SPY trade ideas

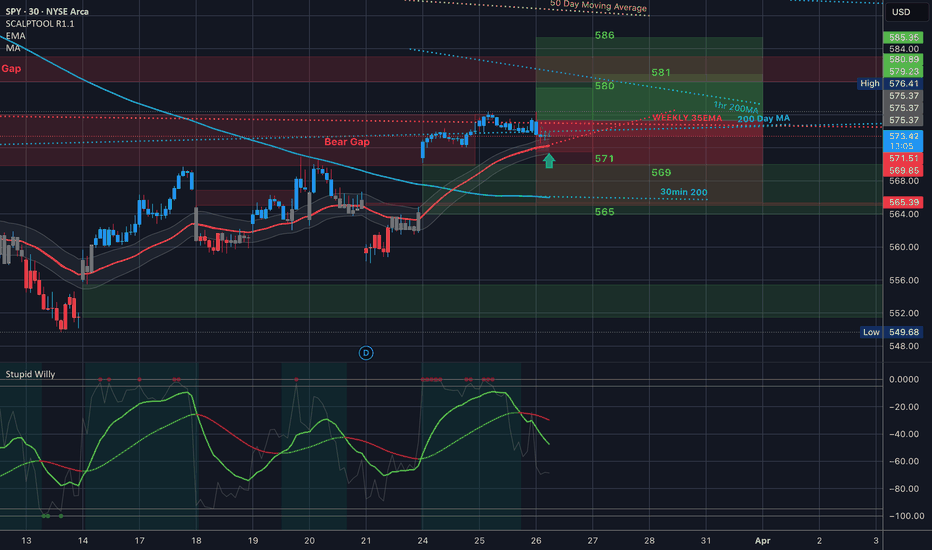

$SPY rejected at the intraday 35EMA, 30min 200 pointing lowerAMEX:SPY That downward facing 30min 200MA. Moving averages are a measure of momentum and we're not going too far up with these downward facing MA's... mentioned this in last nights video. We bounced on the 30min 200 but failed to turn it upward...

$SPY March 27, 2025AMEX:SPY March 27, 2025

15 Minutes.

AMEX:SPY struggling to move upwards as expected.

For the rise 561.48 to 576.42 it has retraced 61.8 levels to 567 levels.

Not it is taking support at 200 averages in 15 minutes

For the fall 576.33 to 567.92 570-571 is a good level to short for an initial target 565- 566 levels for the day.

Since below 200 in 5 minutes not a time to g long for the yet.

SPY/QQQ Plan Your Trade For 3-27-25 : Breakaway PatternToday's Breakaway pattern suggests the markets will continue to melt downward (possibly attempting to fill the Gap from March 24).

I strongly believe the SPY/QQQ are completing the "rolling top" pattern I suggested would happen near or after the March 21-24 TOP pattern my deeper cycle research suggested was likely.

At this point, things are just starting to line up for a broader market decline while the current EPP pattern plays out as a Breakdown of the EPP Flagging formation (moving into consolidation).

Gold and Silver are RIPPING higher. Yes, I do expect a little bit of volatility near these recent highs. But, I also expect metals to continue to rally higher from these levels over the next 10-15+ days. Watch the video.

Bitcoin is stalling/topping - just as I suggested it would months ago.

Now we see how the market move into this new trending phase and how far this current trend will drive price trends. I believe the SPY/QQQ/Bitcoin will all continue to move downward while Gold/Silver move (RIP) higher on this breakaway move.

This is a PERFECT trader's market.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

SPY Hanging on Mid-Range Support – Will It Rebound or Flush?⚠️ Technical Analysis (TA) – Intraday View

Current Price: ~$567.56

* SPY recently experienced a CHoCH followed by BOS, but now formed a new CHoCH → bearish shift in structure.

* Price is testing a minor demand zone between 566–567, holding just above the larger support base at 560–555.

* Volume increased on recent sell candles, showing seller control — but Stoch RSI signals nearing exhaustion.

Indicators:

* MACD: Bearish crossover – but histogram showing potential slowing of momentum.

* Stoch RSI: Deeply oversold and starting to turn up – signals possible bounce/retracement coming.

