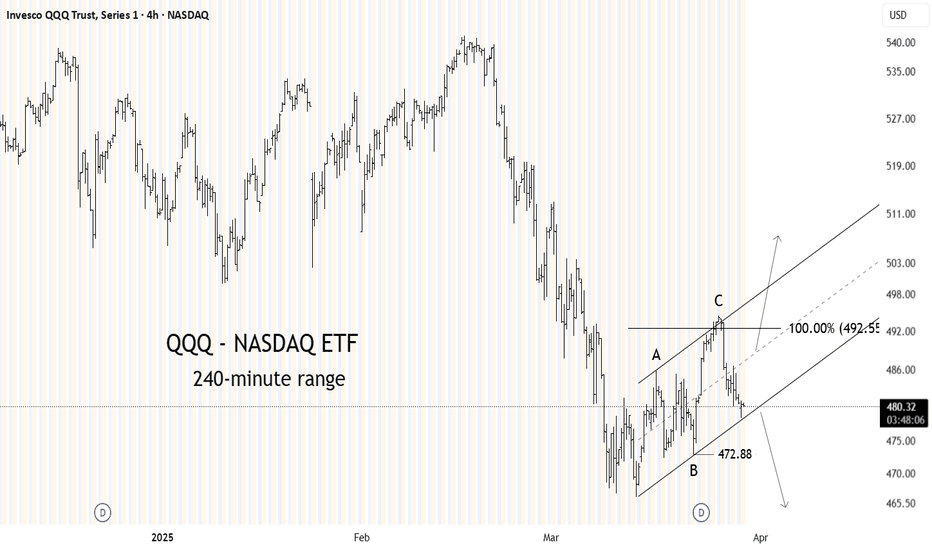

QQQ is Breaking the Trendline – Could the Tech Rally be started?Market Structure & Price Action:

QQQ has broken out of a descending channel and printed a CHoCH to the upside around $471, shifting structure into a bullish stance. The breakout follows a clean reversal from the red demand zone near $463, suggesting institutional interest around that area. Price is now consolidating near $473.5–$474 after a strong 3-bar rally and retest of prior highs.

Supply & Demand Zones:

* Demand Zone (Support): $463–$465

* Supply Zone (Resistance): $495–$497 (unmitigated upper green zone)

Support & Resistance Levels:

* Immediate Resistance: $474 (minor psychological level, aligning with trendline retest zone)

* Major Resistance: $495–$497 (overhead supply)

* Support Levels: $470 > $465 > $463

Indicators:

* MACD: Still bullish, but showing some slowing momentum – histogram flattening.

* Stoch RSI: In overbought territory – may suggest short-term consolidation or pullback.

* Volume: Rising on the breakout, confirming strength.

Options GEX + Sentiment Analysis:

* Gamma Walls:

* CALL Wall (Resistant): $472 (64.62%) – Price is currently sitting above this wall.

* Next Gamma Cluster: $474–$476 (GEX9/GEX10) – Potential short-term magnet.

* PUT Wall Support:

* $465–$463 zone aligning with strong GEX put support and HVL (0DTE) – strong defense.

* IV Rank (IVR): 40.6

* Implied Volatility vs Average (IVx avg): IV is above avg at 3.27%

* Sentiment: PUTS 52.6% | GEX shows 🟢🟢🟢🟡 (Bullish leaning but hedged)

Trade Scenarios:

* Bullish Scenario:

* If QQQ holds above $472 and sustains above the GEX CALL Wall, we may see a move toward $476–$480.

* A breakout above $480 could open the door for a test of the $495–$497 upper supply zone.

* Bearish Scenario:

* Rejection at $474 and failure to hold $470 could push price back toward the $465–$463 demand zone.

* Breakdown below $463 would invalidate the bullish thesis in the short term.

Conclusion:

QQQ is showing strength after breaking the descending structure, and options positioning supports a slow grind higher unless it gets rejected at $474. Watch for consolidation or a clean breakout to confirm momentum continuation. Bulls want to defend $470 on any pullback.

