SOFI at Reversal Zone! Will Bulls Defend This Level or Below 11?🔍 Market Structure & Smart Money Concepts (SMC):

* Current Structure: SOFI is in a clean downtrend channel with consecutive CHoCHs and a recent Break of Structure (BOS) to the downside.

* Price has consolidated into a red SMC Reversal Zone, just below the prior CHoCH level, signaling potential short-term relief or further breakdown.

* Bulls have failed to reclaim control post-CHoCH from March 26–27. Lower highs and aggressive sell-offs dominate.

📉 Technical Indicator Summary:

* MACD: Currently flat but slightly converging—no strong bullish momentum yet.

* Stoch RSI: Resetting from oversold, but not giving a decisive bullish reversal yet. Caution warranted for early longs.

* Trendlines: Price is pressing against a lower trendline, and any break below ~$11.70 could accelerate toward the $11.00 level or lower.

🔧 Support & Resistance:

* Resistance:

* $12.34: Structure high and minor supply.

* $13.89: Former CHoCH and Gamma Call Resistance.

* Support:

* $11.70: Current demand/put wall zone.

* $11.00: Second major PUT Wall and psychological round number.

* $10.85: Fib confluence / key GEX support.

💥 Options & GEX Analysis (from GEX + Options Oscillator):

* IVR: 56.6 (elevated, signaling potential high options premium)

* IVx Avg: 102.2 — suggests volatility pricing is very high

* Options Sentiment:

* CALLs: 26.1%

* GEX: 🔴🔴🔴 (Bearish Gamma setup)

* Put Walls:

* $12.00: Highest negative NET GEX (key support!)

* $11.00: 2nd Put Wall (danger zone if breached)

* Call Resistance:

* $13.00–$13.89: Gamma Wall, strong selling pressure zone

* Bias: Bearish-to-neutral until bulls reclaim $12.34 or break above descending trendline.

📊 Trade Setups (For Educational Purposes Only):

🔴 Bearish Continuation:

* Entry: Below $11.70

* Target: $11.00 → $10.85

* Stop-loss: Above $12.00

🟢 Bullish Reversal Setup (Speculative):

* Entry: On reclaim of $12.34 with volume

* Target: $13.00 → $13.89

* Stop-loss: Below $11.70

🔮 Outlook Summary:

SOFI is trading inside a tight bearish channel near key GEX support. Unless bulls reclaim $12.34 or show aggressive demand near $11.70, the trend favors bears. Keep an eye on GEX and IVR behavior into April 4 OPEX.

🛑 Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage risk accordingly.

SOFI trade ideas

Sofi - ready to run?Sofi is peaking its head above the resistance level, held down by two Fibonacci pivot points. I’d like to see it break above $7 with high volume, that would mark the end of many months of lower highs and lower lows.

Definitely keeping an eye on this one. I would have liked it to have touched $6 but buyers are stepping in and we are trying to reclaim the golden Fibonacci ratio as support.

Keep an eye out for a breakout trade, not financial advice

Why Going Long on SoFi Stock SoFi Technologies (SOFI) is at a pivotal moment, presenting a strong long opportunity as it enters the 5th wave of an Elliott Wave cycle. This final leg typically brings explosive upside momentum, signaling a potential breakout.

While a brief dip below $10 is possible, this could act as a springboard for a powerful rally toward $20 and beyond. The stock's bullish structure, combined with SoFi's growing financial services business, makes it an attractive bet for long-term investors.

With momentum building, now may be the perfect time to go long on SoFi before the next surge begins.

🚨 This is not financial advice. Do your own due diligence (DD) before making any investment decisions. 🚨

SOFI AwaySOFI has changed its course over the last week and seems to be putting in new highs. We have a gap to close between 13.43 and 13.57 with a support and resistance being around 13.57.

The short squeeze seems to be slowing and volume seems to be returning. VWAP is sitting at 16.14, this could and possibly will retest that area once again, with time. RSI is in the oversold area at 46.81.

With an $0.80 a day move, we could see 13.50 within the next few days, provided the market or sector doesn't fall apart. If not, of course it could move back to 12 with a stop loss at 11.18.

