West Pharmaceutical Services Inc.The stock is very clear, forming a downward trend that has been tested multiple times. As you can see, the strength of the recent decline is evident. The current price of the stock is $314.5. The sell entry point is at this level. Our first target is a new low below $265, and our second target is a low below $205.

WST trade ideas

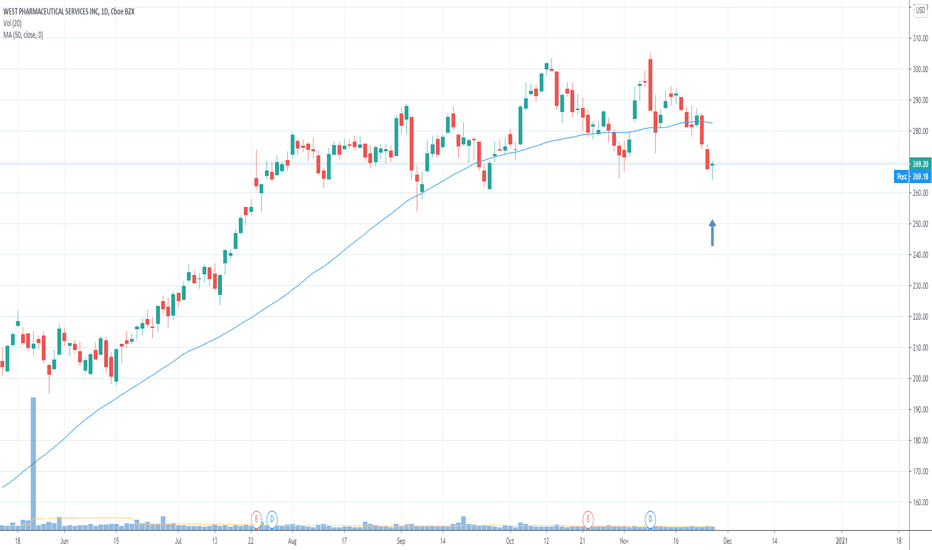

$WST longI've entered a long position in this charts. The reasons for this are the following:

After the low of the 25th July this stock makes contineously higher lows

A few days ago we had a bullish crossover of the SMA 30 and 50

I see the macro situation for US stocks in the following weeks rather bullish (the bullish Q4 is about to begin and the FED has lowered the interest rates)

What could go wrong is that we see another downward move and re-test of the 38.2 % Fibonacci level. Otherwise I see the short-term upward move as more likely.

West Pharmaceutical Services (WST:NYSE) - Impressive PerformanceWest Pharmaceutical Services: Impressive Stock Performance and Positive Indicators

Strong Stock Performance: West Pharmaceutical has demonstrably outperformed the S&P 500 index with a 60% rally since December 2022

Despite fluctuations in the market, West Pharmaceutical Services continues to showcase its financial viability with a remarkable 60% increase in the stock price since December 2022. This substantial growth underscores the company's resilience and attractiveness to investors

Analysing Financial Momentum: Notable positive metrics: Mixed Sales but Strong Contract-Manufactured Revenues and Free Cash Flow

The company's financial momentum reveals a nuanced picture: even with decreased in top-line sales, West Pharmaceutical Services has experienced significant revenue increases through contract-manufacturing and an improvement in their free cash flow. This points to the company’s ability to adapt and capitalize on specific revenue streams, contributing to its overall financial stability.

Demonstrated Value Creation: Building Attractive Shareholder Returns: Compound Value Generation and Promising Technical Indicators

West Pharmaceutical Services has consistently demonstrated its capacity to compound value for shareholders, positioning itself as an appealing investment opportunity. The presence of positive technical indicators further supports the company's potential for future growth, suggesting a promising trajectory in the coming periods.

Conclusion:

Stock prices for West Pharmaceutical Services continues to buck the trend as evidenced by the company’s 60% rally since December 2022 relative to the performance of the S&P 500 during the same period. This demonstrates its market appeal and ongoing resilience for investors. The company's track record of value creation for shareholders and favourable technical indicators makes it a compelling investment choice. Given these factors, it is advisable to revise the recommendation to a "buy" position, with a revised price objective of $428, considering the company's potential for sustained growth and attractive returns.

This content is provided for general information purposes only and is not to be taken as investment advice nor as a recommendation for any security, investment strategy or investment account.

Armónico Bear TrendInteresting stock, Armonic trend, the stock is in obviously bear Market, and it seems will continue in this way. The earnings were below the expectation. The price is continuing its downtrend and the price is using the moving average of the 50 periods as resistance that push down the price. Let's in the coming weeks if the trend will reach the area of attention between levels 152.15 and 119.88.

$WST with a bullish outlook after earnings #StocksThe PEAD projected a bullish outlook for $WST after a positive over reaction following its earnings release placing the stock in Drift B

If you would like to see the Drift for another stock please message us. Also click on the Like Button if this was useful and follow us or join us.

$WST Flagging a Long SetupEarnings out of the way and possibly ready to break higher. Setup could also be viewed as a cup and "high" handle. Either way, worth watching.

West Pharmaceutical Svcs (WST)- DEVELOPS COMPONENTS AND SYSTEMS FOR INJECTABLE DRUG DELIVERY AND PACKAGING FOR HEALTHCARE/CONSUMER PRODUCTS.

WST - Daily PullbackWhat I like:

StochRSI is crossing on daily and moving upward on 2hr

Good, increasing volume on prior wave up

Good block of volume on pullback candles. Expected to help to prevent Stop from being hit

What I don't like:

not a real deep pullback

has already seen a good run up, may be early entry

R: $100

#: 26 shares

E: $300.45

S: $296.54

T: 308.27

West Pharmaceutical Services (WST) needs to hold 21d EMAWST tried to break into new highs, but held back by the volatility of the day. If this holds the 21d EMA, then could be a good aggressive entry point. Keep a stop loss of 9.38% based on the 10d ATR (x2.7) and a position size of R10.67.

Stop Loss: 9.38% (259.67)

Position Size: R10.67

$WST: Weekly trend signal activeWe have a nice signal here in $WST, a trend signal lasting until the 2nd week of October at least, as long as prices hold over the $270 mark. A clear beneficiary of the pandemic, $WST has been growing steadily for a long time, and although overvalued, I think we can squeeze some more upside from the stock before a major top forms.

It will be interesting to see how it acts going into the next quarterly report.

I'm using a proprietary strategy to benefit from these trend signals, you can trade this setup with long stock positions or using options. I'm favoring options for the most part lately, due to the elevated downside risks we have for the time being. I'm skeptical but open to the possibility of a rally peaking by October or EOY, before witneseeing the next large scale correction across most asset classes like we had in February.

Cheers,

Ivan Labrie.

WST:NYSE - WEST PHARMACEUTICAL- Up 100% over last 12 monthsWest Pharmaceutical Services, manufactures and markets pharmaceuticals, biologics, vaccines and other consumer healthcare products. It has had a nice steady run post covid without too much volatility. Seems to have recovered after a recent pullback. Could be worth a watch.