JNUG trade ideas

JNUG a good buy?If the Fed doesn't lower rates again this year, this little correction in the equities markets might actually turn into a full blown recession, following the emerging market decline. If gold prices go up even a little, these gold mining ETF's will rocket. Also, on a technical basis, I see a distinct reverse head and shoulders, which I consider the bottom for them.

Custom Metals Index Setting Up A Major Double BottomDo you follow the metals? Want to see a classic double bottom formation setting up for what I believe will be a "Rip your face off" rally? Here it is.

I use quite a bit of custom index features to track the major markets because I believe these provide a clearer perspective of the markets than following individual symbols. I find the data to be key to making trading decisions. This custom METALS index tracks a number of metals symbols and is showing us that Gold has retested a key low level that will likely prompt a major bottom and a huge upside move. Of course, I could be wrong, but I believe the move in the US Dollar has exhausted the upside move for now and it is time for Gold and Silver to rally back to 2018 highs (or higher).

Concerns from the global markets as well as the fact that foreign governments are stockpiling gold means only one thing - they are preparing for a crisis event and are using gold as a standard of value in the event of this crisis. This means that when the event starts to unfold, which we are seeing the early signs of this right now, then gold will price in the concerns and fears of the global currency and economic fears that are unfolding.

Get ready folks, this could be a very exciting time to be investing in the global markets. My Live Trades algos are already showing +200% roi from recent moves. You won't want to miss the next 5+ years of this activity. Stay ahead of the markets and learn how I can help you find success.

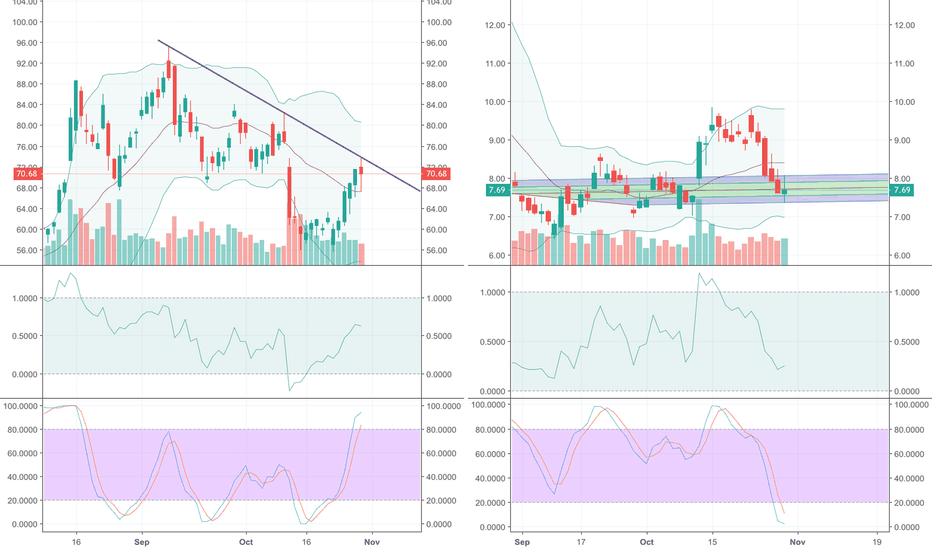

JNUG - Junior storyThe volume in the 3x leveraged junior miner fund jumped in the last few days.

We had a capitulation type of volume price dropped hard.

After today's powerful start bears tried to take control but it was enough only to take out the stops of those who entered today. The opening gap was not filled.

It seems to me the bottom is in.

Pull back expectedAnticipate a healthy pull back into the $15.32/$15.08 before resuming the up trend. Overall there is a wedge squeeze under way that will likely resolve by July 20th. Until then it will remain range bound between $14/$18 until ultimate break down or break out. With annual cycles, I'd anticipate a break out in July.