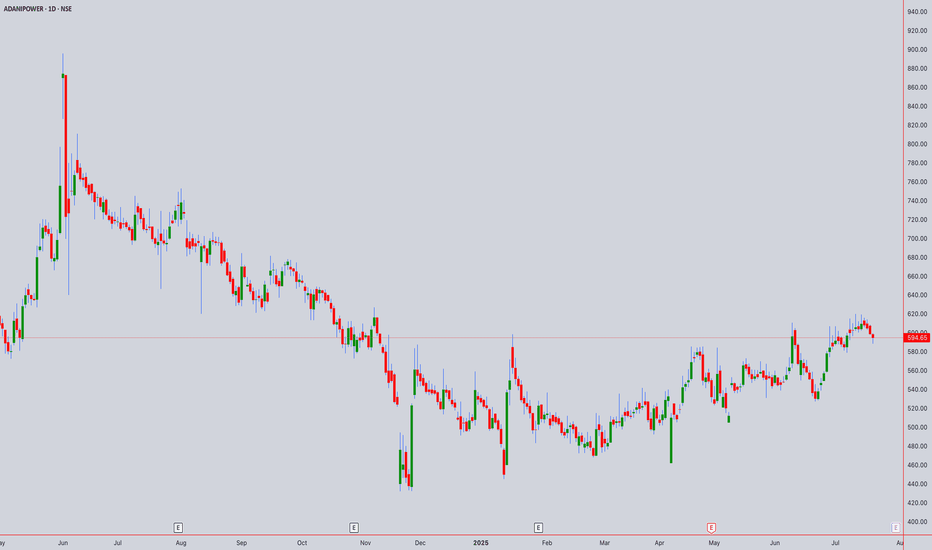

Adani Power (NSE:ADANIPOWER) Technical Analysis July 18th, 2025Current Price : ₹594.65 (as of July 18th, 2025, 02:00PM UTC+4)

Target Price: ₹633.67 (+6.56% upside potential)

Executive Summary

Adani Power is currently showing mixed signals across different timeframes. The stock has broken through key resistance levels but is facing overhead resistance. Multiple technical theories suggest a consolidation phase with potential for upward movement.

1. CANDLESTICK PATTERN ANALYSIS

Intraday Patterns (5M-1H)

Current Formation: Doji/Spinning top patterns indicating indecision

Key Pattern: Inside bar formations suggest consolidation

Volume Profile: Moderate volume with no significant breakout confirmation

Swing Patterns (4H-Weekly)

Primary Pattern: Rectangle/Channel formation identified

Support Zone: ₹513-520 (Strong support)

Resistance Zone: ₹588-600 (Current testing area)

2. HARMONIC PATTERN ANALYSIS

Potential Patterns

ABCD Pattern: Incomplete - monitoring for completion around ₹630-650 zone

Gartley Pattern: Potential bearish setup if rejection occurs at current levels

Fibonacci Levels:

Support: ₹450 (S1), ₹300 (S2), ₹200 (S3)

Resistance: ₹700 (R1), ₹850 (R2), ₹1,000 (R3)

3. ELLIOTT WAVE THEORY

Wave Count Analysis

Primary Wave: Currently in Wave 3 of a larger impulse structure

Sub-wave: Wave 4 correction potentially completing around ₹580-590

Target: Wave 5 projection towards ₹700-750 zone

Invalidation Level: Below ₹513 would negate current count

Time Cycles

Short-term: 5-8 day correction cycle

Medium-term: 21-34 day impulse cycle active

4. WYCKOFF THEORY ANALYSIS

Current Phase Assessment

Phase: Potential Mark-up Phase (Phase D-E transition)

Volume Analysis: Accumulation patterns visible on weekly charts

Smart Money: Institutional interest evident from volume profiles

Composite Operator: Testing supply around ₹600 levels

Key Levels

Spring Test: ₹513 level held as key support

Supply Line: ₹588-600 acting as resistance

Upthrust Potential: Break above ₹605 could trigger mark-up

5. W.D. GANN THEORY ANALYSIS

Square of Nine Analysis

Current Position: 594° on the wheel

Next Resistance: 625° (₹625) - significant Gann angle

Support Level: 576° (₹576) - 45-degree angle support

Cardinal Points: 600° represents a critical decision point

Time Theory

Natural Time Cycles: 90-day cycle completion expected by August 2025

Anniversary Dates: Historical significant dates align with current timeframe

Time Windows: July 25-30, 2025 represents important time cluster

Angle Theory

1x1 Angle: Currently trading above the 1x1 rising angle from ₹513 low

2x1 Angle: Resistance at ₹630 level (steep angle)

