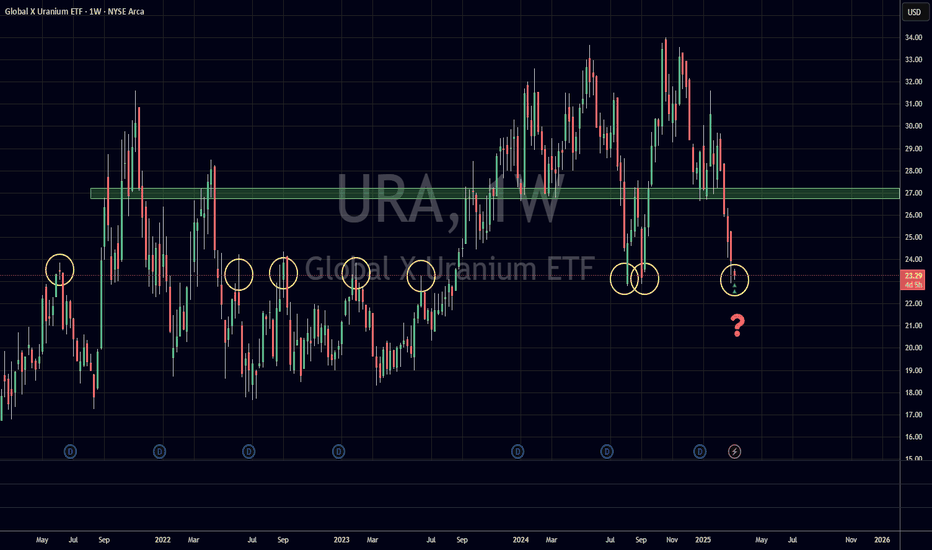

URA at historic Support/Resistance level on WeeklyURA has hit the ~23.00 level. Since June 2021, the 23.00 level has provided resistance or support to URA 7 times, as shown by the yellow circles on the Weekly chart.

Entering a Long position with a upside target to another area of previous support and resistance at the ~27.00 area (green rectangle).

Price Stop: $22.00

Time Stop: 3 months.

URA trade ideas

Utilities vs. Uranium: Is the Nuclear Sector Gaining Momentum?Introduction:

Utilities AMEX:XLU have demonstrated strong performance over the past year, often signaling a "risk-off" market environment where investors seek safety. However, the rise of artificial intelligence (AI) and its impact on market dynamics may be challenging this traditional narrative. Despite the evolving landscape, caution is warranted against assuming that "this time is different." A new factor to watch is the growing influence of the nuclear sector, particularly uranium stocks AMEX:URA .

Analysis:

Risk-Off Sentiment vs. New Trends: While utilities' strong performance typically signals a defensive market stance, the increasing focus on nuclear energy is drawing investor interest toward uranium stocks. The shift reflects a potential change in how market participants view traditional safe havens.

URA-to-XLU Ratio: The upward trend in the URA-to-XLU ratio over recent years indicates a growing preference for uranium stocks over traditional utilities. Even after a significant selloff earlier this year, the ratio formed a higher low, signaling resilience and maintaining its long-term uptrend.

Momentum Shift: The key focus now is whether this ratio can make a new high. If the URA-to-XLU ratio breaks above its previous peak, it would suggest strengthening momentum in the nuclear sector, indicating that this trend could have staying power and possibly reflect a shift in market preferences.

Conclusion:

As the market balances between traditional risk-off sectors like utilities and emerging trends in nuclear energy, the URA-to-XLU ratio serves as a critical indicator of shifting investor sentiment. A new high in this ratio would suggest that the nuclear sector's momentum is strengthening, with uranium stocks potentially leading the way. Do you believe this trend will continue? Share your insights below!

Charts: (Include relevant charts showing the URA-to-XLU ratio, the higher low formation, and potential breakout targets)

Tags: #Utilities #Uranium #NuclearEnergy #XLU #URA #MarketTrends #TechnicalAnalysis

Incoming 50% collapse for Uranium?This is a forecast through until the summer of 2026.

On the above 3 week chart price action has enjoyed a wonderful 400% rise from the bottom. A number of reasons now exist for a bearish outlook.

1) Price action and RSI support breakouts.

2) Regular bearish divergence. Lots of it. 10 oscillators print negative divergence with price action.

3) Almost all tradingview ideas are currently “long”. Remember the majority of traders, almost 95% of them, will lose money.

