ASHOKLEY trade ideas

Long term bet - ashok leylandAshok leyland has been falling like a knife, without much bounces, but a very big support is seen nearby 74 odd levels, one can look to buy there. will update once the actual level of 74 is reached. Will have to look at the price action from there to understand if it can be kept for long term or short term only.

Perfect Elliot Wave In Ashok Leyland (Probability 2)We're in the correction waves of Elliot with a perfect head and shoulders at the end of impulse. Another head and shoulders is seen in making which also completes the corrective waves. (Fundamentally company is cool, this is just the mood of investors captured by the Great Elliot

Perfect Elliot Wave In Ashok Leyland (Probability 1)We're in the correction stage of the long term elliot wave in Ashok leyland. Perfect head and shoulders seen at the end of Elliot's impulse wave.

Hence there can be two possibilities according to elliot wave (there can be more, is pointed two most probable) and this is Probability 1

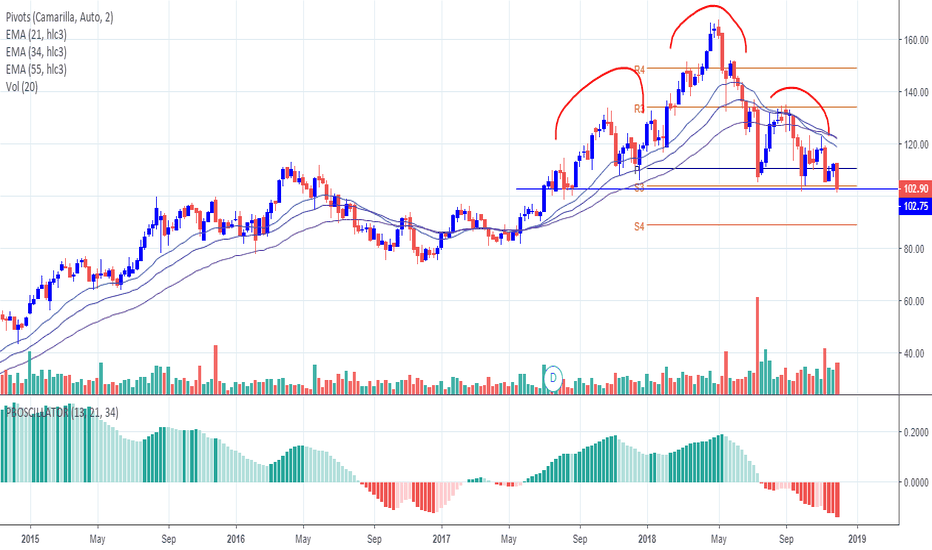

ASHOK LEYLAND - WEAK STRUCTURE#ASHOKLEYLAND

CMP 102.9

Bias - Bearish SUBJECT TO BREAKDOWN OF 100 LEVELS.

Weekly chart shows a perfect H & S pattern.

Price at the neckline region with higher probability of breakdown.

Breakdown of 100 possibly could be disaster for the stock.

Pivot based ema oscillator is at a new 2 year low.

Next major support seen in the region of 80-82. Camarilla S4 at 88.

View negated if price crosses above 112.

Ashok Leyland Beginning of downtrend.Unless we get some great news here, this stock is gonna go in a long downtrend if we break the neckline/support at 105.5.

1) Head and Shoulder signalling trend reversal from bullish to bearish.

2) Descending triangle signalling bearish pattern.

My previous idea had a target of 116-118, which we might not reach. I am going to close my long trades here and will open positions only if we break out of the triangle.

I am seeing a good R/R hereBounced off the current levels four times before making it a strong support, in a short term downtrend forming a descending triangle. Could see narrow range in the coming few days before it breaks out of the triangle. I would place my buy here and next buy at 100. A huge upside potential, a break upward from the triangle could start a new rally and we could see 20-25% gains, or more. The risk to the downside is low. The volume is extremely good. Traded in a narrow range with a huge volume today, so that's a good amount of accumulation

You could place your buy here or wait for the break out from the triangle. I have opened long positions at 105.8