HEROMOTOCO trade ideas

TCS - Monthly Analysis📈 TCS Positional Trade Alert 📈

As observed in the monthly chart of TCS, the stock is on the verge of building strong momentum, making it a potential candidate for a positional trade.

✅ A breakout above the current high would align perfectly with our swing and positional trading setup.

📌 For reference, check out my previous post where I’ve detailed the full trading strategy along with a curated list of 75 high-beta, liquid stocks suitable for such trades.

Stay disciplined. Trade with a plan.

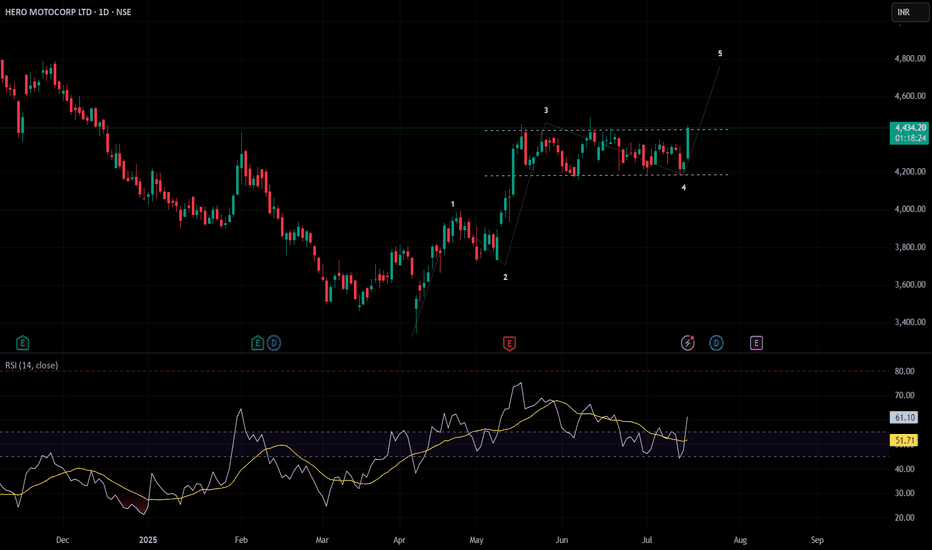

HEROMOTOCO accelerating into a bullish breakout– momentum trade!This is the Daily chart of HERO MOTOCORP LTD.

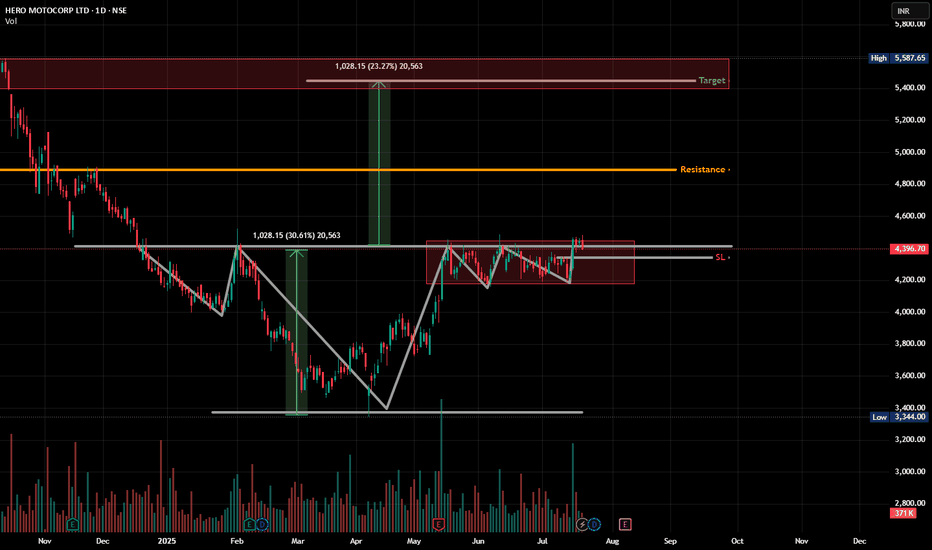

Hero MotoCorp has formed a Head & Shoulders pattern, and the stock has recently given a breakout above the neckline. It has also retested the shoulder zone, confirming the breakout and it's shoulder pattern target is 4800 and head pattern target is 5750.

HEROMOTOCO having a good support zone near at 4100-4200.

If this level is sustain then we may see higher prices in HEROMOTOCO.

Thank You !!