Price/Time Squares: Next square at ₹625 (25²)

Forecasting

Price Target: ₹625-650 based on geometric progressions

Time Target: 15-20 trading days for next significant move

Harmony Level: ₹594 is in harmony with previous swing levels

6. ICHIMOKU KINKO HYO ANALYSIS

Cloud (Kumo) Analysis

Current Position: Price trading above the cloud (bullish)

Cloud Thickness: Thin cloud ahead suggests easier breakout potential

Cloud Color: Green cloud in coming periods (bullish bias)

Line Analysis

Tenkan-sen (9): ₹587 - price above (bullish)

Kijun-sen (26): ₹571 - price above (strong bullish)

Chikou Span: Clear of price action (no interference)

Senkou Span A: ₹579 (support)

Senkou Span B: ₹562 (key support)

7. TECHNICAL INDICATORS

RSI Analysis

Current RSI: 58-62 range (neutral to slightly bullish)

Divergence: No major divergences detected

Overbought/Oversold: Not in extreme zones

Bollinger Bands

Position: Price in upper half of bands

Squeeze: Bands expanding, indicating increased volatility

Signal: Potential for continued upward movement

VWAP Analysis

Daily VWAP: ₹591 (price above - bullish)

Weekly VWAP: ₹584 (strong support)

Volume Profile: Heavy volume around ₹570-580 zone

Moving Averages

SMA 20: ₹583 (bullish crossover)

EMA 20: ₹586 (price above)

SMA 50: ₹567 (strong support)

EMA 50: ₹569 (upward sloping)

SMA 200: ₹524 (long-term bull market)

8. MULTI-TIMEFRAME ANALYSIS

Intraday Timeframes

5-Minute Chart

Trend: Sideways with bullish bias

Key Level: ₹592-596 range bound

Signal: Wait for breakout above ₹600

15-Minute Chart

Trend: Consolidating triangle pattern

Volume: Decreasing (typical in consolidation)

Target: ₹605-610 on upside breakout

30-Minute Chart

Trend: Higher highs and higher lows intact

Support: ₹590-592

Resistance: ₹598-602

1-Hour Chart

Trend: Bullish flag pattern forming

Breakout Level: Above ₹602

Target: ₹625-630

4-Hour Chart

Trend: Strong uptrend since ₹513 low

Pattern: Bull flag consolidation

Key Level: ₹588 as crucial support

Swing Timeframes

Daily Chart

Trend: Primary uptrend intact

Pattern: Rectangle between ₹513-588 broken upside

Target: Next resistance at ₹700 zone

Weekly Chart

Trend: Long-term bullish structure

Support: ₹450-500 major support zone

Resistance: ₹700-750 target area

Monthly Chart

Trend: Recovery from major lows

Long-term View: Potential for ₹850+ targets

Time Horizon: 6-12 months for major targets

9. FORECAST & OUTLOOK

Intraday Forecast (Next 1-5 Days)

Bias: Neutral to Bullish

Range: ₹585-610

Breakout Level: Above ₹605 for ₹625 target

Stop Loss: Below ₹582

Swing Forecast (Next 2-8 Weeks)

Primary Target: ₹633-650

Secondary Target: ₹700-720

Support Zone: ₹570-580

Risk Level: Medium (volatility expected)

Key Risk Factors

Overall market sentiment and Adani group developments

Earnings disappointment (recent -23.91% surprise noted)

Broader power sector dynamics

Regulatory changes in power sector

Trading Strategy Recommendations

For Intraday Traders

Buy: Above ₹602 with ₹610-615 target

Sell: Below ₹590 with ₹582-585 target

Risk Management: 1-2% position sizing

For Swing Traders

Accumulate: ₹580-590 zone

Target: ₹633-650 (first target)

Stop Loss: Below ₹570 (daily close basis)

Time Horizon: 4-8 weeks

Confluence Factors Supporting Bullish View

Multiple theories align for ₹625-650 targets

Strong volume accumulation patterns

Technical breakout from rectangle formation

Ichimoku cloud support

Gann squares and angles alignment

Warning Signals to Watch

Daily close below ₹580

RSI divergence formation

Volume decrease on any upward moves

Broader market weakness

Disclaimer: This analysis is for educational purposes only. Always consult with financial advisors and conduct your own research before making investment decisions. Past performance does not guarantee future results.

