BECTORFOOD trade ideas

BECTORFOOD – RSI Strength with Volume Build-up |BECTORFOOD is showing strength on the daily chart after a prolonged consolidation. The price has formed a rounding bottom structure and is currently testing a key resistance zone.

🔍 Key Observations:

RSI has crossed the 55 level, indicating possible momentum buildup

Volume is rising along with price movement

200 EMA near ₹1480–1500 zone is acting as resistance

Traders and learners should observe how price behaves near this resistance. A close above this zone may indicate continuation of upward trend, while rejection may lead to consolidation or pullback.

🚫 No trading advice is being given here. This is only a technical chart study for educational discussion.

🔒 Disclaimer:

I am not a SEBI-registered advisor. This content is purely for educational and informational purposes. Please do your own research or consult a registered financial advisor before making any decisions.

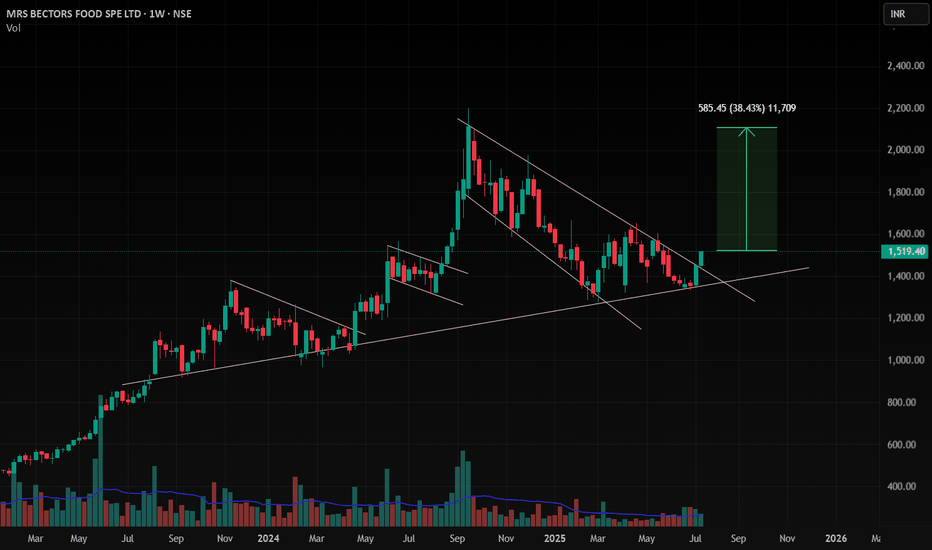

BECTORFOOD : Going long for about 0.625% of the net capitalTechnical Overview :

Took a position for about 0.625% of the net capital from a level closer to the lower trendline of the descending channel. Will be targeting the high of the descending channel for a potential move of about 43% from the current average entry price.

Fundamental Overview :

Mrs. Bectors Food Specialities Limited, a prominent player in India's fast-moving consumer goods (FMCG) sector, has exhibited notable financial performance in recent quarters.

For the fiscal year ending March 31, 2024, Mrs. Bectors reported a revenue from operations of ₹16,239.45 million, marking a 19.22% increase from ₹13,621.39 million in the previous year. The net profit for the year stood at ₹1,403.61 million, reflecting a 55.78% growth compared to ₹900.74 million in FY23.

The company's operating profit margin for FY24 was 15%, with a net profit of ₹145 crore, indicating robust operational efficiency.

Mrs. Bectors Food Specialities Limited has demonstrated strong financial growth, driven by strategic initiatives in product development and market expansion. The significant increases in both revenue and net profit across its key segments underscore the company's solid market position and effective operational strategies.

📢📢📢

If my perspective changes or if I gather additional fundamental data that influences my views, I will provide updates accordingly.

Thank you for following along with this journey, and I remain committed to sharing insights and updates as my trading strategy evolves. As always, please feel free to reach out with any questions or comments.

