Setup

• Flat base breakout above $370 zone, strong price structure

• Volume expanding into earnings — ideal for pre-earnings momentum pop

• Holding all major MAs: 21EMA, 50MA, 200MA clustered below

• MACD & Oscillators tur

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

116.25 MXN

32.88 B MXN

98.19 B MXN

223.04 M

About Applovin Corporation

Sector

Industry

CEO

Adam Foroughi

Website

Headquarters

Palo Alto

Founded

2011

FIGI

BBG01PNPVGY5

AppLovin Corp. engages in the development and operation of a mobile marketing platform. It offers AppDiscovery, MAX, Adjust, and SparkLabs. Its software-based platform caters to mobile application developers to improve the marketing and monetization of applications. The company was founded by Andrew Karam, John Krystynak, and Adam Foroughi in 2011 and is headquartered in Palo Alto, CA.

Related stocks

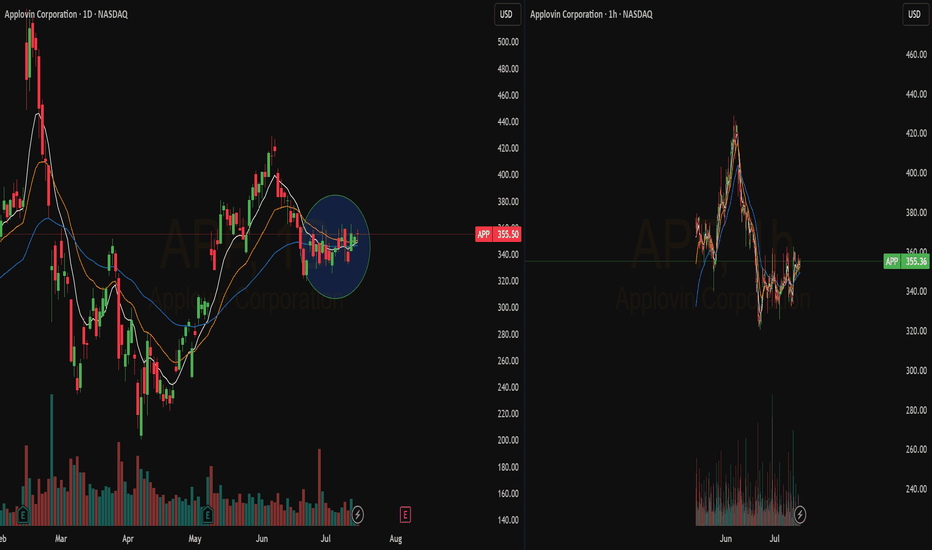

APP Earnings Triangle BreakoutWith APP breaking key resistance to the upside. There is a possibility for an aggressive move to the upside. This will NOT be a straight line up, but does show the possibility of the measured move. If I were to enter this, todays candle would be my entry and my stop loss would be an aggressive close

BofA note: : Excellent setup w/catalysts from mobile gaming & adConfirmation of self-serve launch would put story on track: APP remains top pick under coverage. We see big upside to CY26 EBITDA expectations, with this print potentially prompting upward revisions; the vast majority of investors we spoke with appear to exclude both a continued managed service onbo

$APP Long Setup – Bullish Reversal Attempt off Key SupportApplovin ( NASDAQ:APP ) is attempting to base and reverse off the lower range of its cloud structure after a sharp pullback from highs above $400. Price is holding just under the cloud but showing early signs of curling higher. Despite bearish MACD pressure, momentum is beginning to decelerate, and

APP Weekly Trade Plan – June 20, 2025🟥 APP Weekly Trade Plan – June 20, 2025

🎯 Instrument: APP (Applovin Corp)

📉 Direction: Bearish (Put)

📅 Expiry: 2025-06-20

📊 Confidence Level: 65%

⏰ Entry Timing: Market Open

🔎 Model Consensus Breakdown

Model Direction Summary

Grok/xAI 🔻 Bearish Clear bearish momentum. Recommends $325 put.

