#LCID - 4HR [ A potential bullish view]Lucid blasted off last week with the collaboration of Uber and Robo-taxis. I think that blast infused more investors to the stock and I think it may never come back to take out its lows. If it does, I would load up more on it. I like their designs and the fact that they are now compatible with TESLA's Super Chargers make them even more attractive.

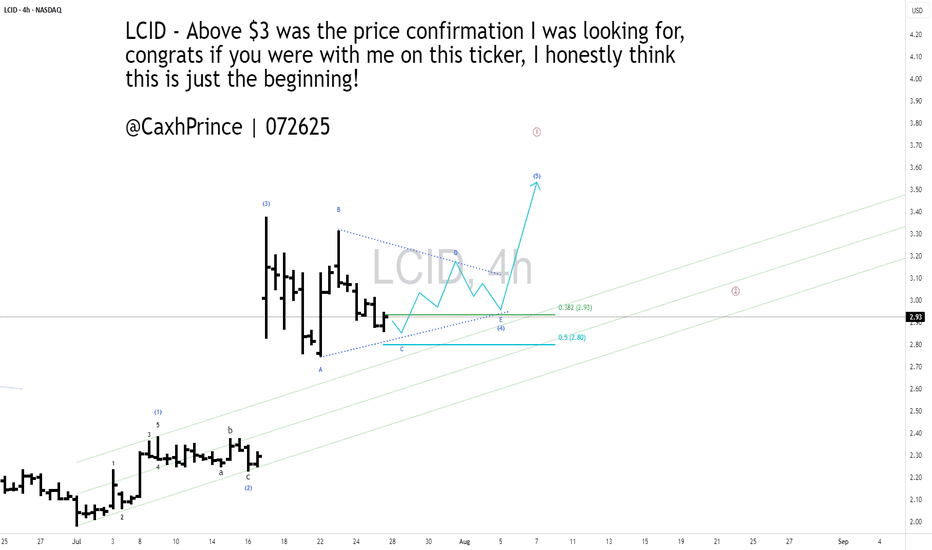

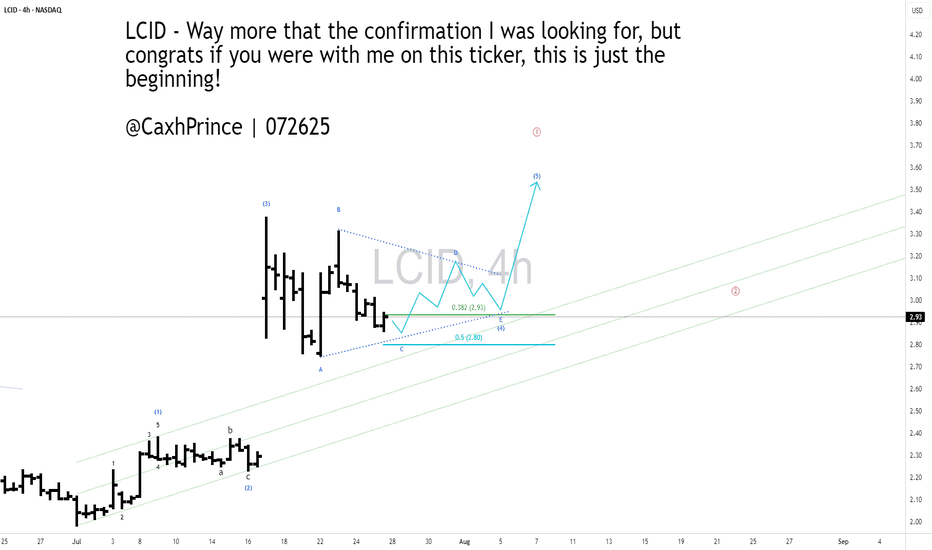

In my count here, I am sensing the current correction could form a triangular pattern for another high before one last correction for ABC down.

Go LCID, Go!!!

Check out my other chart ideas @CaxhPrince everywhere.

