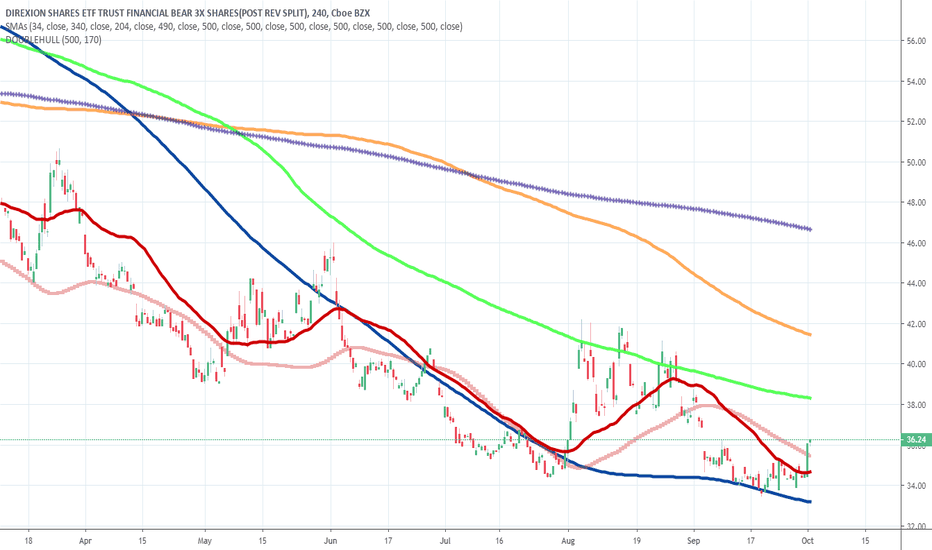

Update and upward on FAZWe hit a new low since my last post, but we are back up over the previous 52 week low. I am still suspicious of that new low invalidating the trend structure indicated by the bull flag pole in March 2020. I blame it on the fact that this ETF is leveraged and also because it is a basket of currencies so it will express a "distorted" and "exaggerated" price structures. In other words, it is not going to yield the cleanest technical patterns. The economy is only getting worse, and within the next few weeks, the US is expecting a record number of retail and restaurant bankruptcies. This is horrible news for banks, and no, this is not going to be a "V" shaped recovery. Therefore, I do not believe the stock market (albeit manipulated) will resume a bull trend. This is why the "new low" in FAZ is not convincing. The banks are in very troublesome waters, even with market bailout now money free flowing again. Everything is heading toward the "Great Reset" which is a nomenclature now entering into the cultural vernacular.

FAZ trade ideas

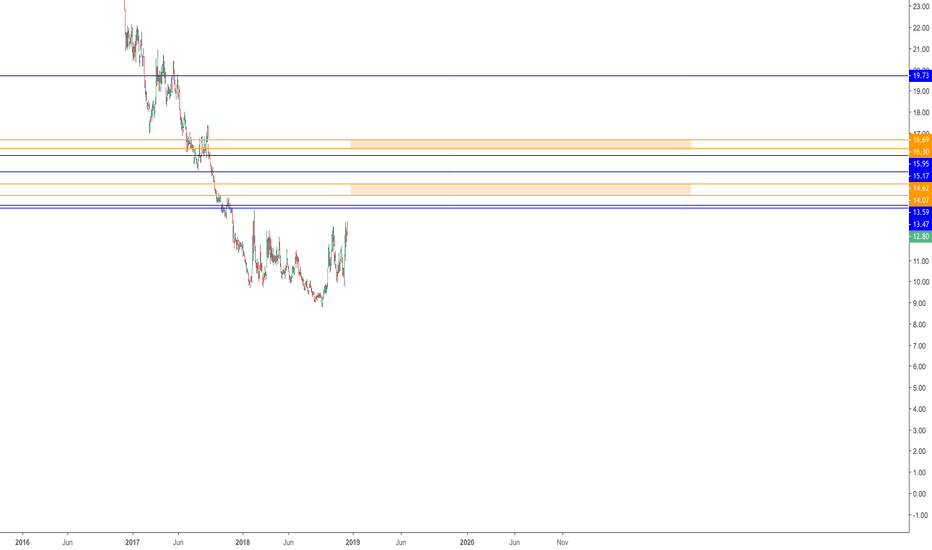

Bear Squeeze Going on Longer than Expected, but Over Soon?I have revised my last view after looking more closely at historical levels. One that is still clear, is that FAZ is respecting both the 52 week low as well as the the all time low. For 12 years FAZ has not breached $23.01, even though it has recently fallen to 24.16 in Feb. 2020. The bears are holding the line! This squeeze is going on longer than some of us thought, but that is just how the market works doesn't it?