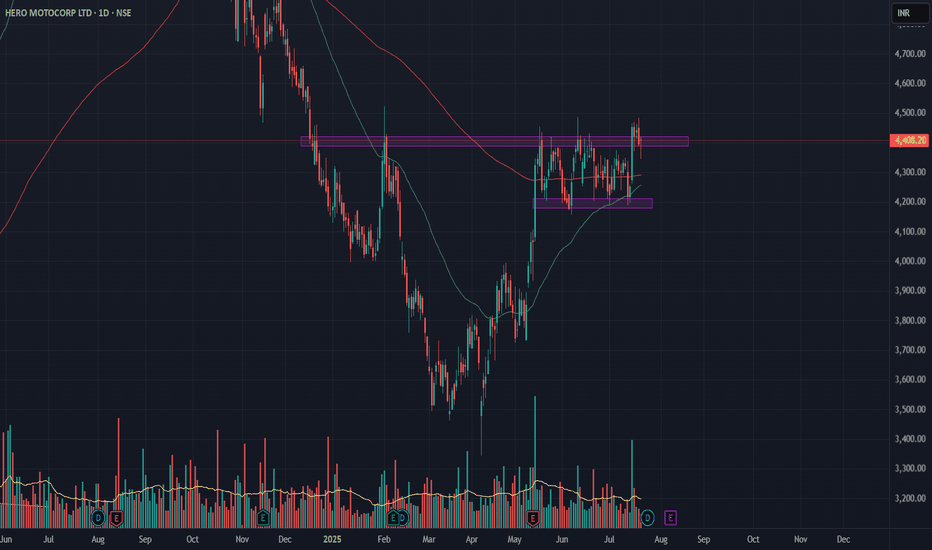

HEROMOTOCO is ready for big breakoutHEROMOTOCO is making inverted Head & Shoulder pattern. Making Pole & Flag pattern on weekly timeframe. Possibility of golden cross over on daily timeframe. Spent more than 2 months within short range and now spending time near high end of the range. Very high chances of break out. 4410 SL 4295 T 4810

Hero Moto Co - Darvas Box Breakout - No AdviceHero Motocorp's stock has shown period of consolidation, forming potential Darvas Box. A breakout above the box on 15 th july. Price movement was also accompanied by increased volume and then followed by golden cross over - showing a good opportunity to long. Warning - Investing in the stock market involves risks. It's essential to conduct thorough research, set clear goals, and consider multiple perspectives before making investment decisions.

HEROMOTOCO - Multi-Right Shoulder H&S (it works out too much)Pattern Watchers!👀

We usually get one head, one left shoulder, and one right shoulder, right?

But this chart said: "Why stop at one? Let’s bulk up the right side!" 😂

🧠 Head & Shoulders spotted –

✔️ Classic neckline around ₹4390

✔️ Multiple failed breakouts but price holding above range

✔️ Right shoulder has been gymming, forming a clean range

📏 Potential breakout target = ~₹5400

🧱 Resistance zone above (highlighted in red) may act as the next boss level

🎯 Watch for:

Break and hold above ₹4450–₹4480

Volume confirmation

Avoid fakeouts — price needs to STAY above neckline

💡 Bonus thought: This could also be interpreted as an Inverse H&S breakout from March, and this range is just a healthy consolidation.