🔐 Key Levels

Support Zones:

* 566–567 → Short-term demand / micro CHoCH

* 560 → Highest negative GEX zone – PUT support

* 555–550 → Strong liquidity zone & 2nd PUT Wall

Resistance Zones:

* 572.5 → HVL zone and broken structure

* 580 → Gamma wall zone, strong CALL resistance

* 590–600 → Extended resistance levels for swings

🧠 GEX & Options Flow Analysis (TanukiTrade Pro)

* GEX Sentiment: 🔴🔵🔴 — Bearish skew, with a weak neutral pocket

* IVR: 26.4 → Volatility low, but near option seller zone

* IVx avg: 20.7

* PUT$%: 53.8% — Strong bearish hedging flow

* CALL Resistance: 580 → gamma ceiling

* PUT Wall:

* 560 → Highest negative NetGEX (dealer support)

* 555 & 550 → backup defense zones

* HVL: 572.5 → key flip level

📌 Current setup shows dealers are heavily short gamma below 572.5, causing negative delta pressure.

🛠️ Trade Setups

📈 Bullish Setup – Bounce from 566–567

* If SPY holds and reclaims 570 with strong bid, a move toward HVL possible

* Entry: Break and hold above 570

* Target 1: 572.5

* Target 2: 578

* Stop-Loss: Below 565

* Options Play:

* Buy Apr 3 $575 Calls

* OR Call Debit Spread: Buy $570 / Sell $580

📉 Bearish Setup – Breakdown Below 565

* Confirmed lower high and break of demand → opens trapdoor

* Entry: Below 565 with momentum

* Target 1: 560

* Target 2: 555

* Target 3: 550

* Stop-Loss: Above 570

* Options Play:

* Buy Apr 3 $560 Puts

* OR Put Spread: Buy $565 / Sell $555

🧭 Final Outlook

* Bias: Bearish → unless 572.5 HVL is reclaimed.

* SPY is caught between strong PUT support at 560 and heavy gamma ceiling at 580.

* If market sentiment worsens or macro triggers hit, 555 is the magnet zone.

* If buyers step in and hold 566+, bounce setups are likely — but it must reclaim HVL for any strength.

📛 Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Please manage your risk accordingly.

Massive Rising wedge 4hr chartMassive rising wedge on 4hr chart!! Been tracking this the last couple weeks. It’s been respecting the trend lines for the this pattern. I believe this is either last leg down in the pattern or one more leg up before it completes the pattern and drops. Target would be 550-560 next week and then 540-550 the following week.

With April 2nd with tariffs being finalized we could see this move happen between now and then. If this is the last leg down before it completes the pattern and drops more and breaks the bottom trend line it will happen by either Friday or Monday. If it does leg up it will most definitely be April 2nd when it breaks through bottom trend line. Let’s see how this plays out but for those saying that we are not in a bear market and the bottom was back 552 then your not paying attention. I feel like the bottom could one of 3 targets - $490-20% drop, $430-20% drop, $307-50% drop. Now this all depends on Senior Cheeto. I am thinking 20%or 30% is ideal.

Nightly $SPY / $SPX Scenarios for March 27, 2025 🔮 🔮

🌍 Market-Moving News 🌍:

🇺🇸🚗 Auto Tariffs Announced: President Trump has announced a 25% tariff on all cars not made in the U.S., effective April 2. This move is expected to impact the automotive industry and could influence market sentiment.

🇬🇧📉 UK Inflation Falls: UK inflation has decreased to 2.8% in February, down from 3% in January, raising speculation about a potential interest rate cut by the Bank of England in May. This development may have implications for global markets.

📊 Key Data Releases 📊

📅 Thursday, March 27:

📉 Initial Jobless Claims (8:30 AM ET):

Forecast: 226,000

Previous: 223,000

Indicates the number of individuals filing for unemployment benefits for the first time during the past week, offering insight into the labor market.

📈 Gross Domestic Product (GDP) – Second Revision (8:30 AM ET):

Forecast: 2.3% annualized growth

Previous: 2.3%

Provides a second estimate of the nation's economic growth for the fourth quarter of 2024.

