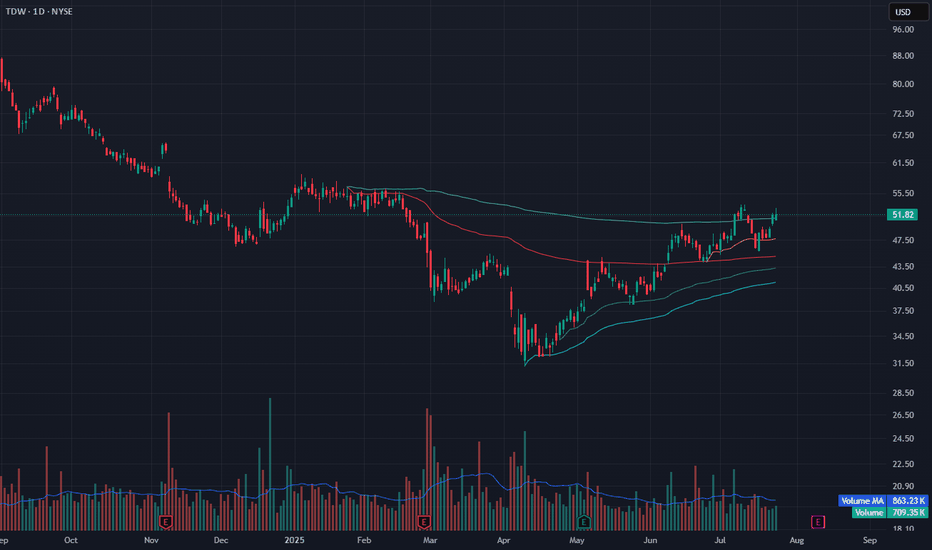

TDW Breaks Out from VWAP Stack – Testing Long-Term ResistanceTDW has broken out from a clean VWAP stack structure and is now testing long-term resistance near $52. Price has made a strong recovery since April and is currently holding above the yellow and red VWAP levels with a higher low pattern.

Today’s close at $51.82 keeps it right at resistance, and a br

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

69.10 MXN

3.77 B MXN

28.06 B MXN

46.57 M

About Tidewater Inc.

Sector

Industry

CEO

Quintin Venable Kneen

Website

Headquarters

Houston

Founded

1955

FIGI

BBG00K66N1Q9

Tidewater, Inc. engages in the provision of offshore marine support and transportation services to the offshore energy industry. The firm offers the towing of, and anchor handling for, mobile offshore drilling units, transporting supplies and personnel necessary to sustain drilling, work over and production activities, offshore construction and seismic and subsea support, geotechnical survey for wind farm construction, and a variety of specialized services such as pipe and cable laying. It operates through the following geographical segments: Americas, Asia Pacific, Middle East, Europe and Mediterranean, and West Africa. The company was founded in 1955 and is headquartered in Houston, TX.

Related stocks

TDW - rise+48% to 73 cents per share on March 01The last earnings report on September 30 showed earnings per share of 49 cents, missing the estimate of $1.25. P/B Ratio (3.601) is normal, around the industry mean (3.775). P/E Ratio (50.264) is within average values for comparable stocks, (50.885). Projected Growth (PEG Ratio) (0.000) is also with

Tidewater to Double?I think tidewater might go down and touch the crossing yellow trend lines. If it does, I think the target is the purple line at $52. If it breaks through that resistance, zoom out and you can see the next resistance is way up at $140. I'm planning to buy if it hits that cross. What's your opinion of

Tidewater... Bad Water. TDWWe are not in the business of getting every prediction right, no one ever does and that is not the aim of the game. The Fibonacci targets are highlighted in purple with invalidation in red. Fibonacci goals, it is prudent to suggest, are nothing more than mere fractally evident and therefore statisti

Tidewater Continues Down For NowBased on historical movement, the peak could occur anywhere in the larger red box. The final targets are in the green boxes. The pending bottom should occur within the larger green box as has been the historical case. Half of all movement has ended in the smaller green box. In this instance, the sig

Tidewater - Reversal of a 10-year long downward trendA new oil prices bull market should favor small & micro cap equities of the oil & gas sector, which reached depressed levels after a 10-year downward trend, giving them the risk-return profile of call options.

We consider that the risk-reward offered by Tidewater, despite its very volatile price, i

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of TDW is 901.00 MXN — it has decreased by −1.10% in the past 24 hours. Watch TIDEWATER INC NEW stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BMV exchange TIDEWATER INC NEW stocks are traded under the ticker TDW.

TDW stock has fallen by −1.10% compared to the previous week, the month change is a −19.12% fall, over the last year TIDEWATER INC NEW has showed a −23.12% decrease.

We've gathered analysts' opinions on TIDEWATER INC NEW future price: according to them, TDW price has a max estimate of 1,307.68 MXN and a min estimate of 560.43 MXN. Watch TDW chart and read a more detailed TIDEWATER INC NEW stock forecast: see what analysts think of TIDEWATER INC NEW and suggest that you do with its stocks.

TDW stock is 1.11% volatile and has beta coefficient of 1.29. Track TIDEWATER INC NEW stock price on the chart and check out the list of the most volatile stocks — is TIDEWATER INC NEW there?

Today TIDEWATER INC NEW has the market capitalization of 47.65 B, it has decreased by −4.48% over the last week.

Yes, you can track TIDEWATER INC NEW financials in yearly and quarterly reports right on TradingView.

TIDEWATER INC NEW is going to release the next earnings report on Aug 11, 2025. Keep track of upcoming events with our Earnings Calendar.

TDW earnings for the last quarter are 17.00 MXN per share, whereas the estimation was 12.44 MXN resulting in a 36.66% surprise. The estimated earnings for the next quarter are 9.82 MXN per share. See more details about TIDEWATER INC NEW earnings.

TIDEWATER INC NEW revenue for the last quarter amounts to 6.83 B MXN, despite the estimated figure of 6.64 B MXN. In the next quarter, revenue is expected to reach 6.03 B MXN.

TDW net income for the last quarter is 873.84 M MXN, while the quarter before that showed 769.45 M MXN of net income which accounts for 13.57% change. Track more TIDEWATER INC NEW financial stats to get the full picture.

No, TDW doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jul 27, 2025, the company has 7.7 K employees. See our rating of the largest employees — is TIDEWATER INC NEW on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. TIDEWATER INC NEW EBITDA is 11.25 B MXN, and current EBITDA margin is 40.06%. See more stats in TIDEWATER INC NEW financial statements.

Like other stocks, TDW shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade TIDEWATER INC NEW stock right from TradingView charts — choose your broker and connect to your account.