Claude ⚠️

AppLovin - the Shoulders – But Not the Breakdown!🟢 Head and Shoulders Pattern (Bearish)

* The price action is forming a left shoulder , a higher peak (head) , and a right shoulder .

* This classical pattern often signals a reversal from bullish to bearish.

* The dotted orange neckline marks the potential support – if broken, it could t

AppLovin Corporation (APP) – Rewiring Ad Tech with AI at ScaleCompany Snapshot:

AppLovin NASDAQ:APP is shedding its legacy gaming identity and emerging as a pure-play AI advertising infrastructure leader. Post its $900M gaming unit divestiture, the company is laser-focused on AXON 2.0, its next-gen AI ad engine, positioning APP as one of the most transformat

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

APP5945421

AppLovin Corporation 5.95% 01-DEC-2054Yield to maturity

6.15%

Maturity date

Dec 1, 2054

APP5945420

AppLovin Corporation 5.5% 01-DEC-2034Yield to maturity

5.22%

Maturity date

Dec 1, 2034

APP5945419

AppLovin Corporation 5.375% 01-DEC-2031Yield to maturity

4.82%

Maturity date

Dec 1, 2031

APP5945418

AppLovin Corporation 5.125% 01-DEC-2029Yield to maturity

4.59%

Maturity date

Dec 1, 2029

See all APP bonds

Curated watchlists where APP is featured.

Software stocks: US companies at our finger tips

49 No. of Symbols

See all sparks

Frequently Asked Questions

The current price of APP is 7,201.50 MXN — it has decreased by −1.62% in the past 24 hours. Watch APPLOVIN CORP stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BMV exchange APPLOVIN CORP stocks are traded under the ticker APP.

APP stock has risen by 10.62% compared to the previous week, the month change is a 14.36% rise, over the last year APPLOVIN CORP has showed a 315.79% increase.

We've gathered analysts' opinions on APPLOVIN CORP future price: according to them, APP price has a max estimate of 12,278.05 MXN and a min estimate of 4,722.33 MXN. Watch APP chart and read a more detailed APPLOVIN CORP stock forecast: see what analysts think of APPLOVIN CORP and suggest that you do with its stocks.

APP stock is 2.12% volatile and has beta coefficient of 3.72. Track APPLOVIN CORP stock price on the chart and check out the list of the most volatile stocks — is APPLOVIN CORP there?

Today APPLOVIN CORP has the market capitalization of 2.42 T, it has increased by 3.19% over the last week.

Yes, you can track APPLOVIN CORP financials in yearly and quarterly reports right on TradingView.

APPLOVIN CORP is going to release the next earnings report on Aug 6, 2025. Keep track of upcoming events with our Earnings Calendar.

APP earnings for the last quarter are 34.21 MXN per share, whereas the estimation was 29.49 MXN resulting in a 16.01% surprise. The estimated earnings for the next quarter are 36.77 MXN per share. See more details about APPLOVIN CORP earnings.

APPLOVIN CORP revenue for the last quarter amounts to 30.40 B MXN, despite the estimated figure of 28.29 B MXN. In the next quarter, revenue is expected to reach 23.35 B MXN.

APP net income for the last quarter is 11.81 B MXN, while the quarter before that showed 12.49 B MXN of net income which accounts for −5.47% change. Track more APPLOVIN CORP financial stats to get the full picture.

No, APP doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Aug 4, 2025, the company has 1.56 K employees. See our rating of the largest employees — is APPLOVIN CORP on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. APPLOVIN CORP EBITDA is 58.15 B MXN, and current EBITDA margin is 49.81%. See more stats in APPLOVIN CORP financial statements.

Like other stocks, APP shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade APPLOVIN CORP stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So APPLOVIN CORP technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating APPLOVIN CORP stock shows the sell signal. See more of APPLOVIN CORP technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.