QQQ trade ideas

QQQ Call (Big Picture)Just marking up QQQ to look for an entry long-term. Looking at the big picture from the monthly, pulled out the Fibster to get my retracement levels. After breaking the trendline, looks like it can head down to 38.2% and head back up or further down to the 52W L. My prediction is that it will bounce from the support I see in the past, which is where I have it marked as an entry point. Let me know your thoughts if you see this.

QQQ - Double Top BreakdownQQQ has formed a double top, a classic bearish reversal pattern indicating potential trend exhaustion. The price has broken below the neckline, confirming the pattern and signaling further downside. If selling pressure continues, we could see a move toward the target zone.

This breakdown suggests that bulls are losing momentum, and unless QQQ can reclaim the neckline, the bearish bias remains intact. However, false breakdowns can occur, so it's important to watch for a potential retest of the neckline before further downside.

📊 Key Levels:

🔵 Entry: Breakdown confirmation below support

🔴 Stop Loss: 524.65 🔻 (Invalidation level if price reclaims this zone)

🟢 Target: 458.59 ✅ (Measured move from the pattern)

🔎 Watch for:

📌 A retest of the neckline as resistance

📌 Increased volume confirming the breakdown

📌 Possible continuation if sellers remain in control

This setup presents a strong risk-to-reward opportunity for bears, but staying cautious of any reversals is key.

To catch a knife... QQQOk, I'm a little bummed I didn't make an idea sooner because my dowsing (as in with a pendulum) nailed the high on both SPY & QQQ. It is documented online, however, so I'm not making this up after the fact fyi.

I had mentioned at the time (around 2/23) 11 days to hit the lower target in SPY (I'll do an idea for it as well). Wednesday is the deadline, though I don't put a ton of faith in these things, dates typically are things to watch in my work and can be reversals.

On 2/26 I worked on what to expect for the first week in March. The message was it goes down, but there's a "scene of the crime" trade, spike down and low on... Wednesday the 5th! When I ask what does this look like, I get "v-bottom".

My dowsing now keeps repeating there will be a small move up to sell into if we get a significant move away from the 503-04 area.

I did my best to get levels, but obviously this is some woo woo kinda stuff, so it can be miraculous at times, and others a complete cluster. Definitely watch Wed. & the 468 area. Ideally, the time and price align for higher odds I'm correct. If we bounce, I'll try to find an upside target. There is also a lower target around 432, but I didn't dig into that much.

3/31/25 - $qqq - Correlation 1... no more protection 4 me3/31/25 :: VROCKSTAR :: NASDAQ:QQQ

Correlation 1... no more protection 4 me

- bought back all my (covered calls) on the "rental" book, which is NYSE:VST , NYSE:UBER , NYSE:DECK , NASDAQ:BLDE , NASDAQ:GAMB as i'd rather take the 15-20% downside on what I believe are stocks that have at least 2x this in terms of upside into YE at this pt. esp in a quarter-end tape that simply looks "scared"

- and i hear you guys that r saying "Bessent" told you more pain to come and "yes", but we shouldn't be believing anyone at this stage, friends. Think critically. here are some pts:

- on my S&P math, the average stock is now down 20% from it's peak. i've writtent extensively about VIX mgmt and mag7 as a component of this equation. we've seen diff sectors, stocks and most importantly mag7 rotate seats (from cold to hot) at varying points in order to smooth the index. therefore, the index is the illusion here. "only an 8% correction" is meaningful in the above context.

- i've reviewed all 500 of the S&P stocks in the last month, and on my thinking, about 80% of them are pretty obvious buys from a MT (nevermind LT context), let's describe MT as 12-18 months. that's not to say there isn't more downside, but buying the index at this pt (to low-IQ and chill) means you'll probably enter pretty well here

- and the narrative/ thinking around AI is probably correct that "a lot of things are going to get demonetized especially software". but the mkt is currently confusing a few things. when we are correlation 1... the market says "all AI-related plays are losers" and that's objectively false. perhaps there will be more losers than winners, because this game of scale is one we haven't seen before. but when you're, say, selling something like NVDA that can't even meet it's chip demand for the next 2 years, trading at 4% FCF yield and growing >20% a year (probably 30-40% CAGR on my conservative math) versus a 10Y being forced lower and you tack on reinvestment risk to trying to "time" the NVDA bottom (which is *probably* at most 15-20% lower)... i'd contend - you're doing it wrong - or you think you're god. nobody times the bottom. we risk manage upside and downside risks with the book.

