Canadian National Railway has huge upside potentialA decades old trendline still unbroken after months of correction, the Canadian economy seems to be in a great position considering the circumstances. After conducting a simple technical analysis predicting a second leg up the upside potential is enormous if I am right about this. The downside is I am looking at a monthly chart so this will need to be a position trade or long term investment to achieve the desired results. Even if my target is reached I will likely hold onto the stock for years afterwards because the company will continue to make money. The intrinsic value for CNI is between $120 and $225 so it is well below the intrinsic value making any new position on it now at a bargain deal. I will likely be allocating a significant portion of my portfolio to it in the next few days to weeks.

CNI/N trade ideas

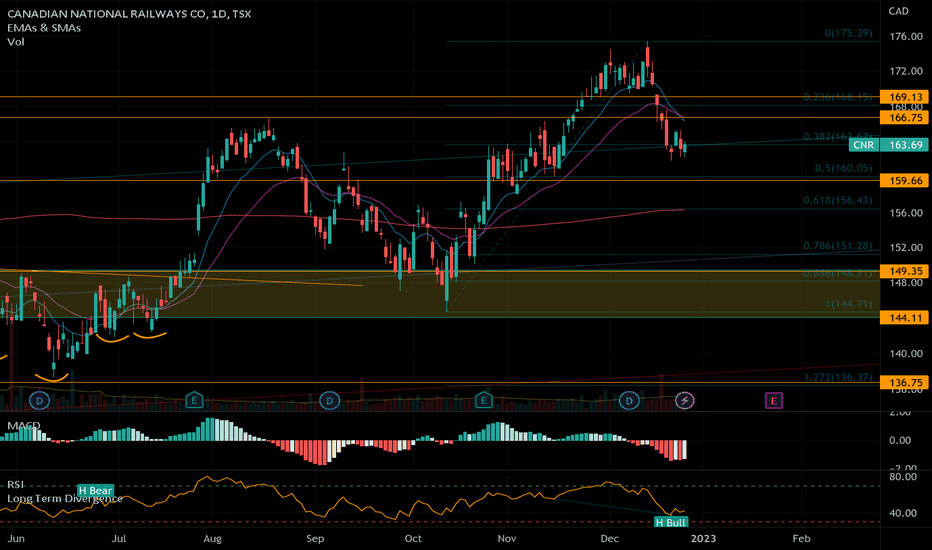

Railway to heavenHistorically, when these 3 indicators RSI, MACD, WILLAIMS, align at lows and turn up on the weekly timeframe, it h as marked the bottom, or relatively close.

The 200 week SMA acting as support, and there is a clear "double bottom" attempt occurring.

This is another staple for the portfolio, you have to own a railway, especially during inflationary times.

CNR has always been a good buy around the 200 week SMACNR has always been a good buy around the 200 week SMA, even if it has taken some time to consolidate here first.

Broadly I think markets are going to turn down, so the rally here will not start right away...

The MACD averages have swung down again, implying more consolidation.

I dont think I have to argue fundamentals for this company... theyre great.

Upside is pretty predictable you just have to zoom out and imagine where this will be in a few years.

CNI: $150 Million Dark Pool Block Trade as YTD Lows are BrokenTrading railroads? Today NYSE:CNI broke its year-to-date lows, the day before it goes ex-dividend.

Of course, none that stopped a dark pool block trader from moving 1.35 million shares over two quick trades this morning.

Bullish? Bearish? Just dividend action?

We shall see. For now, this is a spot to mark if you like NYSE:CNI as this was a massive block trade.

BULLISH IN CANADIAN NATIONAL RAILWAYI see a bullish move from 159.71 , There is a possible bullish move ahead. The reversal have been observed in past market with circle in chart. The two reversal were successful and price moved in upward bullish direction , same way the RSI pumping of reversal was also observed two times and price moved from there to upward direction.

I think the price will cross $175 target in coming times and the stop loss level is 148.84.

NOTE- THE OST IS URELY FOR EDUCATIONAL PUROSE ONLY. NOT A TRADING OR INVESTMENT ADVISE. ALWAYS CONSULT YOUR BROKER OR FINANCIAL EXPERT BEFORE TRADING OR INVESTMENT DECISIONS.