Looking forward, if the overall stock market trend is now down, then there is nowhere else for the banks to go but down. Inversely, this of course means FAZ again is at the launching pad of this rocket about to take off.

The pattern being highlighted is a bull flag with a symmetrical triangle waving in the wind. With respect to the overall down trend, this descending triangle appears as if it is about to "fail" to the upside and launch this crazy ETF past the breakout high of $74.60. Not financial advice of course, but today's closing price at $24.03 looks pretty yummy if the trend is your friend.

Are Bank Stocks About to Take a Dive?Novice technician here, but this is what I am seeing. It seems pretty clear the market structure has changed toward the upside with the crack cocaine of ETF's, FAZ ,in a clear break out. After FAZ's break out in May, it has followed through in an overly extended correction, and has been going sideways for the last few weeks forming a symmetric triangle. Within an uptrend these patterns tend to yield a very strong break out to the upside. It appears FAZ is about to do just that, and commit the bank stocks to their inevitable decline. I think many of us see here see that bank stocks are on the verge of continuing their dramatic fall which is shaping up to make 2008-2009 like an appetizer. I have attempted to trace out the evolving Elliot Wave pattern, but like i said I am still pretty novice on it. Let me know if you see something else I may have missed.

Prepare for financial crisisThe biological crisis has stabilized, but the financial crisis is just beginning. True, the Fed has been injecting huge amounts of money into the financial system via repo and treasury and mortgage bond buying. In just a few weeks we're doing more QE than we did over 8 months back in 2008. That should help prevent outright bank failures, but there's still going to be a lot of pain as mortgages and corporate debt start to default.

The canary in the coal mine for a mortgage default crisis is unemployment, and this week we're likely to see initial jobless claims jump from 280,000 last week to some number in the millions. Reports indicate that New York's unemployment office is receiving 200,000-500,000 new claims per day, and California's jumped from 2,000 to 80,000 overnight. Both offices are overwhelmed and their employees are working huge amounts of overtime to keep up with all the new claims.

Bad mortgages aren't as big a risk to the economy as they were in 2008, but they're still a pretty big risk. The Trump administration has been lowering lending standards for several years, and the share of mortgages considered "high risk" has been rising rapidly. There's going to be pain in the banking sector. I will enter FAZ ahead of Thursday's ICSA report this week.

FAZ IdeaI entered a long position at 12.69 with a Stop at 11.63.

If this thesis is correct, I will let this run and raise my stops along the way.

Areas of the interest are highlighted by the Blue and Orange lines using key Fibonacci levels.

The orange boxes depict Golden Pockets levels that I identified.

FAZ is at a CrossroadsBanks are falling and conversely, FAZ has been on the rise. We appear to be at 2 points of resistance; first is the descending wedge that has been forming over the last several months. 2nd, we seem to be back in that descending channel and nearing resistance. However, the 3rd point of resistance is the ~$11.50 price that has acted as historical support and recent resistance. If this breaks, could we be headed higher? Out of the channel and above the wedge?

Keeping my eyes on this closely over the next few days as there is substantial gains to be made long or short of this depending on if resistance holds or not.

Descending triangle with volume support. Also very low (current) IV could be interesting to enter with a single contract instead of a vertical.

Despite the low IV, a straddle does not look too great as you'd need to give it a month to expiration to increase the wining probability which makes it expensive hence not interesting.

Bull Run nearing the end? Hedge with Bear ETFsAfter nearly a decade of growth in the stock market, many believe the "bubble" will soon pop. With trade wars between the US and China looming in the shadows, we may be seeing a reversal in the near future. This stock, FAZ, is a 3X inverse ETF of the financial index. At the height of the 2008 crisis, this stock hit highs of over $100,000 per share. As the market recovered, and the bulls gained momentum, FAZ steadily declined as it should. Now that we are looking at the possibility of a macro trend reversal, the wise choice would be to diversify into hedges that will protect your portfolio in the case of a collapse. The potential upside here is magnanimous. If we wait until the actual reversal takes place, the highest percentage gains will be already booked. It's highly unlikely that we will see significant loses in this ETF, given that we have reached an apparent bottom. The activity that i've seen, including the double-bottom bounce, leads me to believe that upside action in the near future is imminent. At only $11.13 per share, a small investment could create very impressive potential returns.