CVNA will falling rates save this darling?VNA (Carvana Co.) shows a strong bullish trend with a breakout setup forming. Here’s a detailed technical analysis:

📈 Trend Analysis: Strong Uptrend

CVNA has been in a clear uptrend, characterized by higher highs and higher lows since March.

The ascending yellow trendline confirms consistent buying interest with each pullback being bought.

This trendline is acting as dynamic support and continues to hold the structure of the uptrend intact.

📊 Consolidation Below Resistance

The stock is currently consolidating just below the horizontal resistance at $75.42.

Multiple candles are pressing against this level without significant rejection, which is a bullish sign of accumulation.

Consolidation under resistance, particularly in an uptrend, often leads to a bullish breakout.

🧱 Key Levels

Resistance: $75.42 – Price has tested this level multiple times, forming a potential bullish breakout level.

Support: $67.87 – A key horizontal level from a prior breakout area. Also roughly aligns with the ascending trendline, giving this support more significance.

🔊 Volume Analysis

Volume has been steady but slightly rising as price approaches the resistance.

Watch for a volume spike on the breakout above $75.42, which would add strong confirmation of buying interest and trigger potential upside follow-through.

📍 Potential Scenarios

✅ Bullish Breakout

A clean close above $75.42 could ignite a breakout move.

Potential target zones:

$80–82 short term, based on the height of the previous consolidation.

Higher if momentum builds, given the strength of the current trend.

⚠️ Bearish Pullback

If price fails to break out and drops below the trendline, it could trigger a short-term correction.

First support test would be $67.87; a break below this could shift sentiment bearish in the short term.

🧠 Summary

CVNA is showing classic bullish continuation signals: strong uptrend, consolidation below resistance, and rising support. This ascending triangle pattern often resolves to the upside. Traders should watch for a breakout above $75.42 with volume for a potential entry, while maintaining awareness of support at $67.87 for risk management.

CVNA trade ideas

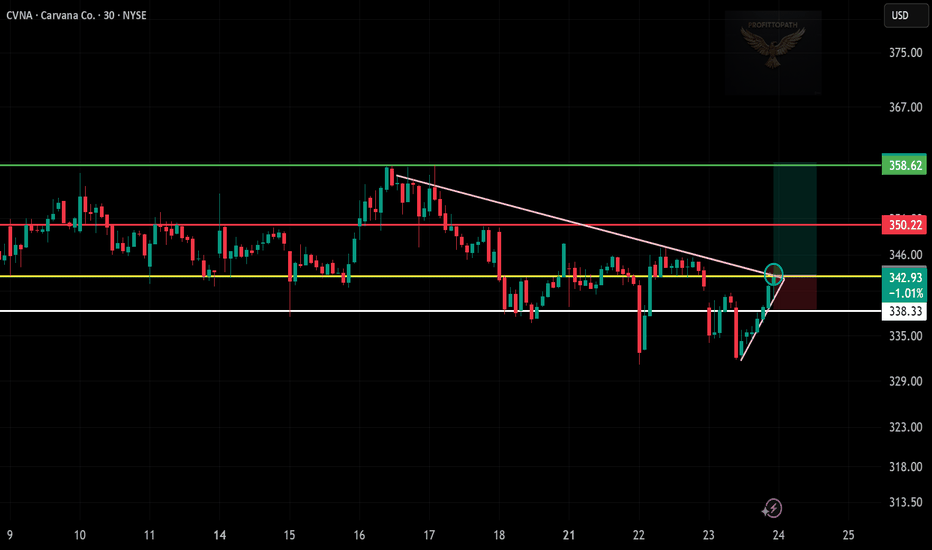

Very DangerousCarvana back near all time highs while in an expanding triangle formation. These happen at times where volatility is increasing and swings have become more wild. It can be a sign a lower liquidity causing small dollar amounts to change the stock's price more drastically.

A daily close under $330 is a giant sell signal for me. Advising extreme caution for those long this stock. I believe there are plenty of better investments out there with far less risk.

Carvana Leading Auto Retail – Outpacing LAD & AN-Financial Performance & Momentum:

Carvana reported a record-breaking adjusted EBITDA of $488M in Q1 2025, up $253M YoY, with an EBITDA margin of 11.5% (+3.8pp YoY). The company's strong operational efficiency positions it as a leader in the auto retail industry, nearly doubling the margins of competitors like Lithia Motors (LAD) and AutoNation (AN).

- Competitive Positioning & Growth Outlook:

Carvana’s EBITDA quality is superior due to lower non-cash expenses, enhancing long-term sustainability. The company expects sequential EBITDA growth in Q2 and targets 13.5% EBITDA margins within 5-10 years.

-Peer Comparison:

- Lithia Motors (LAD): EBITDA margin at 4.4% (up from 4% YoY), facing tariff-related headwinds that could impact pricing and demand.

