MUTHOOTFIN trade ideas

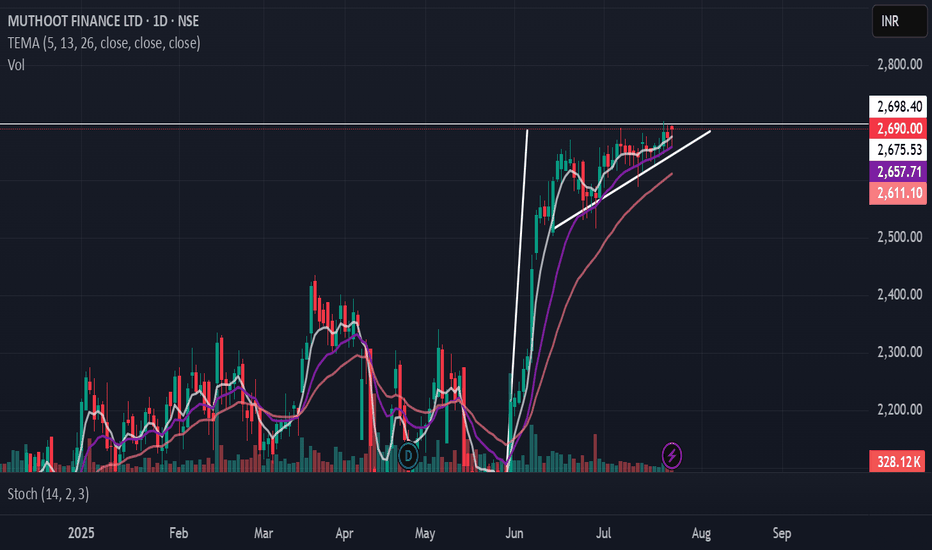

Pole and Flag The pole and flag pattern is a classic continuation pattern in technical analysis, often signaling that the current trend is likely to continue after a brief consolidation. The pattern consists of:

Pole: A sharp, nearly vertical movement in price reflecting strong market momentum.

Flag: A consolidation phase where price moves within parallel trendlines, usually sloping against the direction of the pole, indicating a pause before the next move.

In the provided chart of Muthoot Finance Ltd., the stock exhibits a textbook bullish pole and flag formation, suggesting potential for further upside if technical conditions are met.

How to Trade the Pole and Flag Pattern

1. Entry Point

Enter Long: When price closes above the flag’s upper trendline or resistance level on higher-than-average volume. This confirms the breakout and continuation of the uptrend.

2. Setting the Target

Target Calculation: Measure the distance from the lowest to the highest point of the pole. Add this value to the flag's breakout point to project the potential price target.

For example: If the pole is 400 points (from 2,300 to 2,700) and breakout occurs at 2,700, the target is 3,100.

3. Stop-Loss Placement

Set Stop-Loss: Just below the lower trendline of the flag or recent swing low. This minimizes risk in case of a failed breakout.

4. Volume Confirmation

Confirmation: A valid breakout should be accompanied by a spike in volume, reflecting renewed buying interest.

MUTHOOT FINANCE at Best Resistance !! This is the Daily Chart of MUTHOOT FINANCE .

MUTHOOTFIN is currently trading near its resistance range around the 2700 range.

MUTHOOTFIN has completed its upward move as per its natural price behavior, with the rise reaching up to the 2700 range.

If This level is sustain , then we may see lower prices in MUTHOOTFIN.

Thank You !!

MUTHOOTFIN (Breakout Stock)🚀 MUTHOOT FINANCE – Breakout Stock Alert! 🚀

Muthoot Finance has given a strong breakout, backed by solid fundamentals and increasing investor interest. The stock is showing high momentum with a surge in volumes, indicating strong buying pressure.

📊 Key Highlights:

✅ Breakout Confirmation: Price action suggests a sustained uptrend.

✅ Strong Fundamentals: Consistently delivering robust financial performance.

✅ Sector Strength: NBFCs are gaining traction, making Muthoot Finance a prime candidate for further upside.

✅ FII & DII Interest: Increasing institutional participation adds confidence.

🔎 Keep it on your radar as it could be heading towards new highs!

📢 Disclaimer: This is purely for informational purposes and not a recommendation to buy or sell. Investors are advised to conduct their own research and risk assessment before making any investment decisions, as stock markets are subject to volatility and risks.

