BNBUSDT trade ideas

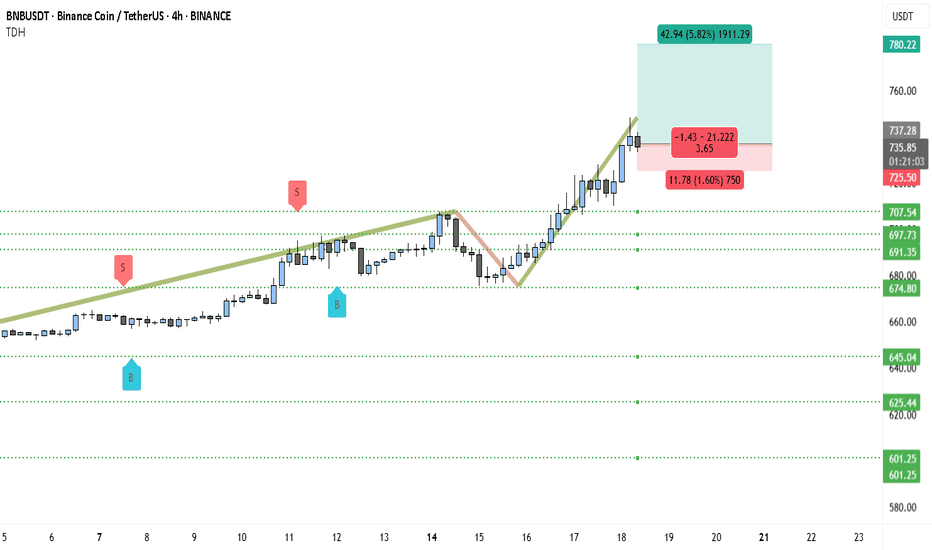

Binance Coin (BNB) to $780? Chart Says 5.8% Rally Incoming!BNBUSDT is currently showcasing a clear bullish structure, supported by consistent demand and a strong breakout beyond previous resistance zones. The price action has steadily evolved into higher highs and higher lows since July 10, confirming bullish market control.

After consolidating around the 707–710 USDT range, the pair decisively broke out, flipping this level into support. The price is now hovering near 736.50 USDT, holding its gains despite brief intraday corrections.

The ascending pattern that started from mid-July saw a short-term dip toward 675 USDT, but strong buying interest quickly stepped in. This bounce marked the formation of a new swing low, followed by a powerful rally above the previous resistance.

The recent long-bodied bullish candles reflect strong momentum and possible accumulation by larger players. Buy and sell signals shown on the chart further validate the demand zone around 674–691 USDT, where bulls aggressively defended support.

The breakout structure is now entering a price discovery phase, with room for a measured move toward the upper resistance near 780 USDT, which is both a psychological round number and the projected Fibonacci extension zone.

________________________________________

📍 Trading Setup (Based on Chart)

• Entry Price: 736.50 USDT (current market price)

• Stop-Loss: 725.00 USDT (just below the recent structure low and horizontal support)

• Take-Profit: 780.22 USDT (Fibonacci target + psychological resistance)

• Risk: 11.78 USDT (~1.60%)

• Reward: 42.94 USDT (~5.82%)

• Risk-Reward Ratio: ~3.65 — favorable for swing-long positions

________________________________________

🧭 Key Zones to Watch

The support zone between 707.54 and 691.35 USDT is now the major demand base. As long as BNBUSDT holds above this area, the bullish thesis remains intact. A retest of this level followed by a bounce would further strengthen the ongoing uptrend.

Immediate resistance is at 737.28 USDT, but the market is attempting to flip this level. If it holds as support on the next retest, upside continuation to 780.22 USDT becomes highly probable.

If bulls fail to defend the 725 USDT level, we could see a deeper retracement toward 707 or 691 USDT, but currently that risk remains low given the strength of the latest breakout.