ADANIPOWER trade ideas

ADANI Power: From Buy to Sell and from Sell to BuyADANI Power: From Buy to Sell and from Sell to Buy. What a strange movement .

610 is a first resistance level to test.

( Not a Buy / Sell Recommendation

Do your own due diligence ,Market is subject to risks, This is my own view and for learning only .)

Adani PowerMost stable Adani Stock devout of any drama.

has a low beta of 1.5

PER of 21

DY of 0.5%

Highest qtr Revenue of Rs 14200 cr

Qtr results were the worst in 3 years !

Annual income of Rs 10,000 cr

Technically in a 45% degree upslope since 2020

At CMP of Rs 550, it could just burst out to another level.

Has been on a consolidating mode for one year now.

ADANI POWER✅ Trade Setup

Parameter Value

Trade Direction BUY

Entry-1 ₹546

Stop Loss (SL) ₹417

Risk ₹129

Reward ₹462

Target ₹1008

Risk-Reward (RR) 3.6

Last Swing High ₹895

Last Swing Low ₹433

🧠 Logic & Key Takeaways

Trend Consistency: All timeframes from yearly to 60M are aligned in an uptrend, adding strong confluence to the buy setup.

Demand Zones: Multiple demand zones lie between ₹410–₹445, acting as a strong cushion. SL at ₹417 is just below key daily/weekly zones.

Entry vs ITF Demand: Entry at ₹546 is exactly in the intraday demand zone, providing a low-risk opportunity.

Target & RR: Ambitious target of ₹1008 aligns with macro bullish momentum. RR of 3.6 is excellent.

📌 Verdict:

✅ High-conviction BUY plan with full time-frame alignment and healthy risk-reward.

📍 Manage position sizing carefully due to the ₹129 risk and keep trailing SL as it breaks above ₹895.

🔍 Multi-Timeframe (MTF) & High Timeframe (HTF) Analysis Summary

Timeframe Trend Demand Zone Type Proximal Distal Avg

Yearly UP BUFL 167 132 150

Half-Yearly UP BUFL 432.5 432 432

Quarterly UP BUFL 432.5 410 421

Monthly UP Rally Rally 471 358 415

Weekly UP Rally Rally 410 380 395

Daily UP DMIP Support 454 417 436

Intraday (ITF 60-240m) UP BUFL 546 537 541.5

📊 Averages Overview

Timeframe Group Trend Avg Proximal Avg Distal Avg of Averages

HTF Avg UP 344 325 334

MTF Avg UP 445 385 415

ITF Avg UP 546 537 541.5

⚠️ Risks / Considerations

Entry at ₹546 is relatively high compared to MTF average (~₹415) — monitor closely for any breakdown below ₹537, which could invalidate short-term demand.

Strong reaction near last high ₹895 could slow momentum—watch for rejection near this zone.

Ensure volumes support the bullish breakout post-entry.

ADANI PORTS FOR YOU - Entry Initiated."Everything is pretty much explained in the picture itself.

I am Abhishek Srivastava | SEBI-Certified Research and Equity Derivative Analyst from Delhi with 4+ years of experience.

I focus on simplifying equity markets through technical analysis. On Trading View, I share easy-to-understand insights to help traders and investors make better decisions.

Kindly check my older shared stock results on my profile to make a firm decision to invest in this.

For any query kindly dm.

Thank you and invest wisely. "

ADANI POWER LTD S/RSupport and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (red line/shade) are where upward trends might stall due to increased selling interest. They act like a ceiling where sellers come in to push prices down.

Breakouts:

Bullish Breakout: When the price moves above resistance, it often indicates strong buying interest and the potential for a continued uptrend. Traders may view this as a signal to buy or hold.

Bearish Breakout: When the price falls below support, it can signal strong selling interest and the potential for a continued downtrend. Traders might see this as a cue to sell or avoid buying.

MA Ribbon (EMA 20, EMA 50, EMA 100, EMA 200) :

Above EMA: If the stock price is above the EMA, it suggests a potential uptrend or bullish momentum.

Below EMA: If the stock price is below the EMA, it indicates a potential downtrend or bearish momentum.

Trendline: A trendline is a straight line drawn on a chart to represent the general direction of a data point set.

Uptrend Line: Drawn by connecting the lows in an upward trend. Indicates that the price is moving higher over time. Acts as a support level, where prices tend to bounce upward.

Downtrend Line: Drawn by connecting the highs in a downward trend. Indicates that the price is moving lower over time. It acts as a resistance level, where prices tend to drop.

