CTAS trade ideas

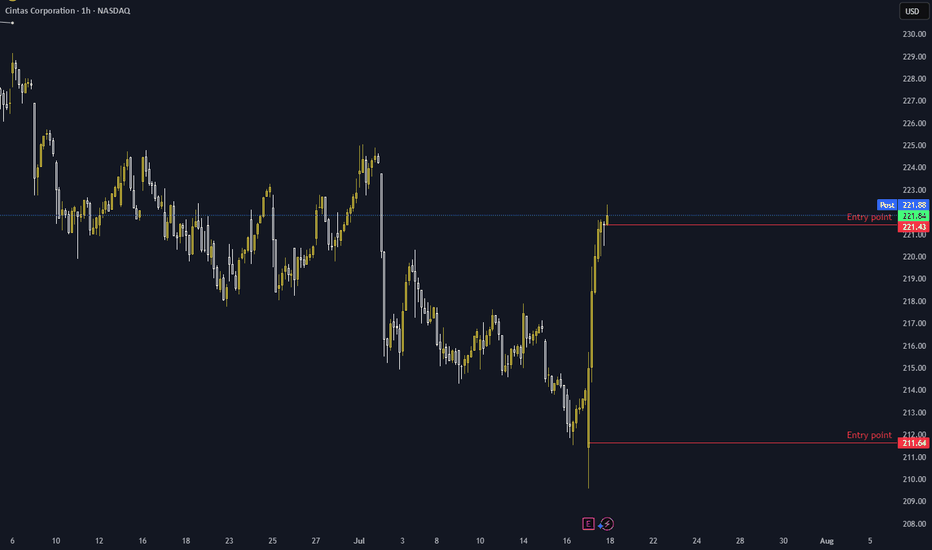

CTAS at All-Time Highs: Time to Book Profits?Cintas Corporation (CTAS) has been on a remarkable bullish journey, delivering consistent gains for patient investors. However, recent price action suggests that a key moment of decision has arrived.

📌 Weekly Demand Zone Gave a Strong Push 📌

After forming a fresh all-time high, CTAS saw a healthy correction that brought it back down to a strong weekly demand zone . This zone acted as a solid support area where buyers stepped in aggressively, pushing the stock back up with strong momentum.

💥 Approaching a Powerful Supply Zone 💥

Now, CTAS is not just near its previous all-time high—it is testing a strong rally-based drop (RBD) supply zone , a region where institutional selling may have previously occurred. Historically, such zones can create downward pressure on price, especially after a sharp rally.

📊 Why Profit Booking Makes Sense Here

All-Time High Levels : CTAS is trading near its all-time high, a region often prone to volatility and resistance.

Strong Supply Zone : The stock is entering a powerful supply area formed by a previous rally followed by a sharp drop—a classic RBD zone.

Risk-Reward Skewed : At these elevated levels, upside potential may be limited while downside risk increases.

Partial Exit Strategy : For those already in profit, this could be a great time to book gains or partially exit to protect capital.

📉 Will the Supply Zone Hold?

It’s important to remember: while supply zones often trigger corrections, they are not guaranteed to hold. CTAS could very well break through this resistance with strong volume and continue its uptrend. But as a trader, protecting your capital should come first.

That’s why this area demands caution. Even though the trend is bullish, the high-probability reaction from this zone warrants locking in gains.

💬 Conclusion 💬

CTAS has shown strength, but with the price now entering a significant supply zone near its all-time high, it’s a logical point to secure profits and reassess risk. Markets don’t move in a straight line—recognizing key zones can give you an edge.

Locking in profits doesn't mean you're bearish — it just means you're smart with your capital.

📌 “In trading, the goal is not to be right. The goal is to make money.”

“Trading is not about being right; it's about managing risk and protecting capital.” 💡💹

Lastly, Thank you for your support, your likes & comments. Feel free to ask if you have questions.

🚀 Stay sharp, stay disciplined—your edge is your mindset! 💪📊

This analysis is purely for educational purposes and is not intended as a trading or investment recommendation. I am not a SEBI registered analyst.

CTAS Cintas Corporation Options Ahead of EarningsIf you haven`t bought CTAS before the previous earnings:

Now analyzing the options chain and the chart patterns of CTAS Cintas Corporation prior to the earnings report this week,

I would consider purchasing the 220usd strike price Calls with

an expiration date of 2025-2-21,

for a premium of approximately $8.05.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

CTAS Cintas Corporation Options Ahead of EarningsIf you haven`t sold CTAS before the previous earnings:

Then analyzing the options chain and the chart patterns of CTAS Cintas Corporation prior to the earnings report this week,

I would consider purchasing the 680usd strike price Calls with

an expiration date of 2024-4-19,

for a premium of approximately $3.20.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Cintas Breaks Out To Record Highs On Earnings Report Cintas Corporation (NYSE: NASDAQ:CTAS ) shattered expectations with its stellar third-quarter performance, propelling the workplace equipment and cleaning supplies provider to record highs and igniting optimism among investors.

