DELHIVERY trade ideas

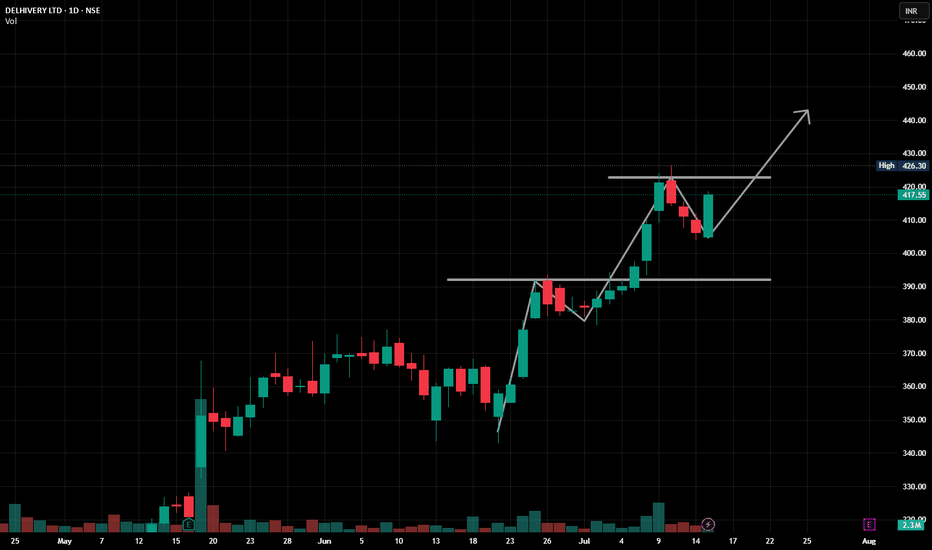

Bullish structure in play!NSE:DELHIVERY

Bullish structure in play!

Forming higher highs & higher lows

Strong bounce from ₹405 support

Eyes on breakout above ₹426.30

Volume confirms buying interest again

More importantly, during this time, NSE:DELHIVERY usually goes to ₹450 as shown here:

https: //www.

Next target? Possibly ₹440–450+ if momentum holds 💪

Let’s see if this delivery gets shipped 🚚📦

DELHIVERY LTD S/RSupport and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (red line/shade) are where upward trends might stall due to increased selling interest. They act like a ceiling where sellers come in to push prices down.

Breakouts:

Bullish Breakout: When the price moves above resistance, it often indicates strong buying interest and the potential for a continued uptrend. Traders may view this as a signal to buy or hold.

Bearish Breakout: When the price falls below support, it can signal strong selling interest and the potential for a continued downtrend. Traders might see this as a cue to sell or avoid buying.

MA Ribbon (EMA 20, EMA 50, EMA 100, EMA 200) :

Above EMA: If the stock price is above the EMA, it suggests a potential uptrend or bullish momentum.

Below EMA: If the stock price is below the EMA, it indicates a potential downtrend or bearish momentum.

Trendline: A trendline is a straight line drawn on a chart to represent the general direction of a data point set.

Uptrend Line: Drawn by connecting the lows in an upward trend. Indicates that the price is moving higher over time. Acts as a support level, where prices tend to bounce upward.

Downtrend Line: Drawn by connecting the highs in a downward trend. Indicates that the price is moving lower over time. It acts as a resistance level, where prices tend to drop.

Disclaimer:

I am not a SEBI registered. The information provided here is for learning purposes only and should not be interpreted as financial advice. Consider the broader market context and consult with a qualified financial advisor before making investment decisions.

Cup & Handle pattern and Trendline Breakout - DELHIVERYTechnical Analysis:

Current Price: ₹351.25 (Note: Live prices can fluctuate. As of the market close today, Delhivery closed around ₹350.60 on the NSE).

Target: Your target of ₹410 suggests a potential upside.

Trendline Breakout: Breaking above a significant downtrend line can indicate a shift in momentum towards an uptrend.

Cup & Handle Pattern Breakout Confirmation: The confirmation of a breakout from a Cup & Handle pattern is a bullish continuation signal, suggesting a potential move higher.

Time Frame: A 1 to 3-month timeframe is reasonable for these patterns to play out if the breakouts are sustained.

Confirming the Breakouts:

Volume: It's crucial to assess if both the trendline and Cup & Handle breakouts were accompanied by a noticeable increase in trading volume. Strong volume adds conviction to the validity of the breakouts.