As always, do your own research and due diligence. Let's see where it goes.

Ascending Channels ✅ Bullish Case (If Price Holds Above ChoCh - $12.39)

Entry: Above $12.50 (Confirmation of 50 EMA break).

Stop-Loss: Below $12.30 (Invalidation of ChoCh).

Target 1: $13.07 (Key Resistance).

Target 2: $13.46 (Major Resistance).

❌ Bearish Case (If Price Falls Below ChoCh - $12.39)

Entry: Below $12.30 (Confirmation of failure).

Stop-Loss: Above $12.50 (Invalidation).

Target 1: $11.41 (Key Support).

Target 2: $10.92 (Major Support).

$SOFI - Working against the trendline and VWAP resistanceNASDAQ:SOFI declined to the 200-day moving average (DMA) area, which was the breakdown target, and then bounced. It’s remarkable how technical targets are hit with such high accuracy.

Currently, it is testing the channel trendline and VWAP resistance. If it can break above $13.70 and hold above that level, it could serve as a launchpad for the next leg.

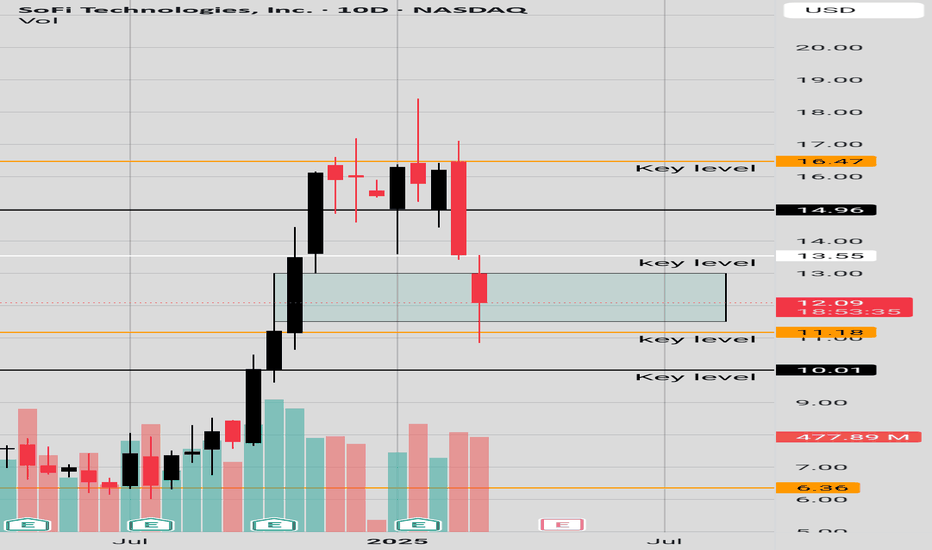

10Day High Wave CandleOn the 10Day Chart price had a serious correction, investors want to know is it over.

RSI is kind of bearish/neutral. Stochastic RSI says there is more room for price to decline. However, we have a high wave candle in a bullish FVG zone with price rejection around the 11.00 price range. On the 10Day Chart we are going to need price to clear 13.55 price for more signs of upward growth.

$SOFI - It can bounce butNASDAQ:SOFI This is a case of a diamond pattern breakdown. Diamond patterns can be either bullish or bearish, depending on how they resolve. In this case, the pattern resolved to the downside.

The breakdown target is around the 200-day moving average (200DMA) or $10–$11 range. So create a plan for that.

We are at the midway potential reversal area, supported by the VWAP.

We had a hammer candle on Friday, so let’s hope it follows through. 🙏

Bearish Sentiment and Wedges Please observe the wedgelike structure for SOFI, we had a little boost on Friday but not enough to close out the wedge like structure, price needs to overcome 12.50 and make a higher low or retest 12.50 for a safe long entry, if price falls back below the low of the wick candle and inside the wedgelike structure the shorting may continue, please observe the chart for key levels and for wedgelike structure. The asset is below the 200 EMA and 50 EMA candle confirming bearish sentiment.

$SOFI - Reversal signal is not clear yetNASDAQ:SOFI dropped to a loading zone and then bounced. It formed a hammer pattern on the weekly chart.

