SPOTIFY-Turn the Music Up!NYSE:SPOT

Why did profit drop?

Spotify reported an operating loss of $75M — at first glance, that looks bad. But there’s logic behind it:

• Increased spending on marketing and podcast development (long-term investment)

• Higher royalty payments — short-term pressure

• Expansion of features and

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

79.51 MXN

25.66 B MXN

353.47 B MXN

146.84 M

About Spotify Technology S.A.

Sector

Industry

CEO

Daniel Ek

Website

Headquarters

Luxembourg

Founded

2006

ISIN

LU1778762911

FIGI

BBG00NSL8XB9

Spotify Technology SA engages in the provision of digital music services. It operates through the Premium and Ad-Supported segments. The Premium segment provides subscribers with online and offline streaming access of music and podcasts on computers, tablets, and mobile devices. The Ad-Supported segment offers users with limited on-demand online access of music and unlimited online access of podcasts on computers, tablets, and mobile and smart devices. The company was founded by Daniel Ek and Martin Lorentzon on December 27, 2006 and is headquartered in Luxembourg.

Related stocks

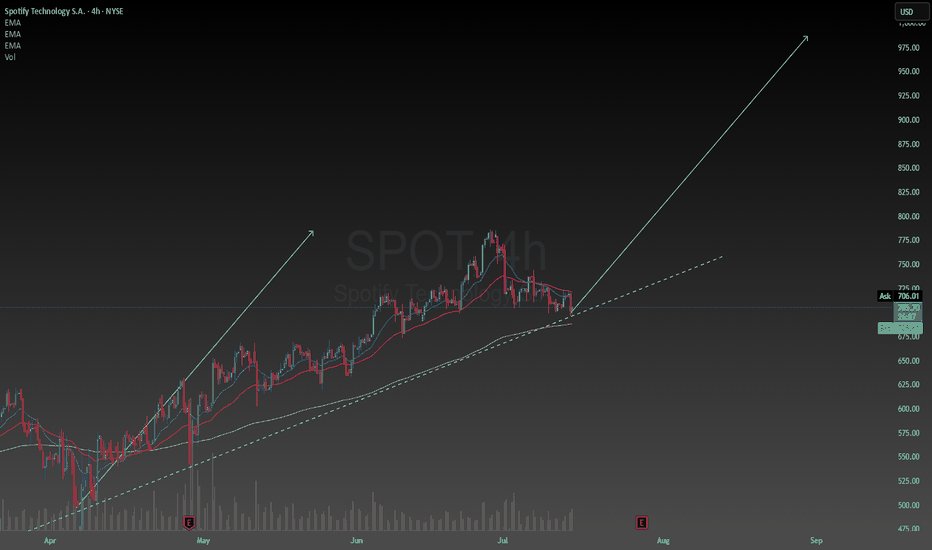

ShortifyI don't post all my trade ideas ahead of time but I will share another short position that I executed before posting, this time in Spotify.

Short entered at $770, stop lost at $790.

Added to my position when we lost the monthly level of support.

The end of the 5 Wave Supercycle.

Trailing stop loss,

SPOT Reversing at VWAP Support – Signs of Seller ExhaustionAfter a sharp drop, SPOT is showing early signs of reversal at a key anchored VWAP support zone. The intraday bounce occurred on low volume, which may indicate seller exhaustion rather than aggressive dip-buying.

Price is holding near the blue VWAP anchored from the April low, a level that previous

Raising the bar for SpotifySpotify has been my favorite stock so far this year. Primarily because resilience in uncertain economies. Subscription-based services, especially freemium models, are seen as defensive. Spotify is the number one music streaming service in the world and unless that changes people will keep using it e

Spotify's Valuation Is Red-Lining (Rating Downgrade)📈 Spotify's Remarkable Comeback

Spotify NYSE:SPOT has transformed itself from a money-losing audio platform into a disciplined, profit-generating tech firm. Through smarter podcast investments, layoffs, and better monetization strategies, the company recently swung from red ink to positive free c

Bullish Strength candle close above Bollinger Band midline.Nice price cross over and close above the midline of the Bollinger Band. Long entry at open on 7/7/25. Expecting volume to follow thru with average or even better above average on green candle. Target is upper BB line and then $785. This could happen fairly quickly in the bull market.

