EW EARNINGS TRADE SETUP

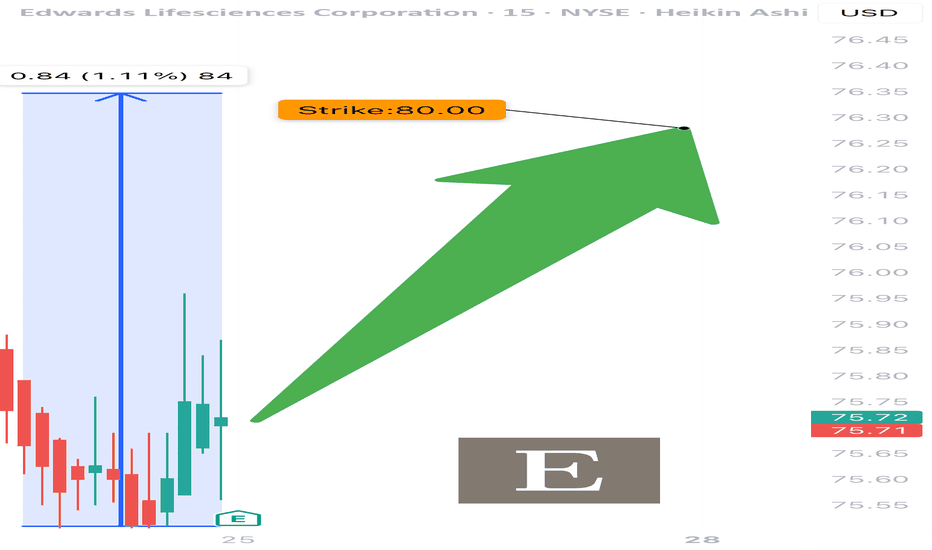

📈 EW EARNINGS TRADE SETUP (07/24) 📈

💥 Quiet stock, loud opportunity. Fundamentals strong. Market asleep. We’re not.

🧠 Quick Read:

• Beat rate: 88% over 8 quarters

• Margins elite (OP Margin: 29%, Net: 75.7%)

• RSI 43 → Neutral setup with room to run

• Big OI at $80 calls (6.7k+) 💪

• IV not bloated → low crush risk ✅

🎯 TRADE IDEA

🟢 Buy EW $80 Call exp 8/15

💰 Entry: $1.55

🎯 Target: $4.65

🛑 Stop: $0.77

📈 Confidence: 70%

📊 Why it works:

• Medical device demand + aging population = macro tailwind

• Market ignoring it = opportunity

• Risk-on tape + IV sweet spot

#EW #OptionsAlert #MedicalTechStocks #EarningsSetup #LongCall #RiskReward #OptionsTrading #StockAlert #SwingTrade #TradingView #SmartMoneyFlow

EW trade ideas

Edwars lifesciences: ready for a bull runAfter a sharpe decline the NYSE:EW stock rebounded and now it seems to be ready for a new bull run.

Actually the P&F chart reversed bullish in august, and after one month of trading range it gave another strong buy signal in october, with the quadruple-top at 73.

At the current price of 74 the stock is retracing from the near term high at 76 and given the price target at 92 and the stop loss at 64 it is still possible to entry long for a nice risk/reward trade.

Looking at the fundamentals , EW achieved fantastic operating results in the last years and is a leader in his sector. With adjusted EPS at $2,45 the stock is roughly trading at a P/E of 30, which is high but in line with the high valuation given historically by the market.

Buy at 86,19 after the rejectionTHIS IS NOT SHORT IDEA!!! Expecting a fall to 86,19 and rejection back to the final target. Enter just after clear rejection on 4H chart. Then set conditional SL, if any two 4H candles closes below the SL zone, cutloss your trade. No rejection at 86,19 = no trade. Don´t fall to the trap by buying lower because the more favorable price. You will made your trade "superrisky". Wish you good luck.

Edwards Lifesciences - A Fine Enterprise

How to summarize this business ?

Rising earnings with high profit margins and low debt over long period of time.

***

EPS has grown from 0.3 in 2010 to 2.48 in 2022, with average profit margin of 22% for the past 7 years. Equity has been growing from 1.9 in 2010 to 9.5 in 2022 (book value per share). For the past 7 years highest Debt to Equity was 0.35 in 2017, currently standing at 0.12 ;

Sales per share have been on a steady rise from 2 in 2010 to 8.6 in 2022.

Company handles cash very well with free cash flow being around the level of net income for most years.

At these market levels with current EPS, company has not been valued so low since 2015, making it an attractive offer for this kind of enterprise.

Have A Great Day.

Edwards Lifesciences (EW) - Frequency Formula Strategy - ShortStrategy Overview: The Frequency Formula

Our trading strategy, "The Frequency Formula," is built on cutting-edge Fourier Wave Transform theory. The strategy utilizes four unique indicators: the Frequency Formula Chop Indicator (FF-CI), Frequency Formula Trend Indicator (FF-TI), the Frequency Formula Volume Indicator with Combined Ratios (FFVI-CR), and the Frequency Formula Net Buy/Net Sell Volume Indicator (FF-NBNS). Together, they identify optimal entry and exit points based on changes in market trends, volumes, and sentiments.