MUTHOOTFINANCE WEEKLY BREAKOUT FOR LONG TERM

FUNDAMENTALS:-

Muthoot Finance, a leading non-banking financial company (NBFC) specializing in gold loans, has shown strong financial fundamentals over the years. Here's a detailed analysis:

### 1. **Financial Performance**

- **Revenue Growth:** Muthoot Finance's revenue has shown consistent growth, with recent numbers reflecting a robust gold loan portfolio.

- **Profit Margins:** Net profit margins have been healthy, benefiting from lower operational costs and an efficient loan disbursement process.

### 2. **Borrowings and Assets**

- The company's borrowings have increased, reaching ₹72,343 crore in March 2024, indicating reliance on external funding to expand its operations. Simultaneously, total assets grew significantly to ₹100,518 crore, reflecting a well-supported asset base.

### 3. **Return Metrics**

- **Return on Equity (ROE):** The ROE has stabilized at around 18% in recent years, reflecting efficient use of shareholder funds despite a slight decline from peak levels.

### 4. **Cash Flow**

- While operating cash flow has fluctuated, free cash flow remained under pressure due to higher borrowings and investments in growth.

### 5. **Shareholding Pattern**

- Promoters hold a dominant stake of 73.35%, while institutional investors such as FIIs and DIIs have shown varied interest over time. DIIs increased their holdings to approximately 13.30% in September 2024.

### 6. **Valuation and Outlook**

- Muthoot Finance trades at reasonable valuations given its market position and profitability. Its focus on gold loans positions it well in uncertain economic climates where asset-backed lending gains traction. Challenges include high dependence on gold price fluctuations and regulatory risks.

Overall, Muthoot Finance remains a strong player in the NBFC sector, underpinned by its specialization in gold loans and sound financial metrics. If you are considering investment, it's important to evaluate market conditions and align them with your risk appetite.

MUTHOOT FINANCE FINANCE LTD Swing TradeHello,

Trend-Based Analysis. Buy the Dips, Sell The Rallies, Also Following the Trend. Let's see where the Price Action takes us, Riding the wave. Potential trade setups based on trend momentum.

Technical analysis based on trend identification and momentum, Looking for high-probability setups within the prevailing trend.

Analyzing the current market trend and potential future price movement. Focusing on risk management and reward-to-risk ratios.

Details is Mentioned in Chart, Read carefully.. .

Muthootfin looks good with Head & Shoulder Pattern watch out.hello Investor's,

Chart looks very promising as pattern is attractive for short & long term view.

Already broken pattern with open low same on one day chart should blast with short correction.

Trade or invests with strict stop loss.

Patience is a game of investing returns.

MUTHOOT FINANCE LTD S/R Support and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (red line/shade) are where upward trends might stall due to increased selling interest. They act like a ceiling where sellers come in to push prices down.

Breakouts:

Bullish Breakout: When the price moves above resistance, it often indicates strong buying interest and the potential for a continued uptrend. Traders may view this as a signal to buy or hold.

Bearish Breakout: When the price falls below support, it can signal strong selling interest and the potential for a continued downtrend. Traders might see this as a cue to sell or avoid buying.

20 EMA (Exponential Moving Average):

Above 20 EMA(50 EMA): If the stock price is above the 20 EMA, it suggests a potential uptrend or bullish momentum.

Below 20 EMA: If the stock price is below the 20 EMA, it indicates a potential downtrend or bearish momentum.

Trendline: A trendline is a straight line drawn on a chart to represent the general direction of a data point set.

Uptrend Line: Drawn by connecting the lows in an upward trend. Indicates that the price is moving higher over time. Acts as a support level, where prices tend to bounce upward.

Downtrend Line: Drawn by connecting the highs in a downward trend. Indicates that the price is moving lower over time. It acts as a resistance level, where prices tend to drop.

RSI: RSI readings greater than the 70 level are overbought territory, and RSI readings lower than the 30 level are considered oversold territory.

Combining RSI with Support and Resistance:

Support Level: This is a price level where a stock tends to find buying interest, preventing it from falling further. If RSI is showing an oversold condition (below 30) and the price is near or at a strong support level, it could be a good buy signal.

Resistance Level: This is a price level where a stock tends to find selling interest, preventing it from rising further. If RSI is showing an overbought condition (above 70) and the price is near or at a strong resistance level, it could be a signal to sell or short the asset.

