The Picks and Shovels of The AI Boom1. Six-Month Price Trend

Long-term uptrend: Over the past 6 months, VRT has climbed from ~ $54 to a recent high around $155—deep into a clear bullish channel

Pullbacks vs higher lows: Corrections have consistently bounced off rising trend-lines and key moving averages (50 & 200-day), reinforcing the uptrend .

🛡️ 2. Key Support & Resistance Levels

Support: Near the 50‑day SMA (~$108–$110)—previous pullbacks found strong buying interest here.

Fibonacci retracement zone: Around $117–$117.5 (61.8% from the 52-week high) also has historical support .

Resistance:

Around $155–$156, the recent 52-week high marks the first major hurdle.

Interim resistance around $128–$130, aligning with various pivot point R‑levels and the 6-month consolidation top .

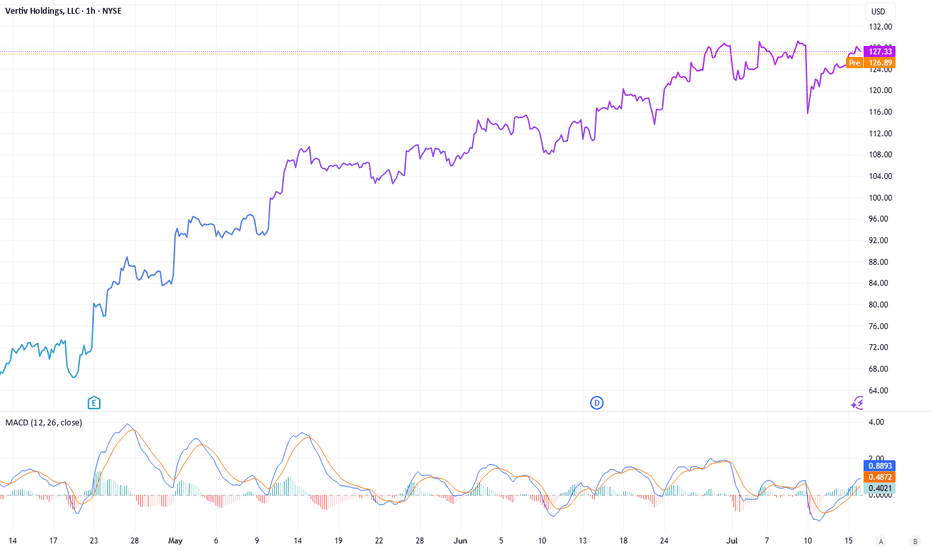

📊 3. Momentum Indicators

Financhill & ChartMill: RSI ~66.6–69.7, moving toward overbought but not extreme

Barchart shorter: 62–64—still in bullish-neutral range

MACD

Positive MACD reading: Values range from ~0.11 to +5.7, indicating bullish crossover momentum

Histogram and signal remain supportive of upward momentum.

Stochastics & ADX

Stochastics: Hovering in the 80s (overbought) but often remains elevated during strong uptrends

ADX ~28–29: Indicates a strong trending stock

⚖️ 4. Overall Technical View

Moving averages: 8, 20, 50, 100, 200‑day (both SMA & EMA) are all positively sloped with price above each—bullish alignment across all timeframes

MACD & RSI: Bullish, with MACD above signal line and RSI in bullish territory (though nearing overbought).

Chart patterns: Active long positions, cup‑and‑handle formations, and break above 50 & 200‑day EMAs suggest continuation setups.

✅ 5. Conclusion

VRT is firmly in a bullish technical regime:

Uptrend confirmed by price structure and moving averages.

Momentum indicators (MACD, RSI, ADX) support continued upside.

Key levels to watch: Support near $117–$110, Resistance around $130 and $155.

Recommendation: The setup favours bullish continuation. That said, RSI nearing overbought (~70) suggests caution—look for short-term consolidation or mild pullbacks before new entries.

