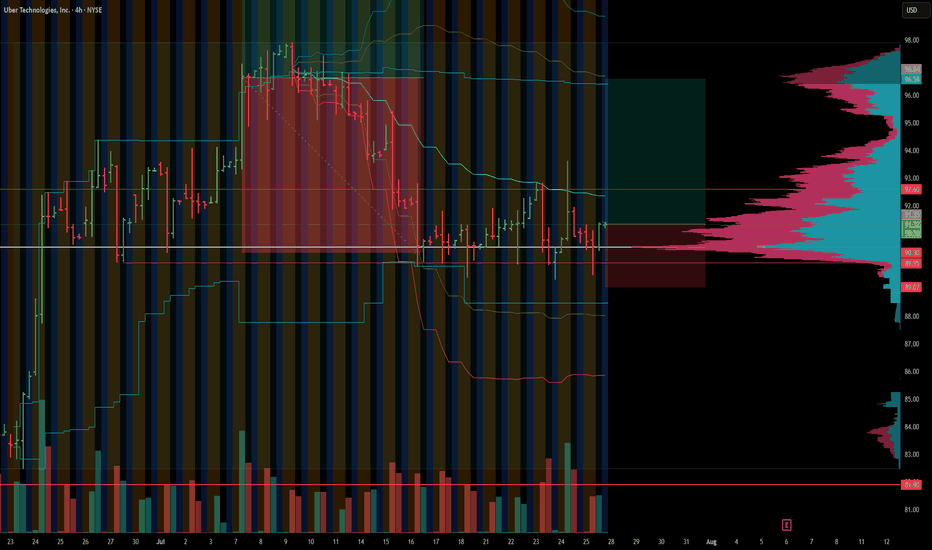

UBER Call Volume Explodes — $98C in Play Before Friday! **UBER \$98C 🚀 Call Volume Surges 3.2x – Weekly Bullish Breakout Brewing (3 DTE) 🔥**

---

### 📊 **Post Body (Optimized for TradingView):**

**UBER Weekly Call Play — Aug 8 Expiry (3 DTE)**

📈 **Sentiment Snapshot:**

* **Call/Put Ratio:** 3.22 — 🟢 Heavy bullish bias

* **Weekly RSI:** 57.6 and risin

Key facts today

Uber Technologies partnered with Waymo for self-driving cars in Atlanta, showcasing high usage rates that could boost the overall network performance.

Uber Technologies has teamed up with Dollar General to sell products on UberEats, aiming at higher-income consumers who prioritize convenience.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

112.70 MXN

205.49 B MXN

916.92 B MXN

2.00 B

About Uber Technologies, Inc.

Sector

Industry

CEO

Dara Khosrowshahi

Website

Headquarters

San Francisco

Founded

2009

FIGI

BBG00PXGMF31

Uber Technologies, Inc. is a technology platform, which engages in the development and operation of technology applications, networks, and product to power movement from point A to point B. The firm offers ride services and merchants delivery service providers for meal preparation, grocery, and other delivery services. It operates through the following segments: Mobility, Delivery, and Freight. The Mobility segment refers to products that connect consumers with Mobility Drivers who provide rides in a variety of vehicles, such as cars, auto rickshaws, motorbikes, minibuses, or taxis. The Delivery segment offers consumers the chance to search for and discover local restaurants, order a meal, and either pick-up at the restaurant or have the meal delivered. The Freight segment focuses on connecting Carriers with Shippers on its platform, and gives Carriers upfront, transparent pricing, and the ability to book a shipment. The company was founded by Oscar Salazar Gaitan, Travis Kalanick, and Garrett Camp in 2009 and is headquartered in San Francisco, CA.

Related stocks

Uber Stock Fails to Hold Above $90Shortly after releasing earnings, Uber’s stock has continued to decline, posting a new drop of over 4% in the latest session, as selling pressure remains dominant in the short term. Although results were in line with expectations —with earnings per share at $0.63 and total revenue reaching $12.65 bi

Uber Stock Chart Fibonacci Analysis 080725Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 91/61.80%

Chart time frame:B

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress:A

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E)

Uber swing playBullish Setup (if you think bounce holds)

• Buy Call Spread:

• Buy $90 Call (Sept expiry)

• Sell $100 Call (same expiry)

• Lower premium, defined risk. Target profit if stock runs to resistance.

• Cash-Secured Put:

• Sell $85 Put (Sept)

• Collect premium. If UBER dips, you get assigned at an

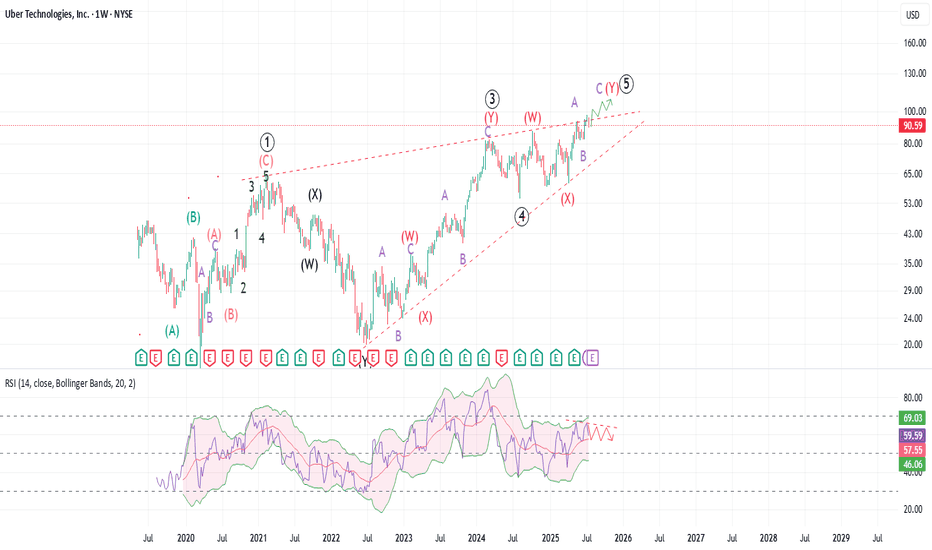

Uber: The end is nigh! Uber is most likely approaching a cycle degree end with a massive leading diagonal structure. The price might get higher than $100 or even close to $150, and it will look like an impulse, but most likely that would a long-term top. Uber is facing maximum pressure from robotaxi competitors and higher