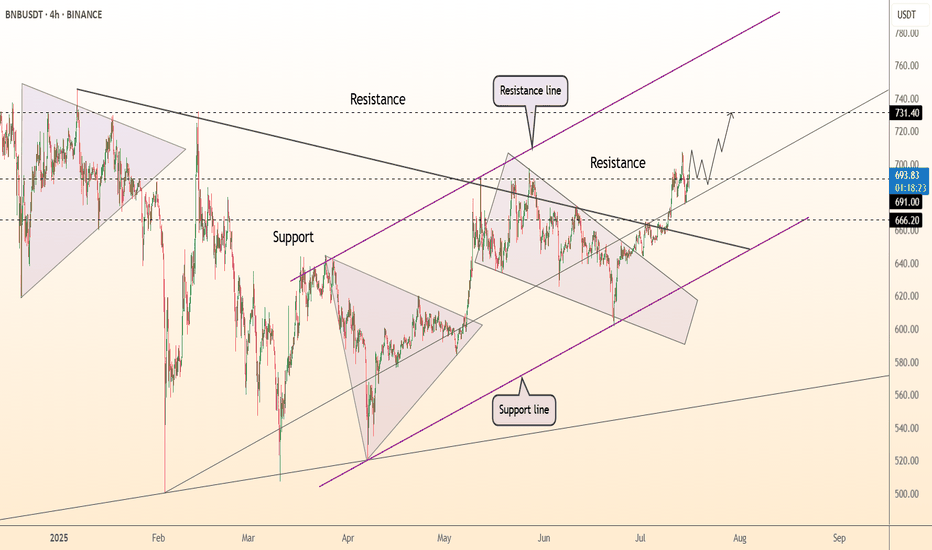

DeGRAM | BNBUSD above the resistance📊 Technical Analysis

● Candle closes have punched through the long-term black resistance and purple trend cap, turning the $666-673 breakout shelf into support as price tracks the grey inner up-sloper inside the rising channel.

● A pennant is coiling just beneath May’s peak; its measured pole and the channel geometry indicate $705 first, then the upper rail / horizontal supply near $731 once $700 gives way.

💡 Fundamental Analysis

● Binance’s 26ᵗʰ quarterly burn, slated for late July, is expected to remove more than 2 M BNB from circulation, reinforcing last week’s TVL uptick and sustaining bid interest .

✨ Summary

Long $666-680; sustained trade above $691 opens $705 → $731. Invalidate on a 4 h close below $641.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

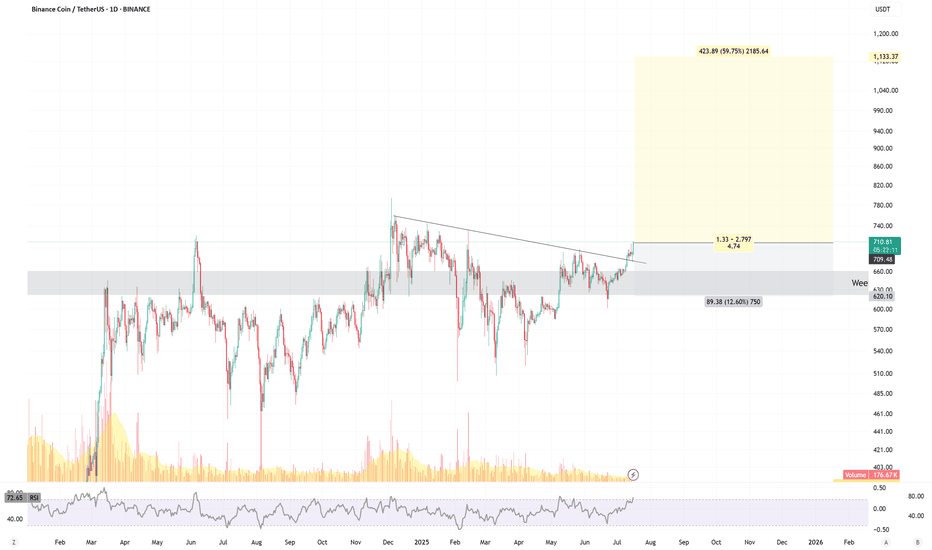

#BNBUSDT: A Major Bull Move Incoming $1000 Target! Binance coin is currently in consolidation phase, with no clear direction of where it will go. We consider two possible areas where it may reverse. Both of these areas have a chance to hit $1000, which we believe the price could head towards once reversed.

If you like our idea, please like and comment!

