WULF trade ideas

WULF / 4h#TeraWulf has continued to advance >> 54% in April, suggesting that the countertrend rally of Minor degree wave A should be underway.

The price might reach the origin of the ending diagonal wave ((v)) >> 3.52 in the coming days. In which case, the rising tide will be thoroughly revealed in a five-wave impulse and highly confirmed, continuing the NASDAQ:WULF 's advance towards the anticipated Fib-targets >> 4.38 >> 5.23.

#CryptoStocks #WULF #BTCMining #Bitcoin #BTC

WULF / 4h#TeraWulf has continued to advance >> 54% in April so far, which would suggest that

the countertrend rally of Minor degree wave A is underway.

The price might reach the origin of the ending diagonal wave ((v)) >> 3.52. In which case, it will confirm as well continuing the NASDAQ:WULF 's advance towards the anticipated Fib-targets >> 4.38 >> 5.23

#CryptoStocks #WULF #BTCMining #Bitcoin #BTC

WULF / 4h#TeraWulf has developed an A-B-C sequence in wave (W) since mid-November,

So that's just an initial subdivision of the correction in one larger-degree downtrend.

The decline of impulsive wave C should have ended at 2.06, with an expanding diagonal

in its fifth wave. >> A rising tide in a five-wave sequence towards the origin of the ending

diagonal wave ((v)) will highly confirm turning the Minor-degree trend upward.

#CryptoStocks #WULF #BTCMining #Bitcoin #BTC

WULF / 4h#TeraWulf has worked marching in place for two straight days, so there is no change in the overall outlook.

The final decline in the 5th wave of the expanding diagonal wave ((v)) very soon lies ahead >> estimated now 24% .

The ultimate target would be around >> 1.68

#CryptoStocks #WULF #BTCMining #Bitcoin #BTC

WULF / 4h#TeraWulf may have expanded an A-B-C sequence in wave (W) since November, so that's all just an initial subdivision of the correction in one larger-degree downtrend.

And the current decline of impulsive wave C seems to end with an expanding diagonal.

Further decline of 5th wave of C (estimated >> 21%) is expected.

The ultimate target would be around >> 1.68

#CryptoStocks #WULF #BTCMining #Bitcoin #BTC

WULF / 4hAs shown on this 4h-frame, #TeraWulf would continue to retrace slightly higher in the ongoing 4th wave of the expanding diagonal wave ((v)), then the following decline estimated by 28% is expected very soon.

The price volatility will likely range into the Fib-levels >> .

#CryptoStocks #WULF #BTCMining #Bitcoin #BTC

$WULF / 4hThere is no change in the last alternate, #TeraWulf may have expanded an ABC sequence as just the initial subdivision of its correcting down in wave (W). Wave C's decline might be concluded with an expanding diagonal, which its 5th wave decline would lie ahead over the next week.

NASDAQ:WULF >> An ultimate decline of 28% is expected!

#CryptoStocks #WULF #BTCMining #Bitcoin #BTC

$WULF / 4hAs an alternative, #TeraWulf may have expanded an ABC sequence as the initial subdivision of its correcting down in wave (W). Wave C's decline might end with an expanding diagonal as its 5th wave.

NASDAQ:WULF >> An ultimate decline by 28% is expected!

#CryptoStocks #WULF #BTCMining #Bitcoin #BTC

$WULF / 4hThere is no change in my #TeraWulf analysis in this frame. The entire pattern as a leading diagonal in wave (A) should have ended by an expanding diagonal as wave((c)), which seems to have found its extreme point on the extension of the diagonal (A)'s boundary line in a double bottom >> that would be considered as a significant extreme & reversal point.

>> There is no redline for the NASDAQ:WULF 's analysis in my view since the Intermediate degree wave (A) that's expanded in a leading diagonal would be just an initial subdivision of the ongoing correction in one larger degree downward.

The following retracement of 78.6% in a three-wave sequence as a countertrend advance of the same degree wave (B) would lie ahead quite soon.

#CryptoStocks #WULF #BTCMining #Bitcoin #BTC

$WULF / 4h#TeraWulf revealed a three-wave sequence as a final decline in wave (v) of the ending diagonal wave ((c)) this week. The entire pattern as the leading diagonal wave (A) should have ended quite well by an expanding diagonal as wave((c)), which finally seems to have found its extreme point on the diagonal (A)'s boundary line >> 2.26. So, today's low might be quite well respected as a significant extreme & reversal point.