Why Now Is a Good Time to Enter

The FF-CI and FF-TI suggest that the current market chop and previous bullish trend are transitioning into a solid downward trend. Simultaneously, the FF-UVI-CR indicates increased selling volume and negative sentiment, suggesting strong support for the downward price movement.

What to Look for When Exiting

Keep an eye on our FF-VMI-CR and FF-NBNS Indicators. When the FF-VMI-CR indicator negative volume (red) and positive volume (blue) signals converge or "squeeze", this indicates a significant increase in net buying volume and might indicate a potential trend reversal; also, watch the FF-NBNS indicator's net-buying value (blue) to increase and close at any value greater than zero, at this point you should exit the position.

Remember to always manage your risk, and don't invest more than you can afford to lose. Happy trading!

EW - Is Medical Tech with 40% Upside is More Attractive Now? Given that all the tech companies are experiencing a lot of pressure at the moment is it worth investing into medical tech company with potential short term 40% upside?

Fundamental indicators:

Revenue and Profits - demonstrated consistent long-term earnings growth over the past 10 years

Profit margin - high efficiency with 20% on average

P/E - quite high with 38x ratio but reduced from 54x in January 2022

Liabilities - no problems with debt

Technical Analysis (Elliott Waves):

EW has enjoyed explosive growth since 2013 and it is clearly visible that this growth cycle is finishing

The last considerable correction was formed by an Ascending Triangle in March 2021

Since then there was was a rapid impulse like movement which has peaked in December 2021. The main question if it was wave 5 or wave 3

Looking at the lower timeframe it is more likely that motive waves 1 and 3 have been formed by zigzags hence we can expect another zigzag of wave 5 after the current Flat correction is completed

What do you think about this scenario for EW ? Do you the alternative scenario where an impulse has already completed is more likely?

Please share your thoughts in the comments and like this idea if you would like to see more stocks analysed using Elliott Waves.

Thanks

$EW breaking out of a ~8month base!Notes:

* Good earnings record

* Very strong up trend on the monthly

* Breaking out of a ~8 month base for the second time

* Has been ranging tightly for the past few weeks between $123.27 and $119.94

Technicals:

* Sector: Healthcare - Medical Devices

* Relative Strength vs. Sector: 1.2

* Relative Strength vs. SP500: 3.88

* U/D Ratio: 1.13

* Base Depth: 20.9%

* Distance from breakout buy point: 1.01%

* Volume 18.81% above its 15 day avg.

Trade Idea:

* You can enter now as the price is still very close to the breakout point

* If you're looking for a slightly better entry you can wait for an opportunity around $123.27 or 119.94

* Manage risk accordingly

Ugly Top x 2And according to Heiken-Ashi candles, this is still in a downtrend.

This has broken the neckline of the 2nd head and shoulders top. You can get a guesstimate of where a head and shoulders top may go by drawing a line from the head to the neckline, then projecting it downward from the neckline.

EW broke the neckline of the first bad/ugly top but did not fall far before resuming an uptrend again. I am not sure if this will be a regular occurrence anymore in our current market like if has been a for the last few years. But who knows?

Earnings Miss noted recently. As of late those do seem to matter, and can linger for a bit longer than they would have in the last few years

I like this stock but am watching for now. Earnings 3-27 AMC.

MKT cap 65.5 Billion. PE 40.94 (could be lower for this sector) Short interest less than 1%. EPS 2.56. Revenue is growing quarter after quarter

Oversold on daily RSI. Not oversold on weekly RSI but closing in on it and is by no mean oversold or monthly RSI, but is not overbought either. Securities can remain oversold for extended periods of time especially if there is a lot of supply at that level.

Edwards Lifesciences Corporation provides products and technologies for structural heart disease, and critical care and surgical monitoring in the United States, Europe, Japan, and internationally. It offers transcatheter heart valve replacement products for the minimally invasive replacement of heart valves; and transcatheter heart valve repair and replacement products to treat mitral and tricuspid valve diseases. The company also provides surgical heart valve therapy products, such as pericardial valves for aortic and mitral surgical valve replacement; aortic heart valves; annuloplasty rings; cardiac cannula devices; beating heart mitral valve repair system for the treatment of degenerative mitral regurgitation, as well as various procedure-enabling platforms to advance minimally invasive surgery. In addition, it offers critical care products, such as hemodynamic monitoring systems to measure a patient’s heart function and fluid status in surgical and intensive care settings; pulmonary artery catheters; arterial pressure monitoring products, oximetry central venous catheters, as well as monitoring platforms that display a patient's physiological information; and Acumen Hypotension Prediction Index, which alerts clinicians in advance of a patient developing low blood pressure. The company distributes its products through a direct sales force and independent distributors. Edwards Lifesciences Corporation was founded in 1958 and is headquartered in Irvine, California.

If you can’t spot the sucker 30 minutes after sitting down at a table,

it’s probably you.