MANAPPURAM trade ideas

Positional Setup for Manappuram Finance Ltd (NSE)

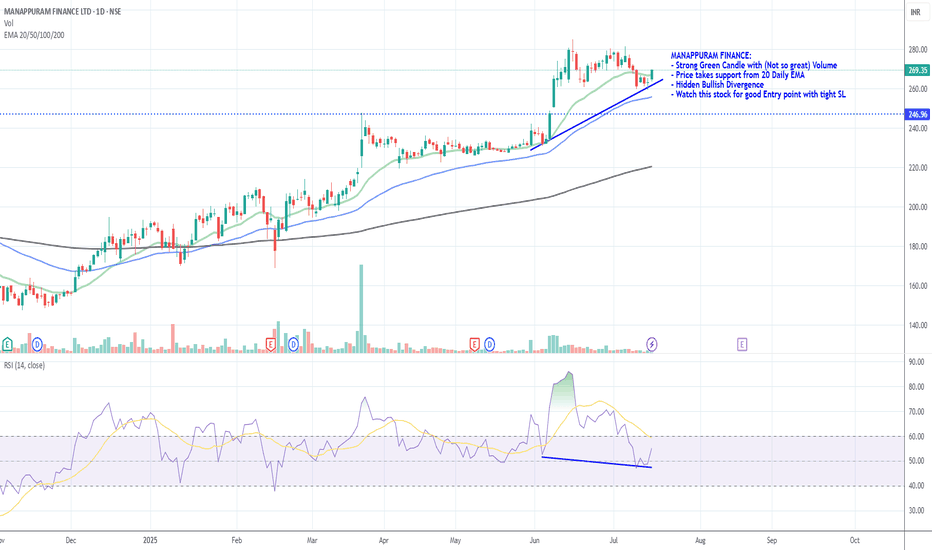

From your TradingView chart:

CMP: ₹264.80

Breakout Zone: ₹245–248 (highlighted in purple)

Previous Resistance: ₹245–250 (now flipped to support)

Indicators:

Supertrend: ✅ Bullish

TEMA (5,9,20): ✅ Trending upward

Volume/Price Action: Sharp breakout candle with nearly 7% gain—strong confirmation

📈 Technical View (Positional)

Manappuram has broken out of a multi-month resistance zone after consolidation.

Strong follow-through with volume indicates strength.

It is now trading at multi-year highs, suggesting fresh upside potential.

🚀 Positional Targets:

Target 1: ₹285

Target 2: ₹305

SL (Closing Basis): ₹248

Manappuram Finance: Long-Term Breakout Alert🚀 Manappuram Finance: Long-Term Breakout Alert! 🚀

🔹 CMP: ₹230 | Stop Loss: ₹170 | Target: ₹290 | ₹372

🔍 Why Manappuram Looks Promising?

🔄 Technical Breakout:

A rounding bottom (or cup-and-handle) breakout with a well-defined base formation—indicating potential long-term upside.

📊 Accumulation Opportunity:

As the breakout occurs, retests may follow—offering an ideal opportunity for staggered accumulation. Long-term investors can accumulate on dips for better risk-reward.

📈 Target Calculation:

📏 Pattern Depth Approach: Targets are derived from the depth of the rounding bottom or cup-and-handle pattern.

📊 Fibonacci Validation:

✅ Retracement Levels (Stop Loss Zones): ₹138 & ₹230

✅ Extension Levels (Price Targets): ₹81.5, ₹230 & ₹138

📌 Pro Tip: Plot these Fibonacci levels yourself to build conviction and sharpen your analysis.

📉 Risk Management:

Stop loss is carefully aligned with Fibonacci retracement to minimize downside risk.

Follow strict position sizing to safeguard capital—especially in volatile market conditions.

⚠️ Caution: Market conditions can shift quickly—adjust your position size based on your risk tolerance and trading plan.

📍 Outlook:

With a confirmed breakout and strong technical alignment, Manappuram Finance offers a high-probability swing trade for long-term investors.

📣 What are your thoughts on this breakout? Share your views in the comments!

📅 Follow for more technical insights and market updates.

📈 #ManappuramFinance #BreakoutAlert #TechnicalAnalysis #SwingTrading #InvestmentOpportunity

📉 Disclaimer: As a non-SEBI registered analyst, I encourage you to conduct independent research or consult a financial professional before making investment decisions.