Disclaimer:

I am not a SEBI registered. The information provided here is for learning purposes only and should not be interpreted as financial advice. Consider the broader market context and consult with a qualified financial advisor before making investment decisions.

MUTHOOT FINANCE LTD S/RSupport and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (red line/shade) are where upward trends might stall due to increased selling interest. They act like a ceiling where sellers come in to push prices down.

Breakouts:

Bullish Breakout: When the price moves above resistance, it often indicates strong buying interest and the potential for a continued uptrend. Traders may view this as a signal to buy or hold.

Bearish Breakout: When the price falls below support, it can signal strong selling interest and the potential for a continued downtrend. Traders might see this as a cue to sell or avoid buying.

20 EMA (Exponential Moving Average):

Above 20 EMA(50 EMA): If the stock price is above the 20 EMA, it suggests a potential uptrend or bullish momentum.

Below 20 EMA: If the stock price is below the 20 EMA, it indicates a potential downtrend or bearish momentum.

Trendline: A trendline is a straight line drawn on a chart to represent the general direction of a data point set.

Uptrend Line: Drawn by connecting the lows in an upward trend. Indicates that the price is moving higher over time. Acts as a support level, where prices tend to bounce upward.

Downtrend Line: Drawn by connecting the highs in a downward trend. Indicates that the price is moving lower over time. It acts as a resistance level, where prices tend to drop.

RSI: RSI readings greater than the 70 level are overbought territory, and RSI readings lower than the 30 level are considered oversold territory.

Combining RSI with Support and Resistance:

Support Level: This is a price level where a stock tends to find buying interest, preventing it from falling further. If RSI is showing an oversold condition (below 30) and the price is near or at a strong support level, it could be a good buy signal.

Resistance Level: This is a price level where a stock tends to find selling interest, preventing it from rising further. If RSI is showing an overbought condition (above 70) and the price is near or at a strong resistance level, it could be a signal to sell or short the asset.

Disclaimer:

I am not a SEBI registered. The information provided here is for learning purposes only and should not be interpreted as financial advice. Consider the broader market context and consult with a qualified financial advisor before making investment decisions.

Muthoot Finance Long Trade on 15m Time Frame: Trade in ProgressA long entry was initiated at 1927.05 on the 9th of October at 10:15 am. The price is nearing Target 1 (1963.50) and remains on track for further movement towards the upper targets. We have now set a trailing stop at 1928.50 to lock in gains and manage risk.

Target Points:

TP 1: 1963.50 (close to being hit)

TP 2: 2022.50

TP 3: 2081.50

TP 4: 2117.95

Trailing Stop: 1928.50

Stop Loss (SL): 1897.55

We'll keep a close eye on this position as it progresses towards the remaining targets.

Muthoot Finance: All-Time High Monthly Breakout!💰📈 Muthoot Finance: All-Time High Monthly Breakout! 🚀

🔍 Current Market Price (CMP): 1745

📉 Stop Loss: 1640

🎯 Target: 1890, 2274

✅ Confirmation Above: 1820

Reason: Muthoot Finance is breaking all-time highs with a monthly breakout. The gold loan business is poised for growth as gold prices skyrocket, potentially leading to higher gold disbursements.

⚠️ Important: Preempting market movements with low position sizing is crucial due to volatility, especially with upcoming election results.

⚠️ Disclaimer: Not a SEBI registered analyst. Consult your financial advisor for personalized advice.

🌟 Let's navigate the waves of opportunity together! #MuthootFinance #MarketAnalysis #TradingInsights 📊💼

MUTHOOT FINANCE LTD S/RSupport and Resistance Levels:

Support Levels: These are price points (green line/share) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (red line/shade) are where upward trends might stall due to increased selling interest. They act like a ceiling where sellers come in to push prices down.

Breakouts:

Bullish Breakout: When the price moves above resistance, it often indicates strong buying interest and the potential for a continued uptrend. Traders may view this as a signal to buy or hold.

Bearish Breakout: When the price falls below support, it can signal strong selling interest and the potential for a continued downtrend. Traders might see this as a cue to sell or avoid buying.

20 EMA (Exponential Moving Average):

Above 20 EMA: If the stock price is above the 20 EMA, it suggests a potential uptrend or bullish momentum.

