APOLLO TYRES ---Ready to Fire UP ? Elliot wave weekly counts 2APOLLO TYRES ---Ready to Fire UP ? Elliot wave weekly counts 2 wave begins

APOLLO TYRES ---Ready to Fire UP ?

weekly counts suggest if sustain abv 439 on weekly basis

than impulse wave may start shortly

EW theory consists multiple possibilities /different structure

this is our educational analysis

APOLLOTYRE trade ideas

Apollo Tyers Weekly Chart – Elliott Wave Outlook Technical Overview

Apollo Tyers has shown a strong structural uptrend over the past few years. Using Elliott Wave Theory, the stock appears to be completing a classic 5-wave impulse pattern on the weekly chart.

Elliott Wave Count Breakdown

Wave (1) to (3): A clear and powerful uptrend, supported by increasing volume and price acceleration.

Wave (4): Currently in progress – the stock is undergoing a complex corrective structure, often seen in Wave 4 phases.

Wave (5): Yet to unfold. Based on Fibonacci projections, the minimum target for Wave 5 is ₹650.

Key Observations

✅ The price took strong support at the 200 EMA on the weekly chart — a crucial indicator used by institutional traders to gauge long-term trend strength.

🔄 The ongoing correction seems to be complex (likely WXY or triangle-based) rather than a simple ABC.

📐 Fibonacci levels suggest the next leg higher (Wave 5) could target the ₹650 zone, with further potential beyond if momentum sustains.

Strategy Insights

If the corrective Wave (4) is indeed near completion: NSE:APOLLOTYRE

Investors may look for confirmation via a breakout above recent consolidation highs.

Traders can wait for trend confirmation with volume and price action before entry.

Stop-loss could be managed below the 200 EMA or below the recent swing low of the corrective move.

APOLLOTYRE - Apollo Tyres Ltd (2 hours chart, NSE) - Long PositiAPOLLOTYRE - Apollo Tyres Ltd. (2 hours chart, NSE) - Long Position; short-term research idea.

Risk assessment: Medium {volume structure integrity risk}

Risk/Reward ratio ~ 2.68

Current Market Price (CMP) ~ 470

Entry limit ~ 464.50 on April 30, 2025

1. Target limit ~ 481 (+3.55%; +16.5 points)

2. Target limit ~ 498 (+7.21%; +33.5 points)

Stop order limit ~ 452 (-2.69%; -12.5 points)

Disclaimer: Investments in securities markets are subject to market risks. All information presented in this group is strictly for reference and personal study purposes only and is not a recommendation and/or a solicitation to act upon under any interpretation of the letter.

LEGEND:

{curly brackets} = observation notes

= important updates

(parentheses) = information details

~ tilde/approximation = variable value

-hyphen = fixed value

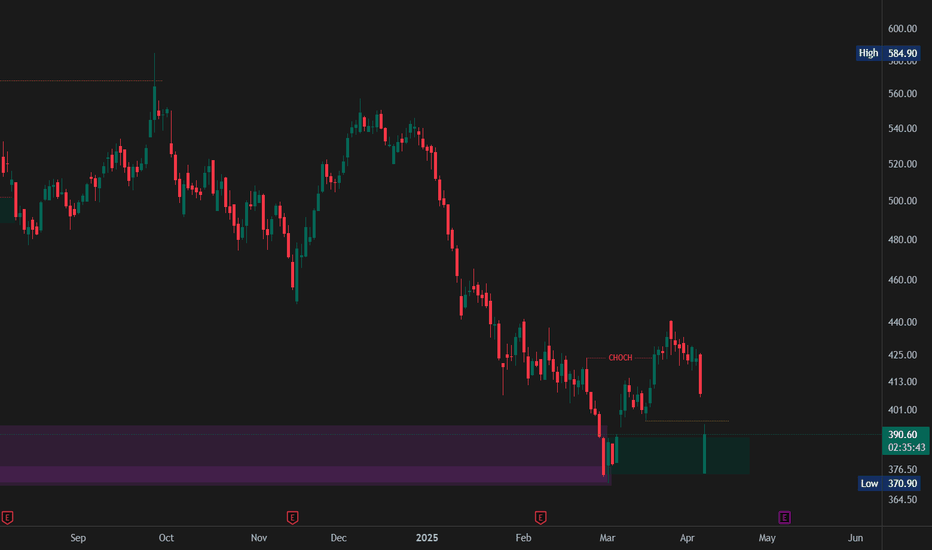

Apollo Tyres at Key Reversal Zone – Big Move Loading!🚨 APOLLO TYRES – Technical Analysis & Trade Plan

🔍 Swing / Positional Opportunity

🔎 Step-by-Step Analysis

1. Monthly Timeframe View

🔸 Previous Monthly High: ₹584.90

🔸 Apollo Tyres Corrected 36.7% from ATH

🔸 Current Market Structure: Price has now entered a strong Monthly POI (Point of Interest) zone.