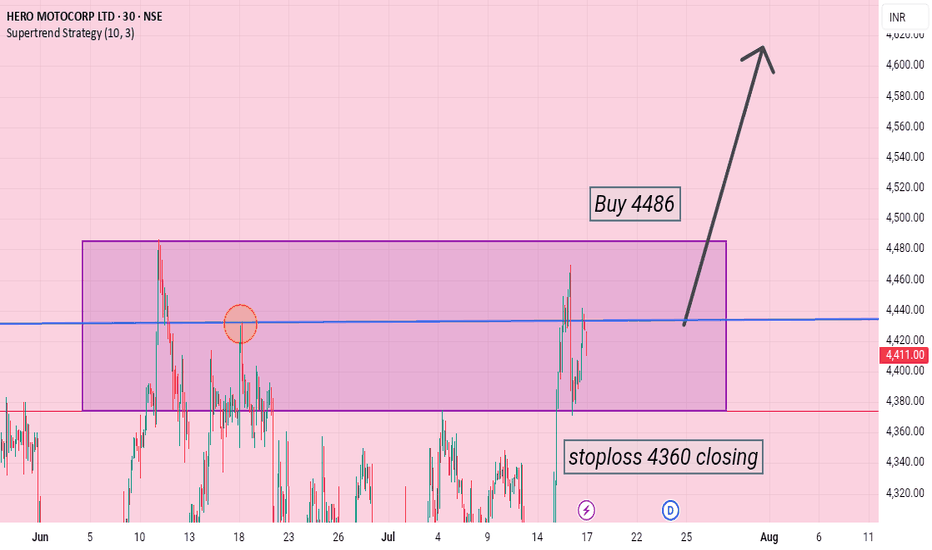

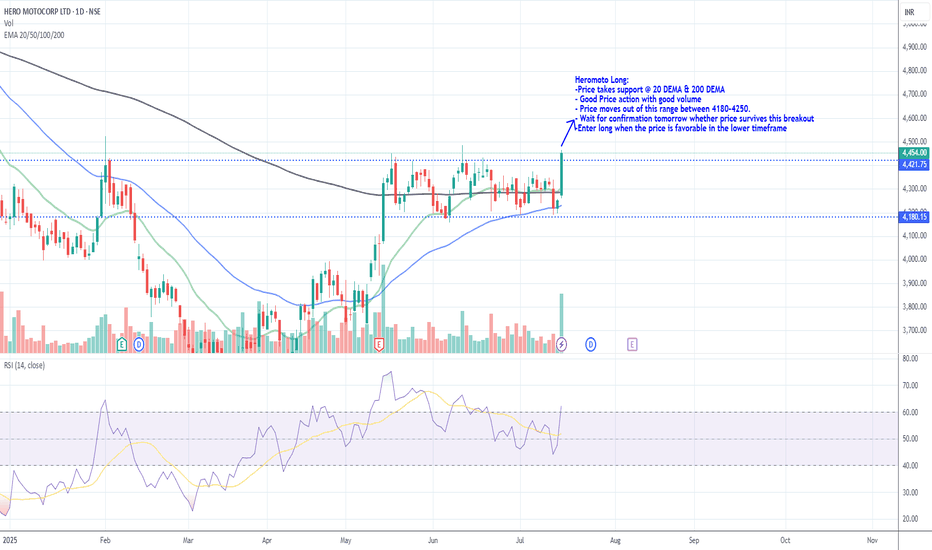

Heromoto Long_Support @ 20 DEMAHeromoto Long:

-Price takes support @ 20 DEMA & 200 DEMA

- Good Price action with good volume

- Price moves out of this range between 4180-4250.

- Wait for confirmation tomorrow whether price survives this breakout

-Enter long when the price is favorable in the lower timeframe

Heromotors Daily Trend Analysis"As per my Daily Trend Analysis, Heromotors Ltd has broken out of a 41-bar range and closed above it today. This breakout indicates a potential upward move toward the resistance zone of 4600 to 4607 in the coming sessions.

Traders are advised to perform their own technical analysis and ensure proper risk management before entering the trade."

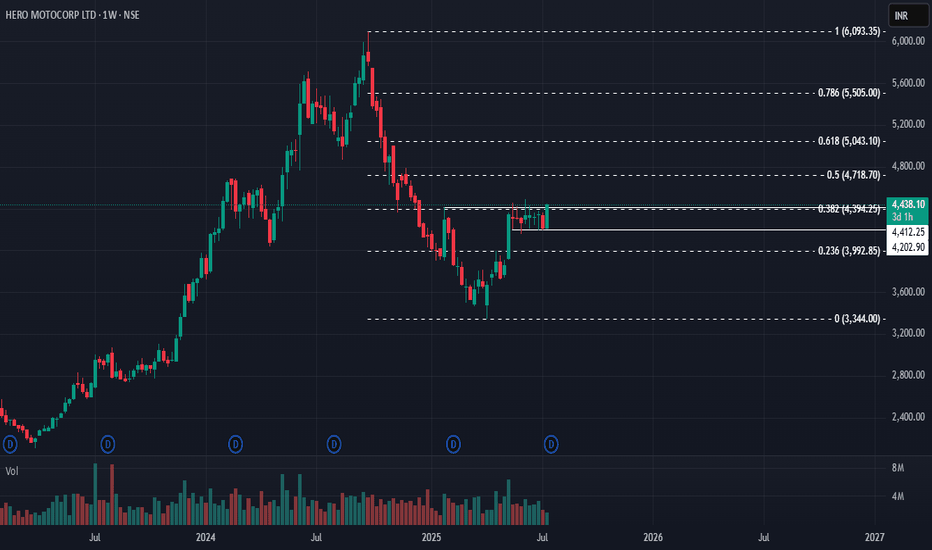

Hero MotoCorp: Reversal in Sight? 🚀 Hero MotoCorp: Reversal in Sight? 🚀

📉 CMP: ₹4438

🔒 Stop Loss: ₹4090

🎯 Targets: ₹5030 | ₹5700

🔍 Why Hero MotoCorp Looks Promising?

