Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

31.28 MXN

31.46 B MXN

156.22 B MXN

692.60 M

About Monster Beverage Corporation

Sector

Industry

CEO

Hilton Hiller Schlosberg

Website

Headquarters

Corona

Founded

1990

FIGI

BBG00JXQCXN3

Monster Beverage Corp. is a holding company, which engages in the development, marketing, sale, and distribution of energy drink beverages and concentrates. It operates through the following segments: Monster Energy Drinks, Strategic Brands, and Other. The Monster Energy Drinks segment sells ready-to-drink packaged energy drinks to bottlers and full-service beverage distributors. The Strategic Brands segment sells concentrates and beverage bases to authorized bottling and canning operations. The Other segment consists of certain products sold by its subsidiary, American Fruits and Flavors LLC to independent third-party customers. The company was founded on April 25, 1990, and is headquartered in Corona, CA.

Related stocks

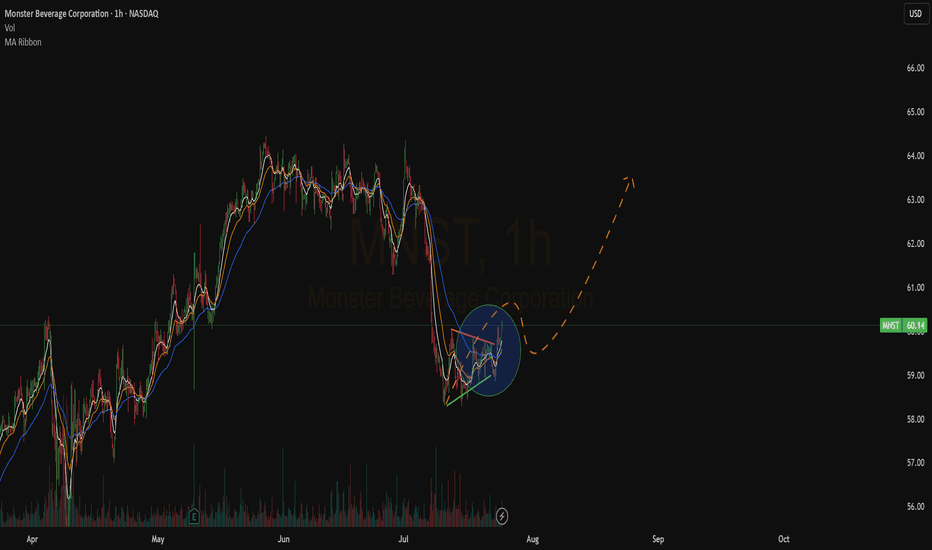

Monster Beverage: Breakout and PullbackMonster Beverage broke out to a new all-time high in May, and now it’s pulled back.

The first pattern on today’s chart is the March 2024 high of $61.23. The maker of energy drinks hesitated at that level in early May but pulled back to hold it last week. Has old resistance become new support?

Seco

Monster Beverage: A Rally Built on Solid Ground?Monster Beverage recently achieved a significant milestone, reaching a new record high after a multi-week rally. This ascent, surpassing its previous peak, indicates robust market confidence. While the proximity of an earnings report may have initially fueled anticipation, the sustained upward movem

Monster Beverage Corp (MNST) – Energizing Global GrowthCompany Snapshot:

Monster NASDAQ:MNST continues to dominate the $60B+ global energy drink market, expanding across 159 countries with a diverse portfolio and strong executive leadership.

Key Catalysts:

Global Market Expansion 🌐

Strategic brands like Predator and Fury targeting emerging markets

Correction Has BegunWe have done the correction of the rise since August.

But this shall not mean a renewal uf the rise. Instead we have to look at the weekly chart to see that we have just corrected this retracement as well.

Thus I assume that we are still within a longer downward correction that begun in December an

MONSTER Stock Chart Fibonacci Analysis 021125Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 46.3/61.80%

Chart time frame: B

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress: C

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

MNST to $50My trading plan is very simple.

I buy or sell when price tags the top or bottom of parallel channels.

I confirm when price hits Fibonacci levels.

So...

Here's why I'm picking this symbol to do the thing.

Price in channel zones

Stochastic Momentum Index (SMI) at oversold level

VBSM is spiked

Important Support and Resistance Area: 50.93-52.95

Hello, traders.

If you "Follow", you can always get new information quickly.

Please click "Boost" as well.

Have a nice day today.

-------------------------------------

(MNST 1W chart)

If it falls from the HA-High indicator and meets the HA-Low indicator, it can be interpreted that the wave ha

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where MNST is featured.

Frequently Asked Questions

The current price of MNST is 1,126.00 MXN — it has increased by 1.44% in the past 24 hours. Watch MONSTER BEVERAGE CORP stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BMV exchange MONSTER BEVERAGE CORP stocks are traded under the ticker MNST.

MNST stock has risen by 1.14% compared to the previous week, the month change is a −2.26% fall, over the last year MONSTER BEVERAGE CORP has showed a 23.06% increase.

We've gathered analysts' opinions on MONSTER BEVERAGE CORP future price: according to them, MNST price has a max estimate of 1,373.42 MXN and a min estimate of 909.43 MXN. Watch MNST chart and read a more detailed MONSTER BEVERAGE CORP stock forecast: see what analysts think of MONSTER BEVERAGE CORP and suggest that you do with its stocks.

MNST reached its all-time high on May 28, 2025 with the price of 1,300.00 MXN, and its all-time low was 478.75 MXN and was reached on May 9, 2018. View more price dynamics on MNST chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

MNST stock is 1.47% volatile and has beta coefficient of 0.26. Track MONSTER BEVERAGE CORP stock price on the chart and check out the list of the most volatile stocks — is MONSTER BEVERAGE CORP there?

Today MONSTER BEVERAGE CORP has the market capitalization of 1.10 T, it has decreased by −0.36% over the last week.

Yes, you can track MONSTER BEVERAGE CORP financials in yearly and quarterly reports right on TradingView.

MONSTER BEVERAGE CORP is going to release the next earnings report on Aug 6, 2025. Keep track of upcoming events with our Earnings Calendar.

MNST earnings for the last quarter are 9.63 MXN per share, whereas the estimation was 9.40 MXN resulting in a 2.42% surprise. The estimated earnings for the next quarter are 9.01 MXN per share. See more details about MONSTER BEVERAGE CORP earnings.

MONSTER BEVERAGE CORP revenue for the last quarter amounts to 37.99 B MXN, despite the estimated figure of 40.52 B MXN. In the next quarter, revenue is expected to reach 39.03 B MXN.

MNST net income for the last quarter is 9.08 B MXN, while the quarter before that showed 5.64 B MXN of net income which accounts for 60.80% change. Track more MONSTER BEVERAGE CORP financial stats to get the full picture.

No, MNST doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jul 27, 2025, the company has 6.56 K employees. See our rating of the largest employees — is MONSTER BEVERAGE CORP on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. MONSTER BEVERAGE CORP EBITDA is 44.53 B MXN, and current EBITDA margin is 28.69%. See more stats in MONSTER BEVERAGE CORP financial statements.

Like other stocks, MNST shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade MONSTER BEVERAGE CORP stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So MONSTER BEVERAGE CORP technincal analysis shows the neutral today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating MONSTER BEVERAGE CORP stock shows the buy signal. See more of MONSTER BEVERAGE CORP technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.