- AutoNation (AN): SG&A as a percentage of gross profit rose to 67.5% in Q1, expected to stay between 66-67% in FY 2025, pressuring margins further.

-Options Flow & Institutional Activity - Key Levels: $350/$370

Recent institutional flow activity indicates strong positioning around $350/$370 strikes, potentially signaling a vertical spread in play rather than outright selling:

1️⃣ Momentum Confirmation:

- CVNA has strong upside momentum following its Q1 results, reinforcing a bullish outlook for near-term price action.

- Institutional traders may be accumulating bullish vertical spreads rather than unwinding positions.

Vertical Spread Setup ($350/$370 Strikes)

- Long Call ($350 Strike) → Signals expectations for further upside.

- Short Call ($370 Strike) → Caps max profit while reducing cost.

- Breakeven Price: $359 → CVNA must close above $359 for profitability.

Profit & Risk Zones

- Above $370: Maximum profit achieved.

- Between $359-$370: Partial profit zone (spread remains in play).

- Below $359: Spread loses value, making recovery dependent on extended upside momentum.

6/30/25 - $cvna - Sizing up... again? tf lol6/30/25 :: VROCKSTAR :: NYSE:CVNA

Sizing up... again? tf lol

- "tf" is the theme of rn

- do stonks rumble higher w/ some garden variety pullbacks? yes, i think so

- but guys... there are some real terminal losers out there trading like they just discovered the cure for death

- if you like this one, perhaps you should consider tsla

- when i get this one (cvna) pitched... it's like when new-to-be-rekt-crypto-bros tell me "XRP is going to beat BTC". no it won't. and that's an incomplete thesis.

- cvna sells cars to poor people with bad credit and then off balance sheets this risk to other "parties" (some of which are related parties) and that train will run off the tracks, eventually. tomorrow? probably not.

- but as we round the corner into 2H, funds that own this (Like we saw w/ pltr on friday) will say "do i need as much cvna".

- ofc there will always be those who think they've got a winner

- but the market is smart.

- so just keep your head screwed on

- because this one is setting up nicely, again, on the short side

V

Not BullishWhen Carvana finishes this completely manipulated bullrun, it will be devastating. Typically extended 5th waves will correct at a minimum back down to wave 2 of said 5th wave. That means $50.

The stock was in an expanding formation which it broke out from and then failed back into. Very bearish. That is also the same type of pattern that Bitcoin displayed years ago before a major bear market. I think the top is in here, but we'll see.

To get that crash down to $50, something will have to come out in the news most likely about Carvana's stock manipulation and the ghost companies they are using to inflate cash flows. That is purely just a theory though. Perhaps they are squeaky clean and it's totally justified that their stock rose as much as it has, but...I'm not in that camp.

Not to mention all the upper management basically sell their stocks every week. Tens of millions of dollars are being siphoned out by the board and upper management almost every single week. The CEO by himself is cleaning house almost every other day lately. www.sec.gov

CVNA Swing Trade Plan – Bearish Breakdown (June 13, 2025)🛑 CVNA Swing Trade Plan – Bearish Breakdown (June 13, 2025)

📉 Setup Summary:

CVNA is flashing strong bearish momentum across 15-minute and daily charts, confirmed by multiple AI models. Although slightly oversold in the short term, the overall directional thesis remains intact: downside toward $293–$295 seems likely in the coming sessions.

🔍 Multi-Model Technical Consensus

Trend: Bearish across 15-min and daily; weakening on weekly

Momentum: MACD bearish, RSI near oversold but no bullish divergence

Volume: Spike on red candles confirms seller strength

Support/Resistance Zones:

• Resistance: $310–$320

• Support: $292–$295

Max Pain: $320 (may act as a temporary gravitational pull on bounce)

🧠 AI Model Signals

✅ Grok/xAI: $310 PUT — bearish, aligns with max pain retrace

✅ Llama/Meta: $300 PUT — short-term continuation

✅ Gemini/Google: $280 PUT — deep OTM swing toward structural support

✅ DeepSeek: $305 PUT — best balance between liquidity, risk/reward, and chart structure

🧩 Conclusion: Slight preference for the $305 PUT for its technical alignment and capital efficiency.

📈 Trade Recommendation

🔻 Strategy: Buy Naked PUT

Ticker: CVNA

Strike: $305

Expiry: 2025-06-27

Entry: At market open

Target Entry Price: $10.50

Profit Target: $15.75 (+50%)

Stop-Loss: $7.35 (–30%)

Confidence: 75%

⚠️ Risk Considerations

Short-Term Bounce Risk: Extremely oversold 15m RSI might trigger intraday upticks

Macro Reversal: Broader market rally or surprise CVNA news could invalidate the bearish thesis

Premium Sensitivity: CVNA is volatile; strict stop-loss adherence is key

Max Pain Risk: Reversion to $320 could neutralize gains quickly

💬 Swing traders — what’s your play here?

