Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

48.95 MXN

6.95 B MXN

125.51 B MXN

138.09 M

About Lamb Weston Holdings, Inc.

Sector

Industry

CEO

Michael J. Smith

Website

Headquarters

Eagle

Founded

1950

FIGI

BBG00PG394G5

Lamb Weston Holdings, Inc. engages in the production, distribution, and marketing of value-added frozen potato products. It operates through the following business segments: Global, Foodservice, Retail, and Other. The Global segment includes branded and private label frozen potato products sold in North America and international markets. The Foodservice segment consists of branded and private label frozen potato products sold throughout the United States and Canada. The Retail segment consists of consumer facing retail branded and private label frozen potato products sold primarily to grocery, mass merchants, club, and specialty retailers. The Other segment includes the vegetable and dairy businesses. The company was founded in 1950, and is headquartered in Eagle, ID.

Related stocks

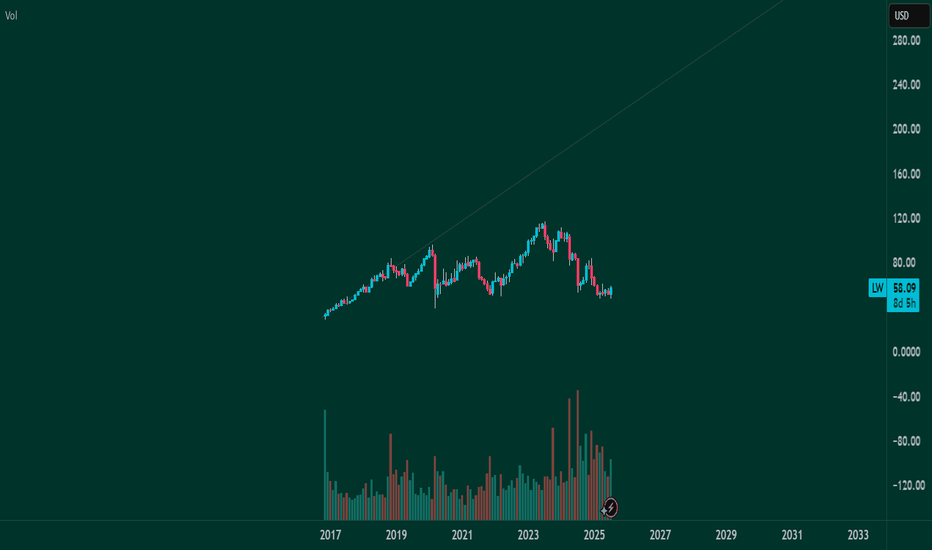

Trading Thesis: Frozen M&A Firestarter– Is LW the Next Takeover 🧠 Trading Thesis: “Frozen M&A Firestarter – Is LW the Next Takeover Pop?”

📉 Ticker: NYSE:LW

🗓️ Timeframe: Daily (1D)

📍 Current Price: $51.32

📈 Fibonacci Extension Target: $136.62 – $170.88

📉 Downside Risk: ~$47.90 if activist push fails

🔭 Time Horizon: 2–6 months

🔍 WaverVanir Thesis

Lamb Weston (

Clear DayTrading strategy video. The "Inside Bar"🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

Lamb Weston Holdings | LW | Long at $51.32Lamb Weston Holdings NYSE:LW , the potato / French fry king, has gone through a tremendous downturn since 2023. Yet, earnings are forecast to grow 22% per year into 2027. Debt is quite high at 2.5x and this company, like many others, will significantly benefit from lower interest rates in the futur

Short | LW NYSE:LW

Technical Analysis of Lamb Weston Holdings, Inc. (LW)

Key Observations:

Current Price Action:

Price: $82.24

Recent Drop: -0.44 (-0.53%)

Bearish Line: $81.94

Support and Resistance Levels:

Immediate Support: $79.78 (Target Price 1)

Further Support: $76.45 (Target Price 2)

Resistance: Th

Long Lamb Weston $LW

🍟 NYSE:LW is one of the largest producers of frozen 🥔products

🍟 Large supplier to $ NYSE:MCD MCD NYSE:LW

🍟 Stock is bouncing after Jana Partners took a stake and the latest earnings

🍟 Unusual Call Options Activity using @Tradestation shows accumulation

🍟 Upside potential 25% to target

LW Lamb Weston Holdings Options Ahead of EarningsIf you haven`t sold LW before the previous earnings:

Now analyzing the options chain and the chart patterns of LW Lamb Weston Holdings prior to the earnings report this week,

I would consider purchasing the 65usd strike price Calls with

an expiration date of 2024-10-18,

for a premium of approximat

Stocks pairs trading: LW vs CLXLet's examine the trade potential for Lamb Weston Holdings (LW) and Clorox (CLX) by analyzing their key financial metrics and recent performance to determine reasons for going long on LW and short on CLX.

