CVNA EARNINGS TRADE IDEA — July 30 (AMC)

## 🚗 CVNA EARNINGS TRADE IDEA — July 30 (AMC)

**Carvana (CVNA)**

📊 **Bullish Confidence**: 85%

📈 **Earnings Play Setup**

💣 Big Volatility + Strong History = Explosive Potential

---

### ⚙️ FUNDAMENTALS SNAPSHOT

✅ **Revenue Growth**: +38.3% YoY

🔁 **8/8 EPS Beats** (114.5% avg surprise)

🟡 **Profit

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

79.83 MXN

4.38 B MXN

285.07 B MXN

125.93 M

About Carvana Co.

Sector

Industry

CEO

Ernie C. Garcia

Website

Headquarters

Tempe

Founded

2012

FIGI

BBG00YMW72K6

Carvana Co. is a holding company and an eCommerce platform, which engages in the buying and selling of used cars. The company was founded by Ernest Garcia, III, Benjamin Huston and Ryan Keeton in 2012 and is headquartered in Tempe, AZ.

Related stocks

CVNA will falling rates save this darling?VNA (Carvana Co.) shows a strong bullish trend with a breakout setup forming. Here’s a detailed technical analysis:

📈 Trend Analysis: Strong Uptrend

CVNA has been in a clear uptrend, characterized by higher highs and higher lows since March.

The ascending yellow trendline confirms consistent buyin

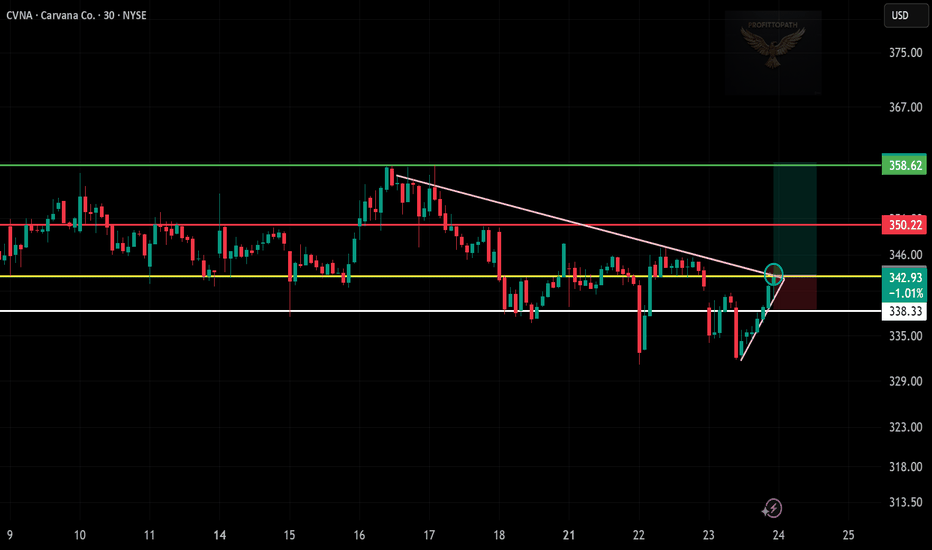

Very DangerousCarvana back near all time highs while in an expanding triangle formation. These happen at times where volatility is increasing and swings have become more wild. It can be a sign a lower liquidity causing small dollar amounts to change the stock's price more drastically.

A daily close under $330 is

Carvana Leading Auto Retail – Outpacing LAD & AN-Financial Performance & Momentum:

Carvana reported a record-breaking adjusted EBITDA of $488M in Q1 2025, up $253M YoY, with an EBITDA margin of 11.5% (+3.8pp YoY). The company's strong operational efficiency positions it as a leader in the auto retail industry, nearly doubling the margins of compe

6/30/25 - $cvna - Sizing up... again? tf lol6/30/25 :: VROCKSTAR :: NYSE:CVNA

Sizing up... again? tf lol

- "tf" is the theme of rn

- do stonks rumble higher w/ some garden variety pullbacks? yes, i think so

- but guys... there are some real terminal losers out there trading like they just discovered the cure for death

- if you like this on

Not BullishWhen Carvana finishes this completely manipulated bullrun, it will be devastating. Typically extended 5th waves will correct at a minimum back down to wave 2 of said 5th wave. That means $50.