Manappuram Finance Share Price Crash: Causes, AnalysisMANAPPURAM

On October 18th, 2024, the stock price of Manappuram Finance Ltd witnessed a sharp decline, raising concerns among investors. The company, known for its gold loan services, microfinance, and other financial offerings, experienced a drop in its stock value by nearly 33% from its all-time high achieved just a few months earlier in July 2024. This blog will provide an in-depth analysis of the reasons behind the crash, key financial metrics, and a perspective on whether this presents a potential buying opportunity.

What Happened?

The recent dip in Manappuram’s stock price can be attributed to regulatory actions affecting its subsidiary, Asirvad Micro Finance. The Reserve Bank of India (RBI) instructed Asirvad to halt new loan disbursements due to non-compliance with certain regulations. Since Asirvad contributes significantly to the overall Asset Under Management (AUM) of Manappuram (approximately 27% as of Q3 FY23), this restriction raised red flags about Manappuram's future earnings potential. The market reacted negatively, pushing the share price down amid concerns over the company’s short-term growth prospects.

Key Financials: A Quick Overview of Manappuram Finance

Manappuram Finance Ltd is a non-banking finance company (NBFC) with a significant presence in gold loans, contributing 58% to its total AUM as of Q3 FY23. Over the years, the company has expanded its services to include microfinance, home loans, and commercial vehicle financing. The company’s gold loan business is stable, while the rapid growth in microfinance and other segments has been a key driver of its diversification strategy.

A Brief History of Manappuram’s Growth

Manappuram Finance has had its ups and downs over the years. The company saw a period of rapid growth between FY08 and FY12, driven by the rising price of gold. During this period, its branch network expanded by over six times, and its AUM grew by more than 90% CAGR. However, regulatory changes in 2012 affected its gold loan business, as the RBI reduced the loan-to-value ratio for NBFCs.

Since then, the company has focused on diversifying its portfolio to include other lending services. Its acquisition of Asirvad in 2015 was a strategic move to enter the microfinance market, which has since become a major contributor to its overall AUM.

Impact of Asirvad Microfinance

Asirvad Microfinance, a key subsidiary of Manappuram, plays a crucial role in its growth strategy. As of Q3 FY23, Asirvad’s AUM stands at ₹8,654 crore, approximately 27% of the company’s total estimated AUM of ₹32,093 crore. The RBI's recent regulatory restrictions on Asirvad are likely to have a short-term impact on the company’s ability to disburse new loans, thereby dampening earnings in the coming quarters. However, if the issues are resolved, it could provide an upside to the stock as the market reacts positively to the lifting of restrictions.

Technical View: Opportunity Amidst the Fall?

From a technical standpoint, Manappuram Finance’s stock price has dropped by over 33% from its all-time high, reached in July 2024. The current price of ₹153 presents an interesting opportunity for investors who believe in the company's long-term growth potential. The stock is trading close to its 52-week low, making it an attractive value buy if regulatory risks are resolved favorably.

Fundamental View: Is Manappuram Undervalued?

Looking at the fundamentals, Manappuram appears undervalued based on its current P/E ratio of 5.77 and the fact that it is trading near its book value. The company boasts a strong return on equity (ROE) of 20.6%, zero pledged shares, and a healthy capital adequacy ratio of 31%. These indicators suggest that despite short-term regulatory hurdles, the company’s long-term fundamentals remain strong.

Should You Buy Manappuram Finance Stock Now?

While the drop in share price may seem alarming, it’s important to weigh both the risks and the potential rewards. Here’s a quick summary:

Positives

Strong fundamentals with low P/E, high ROE, and a diversified lending portfolio.

Zero pledged shares and decent dividend yield.

The regulatory issue with Asirvad could be temporary, and if resolved, it may lead to a rebound in share price.

Risks

Uncertainty surrounding the resolution of Asirvad’s regulatory challenges.

Potential short-term earnings impact due to halted loan disbursements.

Market sentiment may remain negative until clarity emerges on regulatory compliance.

Disclaimer: We are not SEBI-registered advisors. The information provided is for educational purposes only, and readers should take care when using it for any investment decisions.