Sustainability: Monitor if the price holds above the breakout levels in the coming trading sessions.

Potential Upside:

Target (₹410): Represents a potential upside of approximately 16.7% from the ₹351.25 level (or around 17.0% from the ₹350.60 closing price).

Quarterly and Yearly Results & EPS Comparison:

Based on the information available up to the latest reported quarter (December 2024) and the previous fiscal year (FY24):

Latest Quarter Result (December 2024 - Q3FY25): Delhivery reported a consolidated net profit of ₹11.7 crore, compared to a loss of ₹102.9 crore in the same quarter last year. Revenue from operations increased by 19.8% YoY to ₹2,020.7 crore. This marked their second consecutive profitable quarter.

Yearly Result (FY24): For the full fiscal year ending March 2024, Delhivery reported a net loss of ₹1,007.4 crore on a revenue of ₹7,863.7 crore.

EPS Comparison:

Quarterly EPS (December 2024): ₹0.02 (positive), compared to ₹-1.41 in December 2023.

Yearly EPS (FY24): ₹-13.80.

We will need the results for the quarter ending March 2025 (Q4FY25) and the full fiscal year ending March 2025 (FY25) for the most up-to-date comparison. These are expected in the coming weeks. The recent profitability is a significant positive development.

P/E Comparison:

Given that Delhivery has only recently turned profitable, a traditional P/E ratio might not be the most meaningful metric right now. Investors will likely be focusing on the sustainability of their profitability and future growth prospects. As they continue to report profits, a P/E ratio will become more relevant for valuation comparison with peers in the logistics and e-commerce enablement space.

Corporate Action:

As of the latest information, there haven't been any recent significant corporate actions like dividends or stock splits announced by Delhivery. Investors should keep an eye on any future announcements from the company.

Latest News (as of May 19, 2025):

Recent news around Delhivery has been largely positive, focusing on:

Return to Profitability: The consecutive profitable quarters (September and December 2024) have been a major highlight, indicating a turnaround in their financial performance.

Focus on Efficiency and Cost Optimization: The company's efforts to improve operational efficiency and optimize costs are being recognized as key drivers for their profitability.

Growth in Key Business Segments: Reports often highlight the growth in their express parcel and supply chain services.

Analyst Upgrades: Following the positive results, some analysts have upgraded their ratings and price targets for Delhivery.

Partnerships and Expansions: Any news regarding new partnerships or expansion of their network and services is usually viewed positively.

Key Factors to Monitor:

Breakout Sustainability: Watch if the price holds above the breakout levels with good volume.

Upcoming Q4 & FY25 Results: These will be crucial to confirm the sustainability of their profitability and provide further direction for the stock. Look for the announcement dates.

Operational Efficiency: Continue to monitor the company's progress in improving efficiency and reducing costs.

Competition and Industry Trends: Keep an eye on the overall logistics and e-commerce landscape in India.

In conclusion, the potential Trendline and Cup & Handle breakouts on Delhivery, coupled with the recent return to profitability, suggest a bullish outlook with your target of ₹410 within a 1 to 3-month timeframe. However, it's important to monitor the sustainability of the breakouts, closely watch the upcoming full-year results, and consider the overall market sentiment and industry dynamics.

Delhivery Ltd view for Intraday 19th May #DELHIVERY Delhivery Ltd view for Intraday 19th May #DELHIVERY

Resistance 325 Watching above 325 for upside momentum.

Support area 310 Below 320 ignoring upside momentum for intraday

Watching below 309 for downside movement...

Above 314 ignoring downside move for intraday

Charts for Educational purposes only.

Please follow strict stop loss and risk reward if you follow the level.

Thanks,

V Trade Point

Intraday SellThe volume profile is a tool that allows traders to see the volume on a horizontal level at each price. You can visualize at some price levels there is a lot of volume and at some very little to none.The importance of this tool lies in the fact that volume attracts price. Meaning large areas of volume become favorable price magnets.

Formation of the Volume Profile

Unlike standard volume indicators that only show volumes at time, the Volume Profile can provide much more important information, which is volume at a specific price levels.

The advantage of being able to see Volume at each price is very valuable. It tells us which price levels were most important to the "big" market participants who dominate and initiate

The Components of a Volume Profile

High Volume Node (HVN):

An HVN represents a price range with a heavy amount of trading activity compared to the average volume. This level is considered an area of significant price congestion and is often used as a critical support level when the price is below it or as a resistance level when the price is above it.