- so acknowledging tariffs matter, rates matter, short term speech drives emotion. take a step back. i'd argue we're much closer to the bottom than the MSM will let on, as they're index-only thinkers.

- what i'm really looking for is an open below lows (like we had today) and a massive red to green reversal. those have marked all major bottoms. again. we might have a few of these b/c we are in a whacky tape, but that sort of move should be taken into account.

- one more point. seeing my favorite position NASDAQ:NXT dump nearly 6% at the open on "flows" and get rebid basically non-stop until i'm currently writing this... tells me most of what you're seeing is quarter-end balancers, so don't lose the signal through the noise.

- i bought more OTC:OBTC today to top off too, even tho volume light (i'm probably 100% of that volume today already). limits only on this thing.

- most importantly keep your head screwed on. last man standing without getting emotional wins, always. been here, done this. it never gets easier. but you learn to control your emotions. so take a step back. if you're sweating, take some exposure off, you're too big. but if you've made it this far, don't give up. assets > liabilities in this world. and the USD is ultimately a liability. never forget that. the goal isn't to accumulate dollars, but assets.

V

FREE $QQQ Day Trade Setup!🚨 FREE NASDAQ:QQQ Day Trade Setup:

Break below $460.71 (Pre-Market Low)

🎯 $458/ $455

Options: April 1st $460 Puts

Ride H5_D on 2Min. chart. (Close above H5 is an Exit)

Retest PDL (Friday Low) = Look for a rejection

🎯Pre-Market Low

Play April 1st $466 Puts

Not Financial Advice

QQQ: Bullish Continuation & Long Trade

QQQ

- Classic bullish formation

- Our team expects growth

SUGGESTED TRADE:

Swing Trade

Buy QQQ

Entry Level - 468.97

Sl - 457.71

Tp - 491.73

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

QQQ Will Explode! BUY!

My dear subscribers,

This is my opinion on the QQQ next move:

The instrument tests an important psychological level 468.97

Bias - Bullish

Technical Indicators: Supper Trend gives a precise Bullish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 488.44

My Stop Loss - 457.91

About Used Indicators:

On the subsequent day, trading above the pivot point is thought to indicate ongoing bullish sentiment, while trading below the pivot point indicates bearish sentiment.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

My market direction guide with extended-hour. Work best for >+1 day till expiration contract. (SWING)

Personal Interpretation of Indicator:

5MA=yellow(scalp trend)

20MA=orange(pullback of a larger timeframe’s 5MA trend)

I read how previous candles are behaving around 1hr 20MA and use pullback test rejection for direction signal. (Trade Planning, knowing the MA are align with larger timeframes like 4hr or day)

Then, I use 15min 20MA pullback test with wick rejection to find cheaper price entry.

Possible Similarities to 2022 Bear Market QQQ Weekly Chart. Very similar structure and price action to the run up and subsequent bear market of 2022. Plan is to sell into strength and possibly look for longs off deep support levels. If this scenario unfolds it will require adaptability and will present difficult trading scenarios that will punish hesitation and chasing. Great opportunities for long term investors off deep support levels such as 200 SMA on higher timeframes. A pull back to 450 would be the first target and the 21 EMA on the Monthly chart and the 89 EMA on the Weekly. Look for possible put options 7-21 DTE.