>> There is no redline for the NASDAQ:WULF 's analysis in my view since the Intermediate degree wave (A) that's expanded in a leading diagonal would be considered well as an initial subdivision of an ongoing correction in one larger degree to the downside.

The following retracement of 78.6% in a three-wave sequence as a countertrend advance of the same degree wave (B) would lie ahead soon.

#CryptoStocks #WULF #BTCMining #Bitcoin #BTC

$WULF / 4hEventually All Waves Settle!!

The leading diagonal wave (A) may have ended quite well, by an expanding diagonal as wave((c)), which seems to have found its extreme point very close to the diagonal (A)'s boundary-line at Monday 2.52 low.

The following retracement of 78.6% in a three-wave sequence as a countertrend advance of Intermediate degree wave (B), will be developed quite soon.

#CryptoStocks #WULF #BTCMining #Bitcoin #BTC

$WULF / 4hThe leading diagonal wave (A) that seems to be ending by an expanding diagonal as wave((c)) still remains in its very late stage!

The ongoing wave ((c)) diagonal's 5th wave will be searching for its extreme low likely in the week, and it might reach the diagonal wave (A)'s boundary-line as well.

So, further decline by 13% is expected.

The following retracement of 78.6% in a three-wave sequence as a countertrend advance of Intermediate degree wave (B), soon would lie ahead.

The estimated target >> 2.37 >> extreme low & reversal point

#CryptoStocks #WULF #BTCMining #Bitcoin #BTC

$WULF / 4hTeraWulf 's two straight days market selloff and exceeding the last extreme low(2.90) today, quite well would suggest to morph into an expanding diagonal instead the prior contracting one as wave ((c)) which now still remains in its very late stage. And the entire wave structure implies to further decline by 16% as well.

The estimated target >> 2.44 >> extreme low & reversal point .

The following retracement of 78.6% in a three-wave sequence as a countertrend advance of Intermediate degree wave (B) would likely lie ahead, very soon!

#CryptoStocks #WULF #BTCMining #Bitcoin #BTC

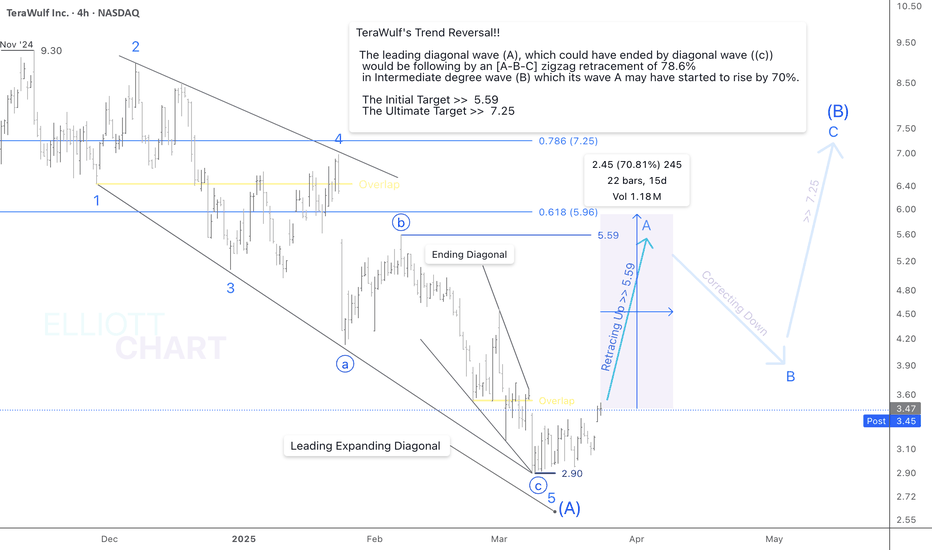

$WULF / 4hTeraWulf's Trend Reversal!!

After marching in place in last couple of the weeks, the NASDAQ:WULF 's trend should have turned to the Upward now.

The following retracement of 78.6% in Intermediate degree wave (B) may have started to advance as well. And now it's expected the countertrend rally by 70% in Minor degree wave A to reach the origin point of the diagonal wave ((c)) at 5.59 over few coming weeks.

The Initial Target >> 5.59

The ultimate target would be around >> 7.25 in few months ahead.

#CryptoStocks #WULF #BTCMining #Bitcoin #BTC

$WULF / 4hTeraWulf has worked marching in place in two straight weeks, while has maintained the price volatility in 16% range above the extreme low pointed at 2.90. And quite stating an Impending Trend Reversal as well!!