LCID trade ideas

A 4HR Bullish view on #Lucid Motors ($LCID)Lucid blasted off last week with the collaboration of Uber and Robo-taxis. I think that blast infused more investors to the stock and I think it may never come back to take out its lows. If it does, I would load up more on it. I like their designs and the fact that they are now compatible with TESLA's Super Chargers make them even more attractive.

In my count here, I am sensing the current correction could form a triangular pattern for another high before one last correction for ABC down.

Go LCID, Go!!!

Check out my other chart ideas @CaxhPrince everywhere.

My thoughts on LCID-4HRLucid blasted off last week with the collaboration of Uber and Robo-taxis. I think that blast infused more investors to the stock and I think it may never come back to take out its lows. If it does, I would load up more on it. I like their designs and the fact that they are now compatible with TESLA's Super Chargers make them even more attractive.

In my count here, I am sensing the current correction could form a triangular pattern for another high before one last correction for ABC down.

Go LCID, Go!!!

Check out my other chart ideas @CaxhPrince everywhere.

Time for Lucid Group Inc. (LCID) – Short-Term Bullish --3.50 USDLucid Group Inc. (LCID) on the 4-hour chart is showing a moderately bullish structure, suggesting potential for continued short-term upside. After a period of consolidation and base-building, the price has broken above key moving averages (MA5, MA10, and MA30), which are now turning upward and beginning to act as dynamic support. This shift indicates improving technical sentiment. The nearest resistance is around the $3.08 level — a zone defined by previous swing highs. A confirmed breakout above this level could pave the way toward the next target around $3.50, which represents both a psychological threshold and a former supply zone.

Supporting this bullish outlook, momentum indicators (likely WaveTrend or Stochastic RSI) are signaling continued upside pressure without yet showing strong overbought conditions. However, caution is warranted: if the price gets rejected at the $3.08 resistance, a pullback toward the $2.70–$2.75 support area is possible. Holding that support would be crucial for maintaining the current higher-low structure. Overall, the technical setup favors a move toward $3.50, but it requires follow-through from buyers at key resistance levels.

Potential TP : 3.50 USD

LUCID going to benefit from recent policy changes Lucid is positioned to enjoy a short-term uplift from the policy change due to its EV-only model and lower volume compared to peers. However, its longer-term success depends on execution—scaling manufacturing, launching key new models, and moving toward profitability in a future without subsidies.

High probability bullish setup #lcidMultiple confluences are suggesting a potential bullish reversal:

A- Price is forming lower highs, while MACD is showing higher lows → bullish divergence

B- MACD crossover is forming, indicating strengthening momentum

C- Bollinger Bands are narrowing, suggesting a potential breakout

D- Support level is holding, confirmed by increased volume, indicating buyer interest

NASDAQ:LCID

Disclaimer: This is not financial advice. The information provided is for educational and informational purposes only. Trading stocks and other financial instruments involves significant risk and may not be suitable for all investors. Always do your own research and consult with a licensed financial advisor before making any trading decisions. Past performance is not indicative of future results.

Buy Idea for Lucid Group (LCID) • Current Price: $2.15

• Support level: $1.99

• Resistance level: $2.42 / $2.85

• Indicators:

• Bollinger Bands show a potential reversal from the lower band.

• MACD and momentum indicators are still weak but may show signs of convergence soon.

• Volume is picking up, which may support a short-term move.

Plan:

• Consider gradual buying around $2.15, with a tight stop-loss at $1.99 to limit downside risk.

• Initial target: $2.42, second target: $2.85.

⚠️ Note: This is a short-term technical idea based on the 4-hour chart. Always adjust your position size and risk level accordingly.

$LCID Future Growth Investors may adopt a bullish stance on Lucid Group Inc. (NASDAQ: LCID) due to substantial insider buying, particularly by the Public Investment Fund (PIF) of Saudi Arabia. In October 2024, PIF purchased approximately 396 million shares at $2.59 each, totaling over $1 billion. This significant acquisition increased PIF's holdings to more than 2.2 billion shares, representing a majority stake in the company .

