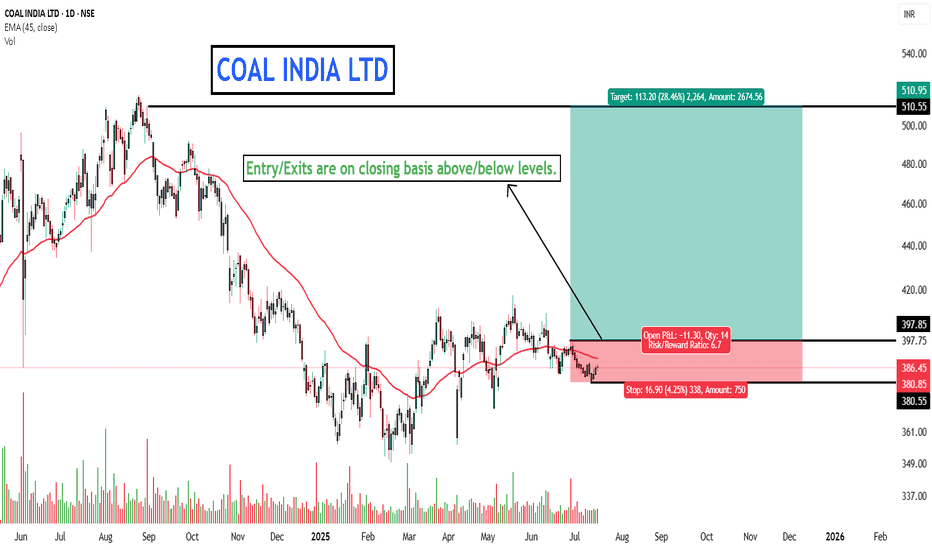

COAL INDIA LTD - DON'T MISS.Everything is pretty much explained in the picture itself.

I am Abhishek Srivastava | SEBI-Certified Research and Equity Derivative Analyst from Delhi with 4+ years of experience.

I focus on simplifying equity markets through technical analysis. On Trading View, I share easy-to-understand insights

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

57.35 INR

353.58 B INR

1.43 T INR

2.27 B

About COAL INDIA LTD

Sector

Industry

CEO

P. M. Prasad

Website

Headquarters

Kolkata

Founded

1973

ISIN

INE522F01014

FIGI

BBG000C452M3

Coal India Ltd. is a holding company, which engages in the production and sale of coal. Its products and services include coking coal, semi coking coal, non-coking coal, washed and beneficiated coal, middlings, rejects, coal fines and coke fines, tar, heavy oil, light oil, and soft pitch. The company was founded in June 14, 1973 and is headquartered in Kolkata, India.

Related stocks

COAL INDIA🎯 Trade Plan – Positional Buy

Parameter Value

Entry ₹383

Stop Loss ₹375

Risk ₹8

Target ₹738

Reward ₹355

R:R 44.4x

Last High ₹544

Last Low ₹350

✅ Key Technical Highlights

✅ All Timeframes Aligned Bullish – strong confluence across HTF, MTF, and ITF.

✅ Entry Zone Overlaps: Monthly, Qtrly, Half-Yearl

Coal India Ltd view for Intraday 21st May #COALINDIA Coal India Ltd view for Intraday 21st May #COALINDIA

Resistance 410 Watching above 411 for upside momentum.

Support area 400 Below 405 ignoring upside momentum for intraday

Watching below 399 for downside movement...

Above 405 ignoring downside move for intraday

Charts for Educational purposes o

Coal India Ltd view for Intraday 8th May #COALINDIA Coal India Ltd view for Intraday 8th May #COALINDIA

Resistance 385 Watching above 386 for upside movement...

Support area 380 Below 380 ignoring upside momentum for intraday

Watching below 379 for downside movement...

Above 385 ignoring downside move for intraday

Charts for Educational purposes

Review and plan for 8th May 2025 Nifty future and banknifty future analysis and intraday plan.