CNI Transportation Infrastructure Swing LongCNI is a Canadian Rail company. With the possible strike in the US, this

company can help take goods from China to the east part of North America.

Technically it is a solid performer with good recent earnings. This is

a slow but steady mover low beta ignores the general stock market and

a recession will have little impact. In the past month no matter any

bear market rally overall, CNI has had relative strength.

I will go long with a far-out call option to grind out some profit with

low risk of unexpected volatility.

option.

Canadian National RailwaySun Storm Investment Trading Desk & NexGen Wealth Management Service Present's: SSITD & NexGen Portfolio of the Week Series

Focus: Worldwide

By Sun Storm Investment Research & NexGen Wealth Management Service

A Profit & Solutions Strategy & Research

Trading | Investment | Stocks | ETF | Mutual Funds | Crypto | Bonds | Options | Dividend | Futures |

USA | Canada | UK | Germany | France | Italy | Rest of Europe | Mexico | India

Disclaimer: Sun Storm Investment and NexGen are not registered financial advisors, so please do your own research before trading & investing anything. This is information is for only research purposes not for actual trading & investing decision.

#debadipb #profitsolutions

CNI Fundamental and Quantiative Analysis Hello,

I was requested to do a quantitative analysis of CNI. It took a little while for me to map this out but here are the results. I will go over a complete review of CNI stock.

Fundamentals

CNI is one of Canada's leading industries with a solid establishment in the industry. It spans across Canada and the USA and is responsible for a huge portion of Canada's commercial shipments, both important and international exports (delivering directly to and from major costal shipping harbours).

CNI was attempting to purchase and take over KSU rail in the US, but have since backed out in favor of letting CP rail have it.

CNI just released its quarterly results which showed some impressive numbers. Summary of these results:

- Revenues of C$3,753 million, an increase of C$97 million or three per cent.

- Record fourth quarter operating income of C$1,566 million, an increase of 11 per cent, and record fourth quarter adjusted operating income of C$1,579 million, an increase of 12 per cent.

- Diluted EPS of C$1.69, an increase of 18 per cent, and adjusted diluted EPS of C$1.71, an increase of 20 per cent.

- Operating ratio, defined as operating expenses as a percentage of revenues, of 58.3 per cent, an improvement of 3.1 points, and record fourth quarter adjusted operating ratio of 57.9 per cent, an improvement of 3.5 points.

Full year results (2021):

- Revenues of C$14,477 million, an increase of C$658 million or five per cent.

- Operating income of C$5,616 million, an increase of 18 per cent, and adjusted operating income of C$5,622 million, an increase of seven per cent.

- Diluted EPS of C$6.89, an increase of 38 per cent, and record adjusted diluted EPS of C$5.94, an increase of 12 per cent.

- Operating ratio and adjusted operating ratio of 61.2 per cent, an improvement of 4.2 points and 0.7 points respectively.

- For the year ended December 31, 2021, after accounting for all direct and incremental expenses as well as income generated from the merger termination fee, CN recorded additional income of C$705 million (C$616 million after-tax) as a result of its strategic decision to bid for KCS.

- Record free cash flow for the year ended December 31, 2021 of C$3,296 million compared to C$3,227 million for the same period in 2020.

- Return on invested capital (ROIC) of 16.4 per cent, an increase of 3.7 points, and adjusted ROIC of 14.1 per cent, an increase of 0.7 points.

Source: www.cn.ca

Analyst price targests for CNI are around 146.

Source: www.marketbeat.com

Verdict on Fundamentals: I would say probably hold and buy.

Technicals:

CNI has had healthy growth over its lifetime. It underperformed the S&P over the past 1 year, with an annualized return of around 13% vs S&P's return of 15%. However, YTD it is outperforming the S&P, with a YTD return of 1.42% and the S&P has a loss of 7.2% YTD.

CNI has held up well in the past, especaily during hard economic downturns where it tends to outperform the market.

For example, during the 07/08 financial crisis, CNI sustained a loss of roughly 48% (see below).