🔸 Today’s Low: ₹375 – This aligns exactly with our key POI, suggesting possible institutional accumulation.

🔸 Previous Key Swing High: ₹423.50 – This has been broken, indicating a shift in structure from bearish to bullish.

💡 This tells us that supply has weakened and buyers have started dominating. The fact that price has moved out of the demand zone and above the previous structure confirms the strength of this level.

2. Lower Timeframe Confirmation

✅ Today’s gap-down has been fully filled, which often confirms price strength and supports a reversal move.

✅ Price reacting sharply at POI shows that smart money is active at this level.

📈 Entry, Stoploss & Targets

📍 Entry Zone: ₹389 – ₹374

📉 Stop-Loss: ₹355 (just below structure and POI)

📊 Target 1: ₹440

🎯 Target 2: ₹520

📌 Risk-Reward: Well defined with a small risk, giving a potential for large upside.

"Risk is limited, but reward potential is big. A textbook Smart Money entry."

⚠️ Market Conditions

📉 Global markets are weak, so it's important to follow risk management strictly.

👉 Always enter with a stop-loss in place. No blind entries.

✅ Summary & Key Takeaway

Apollo Tyres is showing signs of a strong reversal from a high-timeframe demand zone. With confirmations on both higher and lower timeframes, this could be the right time to start accumulating with a long-term view.

A well-timed, low-risk entry could result in substantial gains.

📢 Don’t Miss Out!

✅ Follow for more smart money-based setups.

👍 Drop a like if this helped and comment with your thoughts!

💬 Let’s chat in the comments section. See you there! 🚀📊

Apollo TyresMarket Cap

₹ 25,953 Cr.

Current Price

₹ 409

High / Low

₹ 585 / 404

Stock P/E

19.2

Book Value

₹ 225

Dividend Yield

1.47 %

ROCE

16.4 %

ROE

13.2 %

Face Value

₹ 1.00

EPS

₹ 20.3

Promoter holding

37.4 %

Industry PE

25.0

Debt

₹ 4,801 Cr.

Dividend yield

1.47 %

Intrinsic Value

₹ 230

Reserves

₹ 14,245 Cr.

Debt to equity

0.34

Sales

₹ 25,958 Cr.

NP Ann

₹ 1,722 Cr.

EBIDT last year

₹ 4,587 Cr.

OPM

14.5 %

Qtr Sales Var

5.04 %

Total Assets

₹ 27,505 Cr.

Trade receivables

₹ 2,887

APPOLO TYRES-GOLDEN CROSSOVER N DAILYAppolo tyres showing stronger Price volume momentum,20DEMA Golden cross over other higher DEMAs n Daily chart suggests a move towards 550+,If gives a break out above 550 positionally expect it to test 575-600 based on the Triple bottomformation n weekly chart(For educational purpose only)

Apollo Tyres, Bearish Reversal with Divergences & Evening StarStock : Apollo Tyres

CMP : 499

Timeframe : Monthly

Pattern : Bearish Reversal with Divergences & Evening Star

Trade Type : Short

Price Action & Technical Analysis

- Bearish Divergence

- MACD Down

- Price is below 5 Moving Average

Target 1 - Rs. 436

Target 2 - Rs. 366

Stoploss - Rs. 520

Disclaimer : "The information provided in this content is for educational purposes only. Please do your own research and consult with a professional financial advisor before making any investment or trading decisions. The author is not responsible for any financial losses incurred as a result of applying the information contained in this material."

APOLLO TYRES LTD S/RSupport and Resistance Levels:

Support Levels: These are price points (green line/share) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (red line/shade) are where upward trends might stall due to increased selling interest. They act like a ceiling where sellers come in to push prices down.