Good luck and trade safely,

Team Setupsfx_

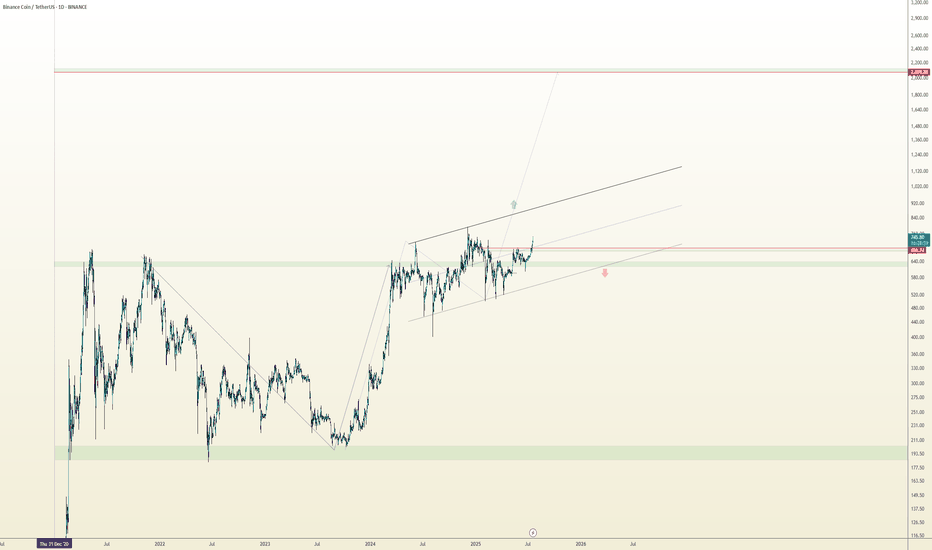

Long BNBBNB has been consolidating above $600-$650 area since March 2024.

BTC dominance continuing to drop is a sign for leading alcoins like BNB to break-out.

Trade setup is as in chart.

Disclaimer:

This analysis is based on my personnal views and is not a financial advice. Risk is under your control.

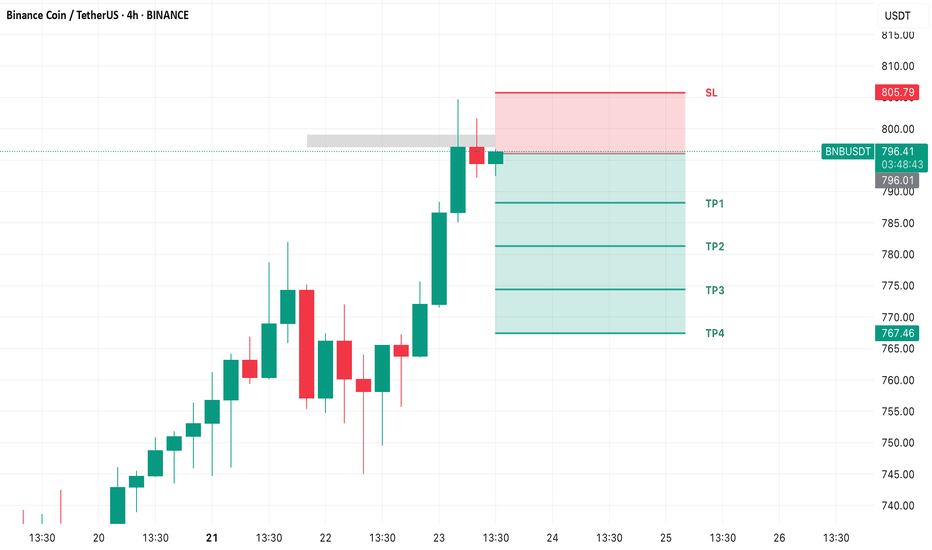

BNBUSDTmy entry on this trade idea is taken from a point of interest below an inducement (X).. I extended my stoploss area to cover for the whole swing as price can target the liquidity there before going as I anticipate.. just a trade idea, not financial advise

Entry; $669.64

Take Profit; $681.96

Stop Loss; $666.11

Perfect Sync: V Reversal Meets Bull Flag

Two clean and classic technical structures:

✅ V-Reversal Formation

✅ Bull Flag – still active and building pressure

After a sharp reversal, the price entered a bullish continuation phase.

Currently moving within the flag structure toward its upper edge.

If we see a breakout to the upside, the move could match the flagpole length, which aligns well with the target from the V-reversal pattern.

📍 Bullish scenario remains valid as long as we stay within structure.