Final stance: Bullish, with an eye on consolidation phases for optimal timing.

🧭 6. Watch Points

Break above $155 on strong volume = next leg higher.

Drop below 50‑day SMA (~$108) with weakness could signal deeper retracement.

RSI sustaining above 70 may lead to short-term kicker higher—or signal an overextension pause.

VRT trade ideas

Vertiv Holdings: Powering the AI ProgressionNYSE:VRT NASDAQ:NVDA NASDAQ:META NYSE:ETN NASDAQ:CEG

While investors are engaged in a race “identify the next major microchip manufacturer”, a quieter opportunity is emerging at the crossroads of artificial intelligence (AI), infrastructure, and long-term demand. Vertiv Holdings (VRT), a company often overlooked amidst the hype, could be the backbone of the AI boom. In a recent NVIDIA earnings call, CEO Jensen Huang dropped a pretty interesting statement: the biggest hurdle for future data centers isn’t chips or regulations- it’s power.

The Power and Cooling Conundrum

AI is no longer some futuristic bet, it’s more like the engine of modern enterprise. Data centers, once powered by modest CPUs, now rely on NVIDIA’s superior GPUs to handle complex, multi-task workloads at scale. But this shift has exposed a critical bottleneck: energy supply can’t keep up with compute demand. Think of NVIDIA’s GPUs as high-performance supercars-powerful yet fuel-hungry, requiring premium infrastructure to operate efficiently. Data centers face challenges like high carbon footprints, downtime risks (recall the $10 billion CrowdStrike outage from a faulty software update), and intense cooling needs due to soaring rack densities.

And this is where Vertiv (VRT) comes in. This company designs and delivers essential infrastructure-uninterruptible power supplies, power distribution units, and advanced cooling solutions (both air and liquid-based)-tailored for data centers, telecom, and industrial clients. If NVIDIA’s GPUs are the brain, Vertiv is the heart and lungs, ensuring these systems run without melting down. The cooling challenge, in particular, is a game-changer. With rack densities exceeding 300kW, traditional air cooling falls short, making Vertiv’s liquid cooling innovations a must-have.

A Strategic Edge: The META-Nuclear Play

The AI race isn’t just about chips- it’s also about the infrastructure to sustain them. A telling sign came from META, which recently inked a nuclear power deal with Constellation Energy. Why nuclear? It offers low-carbon, reliable, 24/7 power with massive capacity-ideal for AI’s energy demands. Yet, Constellation’s deal didn’t address cooling, a gap Vertiv fills perfectly. This collaboration points a broader trend: companies are scrambling to solve power and thermal management issues, and Vertiv is at the forefront of this effort.

Financial Momentum and Analyst Backing

Vertiv’s financials back up its strategic importance. In Q1 2025, the company reported $2.04 billion in revenue-a 25% year-over-year jump, surpassing the $1.94 billion estimate. Adjusted earnings per share hit $0.64, beating the $0.615 forecast. Its backlog soared 50% to $6 billion, signaling robust future demand, while free cash flow margins doubled to 13% ($1.48 billion). Earnings before interest, taxes, depreciation, and amortization grew 22.8%, with a manageable 1.6x leverage ratio and over $350 million annually invested in R&D-much of it for cutting-edge liquid cooling.

Looking ahead, analysts project revenue of $10.76 billion by 2026, with EPS growth of 22% annually and free cash flow reaching $1.6 billion, even as capital expenditure rises to 18.2%. The sentiment is overwhelmingly bullish: Bank of America, Goldman Sachs, and Barclays maintain "Buy" ratings, with target prices ranging from $115 to $130. Oppenheimer, a top analyst, recently raised its target to $132, while 75% of analysts recommend buying, with only 6.3% suggesting a hold or sell.