🏠 Pending Home Sales Index (10:00 AM ET):

Forecast: 1.0%

Previous: -4.6%

Measures housing contract activity for existing single-family homes, offering insights into future home sales.

⚠️ Disclaimer: This information is for educational and informational purposes only and should not be construed as financial advice. Always consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #news #trendtao #charting #technicalanalysis

Toast me or Roast me - I'm still learning & practicing charting

I was looking at descending scallops and some of their features via thepatternsite.com

What is valid or invalid about this charting here??

I have the high peak marked from the ATH that topped the uptrend on AMEX:SPY and the most recent upward breakout prior to trending back down on the 1HR as of yesterday. I know I will only be able to confirm in hindsight but is there good reason here for me to say we have the makings of a long-er term descending scallop in play here?

Thanks to all. I enjoy reading your opinions and discussions on the daily.

Spy What's up guys?

Here's a update .. I'll cover NYA,Qqq,IWM,XLk,XLF

Here's NYA

Notice the price action above the yellow line? That's Wyckoff distribution.

Yesterday we retest that prior support.. the next leg down on this should start.

For more information just research Wyckoff distribution!

XLF (Banks)

Exact same chart as NYA.. Wyckoff retest... Pain incoming

XLK

This is the most important chart you will see on this post!

XLK is the biggest sector on the SPY! If XLK goes down so will the spy!

Daily chart is a major rising wedge..

4hour chart showing a bear flag

That same bear flag is showing on SPY and

Qqq

IWM

Bear flag inside of bear channel

To sum it up if Qqq breaks below 477 tomorrow or Friday , DO NOT CATCH THE KNIFE!!!!! We will most likely make new lows for March..

Core PCE tomorrow but don't forget about end of quarter rebalancing on Friday.. the last hour of the market WILL see some wild moves ..

Next week is a black out period with no earnings and it is the week of Tariffs. I think if they do flush they will try to get most of the selling done before earnings season kicks off April 7th.

Sorry if this is a little rushed but I've been busy.. I'll try to update this more tomorrow..

Lastly

Vix

I thought they would flush this back to 14.73 but when QQQ rejected off it's 200ma , Vix bounced off it's 200ma (No coincidence).. unless PCE sends this below 17.00 tomorrow we are headed back to 23.00

If you need a bigger picture just look at my previous spy post

But let me break this down to you simple.

This spy, you see the yellow area I am highlighting? THAT IS WYCKOFF DISTRIBUTION!

NOW GO TO YOUR WEEKLY CHART , ZOOM OUT AND LOOK AT THE STRUCTURE OF

TVC:DJI

NASDAQ:MSFT

NASDAQ:QQQ

NASDAQ:NVDA

NASDAQ:AAPL

They are all showing distribution , some 6months worth of it.. So what happens when distribution support is broken as It was on SPY at 580?

What happens next is a Reset! It is exactly what happened in 2022...

Tariffs and Trade: Order Behind the Chaos?

AMEX:SPY , NASDAQ:TLT . Tariffs: It seems that mainstream media is depicting this administration's economic policies as chaotic, suggesting a sense of uncertainty and confusion about what’s happening. However, we can infer that the situation is far from messy. Eventually, tariffs worldwide could be balanced on fairer terms, leading to much more efficient global trade. In cases where tariffs remain reciprocally high, it might simply indicate a shift to a different taxation mechanism, moving away from direct government taxation.

SPY WILL FALL|SHORT|

✅SPY has hit a key structure level of 577.50$

Which implies a high likelihood of a move down

As some market participants will be taking profit from their long positions

While others will find this price level to be good for selling

So as usual we will have a chance to ride the wave of a bearish correction

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

SPY/QQQ Plan Your Trade for 3-26-25 : Flat-Down PatternToday's Flat-Down pattern for the SPY/QQQ suggests the markets will consolidate in a sideways channel, generally drifting downward.

As I've been warning all of you for the past month+, the market will likely roll over into a topping formation over the next few days, then start an aggressive downward trend targeting $525-535 on the SPY.

Today's video covers some details related to my expectations and how traders can prepare for the bigger moves I see pending.