Cintas' robust earnings report for Q3 exceeded all forecasts, with earnings growth accelerating by an impressive 22.3% to reach $3.84 per share. This remarkable achievement was complemented by a nearly 10% surge in total revenue, soaring to $2.4 billion, surpassing the projections of FactSet analysts.

Of particular note was Cintas' enhanced gross margin, which rose to 49.4% from 47.2% year-over-year, underscoring the company's commitment to operational efficiency and profitability.

Not content with merely delivering stellar financial results, Cintas ( NASDAQ:CTAS ) demonstrated its dedication to shareholder value by increasing its quarterly cash dividend to shareholders by 17.1%, affirming its status as a stalwart in dividend growth.

Bolstered by its exceptional performance, Cintas ( NASDAQ:CTAS ) raised its full-year guidance, projecting revenue to range from $9.57 billion to $9.6 billion for 2024, up from the previous forecast. Similarly, earnings expectations were revised upwards to a range of $14.80 to $15 per share, reflecting the company's confidence in its continued growth trajectory.

Moreover, Cintas ( NASDAQ:CTAS ) anticipates a decline in interest expense for 2024, signaling improved financial efficiency and bolstering its bottom-line performance.

In response to this stellar performance, NASDAQ:CTAS stock surged by a staggering 10% early Wednesday, catapulting shares to surpass the 636.37 buy point in a four-week tight pattern. Additionally, the stock is trading with a bullish Relative Strength Index (RSI) of 81 indicating an overbought situation or a continuous bullish trend.

CTAS “Cintas” for earningsI believe CTAS “Cintas” will fall for earnings due to the declining workforce in America especially with theory of AI threatening a significant amount of jobs in our near future. I can only see them lowering their forward guidance in this type of economic environment. Also forming a head and shoulders pattern on all charts up to the 1D. Let’s see how this plays out!

CTAS Cintas Corporation Options Ahead of EarningsAnalyzing the options chain and the chart patterns of CTAS Cintas Corporation prior to the earnings report this week,

I would consider purchasing the 500usd strike price Puts with

an expiration date of 2023-10-20,

for a premium of approximately $10.70.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

Cintas Corporation (CTAS) - A Cup of Potential ReturnsCompany: Cintas Corporation

Ticker: CTAS

Exchange: NASDAQ

Sector: Industrials

Introduction:

Greetings and welcome to this analysis. Today, we are analyzing the weekly chart of Cintas Corporation (CTAS), containing a potential Cup and Handle pattern, indicating a bullish continuation, has formed.

Cup and Handle Pattern:

This Cup and Handle pattern is a bullish continuation pattern that marks a consolidation period followed by a breakout. In this case, we've observed a well-defined Cup and Handle over the course of 504 days.

Analysis:

Cintas Corporation's chart shows a clear Cup and Handle pattern, with horizontal resistance at $461.58. The price seems to have breached this level, but we'll need to wait for the weekly candle's close to confirm. If confirmed, this could present an immediate buying opportunity.

All of this action is happening above the 200 EMA, indicating a bullish environment. The projected price target, should the breakout be confirmed, stands at $579.10, signifying a potential rise of 25.5%.

Conclusion:

The weekly chart of Cintas Corporation portrays a well-defined Cup and Handle pattern, suggesting potential for bullish continuation. Traders should monitor the weekly candle close to confirm the breakout above the horizontal resistance level.

As always, this analysis is not financial advice. Prioritize risk management and proper position sizing in all trading decisions.

If you found this analysis useful, please like, share, and follow for more updates. Happy trading!

Best Regards,

Karim Subhieh

Symmetrical TriangleBottom trendline has been broken.

Earnings 7-14

No recommendation.

Steep climb up on Monthly timeframe.

Cintas Corporation provides corporate identity uniforms and related business services primarily in the United States, Canada, and Latin America. It operates through Uniform Rental and Facility Services, First Aid and Safety Services, and All Other segments. The company rents and services uniforms and other garments, including flame resistant clothing, mats, mops and shop towels, and other ancillary items; and provides restroom cleaning services and supplies, as well as sells uniforms. It also offers first aid and safety services, and fire protection products and services. The company provides its products and services through its distribution network and local delivery routes, or local representatives to small service and manufacturing companies, as well as major corporations. Cintas Corporation was founded in 1968 and is headquartered in Cincinnati, Ohio.

EPS (FWD)

11.34

PE (FWD)

33.05

Div Rate (TTM)

$3.80

Yield (TTM)

1.01%

Short Interest

1.26%

Market Cap

$38.35B