Other posts related to this particular position and scrip, if any, will be attached underneath. Do check those out too.

Disclaimer : The analysis shared here is for informational purposes only and should not be considered as financial advice. Trading in all markets carries inherent risks, and past performance is not indicative of future results. It’s essential to conduct your own research and assess your risk tolerance before making any investment decisions. The views expressed in this analysis are solely mine. It’s important to note that I am not a SEBI registered analyst, so the analysis provided does not constitute formal investment advice under SEBI regulations.

Bector Foods (NSE: BECTORFOODS) - Daily TimeframeTechnical Analysis- Daily Timeframe

Falling Wedge Pattern:

The chart highlights a falling wedge pattern, which is a bullish reversal setup. The stock has broken out of this pattern, signaling the potential for further upside.

The breakout is confirmed by increased buying volume, suggesting strong participation from bulls.

Breakout and Targets:

Post-breakout, the stock is moving toward its immediate target of ₹2,000.

If bullish momentum continues, the extended target could be ₹2,200, as projected by the height of the falling wedge pattern.

Support and Resistance Levels:

Immediate Support: ₹1,750 (near the breakout zone of the wedge).

Key Resistance: ₹1,900 (psychological level), followed by ₹2,000 and ₹2,200.

Volume Analysis:

The breakout is accompanied by rising volumes, indicating strong bullish sentiment. A continuation in this trend is crucial for sustained upward movement.

Moving Averages:

The stock is trading above its short-term moving averages, reinforcing the bullish trend. These moving averages could act as dynamic supports during any pullbacks.

Fundamental Analysis of Bector Foods

Company Overview:

Bector Foods is a leading manufacturer in the bakery and dairy segments, producing premium biscuits, bread, and frozen desserts. Its flagship brands, such as Cremica and English Oven, have a strong presence in both retail and institutional markets.

Revenue and Profit Growth:

The company has shown steady revenue growth, supported by increasing demand for bakery products and an expanding product portfolio.

Margins have improved due to economies of scale, cost optimization, and premiumization in its product mix.

Market Position:

Bector Foods benefits from its established brand equity, a growing distribution network, and a strong foothold in the institutional market (e.g., fast-food chains and hotels).

Export growth is a key driver, with the company exporting to over 60 countries.

Growth Drivers:

Rising urbanization and demand for ready-to-eat and premium bakery products in India provide a significant growth runway.

Expansion into newer geographies and categories, such as health and wellness snacks, could add to its growth.

Challenges:

Increased competition from larger FMCG players could put pressure on pricing and market share.

Volatility in raw material costs (wheat, sugar, etc.) may impact margins.

Sector Outlook:

The Indian bakery and packaged food segment is experiencing strong growth, driven by changing consumer preferences and increasing disposable incomes. Bector Foods is well-positioned to capitalize on these trends.

Conclusion:

Technical Outlook:

Breakout: Falling wedge breakout signals bullish momentum.

Targets:

₹2,000 (short-term)

₹2,200 (extended)

Support: ₹1,750 (breakout zone)

Resistance: ₹1,900, ₹2,000

Fundamental Outlook:

Strong revenue growth with improving margins.

Well-positioned in the bakery segment with a solid product portfolio.

Long-term growth supported by rising demand for premium and health-focused bakery products.

MRS BECTORS FOOD SPE LTD S/RSupport and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (red line/shade) are where upward trends might stall due to increased selling interest. They act like a ceiling where sellers come in to push prices down.

Breakouts:

Bullish Breakout: When the price moves above resistance, it often indicates strong buying interest and the potential for a continued uptrend. Traders may view this as a signal to buy or hold.

Bearish Breakout: When the price falls below support, it can signal strong selling interest and the potential for a continued downtrend. Traders might see this as a cue to sell or avoid buying.

MA Ribbon (EMA 20, EMA 50, EMA 100, EMA 200) :

Above EMA: If the stock price is above the EMA, it suggests a potential uptrend or bullish momentum.