Gold and Silver are poised for a potentially BIG BREAKOUT move to the upside. And I still believe Gold/Silver are going to rally another 15-20% within the next 30-45 days.

Bitcoin should follow the SPY/QQQ into a "rollover top" type of pattern then shift into a downward price trend over the next few days.

Everything is following my predictions/expectations almost perfectly.

Now, we try to profit from some of these big moves.

Go get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

$SPY March 26, 2025AMEX:SPY March 26, 2025

15 Minutes.

Sideways consolidation on for moving averages to catch up.

For the moment upside is capped 576-579 levels which is also top of channel.

576 - 578 is a good sell for 571-573 levels target for today.

Since 3 moving averages are nearby 9, 21 and 50.

I expect a one-sided movement.

So far, no trade for me for the week.

* SPY Update 3/25 *Hello again peoples,

As we witnessed today, price did not do what I was looking for yesterday. Instead, we went through some range bound price movement, tested yesterday's high and bounced back strong towards today's high but not break out happened yet. That is just a perfect scenario to raise my blood pressure, but here is what I will be looking for tomorrow.

- Today's consolidation could be a bear trap for those that realized the early signs of trend weakness. As you know, our target for W3 to be completed is right above this resistance at $577. We were able to consolidate, and possibly accumulate, right below that level while holding $573 support. Bears tried, but even when they aggressively pushed down price, as soon as it hit our support, price stabilized and bulls pushed back up at the end of the day.

- If you look at our 30D Volume Profile, you can see 3 levels that I highlighted. The level #1 is the support we held, #2 is here I can see price finding resistance (end of the 70% value area), #3 is where price might go it it breaks #2.

- It might be a crazy coincidence of the universe, but our TP for W3 is right in between #2 and #3.

- In our 5min chart, we can see how we were able to bounce off the 200 EMA. And if you look at the 1hour chart:

- You can see that our 20Ema(orange) is the same as the 200ema in the 5min chart.

- A nice buy opportunity for those that missed today will be if price test that $574 support again before starting our last leg up towards $580.

Anyway, this is what I have for today. Let me know what you think and how I can make my analysis better!

Nightly $SPY / $SPX Scenarios for March 26, 2025🔮 🔮

🌍 Market-Moving News 🌍:

🇺🇸📉 Consumer Confidence Hits Four-Year Low: The Conference Board reported that the Consumer Confidence Index fell to 92.9 in March, marking the fourth consecutive monthly decline and reaching its lowest level since January 2021. Rising concerns over tariffs and inflation are major contributors to this decline.

🇺🇸🏠 New Home Sales Rebound: New home sales increased by 1.8% in February to a seasonally adjusted annual rate of 676,000 units, slightly below the forecasted 679,000. The median sales price decreased by 1.5% to $414,500 from a year earlier, indicating potential affordability improvements in the housing market.

📊 Key Data Releases 📊

📅 Wednesday, March 26:

🛠️ Durable Goods Orders (8:30 AM ET):

Forecast: -1.0%

Previous: 3.2%

Reflects new orders placed with domestic manufacturers for long-lasting goods, indicating manufacturing activity.

⚠️ Disclaimer: This information is for educational and informational purposes only and should not be construed as financial advice. Always consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #news #trendtao #charting #technicalanalysis

SPY Technical Outlook - Will Buyers Step In?AMEX:SPY is experiencing a corrective move after rejecting the upper boundary of the ascending channel. This rejection led to increased selling pressure, bringing price back to the lower boundary of the channel, where buyers may step in to defend the trendline support.

If the price holds at this dynamic support level, a bullish reaction could send AMEX:SPY toward the midline of the channel, with the next target around 607.00. Holding above this level would reinforce the bullish trend structure and increase the probability of continuation toward the upper boundary of the channel.

However, a breakdown below the trendline support would weaken the bullish outlook and open the door for further downside. Monitoring price action, volume, and confirmation signals will be crucial in determining the next move.

SPY Free Signal! Sell!

Hello,Traders!

SPY made a nice bullish

Move and will soon hit a

Horizontal support of 577.19$

From where we can enter

A short trade with the

Take Profit of 566.48$

And the Stop Loss of 583.38$

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.