Price-to-Earnings (P/E) Ratio:

LW: P/E ratio of 10.50

CLX: P/E ratio of 68.01

LW has a sign

Stocks pairs trading: LW vs WRKLet's examine the trade potential for Lamb Weston Holdings, Inc. (LW) and WestRock Company (WRK) by analyzing their key financial metrics and recent performance to determine reasons for going long on LW and short on WRK.

Price-to-Earnings (P/E) Ratio:

LW: P/E ratio of 10.93

WRK: P/E ratio of 43.2

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

LW5284213

Lamb Weston Holdings, Inc. 4.375% 31-JAN-2032Yield to maturity

5.94%

Maturity date

Jan 31, 2032

LW5284211

Lamb Weston Holdings, Inc. 4.125% 31-JAN-2030Yield to maturity

5.48%

Maturity date

Jan 31, 2030

LW4985743

Lamb Weston Holdings, Inc. 4.875% 15-MAY-2028Yield to maturity

5.33%

Maturity date

May 15, 2028

See all LW bonds

Curated watchlists where LW is featured.

Frequently Asked Questions

The current price of LW is 1,068.09 MXN — it has increased by 1.33% in the past 24 hours. Watch LAMB WESTON HLDGS INC stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BMV exchange LAMB WESTON HLDGS INC stocks are traded under the ticker LW.

LW stock has risen by 2.13% compared to the previous week, the month change is a 2.13% rise, over the last year LAMB WESTON HLDGS INC has showed a 0.76% increase.

We've gathered analysts' opinions on LAMB WESTON HLDGS INC future price: according to them, LW price has a max estimate of 1,261.88 MXN and a min estimate of 1,076.31 MXN. Watch LW chart and read a more detailed LAMB WESTON HLDGS INC stock forecast: see what analysts think of LAMB WESTON HLDGS INC and suggest that you do with its stocks.

LW stock is 1.31% volatile and has beta coefficient of 0.39. Track LAMB WESTON HLDGS INC stock price on the chart and check out the list of the most volatile stocks — is LAMB WESTON HLDGS INC there?

Today LAMB WESTON HLDGS INC has the market capitalization of 157.35 B, it has decreased by −2.18% over the last week.

Yes, you can track LAMB WESTON HLDGS INC financials in yearly and quarterly reports right on TradingView.

LAMB WESTON HLDGS INC is going to release the next earnings report on Oct 1, 2025. Keep track of upcoming events with our Earnings Calendar.

LW earnings for the last quarter are 16.93 MXN per share, whereas the estimation was 12.24 MXN resulting in a 38.32% surprise. The estimated earnings for the next quarter are 9.69 MXN per share. See more details about LAMB WESTON HLDGS INC earnings.

LAMB WESTON HLDGS INC revenue for the last quarter amounts to 32.60 B MXN, despite the estimated figure of 30.92 B MXN. In the next quarter, revenue is expected to reach 29.97 B MXN.

LW net income for the last quarter is 2.33 B MXN, while the quarter before that showed 3.01 B MXN of net income which accounts for −22.41% change. Track more LAMB WESTON HLDGS INC financial stats to get the full picture.

Yes, LW dividends are paid quarterly. The last dividend per share was 7.25 MXN. As of today, Dividend Yield (TTM)% is 2.40%. Tracking LAMB WESTON HLDGS INC dividends might help you take more informed decisions.

LAMB WESTON HLDGS INC dividend yield was 2.89% in 2024, and payout ratio reached 58.33%. The year before the numbers were 1.43% and 25.69% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 26, 2025, the company has 10.1 K employees. See our rating of the largest employees — is LAMB WESTON HLDGS INC on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. LAMB WESTON HLDGS INC EBITDA is 24.15 B MXN, and current EBITDA margin is 19.24%. See more stats in LAMB WESTON HLDGS INC financial statements.

Like other stocks, LW shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade LAMB WESTON HLDGS INC stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So LAMB WESTON HLDGS INC technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating LAMB WESTON HLDGS INC stock shows the sell signal. See more of LAMB WESTON HLDGS INC technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.