Below EMA: If the stock price is below the EMA, it indicates a potential downtrend or bearish momentum.

Trendline: A trendline is a straight line drawn on a chart to represent the general direction of a data point set.

Uptrend Line: Drawn by connecting the lows in an upward trend. Indicates that the price is moving higher over time. Acts as a support level, where prices tend to bounce upward.

Downtrend Line: Drawn by connecting the highs in a downward trend. Indicates that the price is moving lower over time. It acts as a resistance level, where prices tend to drop.

Disclaimer:

I am not a SEBI registered. The information provided here is for learning purposes only and should not be interpreted as financial advice. Consider the broader market context and consult with a qualified financial advisor before making investment decisions.

BECTORFOODS Trading within Demand Zone of ₹1651 to ₹1581.05BECTORFOODS' current price stands at ₹1617, placing it within a demand zone ranging from ₹1651 to ₹1581.05. this may serve as a critical support level. Investors might consider watching this range closely for potential signs of a price reversal or consolidation, which could present a buying opportunity if the stock rebounds from this support area.

mrs bector food looks good for 1550++Stock coming out of sideways position

1470 looks a resistance area

1500..1550 next targets..

Stop 1400

cmp1465

risk 65 reward 100

Fmcg stocks on momentum!

Volume need to pickup!

Fundamentally good company

Swing positional call!

Not a reco to buy !

Consult your advisor before any positions!!

Mrs. Bectors Food Specialities Ltd was incorporated as Quaker Cremica Foods Private Limited on September 15, 1995. It manufactures biscuits and bakery products that are marketed under Mrs. Bector’s Cremica and Mrs. Bector’s English Oven brands, respectively.

Mrs. Rajni Bector started the enterprise in 1978 by manufacturing ice creams, bread, and biscuits

mrs bector food looks good for 1550++Stock coming out of sideways position

1470 looks a resistance area

1500..1550 next targets..

Stop 1400

cmp1465

risk 65 reward 100

Fmcg stocks on momentum!

Volume need to pickup!

Fundamentally good company

Swing positional call!

Not a reco to buy !

Consult your advisor before any positions!!

Mrs. Bectors Food Specialities Ltd was incorporated as Quaker Cremica Foods Private Limited on September 15, 1995. It manufactures biscuits and bakery products that are marketed under Mrs. Bector’s Cremica and Mrs. Bector’s English Oven brands, respectively.

Mrs. Rajni Bector started the enterprise in 1978 by manufacturing ice creams, bread, and biscuits

Breakout Script.Stock: Mrs Bectors Food Specialities Ltd

Position: Long

Reasons for the position: Breakout

Mrs Bectors Food Specialities Ltd is a well-established company with a strong track record of profitability.

The company is in a growing industry with a large addressable market.

Mrs Bectors Food Specialities Ltd has a strong management team with a proven ability to execute.

The stock is currently trading at a discount to its intrinsic value.

Cautions:

The stock market is volatile and there is no guarantee that Mrs Bectors Food Specialities Ltd will continue to perform well in the future.

The company faces competition from other companies in the same industry.

The company is subject to risks associated with its industry, such as changes in government regulations or economic conditions.

Necklace Pattern Series- "Bector Foods"How nicely Necklace Pattern is being shaped.

A Necklace is when stock goes down 90% & reaches back to its old lifetime High...Monthly TF clearly indicates target above Life Time High! Its re-claiming its past glory!

This is also called as rounded bottom, but since its re-claiming its old High, its no more a bottom, right?

BECTOR FOOD BREAKOUTDisclaimer- The risk of loss in trading stock, future,forex and option is substantial and losses may exceed initial investments. Past performance,wherther actual or simulated, is not indicative of future results. By viewing this video you agree that decision to purchase or sell any financial product is the sole responsibility of the person initiating such a transaction, specifically you. and Wealth Depth or this Youtuber is not responsible for your decisions or their consequences. This Video is for educational purpose only.

Thank You...😊