As always, be

Take a bullish position as price action shows momentumCurrent Price: $772.60

Direction: LONG

Targets:

- T1 = $795.00

- T2 = $810.00

Stop Levels:

- S1 = $755.00

- S2 = $735.00

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to ide

Spotify is the most beautiful chart of the yearI made chat GPT write this because i was too lazy;

ps. (The intrinsic value for the stock right now is between $400 and $2900)

Q. Why is Spotify stock doing so good this year.

A.

1. First-ever full-year profit in 2024

Spotify swung to a €1.1 billion net profit in 2024—its first annual profit—on

SPOT Weekly Options Trade — June 15, 2025🎧 SPOT Weekly Options Trade — June 15, 2025

💡 Ticker: SPOT

🎯 Strategy: Bullish Swing — Call Option

📅 Expiry: June 20, 2025

⏱ Entry Timing: Market Open

📈 Confidence: 70%

🔍 Analysis Summary

All four models (Grok, Llama, Gemini, DeepSeek) indicate strong bullish momentum on SPOT based on:

✅ Above all

Spotify: Target Zone AheadSpotify has already come quite close to our turquoise Short Target Zone (coordinates: $725.67–$829.30). In our primary scenario, we continue to expect further upside in the near term, as the projected peak of wave B should materialize within this zone—a range that could present opportunities to lock

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where SPOT/N is featured.

Frequently Asked Questions

The current price of SPOT/N is 12,020.00 MXN — it has increased by 0.17% in the past 24 hours. Watch SPOTIFY TECHNOLOGY S.A. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BMV exchange SPOTIFY TECHNOLOGY S.A. stocks are traded under the ticker SPOT/N.

SPOT/N stock has fallen by −7.16% compared to the previous week, the month change is a −10.13% fall, over the last year SPOTIFY TECHNOLOGY S.A. has showed a 90.79% increase.

We've gathered analysts' opinions on SPOTIFY TECHNOLOGY S.A. future price: according to them, SPOT/N price has a max estimate of 16,843.40 MXN and a min estimate of 9,058.00 MXN. Watch SPOT/N chart and read a more detailed SPOTIFY TECHNOLOGY S.A. stock forecast: see what analysts think of SPOTIFY TECHNOLOGY S.A. and suggest that you do with its stocks.

SPOT/N reached its all-time high on Jun 27, 2025 with the price of 14,700.00 MXN, and its all-time low was 1,372.00 MXN and was reached on Nov 9, 2022. View more price dynamics on SPOT/N chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

SPOT/N stock is 1.66% volatile and has beta coefficient of 0.93. Track SPOTIFY TECHNOLOGY S.A. stock price on the chart and check out the list of the most volatile stocks — is SPOTIFY TECHNOLOGY S.A. there?

Today SPOTIFY TECHNOLOGY S.A. has the market capitalization of 2.40 T, it has decreased by −0.10% over the last week.

Yes, you can track SPOTIFY TECHNOLOGY S.A. financials in yearly and quarterly reports right on TradingView.

SPOTIFY TECHNOLOGY S.A. is going to release the next earnings report on Oct 28, 2025. Keep track of upcoming events with our Earnings Calendar.

SPOT/N earnings for the last quarter are −9.28 MXN per share, whereas the estimation was 43.16 MXN resulting in a −121.50% surprise. The estimated earnings for the next quarter are 41.89 MXN per share. See more details about SPOTIFY TECHNOLOGY S.A. earnings.

SPOTIFY TECHNOLOGY S.A. revenue for the last quarter amounts to 92.65 B MXN, despite the estimated figure of 94.14 B MXN. In the next quarter, revenue is expected to reach 91.89 B MXN.

SPOT/N net income for the last quarter is −1.83 B MXN, while the quarter before that showed 4.85 B MXN of net income which accounts for −137.72% change. Track more SPOTIFY TECHNOLOGY S.A. financial stats to get the full picture.

No, SPOT/N doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. SPOTIFY TECHNOLOGY S.A. EBITDA is 39.89 B MXN, and current EBITDA margin is 9.76%. See more stats in SPOTIFY TECHNOLOGY S.A. financial statements.

Like other stocks, SPOT/N shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade SPOTIFY TECHNOLOGY S.A. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So SPOTIFY TECHNOLOGY S.A. technincal analysis shows the sell today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating SPOTIFY TECHNOLOGY S.A. stock shows the buy signal. See more of SPOTIFY TECHNOLOGY S.A. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.