Such large-scale insider purchases are often interpreted as a strong vote of confidence in a company's future prospects. PIF's continued investment suggests optimism about Lucid's strategic direction, including its expansion into the electric SUV market with the upcoming Gravity model and recent acquisitions aimed at enhancing production capabilities .

While other insiders have engaged in stock sales, these are relatively minor compared to PIF's investments. For instance, in August 2024, Eric Bach, Lucid's SVP of Product and Chief Engineer, sold approximately 90,000 shares for $282,000 . Overall, the scale of PIF's purchases indicates a bullish outlook on Lucid's long-term potential.

Sources: Insider Ownership and Buys (Public Investment Fund - PIF):

➤ SimplyWall.St - LCID Insider Ownership

➤ SEC Form 4 Data for LCID Insiders

Recent Insider Sale by Eric Bach (SVP of Product):

➤ SEC Form 4 - Eric Bach Insider Transaction

Lucid's Financial and Strategic Overview:

➤ Finviz - LCID Financial Overview & News

Safe Entry ZoneCurrently stock in down movement.

Has Two significate support level 1h Green Zone (most propaply will respected) and 4h Green Zone (Strongest Support Level) price targeting is the 1h Red Zone (Take Profit Line where you can secure profit) then for long term we got two P.High(Previous Hign) Lines which acts as Strong Resistance Levels MUST Be Respected and Watch-out for any selling Pressure to secure profit.

Note: Potentional of Strong Buying Zone:

We have two scenarios must happen at The Mentioned Zone:

Scenarios One: strong buying volume with reversal Candle.

Scenarios Two: Fake Break-Out of The Buying Zone.

Both indicate buyers stepping in strongly. NEVER Join in unless one showed up.

LCID - PULLBACK & ZOOMGood Morning,

LCID is showing some decent, DECENT Julien, bullish potential. Currently in a bullish wave form with some room to move up. Volume overall is good and the stock position healthy. If it can fully complete its bullish wave we could see some gains up to the 4.20$. We could expect a corrective wave after that action and if all supports hold another nice bullish run.

ENJOY!

LUCID showing possible move!I was looking at LUCID on the weekly chart. Its been on a downtrend since its IPO Merge with CCIV. Momentum indicators have been showing Divergence for more then 2 years. An it looks like Direction could be changing soon to the upside. If it doesn't rejects the RSI trendline it could breakout, An the MacD is also looking bullish as well an close to crossing the zero line. An with short interest at 29.54% it could be a interesting play if price picks up Momentum.

LCID upMVP system

Momentum: upward trend

Volume: significant increase

Price: looks like poss rounded bottom

The R/R here is pretty sweet. I want to play this - I’m watching for a possible dip below support w a recovery back above. The volume here is what interests me. If it does pop up, it could be impressive.

Thank you.

Lucid Stock Chart Fibonacci Analysis 050925Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 2.5/61.80%

Chart time frame: B

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress: A

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E) Hit the top

Stocks rise as they rise from support and fall from resistance. Our goal is to find a low support point and enter. It can be referred to as buying at the pullback point. The pullback point can be found with a Fibonacci extension of 61.80%. This is a step to find entry level. 1) Find a triangle (Fibonacci Speed Fan Line) that connects the high (resistance) and low (support) points of the stock in progress, where it is continuously expressed as a Slingshot, 2) and create a Fibonacci extension level for the first rising wave from the start point of slingshot pattern.

When the current price goes over 61.80% level , that can be a good entry point, especially if the SMA 100 and 200 curves are gathered together at 61.80%, it is a very good entry point.

As a great help, tradingview provides these Fibonacci speed fan lines and extension levels with ease. So if you use the Fibonacci fan line, the extension level, and the SMA 100/200 curve well, you can find an entry point for the stock market. At least you have to enter at this low point to avoid trading failure, and if you are skilled at entering this low point, with fibonacci6180 technique, your reading skill to chart will be greatly improved.

If you want to do day trading, please set the time frame to 5 minutes or 15 minutes, and you will see many of the low point of rising stocks.

If want to prefer long term range trading, you can set the time frame to 1 hr or 1 day.