✅ Rounding Bottom Breakout: Weekly close above ₹4412 confirms this bullish reversal pattern

✅ Box Breakout: 8-week consolidation range of ₹4454–₹4202 broken above ₹4460, signalling strength

✅ Flag & Pole Setup: Larger range of ₹3354–₹4454 forms a flag-pole structure with breakout above ₹4460

💡 Strategic Insight:

📈 Confirmation Level: A weekly close above ₹4500 will further confirm reversal for long-term upside

🔒 Strict SL: Maintain stop loss at ₹4190 to manage downside risks effectively

📍 Outlook: Multiple technical setups indicate potential for a long-term bullish reversal with targets up to ₹5700.

📉 Disclaimer: Not SEBI-registered. Please do your own research or consult a financial advisor before investing.

#HeroMotoCorp #AutoSector #TechnicalAnalysis #BreakoutTrade #ReversalPattern #SwingTrading #StockMarketIndia #InvestmentOpportunity

HERO MOTOCORP LTD. breaking outHero looking good for a swing.

Hero MotoCorp is showing signs of a breakout above ₹4,420 with strong buying momentum. If the price stays above this level with good volume, it could rise toward ₹4,930–₹5,000. This looks like a good opportunity for swing traders to enter and aim for higher gains.

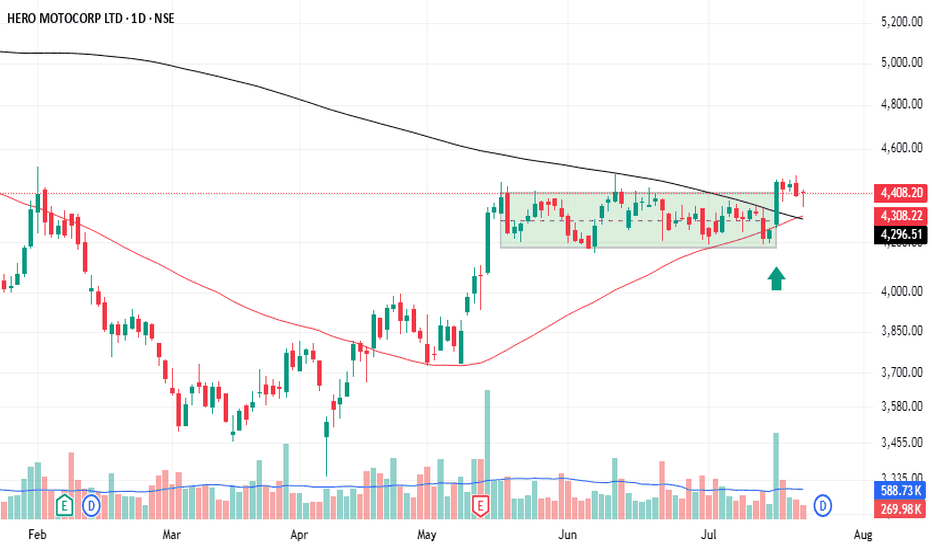

Hero MotoCorp — Daily Chart Breakout Trade SetupHero MotoCorp — Daily Chart Breakout Trade Setup

Range Bound: The stock has been consolidating between ₹4,170–₹4,400 for the past several weeks.

Structure: This is a classic rectangle consolidation, often a continuation pattern.

Volume: Watch for volume expansion on the breakout; prior breakouts lacked follow-through due to low volumes.

Higher Timeframe (Weekly/Monthly) charts show a bullish continuation since mid-May, with high-volume candles across weekly and monthly charts

Key resistance zones: Weekly resistance lies between ₹4,930–₹5,000.

Strong fundamental macro tailwinds: March sales show robust performance in both domestic ICE and EV segments (Vida)

🔍 Key Confirmation Signals for a Potential Trade

✅ Strong daily candle close above ₹4,420

✅ Above-average volume on breakout

✅ RSI crossing 60 on breakout adds momentum confirmation

⚠️ Risk Management Notes

Avoid early entry within the range (false breakouts possible)

Wait for EOD close above resistance for confirmation

Consider a trailing SL once the stock crosses ₹4,500