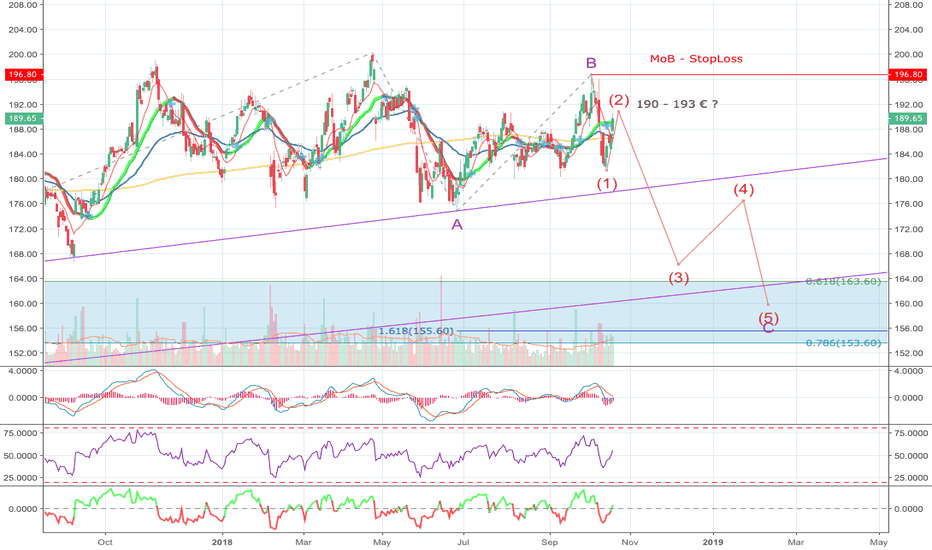

Bottom of the RangeMunich Rueck held stable this year. Now we've seen the retracement of the rise since March by almost 38 %. However a further retracement is possible I consider the chance of a recovery from here. We have reached the bottom of the trading range which we are in since April and the current level of ou

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

922.64 MXN

122.70 B MXN

1.50 T MXN

127.40 M

About MUENCH.RUECKVERS.VNA O.N.

Sector

Industry

CEO

Joachim Wenning

Website

Headquarters

Munich

Founded

1963

ISIN

DE0008430026

FIGI

BBG008KSDFZ2

Münchener Rückversicherungs-Gesellschaft AG engages in the provision of insurance and reinsurance services. It operates through the following segments: Life and Health Reinsurance; Property-Casualty Reinsurance; ERGO Life and Health Germany; EGRO Property-Casualty Germany; and ERGO International. The Life and Health Reinsurance segment includes global life and health reinsurance business. The Property-Casualty Reinsurance segment covers global property-casualty reinsurance business. The ERGO Life and Health Germany segment includes German life and health primary insurance business, global travel insurance business, and digital ventures business. The EGRO Property-Casualty Germany segment covers German property-casualty insurance business, excluding digital ventures business. The ERGO International segment focuses on primary insurance business outside Germany. The company was founded by Carl von Thieme on April 3, 1880 and is headquartered in Munich, Germany.

Related stocks

A safe gain in a few weeksI think the stock will reach its pre covid level verry soon.

I drew the bouncy ball scan on the chart. We have three lower lows, a strong support line and a strong uptrend. Additionally we have a cup with a handle. The handle is unfortunatelly not giving as much pullback as it would in a textbook e

Munich Re - Down - ShortTermThe Pacific Ring of Fire is increasing in activity. The volcanic eruptions and earthquakes and their consequences such as tsunamis have increased significantly compared to the previous two years.

At the same time, the sun is in a solar minimum.

Huge sun holes at the North + South Pole and the equato

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

MURG5416446

Munchener Ruckversicherungs-Gesellschaft Aktiengesellschaft 5.875% 23-MAY-2042Yield to maturity

5.62%

Maturity date

May 23, 2042

M

MURG3666349

Munich Re America Corporation 7.45% 15-DEC-2026Yield to maturity

4.09%

Maturity date

Dec 15, 2026

A383PL

MUNICH REINSURANCE COMPANY 2024-26.05.44 FIXED/VARIABLE RATEYield to maturity

4.00%

Maturity date

May 26, 2044

See all MUV2/N bonds

Curated watchlists where MUV2/N is featured.

German Stocks: Continental champs

16 No. of Symbols

See all sparks

Frequently Asked Questions

The current price of MUV2/N is 12,288.02 MXN — it hasn't changed in the past 24 hours. Watch MUENCHENER RUECKVERSICHERUNGS AG stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BMV exchange MUENCHENER RUECKVERSICHERUNGS AG stocks are traded under the ticker MUV2/N.

MUV2/N stock hasn't changed in a week, the last month showed zero change in price, over the last year MUENCHENER RUECKVERSICHERUNGS AG has showed a 50.82% increase.

We've gathered analysts' opinions on MUENCHENER RUECKVERSICHERUNGS AG future price: according to them, MUV2/N price has a max estimate of 14,210.65 MXN and a min estimate of 10,752.21 MXN. Watch MUV2/N chart and read a more detailed MUENCHENER RUECKVERSICHERUNGS AG stock forecast: see what analysts think of MUENCHENER RUECKVERSICHERUNGS AG and suggest that you do with its stocks.

MUV2/N reached its all-time high on Jun 18, 2025 with the price of 12,288.02 MXN, and its all-time low was 2,814.03 MXN and was reached on Jun 18, 2015. View more price dynamics on MUV2/N chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

MUV2/N stock is 0.00% volatile and has beta coefficient of 0.76. Track MUENCHENER RUECKVERSICHERUNGS AG stock price on the chart and check out the list of the most volatile stocks — is MUENCHENER RUECKVERSICHERUNGS AG there?

Today MUENCHENER RUECKVERSICHERUNGS AG has the market capitalization of 1.60 T, it has decreased by −0.72% over the last week.

Yes, you can track MUENCHENER RUECKVERSICHERUNGS AG financials in yearly and quarterly reports right on TradingView.

MUENCHENER RUECKVERSICHERUNGS AG is going to release the next earnings report on Aug 8, 2025. Keep track of upcoming events with our Earnings Calendar.

MUV2/N net income for the last half-year is 41.46 B MXN, while the previous report showed 73.95 B MXN of net income which accounts for −43.93% change. Track more MUENCHENER RUECKVERSICHERUNGS AG financial stats to get the full picture.

Yes, MUV2/N dividends are paid annually. The last dividend per share was 442.69 MXN. As of today, Dividend Yield (TTM)% is 3.54%. Tracking MUENCHENER RUECKVERSICHERUNGS AG dividends might help you take more informed decisions.

MUENCHENER RUECKVERSICHERUNGS AG dividend yield was 4.11% in 2024, and payout ratio reached 46.75%. The year before the numbers were 4.00% and 44.28% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jun 24, 2025, the company has 43.58 K employees. See our rating of the largest employees — is MUENCHENER RUECKVERSICHERUNGS AG on this list?

Like other stocks, MUV2/N shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade MUENCHENER RUECKVERSICHERUNGS AG stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So MUENCHENER RUECKVERSICHERUNGS AG technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating MUENCHENER RUECKVERSICHERUNGS AG stock shows the buy signal. See more of MUENCHENER RUECKVERSICHERUNGS AG technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.