📉 Breakdown below $570 invalidates this setup.

🧠 Important Reminder:

Enter only after a confirmed breakout.

✅ Apply strict risk management

✅ Never risk more than 1% of your capital on a single position.

Everything’s clear. No noise. Just wait for confirmation — let the market come to you.

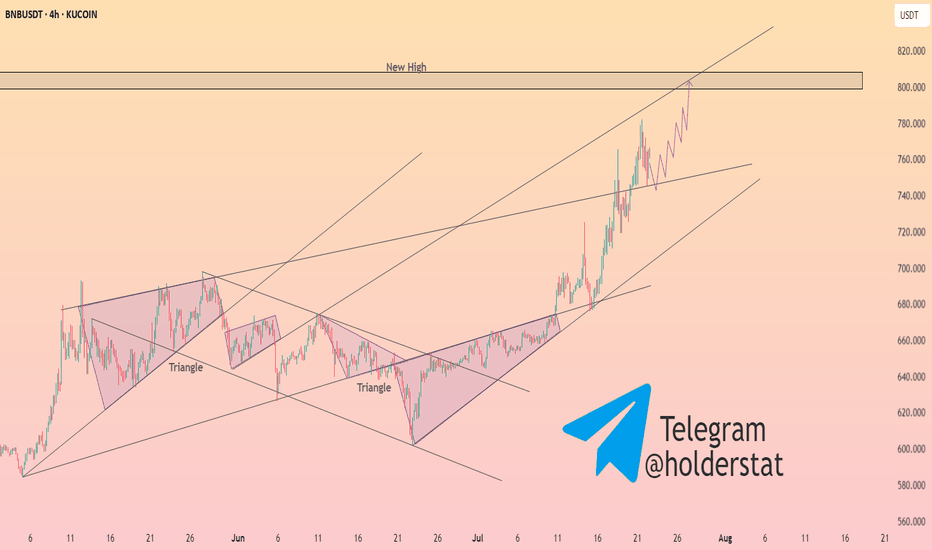

HolderStat┆BNBUSD breakoutBINANCE:BNBUSDT has reclaimed $670 support after breaking out from a long-term falling wedge. The bounce has been strong, and the rising structure now targets the $735–$740 resistance zone. Price action confirms bullish intent with consolidation beneath resistance before breakout.

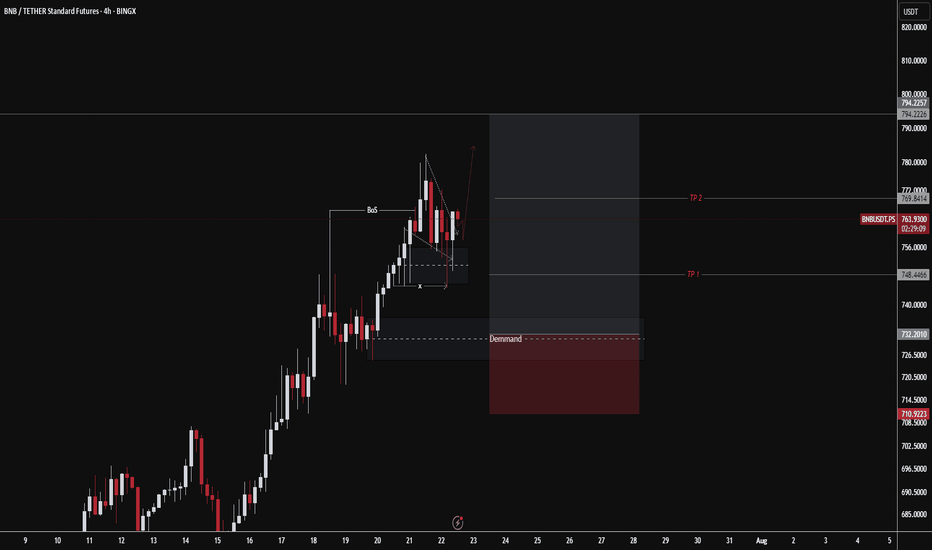

BNB LongI see a buy zone around 735 just after a significant FVG, and moreover, given the overall bullish strength of BNB, the pullback to happen next won't be a deep pullback but rather a light one. Confirming with the Fib retracement tool that zone sits well at the 38% pull back level, which is a good sign of a light bull back to continue the bullish move

#BNB AnalysisThis chart is screaming I want to explode. Very low volume spike indicating accumulation at these levels. Especially at close to previous ATH. Price structure has been respected forming higher high and striving to make lowers not diverging from market structure at the price nears discovery area. The RSI sits at a medium range not close to overbought territory. Has developed a respected rectangle pattern with few retests on previous highs. A fib extension gives a return of a minimum $987, and it can break above that with the structure formation we have. It also sits well above the median yearly average. Until the structure changes bearish, I am long on this with risk to reward ratio, being higher on the upside.