MANAPPURAM @Demand Areaprice taken the liquidity below equal lows at 156 levels.

previously a strong rise is observed from this levels..

we have a liquidity at resistance zone on topside....

this is the best area to continue in this stock for further upside movements.

Best area for long side continuation.

Investment - Manappuram Finance Manappuram finance is ready for next move from here.

Stock price is a potential multiyear breakout candidate once weekly close above 229.

Company is trading at PE of 8.16 where as industry PE is at 22.9.

Company has huge FII holding of 33% increased from 27% in Q2 2023 & DII holding nearly 10%.

Promoter has marginally increased stake in the company.

Strong promoter group.

Please do your own analysis before taking any trade.

Malappuram Finance Ltd.*Manappuram Finance Ltd.*

Rising C&H Formation on Yearly Basis.

RB Formation on Monthly Basis.

Strong Vol Consolidation & Continued Traction.

%age Neeeed to Cross C&H Priceline

7% for Lower priceline

15% for Upper priceline

RSI: 1H>D>W>M

EMAs: Widening Gaps amongst 20/ 50/ 100/ 200 on Monthly Basis.

With Gold Prices on Rise, Increasing consumer base and financials, company is nicely places to grow.

*Trail SL with Upside*

*Book Profit as per Risk Appetite*

*Do your own research as well. This is an Opinion*

*_Happy Investing_*🤓

Manappuram Finance Weekly breakout plus daily breakout.

Strong Long Term Fundamental Strength with an average Return on Equity (ROE) of 20.30%

The company has declared Positive results for the last 7 consecutive quarters

PAT(HY) At Rs 1,134.40 cr has Grown at 40.82 %NET SALES(Q) Highest at Rs 2,359.77 crPBDIT(Q) Highest at Rs 1,587.29 cr.

High Institutional Holdings at 41.49%

buy at zone

this zone marked is potential reversal zone . expecting reversal from that zone.buyers can look for buying confirmation inside the zone.

-- intraday traders can keep 0.236 fib level of swing C to latest swing low. entry is strictly inside zone. keep sl below zone

-- swing traders can keep 0.5 fib level as tgt.

Long trade setup on chartshere's a possible trading idea for Manappuram Finance, keeping in mind that this is not financial advice and you should do your own research before making any trades:

Long trade setup:

Entry: Above ₹196.75 (previous day's high)

Stop-loss: Below ₹190.74 (previous day's low)

Target: ₹210.00 (resistance level)

Rationale:

The stock is currently trading near its previous day's high, which could be a sign of bullish momentum.

The RSI (9) indicator is at 68.27, which is nearing overbought territory but could still allow for some upside movement.

Risk management:

Always use a stop-loss order to limit your potential losses.

Only risk a small percentage of your capital on any one trade.

Considerations:

This is a short-term trading idea and may not be suitable for all investors.

The stock market is volatile and there is no guarantee that this trade will be profitable.

You should consider your own investment objectives and risk tolerance before making any trades.

Additional technical indicators that you may want to consider using to confirm this trade idea include:

Moving averages (such as the 50-day or 200-day moving average)

MACD indicator

Bollinger Bands

It is important to do your own research and analysis before making any trades. This is not financial advice.

[Positional] Mannapuram Short Idea1 minute ago

Note -

One of the best forms of Price Action is to not try to predict at all. Instead of that, ACT on the price. So, this chart tells at "where" to act in "what direction. Unless it triggers, like, let's say the candle doesn't break the level which says "Buy if it breaks", You should not buy at all.

=======

I use shorthands for my trades.

"Positional" - means You can carry these positions and I do not see sharp volatility ahead. (I tally upcoming events and many small kinds of stuff to my own tiny capacity.)

"Intraday" -means You must close this position at any cost by the end of the day.

"Theta" , "Bounce" , "3BB" or "Entropy" - My own systems.

=======

I won't personally follow any rules. If I "think" (It is never gut feel. It is always some reason.) the trade is wrong, I may take reverse trade. I may carry forward an intraday position. What is meant here - You shouldn't follow me because I may miss updating. You should follow the system I share.

=======

Like -

Always follow a stop loss.

In the case of Intraday trades, it is mostly the "Day's High".

In the case of Positional trades, it is mostly the previous swings.

I do not use Stop Loss most of the time. But I manage my risk with options as I do most of the trades using derivatives