Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

4.95 INR

3.99 B INR

95.19 B INR

602.33 M

About EDELWEISS FIN SERV LTD

Sector

Industry

CEO

Rashesh Chandrakant Shah

Website

Headquarters

Mumbai

Founded

1995

ISIN

INE532F01054

FIGI

BBG000R0GF80

Edelweiss Financial Services Ltd. engages in the provision of capital markets, assets management services, commodities, life insurance, and treasury functions. It operates through the following segments: Agency, Capital Based, and Insurance Business. The Agency segment offers broking, advisory, product distribution and fee-based services. The Capital Based segment pertains to treasury, investment income, and financing. The Insurance Business segment represents the activities of Edelweiss Tokio Life Insurance Company Limited. The company was founded by Rashesh Chandrakant Shah and Venkatchalam Arakoni Ramaswamy on November 21, 1995, and is headquartered in Mumbai, India.

Related stocks

Review and plan for 18th December 2024Nifty future and banknifty future analysis and intraday plan.

Swing trade.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hirem

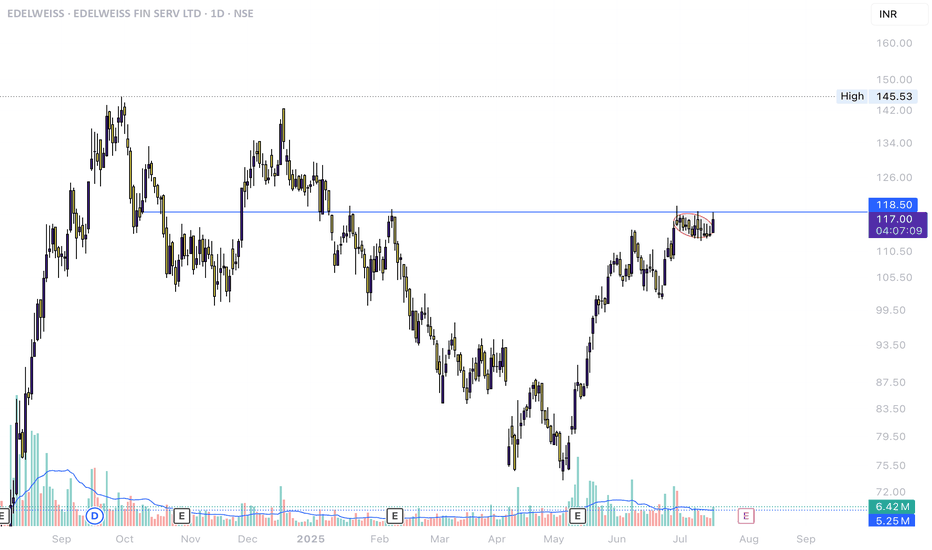

Edelweiss: Ready for a Big Run!🚀 Edelweiss: Ready for a Big Run! 🚀

Current Market Price: ₹136

Stop Loss: ₹115

Targets: ₹159 | ₹195

Key Highlights:

Major Resistance Breakout: Edelweiss broke a significant resistance at ₹122 on 9th September and touched ₹143 before retesting down to ₹102.

Sustaining Above ₹122: The stock is now

EDELWEISS FIN SERV LTD S/RSupport and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (re

Edelweiss Financial Services - Positional Trade Idea💹 Breakout Alert!

Edelweiss Fin Services has broken out above key resistance at ₹123 with strong volume support.

Entry: Above ₹124

Target 1: ₹140

Target 2: ₹145

Stop-loss: ₹113

RSI indicates bullish momentum, and the breakout shows potential for a continued uptrend. Keep an eye on volume for confir

TECHNICAL ANALYSIS of Edelweiss financial services Please note that this analysis is only for educational purposes. I am not giving you any kind of recommendation. Its my analysis for myself. You can use this post as educational purposes. Thank you!

### **Technical Analysis:**

1. **Ascending Triangle Pattern:**

- The chart shows an *ascending tri

Technical Analysis of EDELWEISS Fin Serv LtdTechnical Analysis of EDELWEISS Fin Serv Ltd

Overview of the Stock - The chart presents a 1-hour timeframe of EDELWEISS Fin Serv Ltd (NSE:EDELWEISS) stock. Key indicators and patterns suggest a slightly bullish sentiment.

Key Observations

Price Action: The price has been consolidating above

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of EDELWEISS is 119.05 INR — it has increased by 0.58% in the past 24 hours. Watch EDELWEISS FINANCIAL SERVICES L stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BSE exchange EDELWEISS FINANCIAL SERVICES L stocks are traded under the ticker EDELWEISS.

EDELWEISS stock has risen by 6.16% compared to the previous week, the month change is a 12.40% rise, over the last year EDELWEISS FINANCIAL SERVICES L has showed a 85.29% increase.

EDELWEISS reached its all-time high on May 29, 2018 with the price of 202.35 INR, and its all-time low was 12.95 INR and was reached on Mar 6, 2009. View more price dynamics on EDELWEISS chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

EDELWEISS stock is 3.29% volatile and has beta coefficient of 1.76. Track EDELWEISS FINANCIAL SERVICES L stock price on the chart and check out the list of the most volatile stocks — is EDELWEISS FINANCIAL SERVICES L there?

Today EDELWEISS FINANCIAL SERVICES L has the market capitalization of 114.89 B, it has increased by 6.35% over the last week.

Yes, you can track EDELWEISS FINANCIAL SERVICES L financials in yearly and quarterly reports right on TradingView.

EDELWEISS FINANCIAL SERVICES L is going to release the next earnings report on Jul 31, 2025. Keep track of upcoming events with our Earnings Calendar.

EDELWEISS net income for the last quarter is 1.05 B INR, while the quarter before that showed 1.24 B INR of net income which accounts for −15.30% change. Track more EDELWEISS FINANCIAL SERVICES L financial stats to get the full picture.

Yes, EDELWEISS dividends are paid annually. The last dividend per share was 1.50 INR. As of today, Dividend Yield (TTM)% is 1.24%. Tracking EDELWEISS FINANCIAL SERVICES L dividends might help you take more informed decisions.

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. EDELWEISS FINANCIAL SERVICES L EBITDA is 14.56 B INR, and current EBITDA margin is 15.29%. See more stats in EDELWEISS FINANCIAL SERVICES L financial statements.

Like other stocks, EDELWEISS shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade EDELWEISS FINANCIAL SERVICES L stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So EDELWEISS FINANCIAL SERVICES L technincal analysis shows the buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating EDELWEISS FINANCIAL SERVICES L stock shows the buy signal. See more of EDELWEISS FINANCIAL SERVICES L technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.