Outpacing the Market

Since its liberation date of April 2, Vertiv has outperformed its peers. While the S&P 500 grew 11.48%, NVIDIA rose 45.62%, Eaton Corporation 30.26%, and Constellation Energy 48.3%, Vertiv surged 69.8%. Its focus on data centers and AI-driven infrastructure is reflected in this outperformance, with even uranium ETFs (42.41%) tied to nuclear power trends being outpaced. Vertiv’s faster free cash flow growth and direct exposure to AI’s power and cooling bottlenecks give it an edge over cyclical chipmakers.

A Long-Term Buy?

The thesis is simple: AI is already here and it will stay, and the infrastructure supporting it-especially cooling- is important factor in ensuring the rotation of the gears. Vertiv is quietly becoming, lets say, the NVIDIA of infrastructure, leveraging strong financials, analyst confidence, and a critical role in solving AI’s energy crisis. At a current price of $127.37, with targets up to $132 within the next 18 months (and potentially higher over 2-3 years), VRT could be a pretty confident long-term buy. Unlike chipmakers facing valuation risks, Vertiv may offer stable growth tied to an urgent need, which one is growing today.

Disclosure: I currently hold no positions in VRT, NVIDIA, Eaton, or Constellation Energy.

VRT : Long Position Vertiv Holdings is trading above the 50 and 200-period moving averages.

It has overcome the resistances one by one without being exposed to a very high IV.

It has started to draw a cup.

However, it is much better to focus on the big gap rather than the cup formation because with good chances it can encounter a big resistance there.

Targeting the 50-period ema and the 0.5 level of the short-term Fibonacci retracement levels as a stop point gives us the opportunity to try trading at a not bad risk/reward ratio.

With a small position size or small portfolio percent :

Risk/Reward Ratio : 2.54

Stop-Loss : 103.77

Take-Profit : 145.32

Is VRT (they make cooling systems for data centers) a buy ?Vertiv Holdings Co. (NYSE: VRT) is a leading provider of critical digital infrastructure and continuity solutions, particularly for data centers. Here's an overview of its recent performance, valuation, and potential challenges:

Financial Performance

Q1 2025 Highlights:

-Revenue: $2.04 billion, a 24% increase year-over-year.

-Adjusted EPS: $0.64, up ~49% from Q1 2024.

-Adjusted Operating Profit: $337 million, a 35% increase from Q1 2024.

-Book-to-Bill Ratio: Approximately 1.4x, indicating strong demand.

-Backlog: Increased to $7.9 billion, up ~10% from the end of Q4 2024.

Full-Year 2024 Performance:

-Revenue: $8.012 billion, a 16.74% increase from 2023.

-Net Income: $495 million, a 7.74% increase from 2023.

Valuation Metrics

-Market Capitalization: Approximately $41.13 billion.

-Price-to-Earnings (P/E) Ratio: Approximately 61.7x, which is higher than the industry average, indicating a premium valuation.

-Enterprise Value/Revenue: 5.1x.

-Enterprise Value/EBITDA: 24.5x.

-PEG Ratio: 2.7x, suggesting that the stock may be overvalued relative to its earnings growth.

Potential Challenges

-Valuation Concerns: The high P/E ratio suggests that the stock is priced for perfection. Any shortfall in performance could lead to a significant price correction.

-Supply Chain Risks: Vertiv faces operational risks related to its supply chain and manufacturing processes. Disruptions could impact production and increase costs.

-Regulatory and Legal Challenges: The company is exposed to various legal and regulatory risks that could impact its operations and financial performance.

-Market Dynamics: A slowdown in data center equipment purchases, particularly from major clients like Microsoft and Google, could affect Vertiv's order volumes in the near term.

Disclaimer: This analysis is for informational and educational purposes only and does not constitute financial advice, investment recommendation, or an offer to buy or sell any securities. Stock prices, valuations, and performance metrics are subject to change and may be outdated. Always conduct your own due diligence and consult with a licensed financial advisor before making investment decisions. The information presented may contain inaccuracies and should not be solely relied upon for financial decisions.