Do you ride the momentum lower, or is this oversold enough to fade?

Drop your take 👇 and follow for daily AI-backed trade setups.

Carvana is setting up for a dropI believe CVNA is printing expanding triangle as wave 4 in larger 5.

If this count is correct, currently wave D of triangle is close to its end and soon, around $325-340, the trend should reverse and go down to complete the triangle with wave E which will erase >60% of market cap.

After this move the stock is expected to climb up again.

6/9/25 - $cvna - Shorting it, now.6/9/25 :: VROCKSTAR :: NYSE:CVNA

Shorting it, now.

- was waiting for the insiders to dump their shares like rats on a rotting boat. and here we are. all over again.

- in theory, if you had Company A (listed) and Company B (private) and you controlled both... and Company B bought Company A subprime loans and the loss (of marking them to zero) was less than the appreciation you'd receive in the form of Company A stock (such that you could sell it)... what would that be called?

- remember friends, some turds float.

- but eventually all turds get flushed.

- trade turds with caution.

- and remember to wash your hands.

- size appropriately.

- good luck to those believing this thing has "turned around" for the second time. fafo :)

V

Carvana: The Megaphone Whispers Before It ShoutsCarvana (CVNA) has carved a textbook megaphone formation. Expansion. Volatility. The upper rim is now experiencing reverberation.

From <$20 to over $300 in under 12 months—this isn’t price discovery; it’s narrative acceleration.

But megaphones don't whisper forever. They break. And when they do, it’s rarely gentle.

Now the macro begins to lean against the parabola:

1) Delinquencies on auto loans in the subprime category are increasing.

2) Tariffs on foreign-produced EVs and parts may squeeze supply chains and make people drive their cars longer before switching. Having a paid-off car is the best car you can have.

3) Rates on car loans remain elevated, which is putting a strain on household finances rather than affecting the price-to-earnings (PE) multiple. Tell your wife you just got a brand new car, but you can't afford to buy steak for the month or dine out at Chili's. CVNA is effectively competing with Chili's in that sense.

4) Used car margins are narrowing. The arbitrage window that fed Carvana’s verticality is closing.

Yes, they scaled fast. And yes, they successfully digitized an industry that was previously considered clunky. But CVNA’s business model is still wed to financing velocity. When credit tightens, so does the upside.

May 30 puts offer asymmetric optionality. The setup is clear:

Froth meets friction. Parabola meets pressure. The story is as old as the markets themselves.

Let others chase euphoria. We’ll listen to the widening echo.

CVNA - Carvana at upper extreme. I'm shorting again!I stand by my posts about CVNA.

It's fishiy and it stinks!

Chart wise, price is at the upper extreme again.

A nice short is setting up, and this time for a much larger move...I think, feel, expect.

"...but, isn't there more to say? You MUST explain WHY and WHEN...", I have people saying.

No, it's not a joke.

I leave it with that §8-)

OptionsMastery: 2 types of traders scenarios! 🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

$CVNA - 260CallHi all,

My ai pinged me suggesting a 260 Call expiring around the 6'th of June on CVNA.

This model's performance is not terrible, but i;m not comfortable listening to my own AI which is suggesting to buy a call literally just before earnings. 2.6 Sharpe isn't bad but it's no 3.6 meaning it's not a guaranteed win.

imgur.com

I am more keen on seeing whether the AI right or wrong and letting you guys know about the trade.

Now my AI also suggests that other CAR sector related stocks may experience moves as well, maybe more than CVNA itself. Unfortunately i do not know which ones those are. I just know the CAR sector good.

Waiting for CVNA to choose a direction.Last week I was all in the news and while I do think it's important to stay alert in an environment where our reigning president enjoys dropping posts intraday, I do still support staying out of the general news. It will not only drive you crazy, but it will cloud your judgement. Just watch price action and volume, stay calm, and adjust you risk as needed.

🟢 Bullish Scenario

If CVNA continues up, it will face resistance around 219. But if it breaks above this level (which includes the February 2024 uptrend line, May 2021 pivot, and the daily 50SMA), it will not have a lot of overhead. This would open a door toward around 250 and 260. In the short-term, if it can hold above it's EMAs, we may still be bullish.

🔴 Bearish Scenario

Failure to break through 219, or lose the 10 and 20 EMAs, could set up another leg lower. A break back below the daily 200SMA would clear the path back to 157. At the time of publishing this, CVNA tested 219, and pulled back...now we wait to see if it wants to call a direction today.

⚪️ Neutral / Chop Scenario

If price continues to hover between 194 and 219, we may just be seeing a consolidation phase within a broader downtrend. That would suggest neither bulls nor bears have full control, and we could expect choppy, range-bound behavior this week.

A break outside of this range with volume would help clarify the next direction.