$UBER: Why $UBER Is a Robotaxi WinnerUber is on the verge of a major transformation, with robotaxis set to become a game-changing profit engine.

Technical charts indicate we can enter a long position today with low risk, while aiming for a long term rally resumption from here. Monthly and quarterly timeframe Time@Mode trends are bull

Long Trade Description (UBER | Uber Technologies Inc.)📄

Ticker: NYSE:UBER

Timeframe: 30-Minute Chart

Trade Type: Long – Ascending Triangle Breakout

UBER is forming a strong ascending triangle near resistance, with bullish momentum and clean structure. Entry is taken around $97.48, anticipating a breakout above the horizontal level. Target is set at

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

UBRT4884099

Uber Technologies, Inc. 7.5% 15-SEP-2027Yield to maturity

7.19%

Maturity date

Sep 15, 2027

USU9029YAF7

UBER TECHNO. 20/28 REGSYield to maturity

6.12%

Maturity date

Jan 15, 2028

UBRT5886387

Uber Technologies, Inc. 5.35% 15-SEP-2054Yield to maturity

5.84%

Maturity date

Sep 15, 2054

UBRT5886385

Uber Technologies, Inc. 4.8% 15-SEP-2034Yield to maturity

4.98%

Maturity date

Sep 15, 2034

USU9029YAG5

UBER TECHNO. 21/29 REGSYield to maturity

4.63%

Maturity date

Aug 15, 2029

UBRT5886386

Uber Technologies, Inc. 4.3% 15-JAN-2030Yield to maturity

4.32%

Maturity date

Jan 15, 2030

UBRT6077245

Uber Technologies, Inc. 0.0% 15-MAY-2028Yield to maturity

−4.90%

Maturity date

May 15, 2028

UBRT5706997

Uber Technologies, Inc. 0.875% 01-DEC-2028Yield to maturity

−7.90%

Maturity date

Dec 1, 2028

UBRT5323752

Uber Technologies, Inc. 0.0% 15-DEC-2025Yield to maturity

−39.62%

Maturity date

Dec 15, 2025

See all UBER bonds

Curated watchlists where UBER is featured.

Frequently Asked Questions

The current price of UBER is 1,710.00 MXN — it has increased by 0.83% in the past 24 hours. Watch UBER TECHNOLOGIES INC stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BMV exchange UBER TECHNOLOGIES INC stocks are traded under the ticker UBER.

UBER stock has risen by 0.31% compared to the previous week, the month change is a −4.53% fall, over the last year UBER TECHNOLOGIES INC has showed a 31.54% increase.

We've gathered analysts' opinions on UBER TECHNOLOGIES INC future price: according to them, UBER price has a max estimate of 2,804.63 MXN and a min estimate of 1,533.20 MXN. Watch UBER chart and read a more detailed UBER TECHNOLOGIES INC stock forecast: see what analysts think of UBER TECHNOLOGIES INC and suggest that you do with its stocks.

UBER reached its all-time high on Jul 8, 2025 with the price of 1,819.98 MXN, and its all-time low was 354.21 MXN and was reached on Mar 19, 2020. View more price dynamics on UBER chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

UBER stock is 1.46% volatile and has beta coefficient of 1.20. Track UBER TECHNOLOGIES INC stock price on the chart and check out the list of the most volatile stocks — is UBER TECHNOLOGIES INC there?

Today UBER TECHNOLOGIES INC has the market capitalization of 3.53 T, it has increased by 4.99% over the last week.

Yes, you can track UBER TECHNOLOGIES INC financials in yearly and quarterly reports right on TradingView.

UBER TECHNOLOGIES INC is going to release the next earnings report on Oct 30, 2025. Keep track of upcoming events with our Earnings Calendar.

UBER earnings for the last quarter are 11.82 MXN per share, whereas the estimation was 11.80 MXN resulting in a 0.11% surprise. The estimated earnings for the next quarter are 12.85 MXN per share. See more details about UBER TECHNOLOGIES INC earnings.

UBER TECHNOLOGIES INC revenue for the last quarter amounts to 237.31 B MXN, despite the estimated figure of 233.94 B MXN. In the next quarter, revenue is expected to reach 246.30 B MXN.

UBER net income for the last quarter is 25.42 B MXN, while the quarter before that showed 36.39 B MXN of net income which accounts for −30.14% change. Track more UBER TECHNOLOGIES INC financial stats to get the full picture.

No, UBER doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Aug 12, 2025, the company has 31.1 K employees. See our rating of the largest employees — is UBER TECHNOLOGIES INC on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. UBER TECHNOLOGIES INC EBITDA is 108.25 B MXN, and current EBITDA margin is 10.71%. See more stats in UBER TECHNOLOGIES INC financial statements.

Like other stocks, UBER shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade UBER TECHNOLOGIES INC stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So UBER TECHNOLOGIES INC technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating UBER TECHNOLOGIES INC stock shows the buy signal. See more of UBER TECHNOLOGIES INC technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.