Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

11.05 INR

10.76 B INR

70.07 B INR

656.89 M

About MAX HEALTHCARE INS LTD

Sector

Industry

CEO

Abhay Soi

Website

Headquarters

Gurugram

Founded

1985

ISIN

INE027H01010

FIGI

BBG00VJV7TG4

Max Healthcare Institute Ltd. engages in the management and operation of hospitals and specialty clinics. Its services include domestic and international patient services, hospital network, preventive health plans, and medical and life saver training programs. The company was founded on January 1, 1985 is headquartered in Gurugram, India.

Related stocks

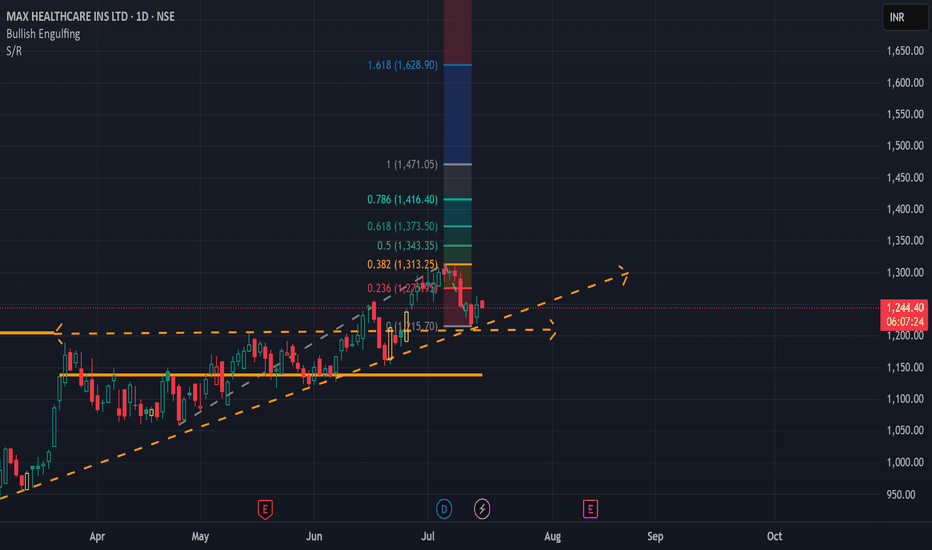

Max Health Care - VCP trade Idea - No Financial AdviceMax Healthcare is showing VCP pattern Breakout and retest. First Correction was deep upto -22.71 %, followed by second Correction of -11.91% and third correction of 7.12% approx before it finally breakout. Market has tendency to trap breakout traders therefore it again retraced below breakout candle

MAX HEALTHCARE INS LTD good to BUYMAX HEALTHCARE INS LTD 1072 is on the verge of its resistance. Signals are bullish after hidden divergence suggests it could be considered for buy for target 1371.

Consolidated sales growth is 26% and profit growth of 100% for last 5 years.

FII's holding is more than 50 %.

MAXHEALTHCARE - Could Breakout from DTHMAXHEALTHCARE has resistance weakening on the Daily charts and may give a breakout with good volume in coming days.

The target of this pattern signals an upside potential of 15% from the current price level in the medium term.

The stock is trading above its 50- and 100-day exponential moving avera

Amazing breakout on Weekly Timeframe - MAXHEALTHCheckout an amazing breakout happened in the stock in Weekly timeframe, macroscopically seen in Daily timeframe. Having a great favor that the stock might be bullish expecting a staggering returns of minimum 25% TGT. IMPORTANT BREAKOUT LEVELS ARE ALWAYS RESPECTED!

NOTE for learners: Place the break

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of MAXHEALTH is 1,279.65 INR — it has increased by 0.97% in the past 24 hours. Watch MAX HEALTHCARE INSTITUTE LIMIT stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BSE exchange MAX HEALTHCARE INSTITUTE LIMIT stocks are traded under the ticker MAXHEALTH.

MAXHEALTH stock has risen by 2.80% compared to the previous week, the month change is a 5.36% rise, over the last year MAX HEALTHCARE INSTITUTE LIMIT has showed a 38.04% increase.

We've gathered analysts' opinions on MAX HEALTHCARE INSTITUTE LIMIT future price: according to them, MAXHEALTH price has a max estimate of 1,400.00 INR and a min estimate of 615.00 INR. Watch MAXHEALTH chart and read a more detailed MAX HEALTHCARE INSTITUTE LIMIT stock forecast: see what analysts think of MAX HEALTHCARE INSTITUTE LIMIT and suggest that you do with its stocks.

MAXHEALTH reached its all-time high on Jul 4, 2025 with the price of 1,314.30 INR, and its all-time low was 101.65 INR and was reached on Sep 1, 2020. View more price dynamics on MAXHEALTH chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

MAXHEALTH stock is 2.38% volatile and has beta coefficient of 1.33. Track MAX HEALTHCARE INSTITUTE LIMIT stock price on the chart and check out the list of the most volatile stocks — is MAX HEALTHCARE INSTITUTE LIMIT there?

Today MAX HEALTHCARE INSTITUTE LIMIT has the market capitalization of 1.23 T, it has increased by 1.94% over the last week.

Yes, you can track MAX HEALTHCARE INSTITUTE LIMIT financials in yearly and quarterly reports right on TradingView.

MAX HEALTHCARE INSTITUTE LIMIT is going to release the next earnings report on Aug 12, 2025. Keep track of upcoming events with our Earnings Calendar.

MAXHEALTH earnings for the last quarter are 4.00 INR per share, whereas the estimation was 4.06 INR resulting in a −1.40% surprise. The estimated earnings for the next quarter are 3.81 INR per share. See more details about MAX HEALTHCARE INSTITUTE LIMIT earnings.

MAX HEALTHCARE INSTITUTE LIMIT revenue for the last quarter amounts to 23.26 B INR, despite the estimated figure of 23.32 B INR. In the next quarter, revenue is expected to reach 24.17 B INR.

MAXHEALTH net income for the last quarter is 3.19 B INR, while the quarter before that showed 2.39 B INR of net income which accounts for 33.58% change. Track more MAX HEALTHCARE INSTITUTE LIMIT financial stats to get the full picture.

Yes, MAXHEALTH dividends are paid annually. The last dividend per share was 1.50 INR. As of today, Dividend Yield (TTM)% is 0.12%. Tracking MAX HEALTHCARE INSTITUTE LIMIT dividends might help you take more informed decisions.

MAX HEALTHCARE INSTITUTE LIMIT dividend yield was 0.14% in 2024, and payout ratio reached 13.55%. The year before the numbers were 0.18% and 13.78% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 26, 2025, the company has 26.83 K employees. See our rating of the largest employees — is MAX HEALTHCARE INSTITUTE LIMIT on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. MAX HEALTHCARE INSTITUTE LIMIT EBITDA is 18.49 B INR, and current EBITDA margin is 27.22%. See more stats in MAX HEALTHCARE INSTITUTE LIMIT financial statements.

Like other stocks, MAXHEALTH shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade MAX HEALTHCARE INSTITUTE LIMIT stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So MAX HEALTHCARE INSTITUTE LIMIT technincal analysis shows the strong buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating MAX HEALTHCARE INSTITUTE LIMIT stock shows the buy signal. See more of MAX HEALTHCARE INSTITUTE LIMIT technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.