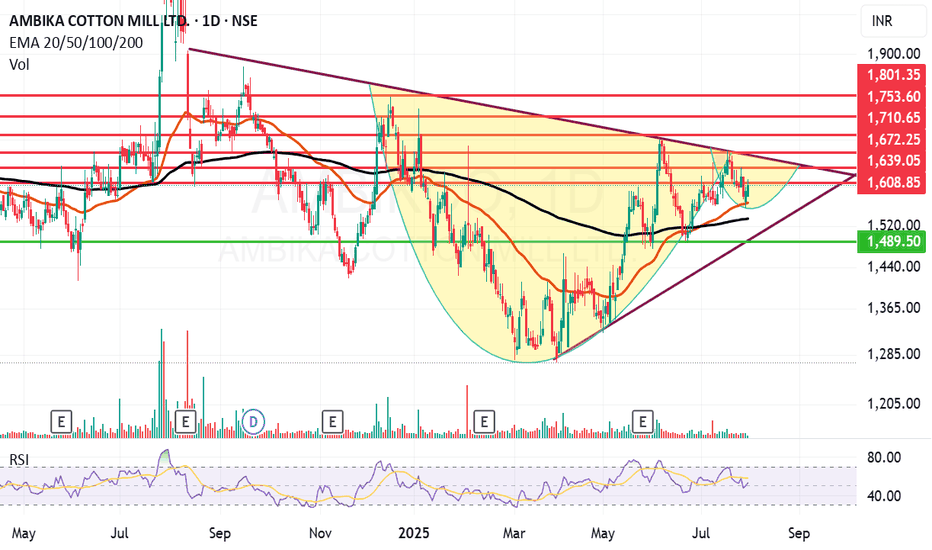

Ambika Cotton looking ambitious on the charts and fundamentally.Ambika Cotton Mills Ltd. engages in the provision of manufacturing and selling of cotton yarn catering to the needs of manufacturers of premium branded shirts and t-shirts.

Ambika Cotton Mills Ltd. Closing price is 1603.20 Dividend Yield @CMP = 2.35%. The positive aspects of the company are attrac

114.85 INR

657.40 M INR

7.02 B INR

2.76 M

About AMBIKA COTTON MILL LTD.

Sector

Industry

CEO

Puthan Veedu Chandran

Website

Headquarters

Coimbatore

Founded

1988

ISIN

INE540G01014

FIGI

BBG000H9ZB35

Ambika Cotton Mills Ltd. engages in the provision of manufacturing and selling of cotton yarn catering to the needs of manufacturers of premium branded shirts and t-shirts. The company was founded on October 6, 1988 and is headquartered in Coimbatore, India.

Related stocks

Ambika Cotton Looking strong on weekly chart. Ambika Cotton Mills Ltd. engages in the provision of manufacturing and selling of cotton yarn catering to the needs of manufacturers of premium branded shirts and t-shirts.

Ambika Cotton Mills Ltd. CMP is 1581.05. The Positive aspects of the company are Attractive Valuation (P.E. = 14), Company wi

AMBIKACO: Favourable Risk RewardGood Risk Reward around 1500

Momentum above 1870

Very well managed company, could be a beneficiary of the upcoming export target laid by GOI for the textile sector.

Watchout for the increasing trend in inventory build-up (concerning), which should reduce over the coming quarters translating to hig

Ambika Cotton Looking strong AgainAmbika Cotton Mills Limited (ACML) based out of Coimbatore in Southern India, is engaged in the manufacture of premium quality Compact and Elitist cotton yarn for hosiery and weaving. Ambika Cotton is an established player in the international and domestic yarn market with exports constituting rough

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of AMBIKCO is 1,500.15 INR — it has decreased by −4.30% in the past 24 hours. Watch AMBIKA COTTON MILLS LTD. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BSE exchange AMBIKA COTTON MILLS LTD. stocks are traded under the ticker AMBIKCO.

AMBIKCO stock has fallen by −6.88% compared to the previous week, the month change is a −5.71% fall, over the last year AMBIKA COTTON MILLS LTD. has showed a −31.19% decrease.

AMBIKCO reached its all-time high on Feb 7, 2022 with the price of 2,829.00 INR, and its all-time low was 32.40 INR and was reached on Jul 12, 2004. View more price dynamics on AMBIKCO chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

AMBIKCO stock is 5.06% volatile and has beta coefficient of 0.88. Track AMBIKA COTTON MILLS LTD. stock price on the chart and check out the list of the most volatile stocks — is AMBIKA COTTON MILLS LTD. there?

Today AMBIKA COTTON MILLS LTD. has the market capitalization of 8.59 B, it has increased by 5.07% over the last week.

Yes, you can track AMBIKA COTTON MILLS LTD. financials in yearly and quarterly reports right on TradingView.

AMBIKCO net income for the last quarter is 158.60 M INR, while the quarter before that showed 142.80 M INR of net income which accounts for 11.06% change. Track more AMBIKA COTTON MILLS LTD. financial stats to get the full picture.

Yes, AMBIKCO dividends are paid annually. The last dividend per share was 35.00 INR. As of today, Dividend Yield (TTM)% is 2.33%. Tracking AMBIKA COTTON MILLS LTD. dividends might help you take more informed decisions.

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. AMBIKA COTTON MILLS LTD. EBITDA is 1.03 B INR, and current EBITDA margin is 14.72%. See more stats in AMBIKA COTTON MILLS LTD. financial statements.

Like other stocks, AMBIKCO shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade AMBIKA COTTON MILLS LTD. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So AMBIKA COTTON MILLS LTD. technincal analysis shows the strong sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating AMBIKA COTTON MILLS LTD. stock shows the sell signal. See more of AMBIKA COTTON MILLS LTD. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.