This is in contrast to the S&P which lost almost 56%.

This may seem like a marginal difference, but when its your money being lost, it really isn't.

Furthermore, since its history, CNI has managed to maintain itself above its 100 moving average, only having touched it twice in its lifetime (circled in teal).

As of right now, CNI has filed its gaps. It looks to be forming a head and shoulders type pattern, yet poorly defined. As I see more market downturn coming in the following weeks and months, I am inclined to believe that CNI may want to retest that 100 moving average for a third time in its history.

Based on technicals, I would say hold CNI but maybe not buy it.

Mathematical Mapping

So this took the longest for me to do.

Based on the previous 1 year of data, CNI has traded almost linerally and similar to SPY. The chart below shows the histogram for CNI, SPY and TSLA for comparison.

While this is raw data over the past year and I have no corrected it for a normal distribution, you can see it is naturally trading within the parameters of a normal distribution (Shown in red). Compared to TSLA which shows much skewness to the left.

This matters because it indicates a stable trading pattern without huge variations up or down. The more skewed the data is (for example, TSLA), the more volatility and dramatic shifts in price are to be expected. This makes CNI an attractive choice to those who do not like to see huge volatility in their investments and instead, steady growth.

Keep in mind, after analysis through Shapiro-Wilk Test, none of these stocks actually can statistically be considered a "normally distributed" dataset (Shaprio-Wilk significance of 0,000). But this is true for most stocks without some kind of manual correction and manipulation, which is why I like to look at the histogram and make my own interpretations.

CNI is currently trading +1 standard deviation away from its mean. This is an area I personally like to see stocks trading at. But there is the potential for CNI to regress back towards its mean which is around the 116 range. I think we will see it retrace to this level in the future. Which leads me to the final point in a math model. The regression forecasts.

Regression forecasts for CNI are as follows:

Short term: Neutral

Long term: Positive

Verdict on Math: I would say absolutely hold, maybe wait to buy.

Overall Impression

I think CNI is a solid stock. If you are invested, I would be keeping this close. If you are not, I would be looking for a buying opportunity.

DISCLAIMER/DISCLOSURE:

Please note, I AM NOT A FINANCIAL ANALYST!

I am basing this analysis off of what I can see from the chart and on my stats background. I don't know what other criteria financial analysts use in making determinations. Make your own financial decisions based on your personal analysis!

Also, I am personally invested in this company.

CNI, LONGHave been watching this and I like the dissipation of supply looks like we are trying to pull through the base resistance we fell back into ..

Long 119.05

stop 117.20

Keeping stop tight ..

otherwise could place below 21 ema ( under prior candle low )

but that is closer to a 4X risk . So , I would rather try multiple times if needed and try to keep stop tighter which also allows me to sell half sooner and de-risk...

CNI , Recent base break with volume added to my primary buy listThis is exactly what I like to see for my strategy . We have a break out of a base into all time highs along , decent volume and a longer term base. Also high institutional ownership at 77.8% and price tag over $100 are extra points that put this as one of the top buys on my list.

I have been having growing success playing stuff that has not pulled back yet on daily as day trades where I pay myself earlier on and try to hold a core position. As I have become more consistent with my day trading, that is one way I like to initially enter these stronger runners . The second is a pullback but followed by a move up into strength .

But the day trading only works when I have the whole trading day to focus on it . For the next two months plus a bit , I am pretty much going 7 days a week working on jobsites. Makes the day trading not possible for me. So, I am going to watch this as a pullback play , end of day entry .

Moving out of my "base building" list to the top of my primary buy list and I will be watching for pullback based entries in future ..

Ps : My strategy is to buy later , I don't go after the breakout itself . I wait for a break up past and then ideally pullbacks on daily chart that still respect and uptrends characteristics. Normally, I am not allowed to buy in bases or breakups, though I do have some exceptions , primarily for day trading something (then the rule doesn't apply) I like to day trade because the rules change allowing me to enter sooner due to trading off a lower timeframe that provides earlier actionable signals .

Anyways, will continue to eye up CNI

Happy Saturday ~