Breakouts:

Bullish Breakout: When the price moves above resistance, it often indicates strong buying interest and the potential for a continued uptrend. Traders may view this as a signal to buy or hold.

Bearish Breakout: When the price falls below support, it can signal strong selling interest and the potential for a continued downtrend. Traders might see this as a cue to sell or avoid buying.

20 EMA (Exponential Moving Average):

Above 20 EMA: If the stock price is above the 20 EMA, it suggests a potential uptrend or bullish momentum.

Below 20 EMA: If the stock price is below the 20 EMA, it indicates a potential downtrend or bearish momentum.

Trendline: A trendline is a straight line drawn on a chart to represent the general direction of a data point set.

Uptrend Line: Drawn by connecting the lows in an upward trend. Indicates that the price is moving higher over time. Acts as a support level, where prices tend to bounce upward.

Downtrend Line: Drawn by connecting the highs in a downward trend. Indicates that the price is moving lower over time. It acts as a resistance level, where prices tend to drop.

RSI: RSI readings greater than the 70 level are overbought territory, and RSI readings lower than the 30 level are considered oversold territory.

Combining RSI with Support and Resistance:

Support Level: This is a price level where a stock tends to find buying interest, preventing it from falling further. If RSI is showing an oversold condition (below 30) and the price is near or at a strong support level, it could be a good buy signal.

Resistance Level: This is a price level where a stock tends to find selling interest, preventing it from rising further. If RSI is showing an overbought condition (above 70) and the price is near or at a strong resistance level, it could be a signal to sell or short the asset.

Disclaimer:

I am not a SEBI registered. The information provided here is for learning purposes only and should not be interpreted as financial advice. Consider the broader market context and consult with a qualified financial advisor before making investment decisions.

buy at zone - swing

ENTRY

- lines marked below is potential reversal zone ( PRZ)

- entry is strictly inside the zone

- look for buying confirmation in smaller time frame ( 15 minutes preferred )

EXIT

1. target

- mark fib retracement from C to latest swing low

- TGT 1 - 0.236 fib level ( intraday tgt)

- TGT 2 - 0.382 fib level

- TGT 3 - 0.5 fib level ( preferred target )

2. SL

- candle close below (PRZ)

- if u didn't get confirmation inside the zone , ignore this pick

- if candle close is below zone , this pattern becomes invalid . IGNORE THIS PICK

- RE-ENTRY can be done , if u again get buying confirmation inside the zone

SWING IDEA - APOLLO TYREApollo Tyres , a leading tyre manufacturer, is showing technical indicators that suggest a promising swing trading opportunity.

Reasons are listed below :

540-560 Resistance Zone Breakout : The 540-560 level has been a significant resistance zone. The price is now breaking out above this crucial zone, indicating strong bullish momentum.

Bullish Marubozu Candle on Daily Timeframe : The recent formation of a bullish marubozu candle on the daily chart indicates strong buying pressure and suggests potential for further upward movement.

Breaking 5-Month Consolidation : The stock is breaking out of a consolidation phase that lasted over 5 months, signaling a potential new bullish trend.

Higher Highs : The stock is consistently making higher highs, indicating a strong upward trend.

Trading Near All-Time High : The stock is trading near its all-time high, suggesting strong market confidence and potential for further gains.

Gradual Increase in Volumes : A noticeable increase in trading volumes confirms the strength of the price move and indicates growing investor interest.

Trading Above 50 and 200 EMA : The stock is trading above both the 50-day and 200-day exponential moving averages (EMA), reinforcing the bullish sentiment and providing strong support levels.

Target - 630 // 670

Stoploss - daily close below 490

DISCLAIMER -

Decisions to buy, sell, hold or trade in securities, commodities and other investments involve risk and are best made based on the advice of qualified financial professionals. Any trading in securities or other investments involves a risk of substantial losses. The practice of "Day Trading" involves particularly high risks and can cause you to lose substantial sums of money. Before undertaking any trading program, you should consult a qualified financial professional. Please consider carefully whether such trading is suitable for you in light of your financial condition and ability to bear financial risks. Under no circumstances shall we be liable for any loss or damage you or anyone else incurs as a result of any trading or investment activity that you or anyone else engages in based on any information or material you receive through TradingView or our services.

@visionary.growth.insights