Is BNB About to Explode—or About to Collapse?Yello Paradisers! Could this be the beginning of the next BNB rally, or just another classic trap to liquidate early longs before the real move begins? Let’s dive into this high-probability setup before it’s too late.

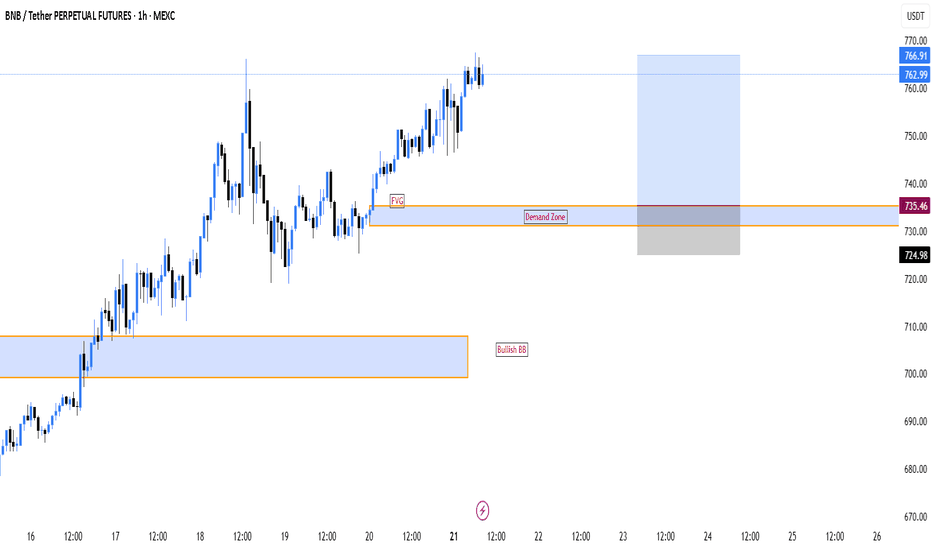

💎BNBUSDT is currently showing good signs of bullish continuation. The price has successfully broken out of a descending channel and performed a precise retest of that structure—an early confirmation of strength. Following this, we’ve seen a strong reaction from a Fair Value Gap (FVG) and the 200 EMA, both of which align perfectly with the inducement taken just before the bounce. This confluence of technical signals significantly increases the probability of a sustained bullish move in the near term.

💎If price pulls back from current levels, it could offer us a more attractive risk-to-reward opportunity for long entries. Traders who are targeting higher RR ratios, such as 1:2 or beyond, may prefer to wait for a deeper pullback into our predefined support zone for a cleaner entry. This zone remains critical for maintaining our bullish bias.

💎However, if the price breaks down and we see a full candle close below that support zone, the entire bullish scenario becomes invalid. In such a case, it would be more prudent to stay on the sidelines and wait for a clearer and more favorable price action setup to emerge before jumping back in.

We are playing it safe right now. If you want to be consistently profitable, you need to be extremely patient and always wait only for the best, highest probability trading opportunities.

MyCryptoParadise

iFeel the success🌴

BNB/USDT – Ascending Triangle Breakout Setuphi traders

The BNB/USDT chart is displaying a classic ascending triangle pattern, which typically signals a potential bullish breakout. This pattern has formed over the past year, characterized by a series of higher lows (shown by the rising red trendline) while repeatedly testing a strong horizontal resistance zone around $690–$730 (highlighted in green).

BNB is currently trading near the upper resistance boundary at $692.85, showing signs of bullish momentum. A successful breakout above the $730 resistance level could confirm the ascending triangle breakout and trigger a strong upside move.

