Ambika Cotton looking ambitious on the charts and fundamentally.Ambika Cotton Mills Ltd. engages in the provision of manufacturing and selling of cotton yarn catering to the needs of manufacturers of premium branded shirts and t-shirts.

Ambika Cotton Mills Ltd. Closing price is 1603.20 Dividend Yield @CMP = 2.35%. The positive aspects of the company are attractive Valuation (P.E. = 13.9), Stocks Outperforming their Industry Price Change in the Quarter, Companies with Zero Promoter Pledge, Companies with Low Debt, Rising Net Cash Flow and Cash from Operating activity and FII / FPI or Institutions increasing their shareholding. The Negative aspects of the company are Increasing Trend in Non-Core Income, Fall in Quarterly Revenue and Net Profit (YoY) and Companies with growing costs YoY for long term projects.

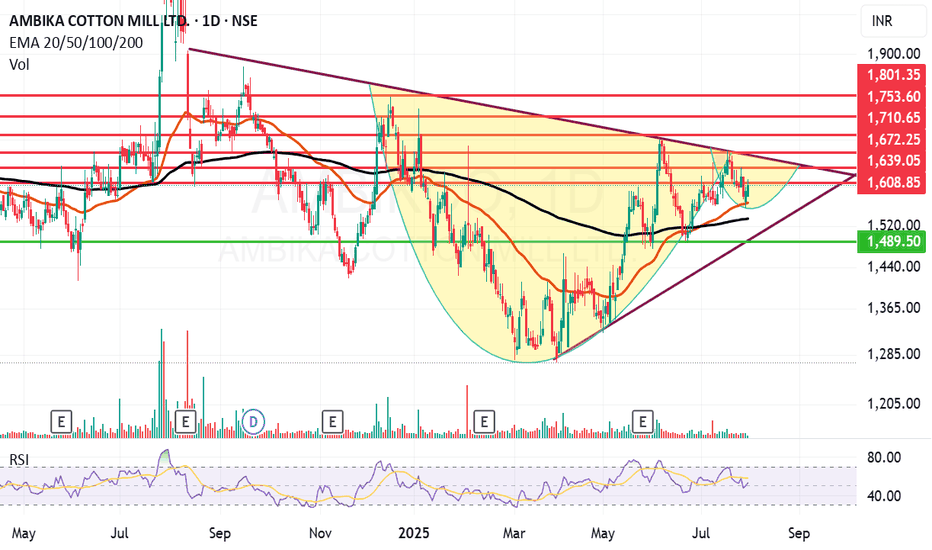

Entry can be taken after closing above 1609 Historical Resistance in the stock will be 1631, 1672 and 1710. PEAK Historic Resistance in the stock will be 1753 and 1801. Stop loss in the stock should be maintained at Closing below 1533 or 1489 depending upon your risk taking ability.

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock or index. The Techno-Funda analysis is based on data that is more than 3 months old. Supports and Resistances are determined by historic past peaks and Valley in the chart. Many other indicators and patterns like EMA, RSI, MACD, Volumes, Fibonacci, parallel channel etc. use historic data which is 3 months or older cyclical points. There is no guarantee they will work in future as markets are highly volatile and swings in prices are also due to macro and micro factors based on actions taken by the company as well as region and global events. Equity investment is subject to risks. I or my clients or family members might have positions in the stocks that we mention in our educational posts. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message. Do consult your investment advisor before taking any financial decisions. Stop losses should be an important part of any investment in equity.

AMBIKCO trade ideas

Ambika Cotton Looking strong on weekly chart. Ambika Cotton Mills Ltd. engages in the provision of manufacturing and selling of cotton yarn catering to the needs of manufacturers of premium branded shirts and t-shirts.

Ambika Cotton Mills Ltd. CMP is 1581.05. The Positive aspects of the company are Attractive Valuation (P.E. = 14), Company with Zero Promoter Pledge, Company with Low Debt and FII / FPI or Institutions increasing their shareholding. The Negative aspects of the company are Increasing Trend in Non-Core Income, Stocks Underperforming their Industry Price Change in the Quarter, and Annual net profit declining for last 2 years.

Entry can be taken after closing above 1589 and compounding above 1630 closing. Targets in the stock will be 1714 and 1760. The long-term target in the stock will be 1868 and 1906+. Stop loss in the stock should be maintained at Closing below 1467 or 1382 depending on your risk taking ability.

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock or index. We do not guarantee any success in highly volatile market or otherwise. Stock market investment is subject to market risks which include global and regional risks. I or my clients might have positions in the stocks that we mention in our posts. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message. Do consult your investment advisor before taking any financial decisions. Stop losses should be an important part of any investment in equity.

AMBIKACO: Favourable Risk RewardGood Risk Reward around 1500

Momentum above 1870

Very well managed company, could be a beneficiary of the upcoming export target laid by GOI for the textile sector.

Watchout for the increasing trend in inventory build-up (concerning), which should reduce over the coming quarters translating to higher sales growth. What would the company do w.r.t the cash they receive would throw more light on the future growth rate of the company.

Ambika Cotton Looking strong AgainAmbika Cotton Mills Limited (ACML) based out of Coimbatore in Southern India, is engaged in the manufacture of premium quality Compact and Elitist cotton yarn for hosiery and weaving. Ambika Cotton is an established player in the international and domestic yarn market with exports constituting roughly sixty percent of its revenues. CMP of the stock is 1600.

Entry after closing above 1602. Targets in the stock will be 1643 and 1676. Long term targets in the stock will be 1700+. Stop loss in the stock should be maintained at closing below 1488.

The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message.

Ambika Cotton Mills LtdClear Breakout - Target and SL given in chart

Market Cap

₹ 958 Cr.

Current Price

₹ 1,675

High / Low

₹ 1,888 / 1,310

Stock P/E

8.56

Book Value

₹ 1,426

Dividend Yield

2.09 %

ROCE

20.6 %

ROE

14.5 %

Face Value

₹ 10.0

Promoter holding

50.2 %

EPS last year

₹ 195

EPS latest quarter

₹ 31.7

Debt

₹ 0.00 Cr.

Pledged percentage

0.00 %

Net CF

₹ -110 Cr.

Price to Cash Flow

-12.0

Free Cash Flow

₹ -97.6 Cr.

Debt to equity

0.00

OPM last year

20.6 %

OPM 5Year

21.8 %

Reserves

₹ 811 Cr.

Price to book value

1.17

Int Coverage

24.8

PEG Ratio

0.66

Ambika Cotton 👚 - Result pop and long way to go from here?NSE:AMBIKCO

I am sharing my view on Ambika cotton previously several times -

from Rs1200.00 - stock is now poised for strong upside of above Rs 2200

Results that has come for this share has been exceptional

In the video I am sharing the technical and fundamental -result for 31 / 12 /2021

Disc: Invested , do you due diligence and research before taking action.

AMBIKA COTTON LOOKING GOODVIEW : -

POSITIVE

DISCLOSURE

This is only for educational purpose

This is not a recommendation

I am not SEBI registered

Do not TRADE/INVEST basis what I publish here

I am not responsible for your loss or gain

It is prudent to assume that I have ulterior motives in publishing this Idea

I and my clients might or might not have a position, I and my clients might or might not have a opposite position