The $16 to $17 range marks a key resistance zone, and breaking above it would signal bullish momentum.

On the downside, $13 serves as a critical support level. If it fails to hold, we might see a pullback to $11.

My thoughts for the coming weeksWe are at a tough patch now unfortunately looking at the charts, and so I think it's safe to assume we will see some selling and slowing down in upward price action, until we find more momentum to carry us into price discovery.

As you can see, we're heading towards some very important areas. One being an old support level, now resistance. Following that we have the Fibonacci golden zone at an arms reach as well. If we manage to blow past those, we then have the big one which completely ruined us for years.

Conclusion:

As you can see from my comments on the chart, I can see us in the coming weeks cooling off, and eventually selling down towards the $10 range, to then eventually gain momentum and try again.

Key Zones and LevelsThe price is currently in the daily MMBM and has retraced from the -1.5 standard deviation level to the Optimal Trade Entry (OTE) zone. I would like to see a confirmed closure above the bearish imbalance, which initially drove the price down to the 0.62 Fibonacci retracement level. A strong close above this imbalance could indicate further bullish momentum and potential continuation toward higher levels.

Important ConsolidationGood day Team:

With time we can tell.

SOFI is consolidating after an intense correction at a key level 14.65; at times past that level served as a reversal after prior consolidation, but we need a lot of buying pressure to reverse that downtrend. Have a good day please stay safe.

$SOFI is poised to reach the $20 range following its correctionNASDAQ:SOFI 's price began 2025 at $15.40. Today, it traded at $15.56, marking a 1% increase since the start of the year. The forecasted price for SoFi at the end of 2025 is $41.23, representing a year-over-year change of +168%. The expected rise from today to year-end is +165%.

By mid-2025, the price is projected to reach $20-$29.56.

Strong Growth Prospects: NASDAQ:SOFI has shown significant growth in revenue and profitability. The company reported a 35.8% year-over-year revenue growth and a 45% net profit margin in 20241.

Positive Market Trends: Analysts are optimistic about NASDAQ:SOFI 's future performance, with some projecting a 72% upside potential, targeting a $25 share price.

Diverse Financial Services: NASDAQ:SOFI offers a wide range of financial services, including lending, investing, and banking, which helps diversify its revenue streams and reduce risk.

Member Growth: The company has been experiencing robust member growth, which is a positive indicator of its expanding customer base and market reach.

Buy NASDAQ:SOFI now and let's get wealthy!

Cycling Down and Head and Shoulders?Good day many thanks to Marta from Real Life Trading Academy from pointing out the hypothetical head and shoulders on the daily chart, please observe possible hypothetical downward action for SOFI and the key levels. All the best, remember anything could happen so please be safe and careful only go crazy paper trading with fake money.

SOFI - To fly, or not to fly...Been in this for a long time, not sure if I want to take profits and wait to buy back.

If we get over the $18 to $20 area, it could fly, but I am not sure of what catalyst could do that in this market.

It is about to retest the $18 area, it would be nice to break above and continue, but I feel a correction may be looming, 20%.

How does this sound to you? Any insight?

$SOFI: DIP BUYING OPP. INBOUND!NASDAQ:SOFI : DIP BUYING OPP INBOUND!

Are you looking to buy more cheap Sofi shares?

Check this out then...

DIP BUY BOX: $13-$15 🎯

The indicator up top is the Williams %R and it is one of my favorite tools!

Do you see how every time we break above -20 or hit the Red barrier and reject we go all the way down to -80 or the Green Support Beam and vice versa? 👀

Yes, every single time since NASDAQ:SOFI went public back in 2020!

If you are a probabilities person like me then you understand that we most likely will at a minimum go to -80 and would put the price under $15, thus giving an opportunity to investors and traders.

The bullish side to this is this is great consolidation before the next BIG MOVE! Which I believe when the pendulum swings in the opposite direction we could swing to ATHs before getting to the Red barrier!!

This time could be different but the probabilities say it won't be friends. Hope you enjoyed this TA! Have a great Sunday!

Not financial advice