Target & Potential Move:

Breakout target: ~ $950 - $1,000

Measured move: 40% from the breakout point, aligning with the height of the triangle

Summary:

Pattern: Ascending Triangle (bullish)

Breakout Confirmation Level: $730+

Potential Target: $1,000

If the breakout is confirmed with strong volume and momentum, BNB could rally sharply in the coming weeks. Traders should watch for confirmation before entering.

BNB wait for entry

BNB has been consolidating around its current weekly support level for over a year.

Such prolonged consolidation often precedes a significant breakout. Accumulating at this key support zone could present a strong opportunity for long-term positioning.

For short-term trades, it’s best to patiently wait for price to trigger the setup outlined in the chart.

Disclaimer:

This analysis is based on my personnal views and is not a financial advice. Risk is under your control.

DeGRAM | BNBUSD broke the resistance line📊 Technical Analysis

● Breakout: price pierced the purple descending resistance, retested it and the green $641-648 demand cluster, then bounced—confirming the breakout as valid support.

● Rising channel intact; higher-low sequence points to the mid-band confluence at $673. A measured move from the mini flag that is forming inside the channel also projects to $705.

💡 Fundamental Analysis

● Binance’s “Megadrop 2” airdrop locked another 350 k BNB this week while BNB Chain TVL rose 4 %, tightening float and sustaining bid.

✨ Summary

Long $645-655; hold above $641 targets $673 ➜ $705. Invalidate on a 4 h close beneath $604.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

Why Ethereum’s Will 10×🚀 Ethereum’s Next 10×: Why bank-grade adoption + the stable-coin avalanche make a moonshot look conservative

Big banks are building on-chain right now. JPMorgan & Bank of America began 2025 pilots for dollar-backed tokens that settle on Ethereum, while Societe Generale just unveiled its USD CoinVertible stable-coin on main-net.

Stable-coins already move more money than Visa + Mastercard combined. $27.6 trillion flowed through stable-coins in 2024—most of it routed over Ethereum block-space.

Ethereum clears four-fifths of that stable-coin volume. More than 80 % of all stable-coin transactions occur on ETH or its L2s, locking in network effects that rivals can’t match.

ETF wall-of-money is already hitting the gate. 2025 Ethereum ETFs posted a record $743 million month of inflows—the strongest vote of institutional confidence to date.

ETH supply keeps shrinking while demand spikes. Post-Merge burn has removed roughly 332 k ETH, flipping issuance negative; base-line inflation is now < –1.3 %/yr.

30 million ETH is locked in staking, slicing liquid float by 25 %. The yield engine tightens supply just as banks and ETFs need inventory.

Real-world assets are going token-native. Tokenized bond issuance jumped 260 % in 2024 to €3 billion, and virtually every pilot settles on ERC-standards.

Layer-2 roll-ups slashed average gas fees to <$4. Cheaper block-space makes day-to-day payments viable, driving still more stable-coin throughput (and fee burn).

User base is exploding toward mass scale. Active ETH wallets hit 127 million—up 22 % YoY—showing that retail, devs, and institutions are onboarding together.

Energy-efficient PoS removes the last ESG roadblock. With > 99 % less energy use than PoW chains, Ethereum checks the sustainability box that banks and asset managers need for wide-open deployment.

Bottom line: when TradFi giants plug directly into Ethereum rails and stable-coins dwarf legacy payment rails, every transfer torches a little more supply. Add the ETF flywheel and a vanishing float, and a 10× move shifts from “moon-boy” to math.

OTHER EXAMPLES

TSLA

www.tradingview.com

Total 2

www.tradingview.com

MartyBoots here—trading for 17 years, and I would like to hear YOUR take!

👉 Can Ethereum really 10× from here? Drop your best argument below, hit the 👍 if you learned something, and smash that Follow to stay in the loop on every crypto deep-dive I post.

Binance Coin (BNB): Similar Pattern Forming / Liquidity HuntingBNB coin has pretty similar price ation compared to Novemenr 2024 bullish buildup we had. Lately price has been rather trading in a sideways chanel with quite some liqudiity huntings on the way as well.

What we are expecting currently is a further buyside dominance which would lead the price to local high area, from where we might be seeing some strong downard movement and from wher ewe will be trying to catch a short position as well.

P.S. not our favourite coin to trade but scalping is pretty decent on this one tbh.

Swallow Academy