Below 20 EMA: If the stock price is below the 20 EMA, it indicates a potential downtrend or bearish momentum.

Disclaimer:

I am not a SEBI registered. The information provided here is for learning purposes only and should not be interpreted as financial advice. It's important to remember that while these indicators can be useful, they are not foolproof. Always consider the broader market context and consult with a qualified financial advisor before making any investment decisions.

Muthoot Finance may see a rise.MUTHOOT FINANCE may see a rise in the coming sessions. The stock is showing signs of a good comeback after a big fall on the daily chart. This stock should be on your radar. Even before this, this stock has shown a rise at the same price. It is expected that the stock will show rise this time also.

MUTHOOT FINANCE LTD S/R for 15/7/24Support and Resistance Levels: In technical analysis, support and resistance levels are significant price levels where buying or selling interest tends to be strong. They are identified based on previous price levels where the price has shown a tendency to reverse or find support.

Support levels are represented by the green line and green shade, indicating areas where buying interest may emerge to prevent further price decline.

Resistance levels are represented by the red line and red shade, indicating areas where selling pressure may arise to prevent further price increases. Traders often consider these levels as potential buying or selling opportunities.

Breakouts: Breakouts occur when the price convincingly moves above a resistance level (red shade) or below a support level (green shade). A bullish breakout above resistance suggests the potential for further price increases, while a bearish breakout below support suggests the potential for further price declines. Traders pay attention to these breakout signals as they may indicate the start of a new trend or significant price movement.

20 EMA: The yellow line denotes 20 EMA, to interpret the 20 EMA, you need to compare it with the prevailing stock price. If the stock price is below the 20 EMA, it signals a possible downtrend. But if the stock price is above the 20 EMA, it signals a possible uptrend.

Disclosure: I am not SEBI registered. The information provided here is for learning purposes only and should not be interpreted as financial advice. It is important to consult with a qualified financial advisor before making any investment decisions. Tweets neither advice nor endorsement.

MUTHOOT FIN /SWING TRADE# PRICE TRADING WITHIN PATTERN

#POSSIBILITY OF BREAKOUT

#RTST MA21 EMA 21

#SL 1750

ALWAYS TAKE RISK REWARDS INTO ACCOUNT. IT IS THE CORE STRENGTH OF TRADING.

NO MATTER WHAT END OF THE DAY WHAT YOU EARN - WHAT YOU LOSE =RETURNS

"Investing in the stock market involves balancing risk and reward. Higher potential returns typically come with higher risk, while safer investments may offer lower returns. It's essential to assess your risk tolerance and investment goals carefully. Diversifying your portfolio can help manage risk. Remember, informed decisions and a long-term perspective are key to navigating the complexities of the market."

MUTHOOT FINANCE LTD S/R for 3/7/24Support and Resistance Levels: In technical analysis, support and resistance levels are significant price levels where buying or selling interest tends to be strong. They are identified based on previous price levels where the price has shown a tendency to reverse or find support.

Support levels are represented by the green line and green shade, indicating areas where buying interest may emerge to prevent further price decline.

Resistance levels are represented by the red line and red shade, indicating areas where selling pressure may arise to prevent further price increases. Traders often consider these levels as potential buying or selling opportunities.

Breakouts: Breakouts occur when the price convincingly moves above a resistance level (red shade) or below a support level (green shade). A bullish breakout above resistance suggests the potential for further price increases, while a bearish breakout below support suggests the potential for further price declines. Traders pay attention to these breakout signals as they may indicate the start of a new trend or significant price movement.

20 EMA: The yellow line denotes 20 EMA, to interpret the 20 EMA, you need to compare it with the prevailing stock price. If the stock price is below the 20 EMA, it signals a possible downtrend. But if the stock price is above the 20 EMA, it signals a possible uptrend.

Disclosure: I am not SEBI registered. The information provided here is for learning purposes only and should not be interpreted as financial advice. It is important to consult with a qualified financial advisor before making any investment decisions. Tweets neither advice nor endorsement.

MUTHOOT FINANCE LIMITED view for 27th June #MUTHOOTFIN MUTHOOT FINANCE LIMITED Intraday level for 27th June #MUTHOOTFIN

Selling opportunity below 1764

Stop Loss area 1785-1790

Charts for Educational purposes only.

Please follow strict stop loss and risk reward if you follow the level.

Thanks,

V Trade Point