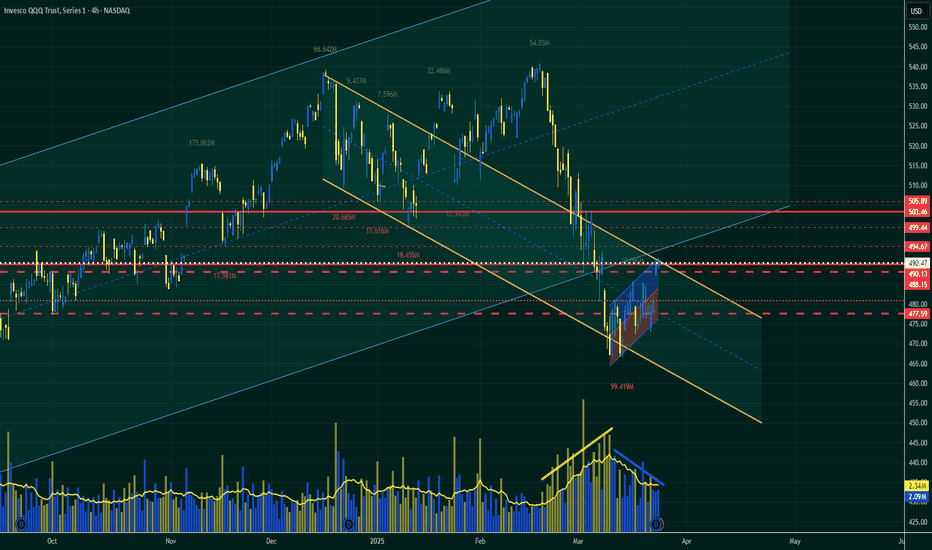

QQQ: Bearish Reversal Likely — Weak Buyer Conviction at Key ResiQQQ may be setting up for a bearish reversal, as several technical confluences suggest the recent rally is losing steam. Despite a short-term bounce, price is approaching a critical decision zone, and buyers appear to lack conviction.

🔺 1. Price Testing Upper Boundary of Descending Channel

QQQ has rallied into the upper boundary of the descending channel (yellow lines) that’s been in place since late December. This often acts as resistance—and the price has yet to break above it with strength.

🔵 2. Hitting the Edge of Rising Regression Channel

The current price is tagging the upper edge of the blue rising regression channel, an area that has previously triggered sell-offs. Unless there’s a decisive breakout, this could mark a local top.

📉 3. Volume Divergence – Weak Buyer Interest

Despite the recent rally attempt, volume is declining, showing clear divergence. This is a warning sign: while price moves up, momentum is fading, and buyers don’t appear to be stepping in strongly. It’s often a precursor to a reversal.

🟩 4. Lower Boundary of Rising Channel Still Intact... For Now

Price remains near the long-term rising channel’s lower support, but failure to hold this level could trigger accelerated downside.

📌 Key Levels to Watch:

🔻 Resistance

490.13 – 494.67:

This zone is packed with prior support-turned-resistance and coincides with the descending and regression channel boundaries. A rejection here would confirm the bearish thesis.

499.44:

A psychological and historical resistance level. Bears would likely pile in if price fails here again.

🔺 Support

488.15:

Immediate minor support. Weak defense here could quickly lead to further selling.

477.59:

Next key level below current price. If breached, it could validate a more extended correction.

🧠 Summary:

QQQ is at a technical crossroads, with several overlapping resistance levels and a clear lack of buying volume. Until buyers show conviction above 494–495, the setup favors a bearish reversal from current levels.

🔔 Watch for a rejection around 490–495 with increasing sell volume for confirmation.

💬 What’s your outlook? Do you see further downside or a breakout brewing?

Leaders Leading LowerIf you create a portfolio of equal parts AAPL, MSFT and NVDA, you'd have an index that represents 25% of the numerical influence on QQQ. Those three stocks account for most of the directional move of the Nasdaq 100. They are the bullies on the block and you aren't getting around them. Where they go the index will surely follow. So far this year that portfolio is off 12%, while QQQ is down around 7%. Think we've hit the bottom yet?

I'll be honest here friends it's not looking good...I'll be honest here friends it's not looking good...

This may have been a Dead Cat Bounce on the NASDAQ:QQQ and AMEX:SPY friends.

GAP fills in both names lead to Bear Flag Breakdowns which in my mind leads to the next leg down.

Rejecting 200DMA on the NASDAQ:QQQ and losing control on the AMEX:SPY

Markets are hanging on slightly, lets see what happens the rest of the week.

Not financial advice