Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

251.90 INR

43.78 B INR

408.67 B INR

129.26 M

About HERO MOTOCORP LTD

Sector

Industry

CEO

Vikram S. Kasbekar

Website

Headquarters

New Delhi

Founded

2020

ISIN

INE158A01026

FIGI

BBG000CSDWC6

Hero MotoCorp Ltd. engages in the manufacture of two wheeler. Its products include Karizma ZMR, Xtreme Sports, Achiever 150, New Glamour, Super Splendor, and Passion X Pro. It operates through the Domestic and Overseas segments. The company was founded by Brijmohan Lall Munjal on January 19, 1984 and is headquartered in New Delhi, India.

Related stocks

TCS - Monthly Analysis📈 TCS Positional Trade Alert 📈

As observed in the monthly chart of TCS, the stock is on the verge of building strong momentum, making it a potential candidate for a positional trade.

✅ A breakout above the current high would align perfectly with our swing and positional trading setup.

📌 For refer

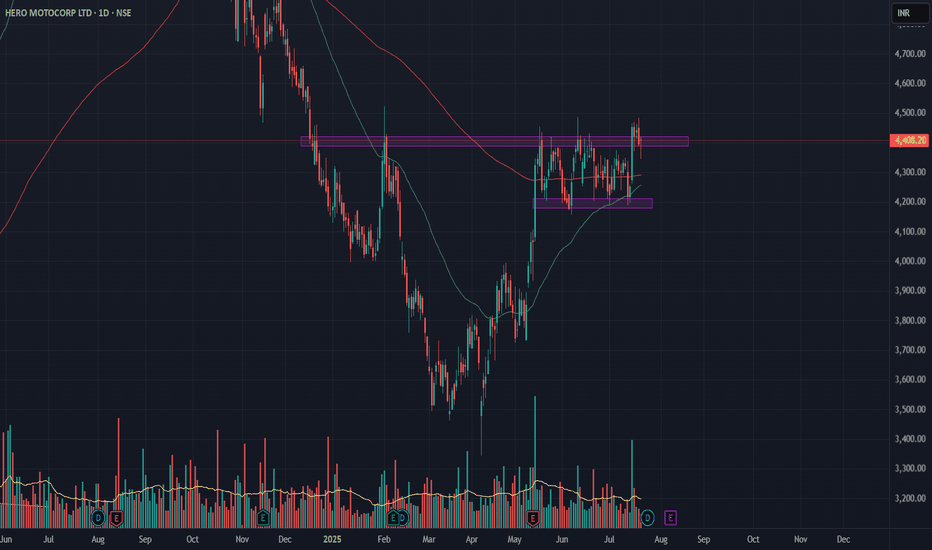

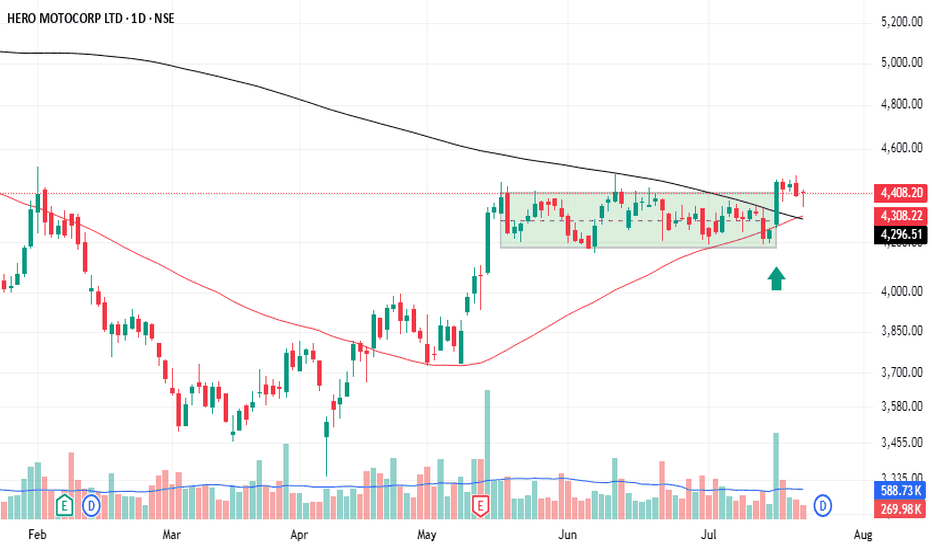

HEROMOTOCO accelerating into a bullish breakout– momentum trade!This is the Daily chart of HERO MOTOCORP LTD.

