Breakout Brewing: Is TRGP About to Explode?🔹 Trade Summary

Setup:

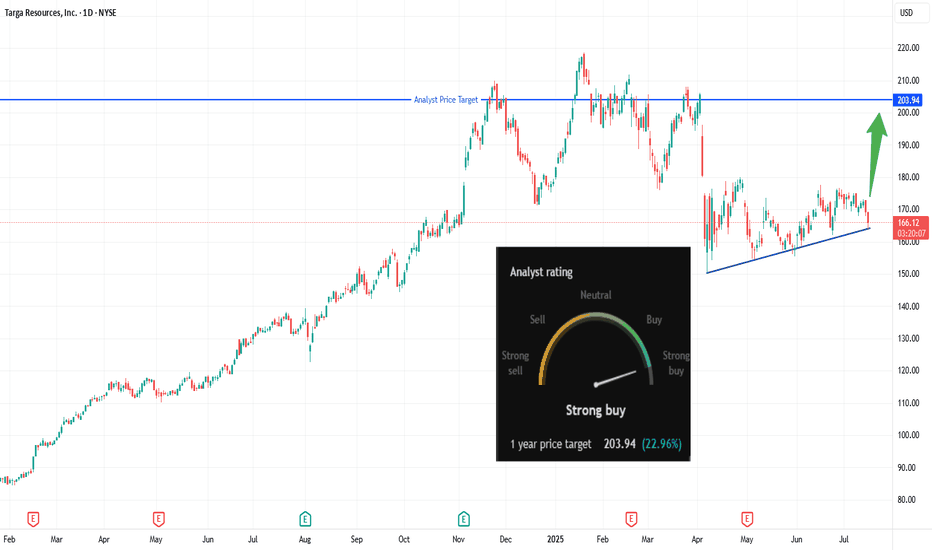

Ascending triangle forming over several months

Price consolidating near major resistance

Strong analyst buy rating with 1-year target at $203.94

Entry:

Buy on daily close above $169.42 (breakout trigger)

Stop-loss:

Below $159 (invalidate the setup)

Targets:

$203.94 (analyst target / recent highs)

Risk/Reward:

Approx. 1:3.5 (risking ~$10 for ~$34 gain)

🔹 Technical Rationale

🔹 Ascending triangle pattern suggests bullish continuation

🔹 Flat resistance at $169.42 now being challenged

🔹 Daily timeframe, recent higher lows showing building pressure

🔹 Catalysts & Context

🚦 Analyst “Strong Buy” rating with 1-year upside potential of +22.96%

🛢️ Energy sector momentum, especially in midstream & LNG plays

📰 Potential earnings/corporate updates could drive breakout

🔹 Trade Management Plan

Entry: Buy only on daily close above $169.42

Stop-loss: Below $159 — trail up if price closes above $180

Scaling: Take partial profits at $185, remainder at $203.94 (target)

What’s your view? Are you watching NYSE:TRGP ? Comment below or vote:

🔼 Bullish

🔽 Bearish

🔄 Waiting for confirmation

🔹 Disclaimer

Not financial advice. Trade at your own risk.

*** Don't forget to follow us for more trade setups ***

TRGP trade ideas

Another Nat Gas Play Breaking Out! The US is going big into the LNG exporting business in the next few years, and any company that can move that along is going to make money.

The technicals still look strong to go higher, but right now the future fundamentals look even more compelling.

Targa Resources Corp. provides midstream natural gas and natural gas liquids services. It also provides gathering, storing, and terminaling crude oil, and storing, terminaling, and selling refined petroleum products. It operates through the Gathering and Processing and Logistics and Transportation segments. The Gathering and Processing segment includes assets used in the gathering of natural gas produced from oil and gas wells and processing this raw natural gas into merchantable natural gas by extracting NGLs and removing impurities, and assets used for crude oil gathering and terminaling. The Logistics and Transportation segment focuses on the activities necessary to convert mixed NGLs into NGL products and provides certain value-added services such as the storing, fractionating, terminaling, transporting and marketing of NGLs and NGL products, including services to LPG exporters, and the storing and terminaling of refined petroleum products and crude oil and certain natural gas supply and marketing activities in support of its other businesses. The company was founded in October 2005 and is headquartered in Houston, TX.

filing the gap at 77 before see reversal indicators curling upThe stochastics are at a low, and then you got MACD still forcing its way down some more; it should restore bullish with a reversal pattern, but do not see this at this level until it drops a few points; we can see there is a sentiment of a reversal, but we are waiting until we see an indicator, or some change in moving progress.

Targa Resources Corp. WCA - Ascending TriangleCompany: Targa Resources Corp.

Ticker: TRGP

Exchange: NYSE

Sector: Energy

Introduction:

In today's examination, we focus on Targa Resources Corp. (TRGP) listed on the NYSE, a key player in the energy sector. The weekly chart exhibits a bullish breakout from an Ascending Triangle pattern, which has been forming over the past 66 weeks.

Ascending Triangle Pattern:

The Ascending Triangle is a classical charting pattern characterized by a horizontal resistance line and an upward-sloping support line. In this case it serves as a bullish continuation pattern.

Analysis:

Targa Resources' previous trend was upward, symbolized by the green diagonal line. This upward trend was momentarily halted by a consolidation phase forming the Ascending Triangle pattern. The upper horizontal boundary of the pattern is around 80, with 4 touch points, while the lower diagonal boundary ranges between 55-76 and also has 4 touch points.

The price is well above the 200 EMA, implying a bullish environment. Currently, the price appears to have broken above the horizontal boundary, favoring a long entry. The price target for this bullish setup is at 103, which corresponds to an estimated rise of 30%.

Conclusion:

The weekly chart of Targa Resources presents an attractive bullish breakout opportunity through the Ascending Triangle pattern. This setup, validated by a breach above the horizontal boundary, could offer a rewarding long trading prospect.

---------------------------------------------------------------------------------------------------------------------------

Please remember, this analysis should be a part of your comprehensive market research and risk management strategy, and is not direct trading advice.

If you find this analysis valuable, please consider liking, sharing, and following for more insights. Wishing you successful trading!

Best regards,

Karim Subhieh

Disclaimer: This analysis is not financial advice and is intended for educational purposes only. Always conduct your own research and consult with a financial advisor before making investment decisions.

TARGA RESOURCES CORPORATION Publication Hey guys, TARGA RESOURCES CORPORATION is in a fake bearish movement with low past sell volume and some kind of hammer candle. The TIMEFRAME M1 shows us a dragon with a large volume of purchases issued. It goes on the VWAP to go and test it. There is a great chance that it will break the VWAP if we pass the middle of the stabilization zone so we can go to the top of the zone for a first test. Great propability of breakout the stabilization zone for arrival on the next top. And if the buyers push may have an aggressive rally to the top of the bullish channel.

Please LIKE & FOLLOW, thank you!

trgp best level to buy 40% gains by projectsyndicatetrgp daily chart review.

best level to buy for 40% gains

update by projectsyndicate

mirror levels 34//36

target is S/D zones 43//47.50

40/50% gain.

put this on your watchlist

solid setup.

update brought to you by Projectsyndicate.

B barnes group inc D1 short into resistance 25%

box inc daily update by projectsyndicate

hog daily best level to buy for 25% gain projectsyndicate

gwb daily best level to buy 25-30% gain by projectsyndicate

ntla daily best level to buy 40%/50% upside by projectsyndicate