Low Volume Node (LVN):

An LVN indicates a narrow price range with low trading activity and volume. It serves as a key support level when the price is above it or a resistance level when the price is below, denoting minimal price congestion.

Point Of Control (POC):

The point of control is the price level at which the highest volume was traded within the selected time period. It is the peak of the volume profile histogram and is often considered a point of interest for traders. The POC can act as a magnet for price action and is generally a level traders use to book profits.

Delhivery Ltd.*Delhivery Ltd.*

*W* in the making on Monthly Basis.

Retracement starting from Bottoming out.

Volume traction building up.

Respective targets mentioned.

Logistics business turning around.

*Trail SL with Upside*

*Book Profit as per Risk Appetite*

This is an Opinion. Do your own research.

*_Happy Investing_*🤓

DELHIVERY INTRADAY TARGETS DONE!Delhivery on the 15-minute timeframe delivered a stellar intraday performance, achieving all predefined targets with precision. This long trade was executed using the Risological Swing Trading Indicator , ensuring a well-timed entry and a disciplined approach.

Delhivery Key Levels:

TP1: 340.80 ✅

TP2: 346.20 ✅

TP3: 351.60 ✅

TP4: 354.90 ✅

Delhivery Technical Analysis:

The trade was initiated at an entry price of 337.45, with a stop-loss positioned at 334.75 to limit downside risk.

Delhivery exhibited strong bullish momentum, crossing the Risological trend line early in the session.

The stock maintained upward movement, achieving all take-profit levels in this intraday trade. This setup highlights the power of the Risological indicator in capturing quick and profitable opportunities in volatile markets.

All the best and do follow me for more success stories, insights, tips and profitable stock calls.

Namaste!

Delhivery back to old highsNSE:DELHIVERY has a good business, almost all packages from small to medium online stores to large brands use delhivery to deliver thier packages.

Their recent results have been good and profits are increasing on a stable basis compared to the sudden downside in June 2022, with their business working well and results showing the same, Delhivery could be the next zomato type stock to become a multibagger, for now, we will target its previous high made as our initial targets

CMP: 431

Target: OLD high liquidity 679

Upside: 57.5%

Trade type: Long term

Risk: General business risk of online store demand for delivery decreasing which i dont see as viable, if results are bad and stock is affected, i will update when to exit such a stock

Risk averse investors can also keep a stop loss 350 but I dont use stop losses for Fundamental and technical long term trades.

#Risky set-up This idea /setup is pretty risky. Set-up is based on trendline supp like one can stock bounce back from trendline two times but at third it broke it but it recovered well . Fundamentals of stock is weak. Actually setup is for daily time frame but I choice (w) time frame so u can know reason behind this setup. One can draw all that drawing in there chart at daily time frame and analysis this on both frame at there own ( in simple setup is purely based on technical analysis) This for only education purpose only I will not be liable for any of your lose.

Delhivery set to give breakout and backed by good volumeIn daily the nearest resistance was around 414.5 to 421 TF price is trading in between a range of 355.20 to 420, and 2nd August the price was trying to break the resistance of 421 with huge volume of 14.404M even though Nifty 50 in -1.17% negative and Sensex in -1.08%. And the last 30 Days average volume of DELIVERY LTD is just 2.73M.

Delhivery can deliver post a good resultDelhivery Ltd. CMP is 416.10. engages in the provision of logistics solutions to eCommerce partners. It involves in building the operating system for commerce, through a combination of infrastructure, logistics operations, and cutting-edge engineering and technology capabilities. It offers express parcel, partial-truckload, freight, truckload freight, cross-border, and supply chain services.

The positive aspects of the company are Company with Low Debt, Company with Zero Promoter Pledge, MFs increased their shareholding last quarter, Annual Net Profits improving for last 2 years and with increasing Profit Margin (QonQ). The Negative aspects of the company are negative Valuation (P.E. =-292), and Declining Net Cash Flow.

Entry can be taken after closing above 422. Targets in the stock will be 434 and 457. The long-term target in the stock will be 476 and 487. Stop loss in the stock should be maintained at Closing below 396 or 368 depending on your risk taking ability.

The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock. We do not guarantee any success in highly volatile market or otherwise. Stock market investment is subject to market risks which include global and regional risks. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message.