NATIONALUM trade ideas

National Aluminium 183 .. Breakout .. Good to have in PortfolioNational Aluminium 183 has given breakout. Support at 174. Target 207.

It is a good to have stock in portfolio

Currently trading at 6.4 PE and has potential to move to 13 PE which would be a price target of 372.

A good dividend payout company ( 4.5 %) and FII's have increased their stake.

With ROE @ 32.73 and ROCE @ 43.96 which are highest among the industry sector .

Nalco - Harmonic Pattern Analysis and outlookNATIONAL ALUMINIUM CO LTD: CMP- 183.84;

📉 Suggested Pattern:

- BAT harmonic pattern completion.

📊 Recent Price Action:

- Shares of National Aluminium Company Limited closed below the previous closing price.

- Formation of a Lower Low, reinforcing bearish sentiment.

📈 Forecast:

- Potential Downside Target: ₹166.

- Expected Consolidation Range if 166 is breached : ₹150-₹160.

🔍 Key Observations:

- The bearish trend suggests a continuation of the decline in the coming days.

- Important to monitor price action and volume dynamics for further confirmation

NATIONAL ALUMINIUM SWING TRADE📊 Price Action & Trend Analysis

Analyzing market trends using price action, key support/resistance levels, and candlestick patterns to identify high-probability trade setups.

Always follow the trend and manage risk wisely!

Price Action Analysis Interprets Market Movements Using Patterns And Trends On Price Charts.

👉👉👉Follow us for Live Market Views/Trades/Analysis/News Updates.

Darvas Box Strategy - Break out Stock - Swing TradeDisclaimer: I am Not SEBI Registered adviser, please take advise from your financial adviser before investing in any stocks. Idea here shared is for education purpose only.

Stock has given break out. Buy above high. Keep this stock in watch list.

Buy above the High and do not forget to keep stop loss, best suitable for swing trading.

Target and Stop loss Shown on Chart. Risk to Reward Ratio/ Target Ratio 1:2

Stop loss can be Trail when it make new box / Swing.

Be Discipline, because discipline is the key to Success in Stock Market.

Trade what you See Not what you Think.

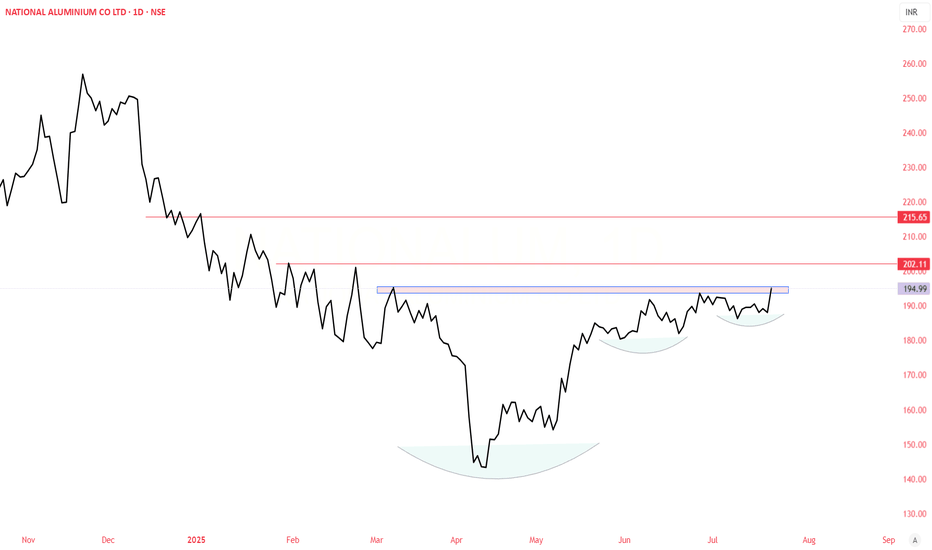

NATIONAL ALUMINIUM CO LTD S/RSupport and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (red line/shade) are where upward trends might stall due to increased selling interest. They act like a ceiling where sellers come in to push prices down.

Breakouts:

Bullish Breakout: When the price moves above resistance, it often indicates strong buying interest and the potential for a continued uptrend. Traders may view this as a signal to buy or hold.

Bearish Breakout: When the price falls below support, it can signal strong selling interest and the potential for a continued downtrend. Traders might see this as a cue to sell or avoid buying.

20 EMA (Exponential Moving Average):

Above 20 EMA(50 EMA): If the stock price is above the 20 EMA, it suggests a potential uptrend or bullish momentum.

Below 20 EMA: If the stock price is below the 20 EMA, it indicates a potential downtrend or bearish momentum.

Trendline: A trendline is a straight line drawn on a chart to represent the general direction of a data point set.

Uptrend Line: Drawn by connecting the lows in an upward trend. Indicates that the price is moving higher over time. Acts as a support level, where prices tend to bounce upward.

Downtrend Line: Drawn by connecting the highs in a downward trend. Indicates that the price is moving lower over time. It acts as a resistance level, where prices tend to drop.

RSI: RSI readings greater than the 70 level are overbought territory, and RSI readings lower than the 30 level are considered oversold territory.

Combining RSI with Support and Resistance:

Support Level: This is a price level where a stock tends to find buying interest, preventing it from falling further. If RSI is showing an oversold condition (below 30) and the price is near or at a strong support level, it could be a good buy signal.

Resistance Level: This is a price level where a stock tends to find selling interest, preventing it from rising further. If RSI is showing an overbought condition (above 70) and the price is near or at a strong resistance level, it could be a signal to sell or short the asset.

Disclaimer:

I am not a SEBI registered. The information provided here is for learning purposes only and should not be interpreted as financial advice. Consider the broader market context and consult with a qualified financial advisor before making investment decisions.

NATIONALUMNSE:NATIONALUM

One Can Enter Now !

Or Wait for Retest of the Trendline (BO) !

Or wait For better R:R ratio !

Note :

1.One Can Go long with a Strict SL below the Trendline or Swing Low.

2. R:R ratio should be 1 :2 minimum

3. Plan as per your RISK appetite and Money Management.

Disclaimer : You are responsible for your Profits and loss, Shared for Educational purpose

Darvas Box Strategy - Break out Stock - Swing TradeDisclaimer: I am Not SEBI Registered adviser, please take advise from your financial adviser before investing in any stocks. Idea here shared is for education purpose only.

Stock has given break out. Buy above high. Keep this stock in watch list.

Buy above the High and do not forget to keep stop loss, best suitable for swing trading.

Target and Stop loss Shown on Chart. Risk to Reward Ratio/ Target Ratio 1:2

Stop loss can be Trail when it make new box / Swing.

Be Discipline, because discipline is the key to Success in Stock Market.

Trade what you See Not what you Think.