Disclaimer:

I am not a SEBI registered. The information provided here is for learning purposes only and should not be interpreted as financial advice. Consider the broader market context and consult with a qualified financial advisor before making investment decisions.

Short trade on Adani power in break from supportAdani Power: Weak momentum and bearish signals. Short-term bearish bias, potential targets: 510.50 and 450.30. Protect downside with a stop-loss above 532.00.

Key Points:

Clear and concise: The prompts are direct and easy to understand.

Engaging: They highlight the potential for a short-term bearish move.

Actionable: They provide clear entry points and stop-loss levels.

Risk management: The importance of a stop-loss is emphasized.

Remember: These are just trade ideas based on the provided chart. It's important to conduct your own research and analysis before making any investment decisions.

Adani Power at SupportThe strongest Adani Group company with sound financials and comfortably manageable debt along with sound current ratio.

Stock P/E - 14.8

ROCE 5Yr - 16.6 %

ROE 5Yr - 39.2 %

Debt to equity - 0.80

Current ratio - 1.60

The technical chart pattern suggest an entry.

Note: The idea is intended to spread awareness regarding the ratios that you should consider before investing and the chart reading done.

Any financial commitment will solely be your risk and should be done after thorough research.

ADANI POWERADANI POWER – CMP 670.20 as on EOD 2 sep 2024

RSI breakout has taken place.

Stock has seen upsurge with sizeable volumes exactly from oversold region of RSI.

Same zone is also a good demand zone.

Now need to see if Adani power has the strength to cross the downward trendline and breach 700 levels to reach 740 / 800 / 870 levels and above.

Disclaimer –

I am not a SEBI REGISTERED person or analyst.

I am not responsible for anyone’s gains or losses.

I am doing this only to increase my knowledge and to learn.

Adani Power Price Action PredictionAs my analysis NSE:ADANIPOWER is now ready to move for upside. Breakout of 30 mins candle will decide to take decision to take risk for buy side.

Note: This is my personal analysis, only to learn stock market behavior. Kindly do your own analysis/research to take any trade. Thanks & Regards

ADANIPOWER LONGBeautiful Setup. Keep an eye on it.

Flag Pattern visible.

Breakout expected.

Good for Short Term.

Disclaimer : This is not a Buy or Sell recommendation. I am not SEBI Registered. Please consult your financial advisor before making any investments . This is for Educational purpose only.

MACD Crossover Swing Trade📊 Script: ADANIPOWER

📊 Sector: Power Generation & Distribution

📊 Industry: Power Generation And Supply

⏱️ C.M.P 📑💰- 628

🟢 Target 🎯🏆 - 668

⚠️ Stoploss ☠️🚫 - 611

📊 Script: HUDCO

📊 Sector: Finance

📊 Industry: Finance - Housing

⏱️ C.M.P 📑💰- 233

🟢 Target 🎯🏆 - 246

⚠️ Stoploss ☠️🚫 - 228

📊 Script: JSWINFRA

📊 Sector: Marine Port & Services

📊 Industry: Miscellaneous

⏱️ C.M.P 📑💰- 259

🟢 Target 🎯🏆 - 278

⚠️ Stoploss ☠️🚫 - 250

📊 Script: METROBRAND

📊 Sector: Leather

📊 Industry: Leather / Leather Products

⏱️ C.M.P 📑💰- 1081

🟢 Target 🎯🏆 - 1153

⚠️ Stoploss ☠️🚫 - 1044

📊 Script: HBLPOWER

📊 Sector: Auto Ancillaries

📊 Industry: Auto Ancillaries

⏱️ C.M.P 📑💰- 521

🟢 Target 🎯🏆 - 559

⚠️ Stoploss ☠️🚫 - 504

⚠️ Important: Always maintain your Risk & Reward Ratio.

✅Like and follow to never miss a new idea!✅

Disclaimer: I am not SEBI Registered Advisor. My posts are purely for training and educational purposes.

Eat🍜 Sleep😴 TradingView📈 Repeat 🔁

Happy learning with trading. Cheers!🥂

ADANI POWER - Swing TRADE IdeaThe stock is in uptrend in all Higher time frames.

The stock has been in good consolidation for 12 weeks.

Downside wicks in the last 3 weeks indicate good buying coming in.

The last week candle seems to be an indecision candle post diminishing selling pressure and buying stepping in.

The lower time frame price actions such as Daily and 75 mins confirm the upside price momentum.

My SL and targets as mentioned in chart. I would plan a wide SL of 12% and target of 22% trailing. Target 1 - 591 ALL Time high.