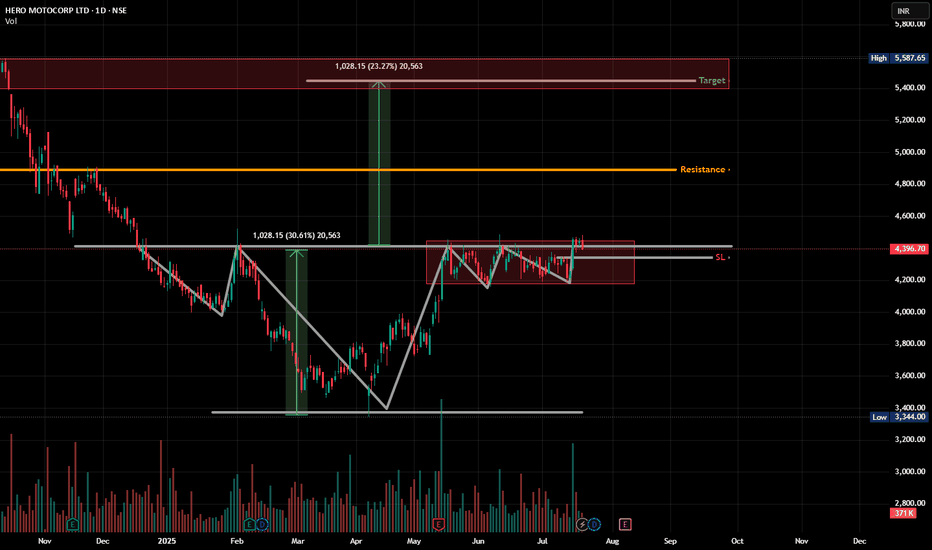

Hero MotoCorp has formed a Head & Shoulders pattern, and the stock has recently given a breakout above the neckline. It has also retested the shoulder zone, confirming the breakout and it's shoulder pattern target is 4800 and head pattern target is 5750

HEROMOTOCO is ready for big breakoutHEROMOTOCO is making inverted Head & Shoulder pattern. Making Pole & Flag pattern on weekly timeframe. Possibility of golden cross over on daily timeframe. Spent more than 2 months within short range and now spending time near high end of the range. Very high chances of break out. 4410 SL 4295 T 481

Hero Moto Co - Darvas Box Breakout - No AdviceHero Motocorp's stock has shown period of consolidation, forming potential Darvas Box. A breakout above the box on 15 th july. Price movement was also accompanied by increased volume and then followed by golden cross over - showing a good opportunity to long. Warning - Investing in the stock market

HEROMOTOCO - Multi-Right Shoulder H&S (it works out too much)Pattern Watchers!👀

We usually get one head, one left shoulder, and one right shoulder, right?

But this chart said: "Why stop at one? Let’s bulk up the right side!" 😂

🧠 Head & Shoulders spotted –

✔️ Classic neckline around ₹4390

✔️ Multiple failed breakouts but price holding above range

✔️ Righ

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of HEROMOTOCO is 4,599.35 INR — it has decreased by −1.29% in the past 24 hours. Watch HERO MOTOCORP LTD. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BSE exchange HERO MOTOCORP LTD. stocks are traded under the ticker HEROMOTOCO.

HEROMOTOCO stock has risen by 7.93% compared to the previous week, the month change is a 6.85% rise, over the last year HERO MOTOCORP LTD. has showed a −12.24% decrease.

We've gathered analysts' opinions on HERO MOTOCORP LTD. future price: according to them, HEROMOTOCO price has a max estimate of 6,200.00 INR and a min estimate of 3,575.00 INR. Watch HEROMOTOCO chart and read a more detailed HERO MOTOCORP LTD. stock forecast: see what analysts think of HERO MOTOCORP LTD. and suggest that you do with its stocks.

HEROMOTOCO reached its all-time high on Sep 24, 2024 with the price of 6,245.00 INR, and its all-time low was 1,434.05 INR and was reached on Apr 15, 2013. View more price dynamics on HEROMOTOCO chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

HEROMOTOCO stock is 2.53% volatile and has beta coefficient of 1.08. Track HERO MOTOCORP LTD. stock price on the chart and check out the list of the most volatile stocks — is HERO MOTOCORP LTD. there?

Today HERO MOTOCORP LTD. has the market capitalization of 894.97 B, it has increased by 2.34% over the last week.

Yes, you can track HERO MOTOCORP LTD. financials in yearly and quarterly reports right on TradingView.

HERO MOTOCORP LTD. is going to release the next earnings report on Oct 29, 2025. Keep track of upcoming events with our Earnings Calendar.

HEROMOTOCO earnings for the last quarter are 56.22 INR per share, whereas the estimation was 54.21 INR resulting in a 3.72% surprise. The estimated earnings for the next quarter are 68.11 INR per share. See more details about HERO MOTOCORP LTD. earnings.

HERO MOTOCORP LTD. revenue for the last quarter amounts to 95.79 B INR, despite the estimated figure of 98.45 B INR. In the next quarter, revenue is expected to reach 123.20 B INR.

HEROMOTOCO net income for the last quarter is 17.05 B INR, while the quarter before that showed 11.61 B INR of net income which accounts for 46.84% change. Track more HERO MOTOCORP LTD. financial stats to get the full picture.

HERO MOTOCORP LTD. dividend yield was 4.43% in 2024, and payout ratio reached 75.36%. The year before the numbers were 2.44% and 61.38% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 8, 2025, the company has 35.67 K employees. See our rating of the largest employees — is HERO MOTOCORP LTD. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. HERO MOTOCORP LTD. EBITDA is 58.97 B INR, and current EBITDA margin is 14.71%. See more stats in HERO MOTOCORP LTD. financial statements.

Like other stocks, HEROMOTOCO shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade HERO MOTOCORP LTD. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So HERO MOTOCORP LTD. technincal analysis shows the buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating HERO MOTOCORP LTD. stock shows the buy signal. See more of HERO MOTOCORP LTD. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.