LCID | Long | High-Volume Base Formation| (April 9, 2025)LCID | Long | High-Volume Base Formation + Oversold Recovery | (April 9, 2025)

1️⃣ Insight Summary:

Lucid has been in a long-term downtrend since 2021, but recent price action shows early signs of accumulation with heavy volume and buy signals forming at a historical base. This could be the beginning of a multi-leg recovery if buyers step in.

2️⃣ Trade Parameters:

Bias: Long

Entry Zone: $2.16 – $2.43 (current range with compound positioning)

Stop Loss: Below $2.00 (clear invalidation and structure breakdown)

TP1: $2.92

TP2: $5.23

Final TP: $13.06 (long-term stretch target based on full reversal range)

Partial Exits: Around $2.90 and $5.20 to secure early gains and reduce risk

3️⃣ Key Notes:

✅ LCID has been consolidating sideways with significant buy-side volume appearing since Q4 2024

✅ Multiple buy signals recently printed on the daily chart

✅ While it’s unrealistic to expect a return to $55–60, even a move toward $13 offers a 6x return from this range

✅ Lucid continues to operate as an EV tech and components manufacturer — a sector with long-term potential

❌ Invalidation clearly lies under $2.00 — if price breaks this zone, the setup loses its foundation

📊 RSI and volume support the case for a potential macro reversal forming here

4️⃣ Follow-up Note:

Actively monitoring and risk-managing this trade. Will update the idea if price breaks above key resistance or if downside pressure resumes.

Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible.

Disclaimer: This is not financial advice. Always conduct your own research. This content may include enhancements made using AI.

LCID: Is the Bearish Trend Finally Nearing a Reversal?LCID is still in a long-term bearish trend, but there are signs it could be nearing a shift. Here's the breakdown:

✅ Bearish trend since 2021: LCID’s price dropped from 64.86 to 1.93, a major decline over the past few years.

📉 Substantial declines: After a 280% gain in 2021, LCID has seen significant losses —

-82% in 2022

-38% in 2023

-28.3% in 2024

-21% so far in 2025.

🔄 Rebounds, but trend still down: Despite rebounds of over 180% in 2023 and 100% in 2024, the bearish trend remains intact.

⚠️ Diminishing volatility: Large price swings in 2024 slowed down, suggesting the stock might be nearing a bottom.

❌ Still below key MAs: LCID remains below its 200-day and 20-day moving averages, signaling that the overall trend is still bearish.

👀 Key level — 1.93: A strong hold above this low could signal a potential trend shift in the mid-term.

Bottom line?

LCID could be stabilizing, but the bearish trend stays in place until it holds above 1.93. Watch for confirmation before expecting a trend reversal.

LCID Rejection at Resistance – Short Setuphere’s the setup on Lucid (LCID). The stock had a nice pop after the Morgan Stanley upgrade, but let’s be real—it’s still bleeding cash with no real turnaround yet.

📉 Why I’m Looking to Short:

LCID ran into resistance (check the chart) and failed to break through.

If it drops below support, we could see a solid move down.

The company is still burning money, and the hype from the upgrade might fade fast.

💰 Trade Plan:

Short entry: If LCID breaks below support (marked on the chart).

Target 1: First key support level.

Target 2: Deeper move if selling pressure increases.

Stop loss: Above recent highs (just in case it rips).

⚠️ Risk Factors:

If LCID holds support, we could see a short squeeze.

Saudi backing & AI hype might keep it from fully breaking down.

LCID looks like it could hit a nice 50% popBasically been in an extended downtrend since the SPAC merger in

'21. I have seen sporadic bullish news fundamental wise but those I take with a grain of salt.

What has really snagged my attention is we broke out of the falling wedge on the weekly, made a lower low, catching out people who took the breakout early, we bounced up, double topped, generating some decent liquidity above those 5-6 highs to our immediate left.

On top of that when we came in for the 2nd bottom we put in a pretty clean accumulation schematic, volume jiving on cue.

Daily P pattern on the TPO, bull flag on the 15, the more I look, the more I like it.

Much love and good luck!