AEGISLOG - Aegis Logistics Ltd. (45 minutes chart, NSE) - LongAEGISLOG - Aegis Logistics Ltd. (45 minutes chart, NSE) - Long Position; short-term swing research idea.

Risk assessment: High {volatility risk}

Risk/Reward ratio ~ 2.63

Current Market Price (CMP) ~ 880

Entry limit ~ 870 to 860 (Avg. - 865) on May 22, 2025

1. Target limit ~ 890 (+2.89%; +25 points)

2. Target limit ~ 915 (+5.78%; +50 points)

Stop order limit ~ 846 (-2.20%; -19 points)

Disclaimer: Investments in securities markets are subject to market risks. All information presented in this group is strictly for reference and personal study purposes only and is not a recommendation and/or a solicitation to act upon under any interpretation of the letter.

LEGEND:

{curly brackets} = observation notes

= important updates

(parentheses) = information details

~ tilde/approximation = variable value

-hyphen = fixed value

AEGISLOG trade ideas

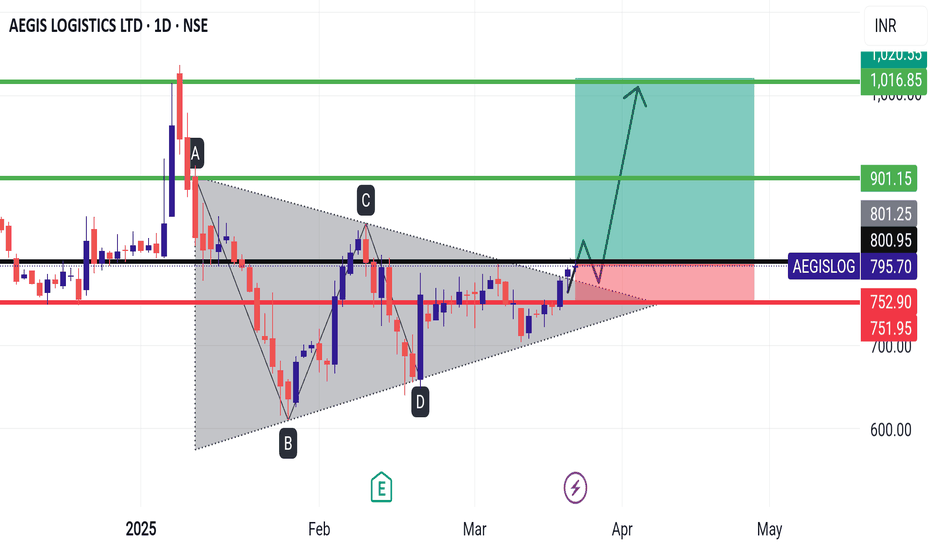

Flag & Pole breakoutThis stock exhibited highly volatile movements this week, accompanied by remarkable volumes. It attempted to break out above its previous high of ₹970 but failed.

The subsequent correction occurred on low volumes.

A POM is scheduled for January 12th, suggesting the possibility of significant news.

An inverted hammer candlestick has formed, indicating an excellent risk-to-reward opportunity. The support level can serve as the stop loss.

The stock should be analyzed primarily on the weekly timeframe, as charts on other timeframes, including the daily, are extremely noisy. The weekly chart, on the other hand, is clear and well-structured.

Aegis Logistics: Prepping for a Small Rounding Bottom Breakout!🚀 Aegis Logistics: Prepping for a Small Rounding Bottom Breakout! 🚀

Current Market Price: 850

Stop Loss: 780

Targets: 925, 970, 1070

Aegis Logistics is showing signs of a potential small rounding bottom breakout. A confirmation above 925 could set the stage for further upside. Given the stock's volatility and scrutiny, a staggered approach to positioning is recommended for risk management.

📈 Strategy:

Monitor for confirmation above 925 for stronger conviction.

Add positions cautiously, considering the market's volatility.

📉 Disclaimer: As a non-SEBI registered analyst, I recommend conducting thorough research or seeking advice from financial professionals before making investment decisions.

#AegisLogistics #TechnicalAnalysis #RoundingBottom #BreakoutStrategy #MarketOpportunities

Breakout after long consolidationDouble digit ROE and ROCE

Debt to Equity ~1

PEG Ratio a little higher than 2

EPS continuously increasing

FII stake increased

DII presence

Technical: After a strong bull run the stock went into sidewise consolidation forming a triangle pattern. Currently the volumes are the highest ever clearly showing the buying pressure by institutions.

Note: Only analysis not a buy/sell recommendation.

Aegis Logistics looks good on chart now 907 Hello Investors,

Aegis Logistics 📊 looks very promising (not a promise) as two chart patterns coincide each other.

Now 907 go long for expected return as flag pole and head & shoulder both sink in together.

short term holding can give good return if market condition and sector performance support the chart pattern. Long term has bigger target's based on quarterly results.

Some news flow and global markets are unstable so keep in mind as sector may get impact due to business parameters.

AEGIS LOGISTICS LTD S/RSupport and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (red line/shade) are where upward trends might stall due to increased selling interest. They act like a ceiling where sellers come in to push prices down.

Breakouts:

Bullish Breakout: When the price moves above resistance, it often indicates strong buying interest and the potential for a continued uptrend. Traders may view this as a signal to buy or hold.

Bearish Breakout: When the price falls below support, it can signal strong selling interest and the potential for a continued downtrend. Traders might see this as a cue to sell or avoid buying.

20 EMA (Exponential Moving Average):

Above 20 EMA(50 EMA): If the stock price is above the 20 EMA, it suggests a potential uptrend or bullish momentum.

Below 20 EMA: If the stock price is below the 20 EMA, it indicates a potential downtrend or bearish momentum.

Trendline: A trendline is a straight line drawn on a chart to represent the general direction of a data point set.

Uptrend Line: Drawn by connecting the lows in an upward trend. Indicates that the price is moving higher over time. Acts as a support level, where prices tend to bounce upward.

Downtrend Line: Drawn by connecting the highs in a downward trend. Indicates that the price is moving lower over time. It acts as a resistance level, where prices tend to drop.

RSI: RSI readings greater than the 70 level are overbought territory, and RSI readings lower than the 30 level are considered oversold territory.

Combining RSI with Support and Resistance:

Support Level: This is a price level where a stock tends to find buying interest, preventing it from falling further. If RSI is showing an oversold condition (below 30) and the price is near or at a strong support level, it could be a good buy signal.

Resistance Level: This is a price level where a stock tends to find selling interest, preventing it from rising further. If RSI is showing an overbought condition (above 70) and the price is near or at a strong resistance level, it could be a signal to sell or short the asset.

Disclaimer:

I am not a SEBI registered. The information provided here is for learning purposes only and should not be interpreted as financial advice. Consider the broader market context and consult with a qualified financial advisor before making investment decisions.