Is it possible price action continues to climb? Sure.

Is it probable? No.

Ww

Nov 3, 2024 Best Scenario for URA by Mid-LAte 2025 >2X Nov 3, 2024

Best Scenario for URA

by Mid-LAte 2025

Minimum Return 1:2 Ratio (Double your money)

The uranium industry forecast for 2025

indicates a tightening market with rising

prices, driven by growing nuclear energy demand and potential

supply constraints.

This environment is likely to benefit

uranium producers and drive

increased investment in exploration and production

URA eyes on $31.44: Major Support to hold for $37 final targetFollowup to my plot looking for $31 break (click).

URA broke above a major zone with ease.

Likely to be retested for possible late longs.

Or look for Break-n-Retest of zones above.

$ 31.43 - 31.66 is Major Support that must hold.

$ 34.37 - 34.55 is the proven immediate hurdle.

$ 36.26 - 37.07 is the final target for this wave.

.

Previous Analysis:

.

See "Related Publications" below for other Uranium stocks

==================================================================

.

URA - Uranium OpportunityURA completed the full projected drawdown from the inverted head and shoulders. Purple lines are fib confluences using Connies method. The composite index shows favorable momentum. Volatility weighted MACD has a signal crossover. And Martin Prings concept of total return (rate of change + dividend)/(3 month commercial paper) has a signal crossover.

Uranium has consistently maneuvered through Justin Mamis sentiment cycle. We appear to have recently seen an aversion stage.

This is still an aggressive area for an entry and commodities require patience at this point in the cycle.

AMEX:URA

URA Riding the Tenken into a possible C-ClampI've been following the Uranium trade for a while now. I've seen comparisons to a slow moving crypto cycle. Even the personalities that follow it, trade it, talk about it have comparisons in being some larger than life personalities. It's been a fun own and follow for me.

I own a few individual companies, but of course there is correlation with the bigger companies and the large ETFs.

Taken a look at the Global X Uranium ETF here just to check and see how the market is tracking on a broader scale.

Still looking good on the cloud. Price riding the Tenken. It has opened up what I believe is a bearish C clamp to the Kijun. My thoughts are a healthy cool off before continuation. Fingers crossed. AMEX:URA

Shorting URA: 1+ Year Trend Channel BreakoutMonitor URA for a breakdown below the lower boundary of its ascending trend channel. If the price breaks out of the trend channel downward, look for a subsequent bounce back to the $30 price range to test the resistance level. Upon confirmation of resistance at $30, consider entering a short trade using put options to capitalize on the expected downward movement. This strategy aims to take advantage of a failed recovery within the channel, signaling a potential shift in trend.

COPX finding Support, Long Trade is Detailed This video shows COPX, the Copper Miners ETF, is coming down into potential support. The weekly chart clearly shows a prior Resistance price area that is now potential Support. The volume has been gang busters up through the Resistance Area. The Weekly RSI reading is still above the important 50 threshold so , overall the Trend is still more Bullish than Bearish. The exact buy and sell points have been shown as I will trade it, Thx!

uranium bull run in placeURA ETF is close to second level breakout

daily chart shows a breakout already.

monthly chart is at resistance but can move higher

in the next month. Cup and handle pattern

has formed on the monthly chart.

Electric cars will need to be charged and BYD is

going to overtake Toyota and Volkswagon in the next

decade.

While the empire was busy occupying,

China was quietly working to build its economy.

Now the world can have cheap electric cars which need

to be charged.

URANiUM: $24 | Demand for Power on the Risewith supply limited and regulated

investors in RADiOACTiVE Marterial

shall be rewarded big time

developing nations

are running out of coal

and oil being regulated to the highs by Russia and Arabs make it

difficult for new nations to keep up with demand for energy

bullish on Uranium bullish on uranium and expect this ETF to breakout soon

Support: $17

Resistance I: $43

Resistance II: $100

According to Munro, who is co-chair of the World Nuclear Association’s Nuclear Fuel Demand Working Group, “we are on the cusp of a new nuclear age in which decarbonisation imperatives collide head-on with unrealistic expectations of renewables penetration, leaving nuclear power to wean the world off coal and decarbonise the expanding electrical grid, domestic heating, industrial heating and hard to abate areas of industry including hydrogen production. If nuclear power can achieve its decarbonisation potential around the world, the implications for uranium demand will be astonishing.”