$NYSE:VRT (Vertiv Holdings, LLC) Bullish Outlook NYSE:VRT

Company Overview:

Cooling for Data Centers. One of the very few.

Vertiv Holdings Co. engages in the design, manufacture, and service of critical digital infrastructure technology that powers, cools, deploys, secures and maintains electronics that process, store and transmit data. It also offers power management products, thermal management products, integrated rack systems, modular solutions, and management systems for monitoring and controlling digital infrastructure.

Vertiv Group Corp., established in 2016 after its acquisition by Platinum Equity, stands as a global leader in data center cooling solutions. Offering precision cooling systems and thermal management solutions since its inception, Vertiv has garnered recognition for its innovative technologies and commitment to sustainability. Recent developments, especially in energy-efficient cooling systems, underscore its dedication to meeting evolving market needs. Vertiv's focus on innovation, reliability, and customer satisfaction has solidified its position as a top choice for organizations seeking cutting-edge cooling solutions for their critical digital infrastructure.

Other companies may partake in Data Center Cooling but Vertiv (VST) specializes in it. That's the big difference. It's not a side piece of the business to make additional $. That's what makes it special. That's why I mentioned there really isn't many companies that specialize in this critical area especially with the growth of data centers.

Technicals:

Positive Divergence

RSI at 36 and as of now crossing RSI-Based MA

Descending Wedge (breaking out as of 3/12)

Downside: A lot of resistance to break through as in it 's under ALL Moving Average's.

Overall NYSE:VRT continues to to increase every single quarter and is in a very strong market of data centers as these will continue to increase and need cooling. Institutions own 83.77%

VRT Snapshot

VRT Growth

2/20/25 - $vrt - lil ST punt only2/20/25 :: VROCKSTAR :: NYSE:VRT

lil ST punt only

- not cheap, not expensive, but reasonable

- dr. warren says... better to pay reasonable px for great asset than great px for mediocre asset

- nvda results r on deck and mkt probably remains choppy until then, but my industry sources confirming this result will be smash and deekseek fear has more or less passed... demand still booked

- what this means is the whole complex runs (unclear on TPU types, avgo, googl, etc. but probably still bid)

- i think the NASDAQ:MU move earlier this week also a snippet view into the nvda results

- so here's a name 3% fcf yields, growing high DD... sub 1.5x peg. unique DC niche

- to be clear, i was trading this tape today but i'm not really enjoying it. i do like action, but lately it feels like i'm a fat chick on a treadmill and "not yet seeing results" but standing in place. i guess that deserves a pat on the back... if i can reach... it.

- all jokes aside

- looking for some ST punts. i am still playing NASDAQ:NICE from today's insane dump. took most of the ST action off here already with some nice gains, but apparently i'm back in this thing for the LT. valuation is just too obvious and it's good money

- here's an interesting one. vrt.

whatchu think anon? let's pay for weekend steaks?

V

1/27/25 - $vrt - i bot $110, trade1/27/25 :: VROCKSTAR :: NYSE:VRT

i bot $110, trade

- trading buy

- overbaked cake

- nvda complex reeling bc deepseek (i will write more on this later - but i've added to my 2027 NVDA calls after taking a bit off the table earlier last week)

- this one seems a bit like a reversion trade/ but growth phenom. any reversal in semis sees this go +5-10% ez. (also nancy)

- and if not, we can find a better LT parking spot w more nuanced size and expires.

V

Even If It Pops.... ITS BOUND TO DROP!Now, I am wishy washy with when I use technical and fundamental's to back my thesis up.

This is a technical thesis that has nothing to so with the company, but everything to do with human behavior.

Over stretched and weaknesses are showing, TAKE ADVANTAGE.

Lastly, you may looks at my ideas and thing "he has no clue what he is talking about", my arrows and lines are not meant to be 100% accurate, but more of a general movement that the stocks are most likely to follow.

Pay the most attention to my levels of volume.