So there is no change in the prior outlook on this frame, NASDAQ:WULF should have ended the expanding diagonal as wave (A) by an ending diagonal as the final decline in its wave ((c)) at 2.90. And so, the following retracement of 78.6% in Intermediate degree wave (B) might be starting to advance in coming days.

And technically, it's well expected the countertrend rally by 70% in Minor degree wave A to reach the origin point of the diagonal wave ((c)) at 5.59 in coming weeks.

The ultimate target would be around >> 7.25 in few months ahead.

#CryptoStocks #WULF #BTCMining #Bitcoin #BTC

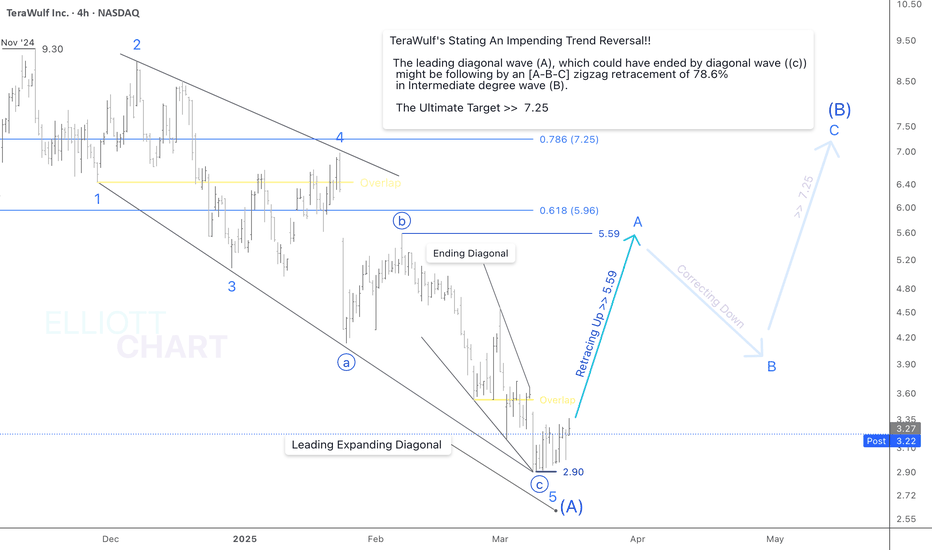

$WULF / 4hTeraWulf's Stating An Impending Trend Reversal!!

As illustrated on the 4h-frame above, NASDAQ:WULF seems to have ended the expanding diagonal as wave (A) by an ending diagonal as the final decline in its wave ((c)) at 2.90. And so, the following retracement of 78.6% in Intermediate degree wave (B) may have started to advance in last week.

Technically, it's now expected the countertrend rally by 70% in Minor degree wave A to reach the origin point of the diagonal wave ((c)) at 5.59 in few weeks ahead.

The ultimate target would be around >> 7.25 in few coming months.

#CryptoStocks #WULF #BTCMining #Bitcoin #BTC

WULF / 4hTeraWulf's Stating An Impending Trend Reversal !!

As illustrated on the 4h-frame above, NASDAQ:WULF seems to have ended the expanding diagonal as wave (A) by an ending diagonal as the final decline in its wave ((c)) at 2.90. And so, the following retracement of 78.6% in Intermediate degree wave (B) may have started to advance in last week.

Technically, it's now expected the countertrend rally by 70% in Minor degree wave A to reach the origin point of the diagonal wave ((c)) at 5.59 in few weeks ahead.

The ultimate target would be around >> 7.25 in few coming months.

#CryptoStocks #WULF #BTCMining #Bitcoin #BTC

$WULF / DailyNASDAQ:WULF may have started a counter-trend rally by 66% at its significant low(3.16) last day.

So after expanding five overlapping wave structure (in Minor degree) to the downward as the leading diagonal wave (A), following the same degree wave (B) in a three-wave retracement of 78.6% would likely lie ahead, and it might be taking time until mid-June.

Currently, NASDAQ:WULF 's rally of Minor degree wave A towards the Fib 0.618 retracement lavel seems to have started as well. The Fib-retracement target >> 6.16

The overall wave structure of retracing up in Intermediate degree wave (B) illustrated well on the daily chart above.

#CryptoStocks #WULF #BTCMining #Bitcoin #BTC