−0.03 INR

−3.48 M INR

6.99 B INR

148.81 M

About LANCER CONTAINER LINES LIMITED

Sector

Industry

CEO

Sumit Sunil Sadh

Website

Headquarters

Mumbai

Founded

2011

ISIN

INE359U01028

FIGI

BBG00CM9TCX5

Lancer Container Lines Ltd. engages in the provision of logistics services. It is engaged in the business of freight forwarding, clearing and forwarding, non-vessel operating common carrier, and trading in containers and related activities. The firm also offers less than container load (LCL) consolidation and break bulk cargo services. The company was founded on March 7, 2011 and is headquartered in Mumbai, India.

Related stocks

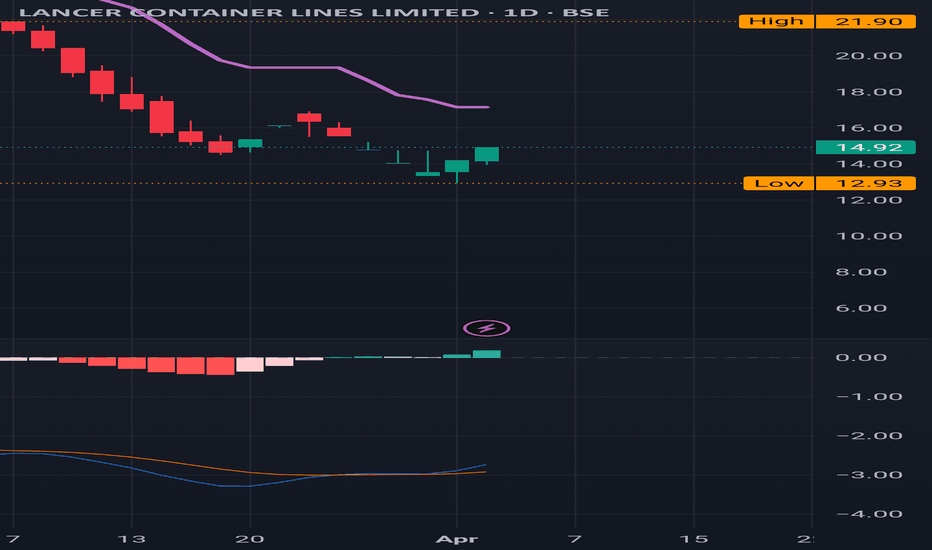

Lancer Container: Looks very interesting

Lancer Container: Looks very interesting

From 27.95 to 14.50 and from there back to back greens and buyer circuits . Excellent recovery

MACD positive Crossed over by just a tip towards 0

(Not a Buy / Sell Recommendation

Do your own due diligence ,Market is subject to risks, This is my own v

Lancer Container Lines Ltd Trend Analysis (900%+ ROI potential)Reserves nearly doubled and borrowings got reduced by 60% in last one year.

Shareholdings of the promoters have been declining since Dec 2021.

Considering the fundamentals, price is available at fair value to initiate accumulation.

Technically price is bottoming out to mark the end of a larger deg

Lancer Container Lines *Lancer Container Lines*

Asc. Triangle BreakOut on Monthly Basis.

Downward Price channel BreakOut on Monthly Basis.

Strong Vol. Consolidation. Continued BuiltUp

RSI: 1H>D>W<M

Trail SL with Upside.

Book Profit as per Risk Appetite.

Do Your Own Research as well. This is an Opinion.

Happy Investin

available at cheap valuationsLancer offers a wide range of container size and types ranging from 20 feet and 40 feet sizes and from Dry Van to Special Equipment. It has current inventory of more than10,000 containers to suit all types of customer needs. Lancer also provides Air Freight Services across the globe. Being well-conn

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of LANCER is 14.31 INR — it has increased by 0.49% in the past 24 hours. Watch LANCER CONTAINER LINES LIMITED stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BSE exchange LANCER CONTAINER LINES LIMITED stocks are traded under the ticker LANCER.

LANCER stock has fallen by −7.62% compared to the previous week, the month change is a −7.97% fall, over the last year LANCER CONTAINER LINES LIMITED has showed a −74.58% decrease.

LANCER reached its all-time high on Feb 5, 2024 with the price of 110.00 INR, and its all-time low was 0.44 INR and was reached on Apr 13, 2016. View more price dynamics on LANCER chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

LANCER stock is 3.55% volatile and has beta coefficient of 0.69. Track LANCER CONTAINER LINES LIMITED stock price on the chart and check out the list of the most volatile stocks — is LANCER CONTAINER LINES LIMITED there?

Today LANCER CONTAINER LINES LIMITED has the market capitalization of 3.58 B, it has increased by 1.10% over the last week.

Yes, you can track LANCER CONTAINER LINES LIMITED financials in yearly and quarterly reports right on TradingView.

LANCER net income for the last quarter is −324.42 M INR, while the quarter before that showed 43.59 M INR of net income which accounts for −844.30% change. Track more LANCER CONTAINER LINES LIMITED financial stats to get the full picture.

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. LANCER CONTAINER LINES LIMITED EBITDA is 121.25 M INR, and current EBITDA margin is 2.15%. See more stats in LANCER CONTAINER LINES LIMITED financial statements.

Like other stocks, LANCER shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade LANCER CONTAINER LINES LIMITED stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So LANCER CONTAINER LINES LIMITED technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating LANCER CONTAINER LINES LIMITED stock shows the sell signal. See more of LANCER CONTAINER LINES LIMITED technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.