Quarterly results.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar

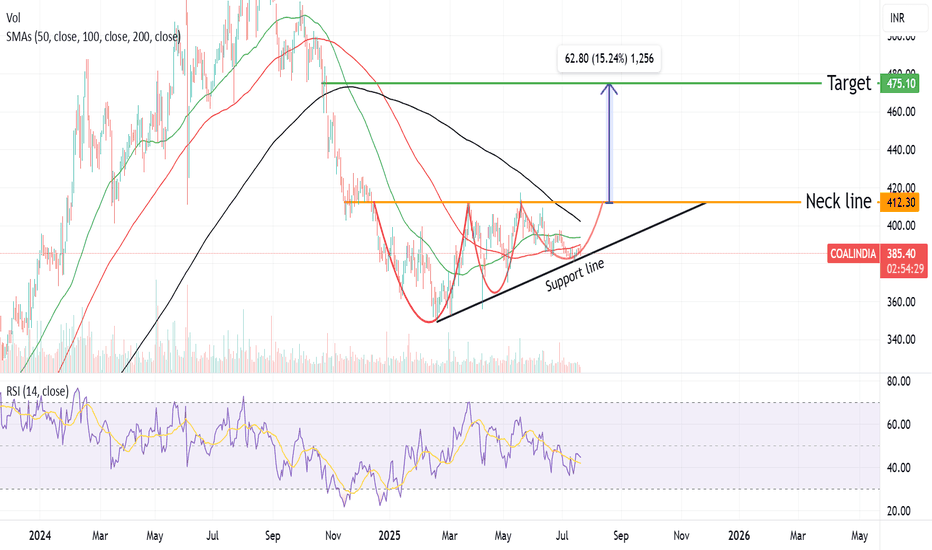

COALINDIA : Positioned for a BreakoutCOAL INDIA LTD (COALINDIA): Consolidation and Potential Reversal 🌟

Price Action Overview:

Current price: ₹414.05 , trading near a key consolidation zone.

A deep retracement zone has been identified between ₹374–₹394 , where buyers are likely to dominate.

Liquidity building in this range may a

COAL INDIA 1D TFNSE:COALINDIA has been bearish for a long time and now is retracing. The bearish run could continue if the stock breaks the demand zone with a strong bearish candle and a good volume. Recently Coal India has invested in creating a solar power plant.This news could even disrupt the bearish run.But

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where COALINDIA is featured.

Frequently Asked Questions

The current price of COALINDIA is 380.85 INR — it has decreased by −1.19% in the past 24 hours. Watch COAL INDIA LTD. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BSE exchange COAL INDIA LTD. stocks are traded under the ticker COALINDIA.

COALINDIA stock has fallen by −1.31% compared to the previous week, the month change is a −3.34% fall, over the last year COAL INDIA LTD. has showed a −22.65% decrease.

We've gathered analysts' opinions on COAL INDIA LTD. future price: according to them, COALINDIA price has a max estimate of 485.00 INR and a min estimate of 367.00 INR. Watch COALINDIA chart and read a more detailed COAL INDIA LTD. stock forecast: see what analysts think of COAL INDIA LTD. and suggest that you do with its stocks.

COALINDIA reached its all-time high on Aug 26, 2024 with the price of 544.70 INR, and its all-time low was 109.50 INR and was reached on Oct 15, 2020. View more price dynamics on COALINDIA chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

COALINDIA stock is 1.47% volatile and has beta coefficient of 1.03. Track COAL INDIA LTD. stock price on the chart and check out the list of the most volatile stocks — is COAL INDIA LTD. there?

Today COAL INDIA LTD. has the market capitalization of 2.35 T, it has increased by 0.57% over the last week.

Yes, you can track COAL INDIA LTD. financials in yearly and quarterly reports right on TradingView.

COAL INDIA LTD. is going to release the next earnings report on Jul 31, 2025. Keep track of upcoming events with our Earnings Calendar.

COALINDIA earnings for the last quarter are 15.60 INR per share, whereas the estimation was 13.93 INR resulting in a 11.99% surprise. The estimated earnings for the next quarter are 13.49 INR per share. See more details about COAL INDIA LTD. earnings.

COAL INDIA LTD. revenue for the last quarter amounts to 378.25 B INR, despite the estimated figure of 371.49 B INR. In the next quarter, revenue is expected to reach 346.12 B INR.

COALINDIA net income for the last quarter is 96.04 B INR, while the quarter before that showed 85.06 B INR of net income which accounts for 12.91% change. Track more COAL INDIA LTD. financial stats to get the full picture.

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. COAL INDIA LTD. EBITDA is 470.63 B INR, and current EBITDA margin is 32.83%. See more stats in COAL INDIA LTD. financial statements.

Like other stocks, COALINDIA shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade COAL INDIA LTD. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So COAL INDIA LTD. technincal analysis shows the strong sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating COAL INDIA LTD. stock shows the neutral signal. See more of COAL INDIA LTD. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.