The stock was in an expanding formation which it broke out from and then failed back into. Very bearish. Th

CVNA Swing Trade Plan – Bearish Breakdown (June 13, 2025)🛑 CVNA Swing Trade Plan – Bearish Breakdown (June 13, 2025)

📉 Setup Summary:

CVNA is flashing strong bearish momentum across 15-minute and daily charts, confirmed by multiple AI models. Although slightly oversold in the short term, the overall directional thesis remains intact: downside toward $293–

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

CVNA5156797

Carvana Co. 5.5% 15-APR-2027Yield to maturity

15.97%

Maturity date

Apr 15, 2027

CVNA5240196

Carvana Co. 4.875% 01-SEP-2029Yield to maturity

12.51%

Maturity date

Sep 1, 2029

CVNA5050779

Carvana Co. 5.875% 01-OCT-2028Yield to maturity

12.25%

Maturity date

Oct 1, 2028

CVNA5406700

Carvana Co. 10.25% 01-MAY-2030Yield to maturity

11.83%

Maturity date

May 1, 2030

CVNA5656725

Carvana Co. 14.0% 01-JUN-2031Yield to maturity

11.37%

Maturity date

Jun 1, 2031

CVNA5050777

Carvana Co. 5.625% 01-OCT-2025Yield to maturity

10.93%

Maturity date

Oct 1, 2025

CVNA5656702

Carvana Co. 11.0% 01-JUN-2030Yield to maturity

9.57%

Maturity date

Jun 1, 2030

CVNA5656701

Carvana Co. 9.0% 01-DEC-2028Yield to maturity

8.10%

Maturity date

Dec 1, 2028

See all CVNA bonds

Frequently Asked Questions

The current price of CVNA is 6,950.21 MXN — it has decreased by −3.80% in the past 24 hours. Watch CARVANA CO stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BMV exchange CARVANA CO stocks are traded under the ticker CVNA.

CVNA stock has risen by 12.10% compared to the previous week, the month change is a 12.46% rise, over the last year CARVANA CO has showed a 152.73% increase.

We've gathered analysts' opinions on CARVANA CO future price: according to them, CVNA price has a max estimate of 9,444.65 MXN and a min estimate of 4,344.54 MXN. Watch CVNA chart and read a more detailed CARVANA CO stock forecast: see what analysts think of CARVANA CO and suggest that you do with its stocks.

CVNA reached its all-time high on Jul 7, 2025 with the price of 6,610.00 MXN, and its all-time low was 70.00 MXN and was reached on Dec 28, 2022. View more price dynamics on CVNA chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

CVNA stock is 3.95% volatile and has beta coefficient of 2.44. Track CARVANA CO stock price on the chart and check out the list of the most volatile stocks — is CARVANA CO there?

Today CARVANA CO has the market capitalization of 959.28 B, it has increased by 2.41% over the last week.

Yes, you can track CARVANA CO financials in yearly and quarterly reports right on TradingView.

CARVANA CO is going to release the next earnings report on Oct 30, 2025. Keep track of upcoming events with our Earnings Calendar.

CVNA earnings for the last quarter are 25.89 MXN per share, whereas the estimation was 21.98 MXN resulting in a 17.78% surprise. The estimated earnings for the next quarter are 23.71 MXN per share. See more details about CARVANA CO earnings.

CARVANA CO revenue for the last quarter amounts to 90.79 B MXN, despite the estimated figure of 85.86 B MXN. In the next quarter, revenue is expected to reach 93.12 B MXN.

CVNA net income for the last quarter is 3.43 B MXN, while the quarter before that showed 4.43 B MXN of net income which accounts for −22.43% change. Track more CARVANA CO financial stats to get the full picture.

No, CVNA doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Aug 2, 2025, the company has 17.4 K employees. See our rating of the largest employees — is CARVANA CO on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. CARVANA CO EBITDA is 33.80 B MXN, and current EBITDA margin is 9.56%. See more stats in CARVANA CO financial statements.

Like other stocks, CVNA shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade CARVANA CO stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So CARVANA CO technincal analysis shows the buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating CARVANA CO stock shows the buy signal. See more of CARVANA CO technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.