VERTIV for your long/medium term PortfolioThis Stock is interesting at the marked area which is a 1.618 extention of the first corrective move and a 0.618 retracement of the last strong push up.

i d like to see a crossing of the decending trendline o fthe correction and afterwards a crossing of the sma(89) to the upside.

let' s see what happens.

good luck all!

Ready to go very very very soonThe stock appears to be in a pullback phase. I anticipate it will find support around the previous monthly highs, keeping prices contained between that level and the anchored VWAP (Volume-Weighted Average Price) from the recent swing high. Once the price advances back up toward this anchored VWAP and experiences a slight pullback, the key will be to break through it. If the stock establishes a pattern of higher highs and higher lows on the 30-minute chart, it would strengthen the bullish outlook.

Vertiv Long at 126.94 - because it's ThanksgivingRationale:

1) My algo's buy signals are 135-0 on it since 2018

2) The average gain is 2.45% in 9 days, with the majority of trades closing in 1 trading day.

3) Its average daily return for me is .27% - almost 7x the average daily return of the S&P

4) NICE uptrend

5) Good support nearby

I rest my case. Argue with me if you must.

Per my usual strategy, once I'm in I'll add at the close on any day it is still oversold and I will use FPC (first profitable close) to exit any lot on the day it closes at any profit.

Happy Thanksgiving to everyone! Hopefully, this will give me even more to be thankful for very soon!

As always - this is intended as "edutainment" and my perspective on what I am or would be doing, not a recommendation for you to buy or sell. Act accordingly and invest at your own risk. DYOR and only make investments that make good financial sense for you in your current situation.

Update: Trade closed $138 $VRTOne of my best performing single name equities of 2024 - $NYSE:VRT. I've closed most of this trade because it has swollen to be a larger portion of my portfolio than was intended, i.e. portfolio rebalancing. I will keep VRT on my watchlist as a new leader in the AI infrastructure category and a YTD leader overall. I will shop for pullbacks to the 18, 21, and even 50 day moving averages, or a new pattern development -- the latter would take at least several weeks from now to form with enough duration for me to be interested.

My goal is to lock in this profit and to not give it back.

$VRT Head and Shoulders Failure Signal Note: I am LONG NYSE:VRT

A Head and Shoulders failure pattern occurs when prices break below the neckline, suggesting a potential reversal to an up-trend; however, the move lower does not gain traction. Instead, prices drift higher until trading above the previously defined Right Shoulder high.

My long entry triggers when price > right shoulder high, which invalidates the bearish setup, and signals a continuation of the up-trend as trapped short sellers are forced to cover. Often times, this amplifies the momentum in the move higher.

Past performance is not indicative of future results. Opinions are not positions, and vice versa.

VRT heads up at $125 then 132: Golden Genesis Fib gave us >50% This is a follow up to my $83.69 Entry Call (click).

VRT launched EXACTLY from our Golden Genesis entry.

We have just hit a local golden for booking 50% profits.

We can look for one more push to next Golden Genesis.

$125.91 is the exact level to book some profits.

$132.49 is the next major target to sell the rest.

$120.96 will serve as a stop loss shield if trailing.

Previous Analysis and Entry Call:

==================================================================

.

VRT pullback from $101 to $87MODs have suggested that I provide more detail about the picks I make.

Sorry. I'm not as verbose as y'all, and I don't like things to be complicated.

My trading plan is very simple.

I buy or sell at top & bottom of parallel channels.

I confirm when price hits Fibonacci levels.

Bonus if a TTM Squeeze in in play.

I hold until target is reached or end of year, when I can book a loss.

So...

Here's why I'm picking this symbol to do the thing.

Price at top or near top of channels (period 100 52 39 & 26)

Stochastic Momentum Index (SMI) at overbought level

TTM Squeeze is off

TTM Squeeze momentum is above former high

VBSM is above former high

Impulse MACD is above former high

Price at near Fibonacci level of $102

In at $101

Target is $87 or channel bottom